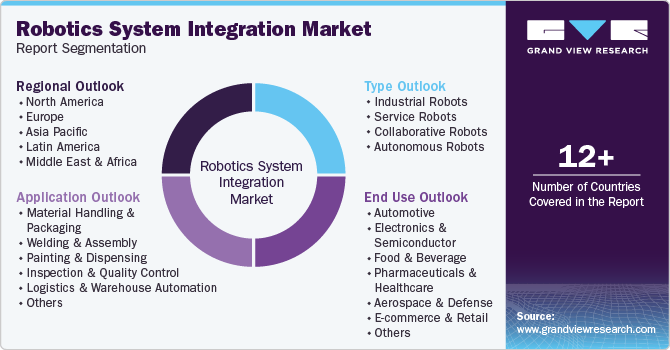

Robotics System Integration Market Size, Share & Trends Analysis Report By Type (Industrial Robots, Autonomous Robots), By End Use (Automotive, Electronics And Semiconductor), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-551-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Robotics System Integration Market Trends

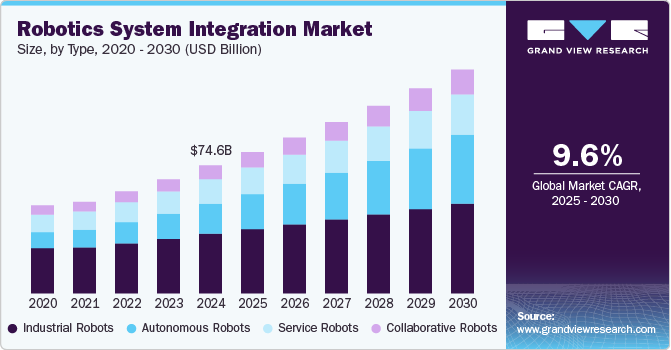

The global robotics system integration market size was estimated at USD 74.56 billion in 2024 and is expected to grow at a CAGR of 9.6% from 2025 to 2030. The robotics system integration market is witnessing robust growth as industrial automation continues to reshape global production landscapes. As companies strive for greater efficiency, precision, and scalability, robotics system integrators play a crucial role in bridging the gap between advanced robotic technologies and real-world manufacturing needs. These integrators are responsible for tailoring end-to-end automation solutions-ranging from robotic arms and conveyor systems to sensors and AI-powered controllers-ensuring optimal performance within existing infrastructure.

Industries such as electronics, packaging, automotive, and heavy machinery are increasingly adopting robotics integration to streamline operations, improve quality control, and reduce downtime. Furthermore, the need for customization, system interoperability, and post-deployment support further amplifies the demand for experienced system integrators.

The robotics system integration industry is strongly driven by automation in the automotive sector. Robotic arms and autonomous systems are being integrated for welding, painting, and assembly processes in car manufacturing plants. Automakers are investing in customized robotic integration to meet production and quality standards. Integrators play a pivotal role in linking robots with sensors, vision systems, and control software for vehicle production lines. This trend is expected to grow as electric vehicle production further accelerates automation needs.

The boom in e-commerce has directly impacted on the robotics system integration industry through demand for warehouse automation. Fulfillment centers are adopting robotics for picking, packing, and sorting, requiring integration with inventory management and logistics software. System integrators are designing solutions that enable fast and accurate order processing. The need for flexible, scalable systems in dynamic environments fuels growth in integration services. This trend is expected to continue with the rising pressure for next-day and same-day deliveries.

Advanced vision systems and sensor technologies are revolutionizing the robotics system integration industry. Robotic solutions now require precise integration of cameras, LiDAR, and proximity sensors to function in complex environments. Integrators are instrumental in calibrating and syncing sensory data with robot behavior for accurate operations. This is particularly vital in quality inspection, material handling, and autonomous navigation applications. As sensory technologies evolve, integration complexity increases-further emphasizing the role of system integrators.

The robotics system integration industry is expanding beyond large enterprises as SMEs adopt robotic automation. Lower hardware costs and service-based integration models make robotics accessible to small businesses. Integrators offer cost-effective, lightweight automation setups tailored to smaller operations. This democratization of robotics integration broadens the market and encourages innovation across various sectors. SMEs now contribute significantly to market growth and integration demand.

The explosive growth of e-commerce and just-in-time delivery models is fueling demand for robotics integration in logistics and warehousing. Integrators are deploying automated guided vehicles (AGVs), robotic picking arms, and autonomous mobile robots (AMRs) to optimize inventory handling, order fulfillment, and shipping processes. Companies like GreyOrange, Locus Robotics, and Geek+ are emerging as key players with specialized logistics automation technologies. Robotics system integrators are now tasked with creating seamless, scalable solutions that integrate with warehouse management systems and cloud platforms. This trend underscores the critical role of robotics in addressing labor shortages, speeding up operations, and reducing logistics costs.

Type Insights

The industrial robots segment captured a significant revenue share of over 46% in 2024. Vision-guided robots are transforming the industrial robots segment by enabling intelligent automation in tasks such as inspection, sorting, and adaptive handling. These robots use cameras and sensors to perceive their environment and make real-time decisions, increasing process flexibility. Robotics system integrators play a key role in designing and installing these vision systems to align with robotic tasks and production requirements. The rise of smart manufacturing and Industry 4.0 has accelerated the demand for such intelligent robotic solutions. As a result, vision integration is becoming a standard feature in modern industrial robot deployments.

The autonomous robots segment is expected to witness the highest CAGR of 14.5% from 2025 to 2030. Autonomous Mobile Robots (AMRs) are seeing rapid adoption in warehouses and distribution centers due to their ability to navigate dynamically without fixed paths. These robots optimize internal logistics by transporting goods across complex layouts using advanced sensors and SLAM (Simultaneous Localization and Mapping) technology. Robotics system integrators are critical in integrating AMRs with warehouse management systems and ensuring smooth coordination with other automated systems. The demand for flexible and scalable automation is pushing businesses toward AMRs over traditional AGVs. This shift is revolutionizing intralogistics efficiency and driving demand in the autonomous robots segment.

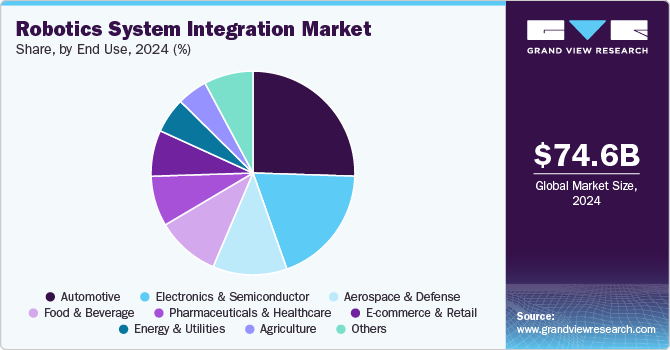

End Use Insights

The automotive segment captured significant market share in 2024. Automotive manufacturers are heavily adopting robotic systems for painting and surface finishing to improve consistency and reduce hazardous human exposure. Robotics system integrators are customizing multi-axis paint robots with electrostatic spray guns and smart flow control systems to deliver uniform coating on complex vehicle surfaces. These robots operate in highly controlled environments, ensuring minimal paint waste and environmental compliance. Their integration helps reduce costs, improve finish quality, and accelerate production lines. This trend reflects the growing need for high-throughput, eco-friendly solutions in automotive paint shops.

The electronics & semiconductor segment is expected to witness the highest CAGR from 2025 to 2030. The electronics and semiconductor industries are witnessing a growing demand for micro-robotic systems to perform ultra-precise assembly tasks. Robotics system integrators are customizing solutions capable of handling components smaller than a millimeter, such as microchips, resistors, and sensors. These robots are equipped with high-resolution cameras, force sensors, and precision actuators to achieve micro-level accuracy. As device miniaturization accelerates, especially in consumer electronics and wearable tech, micro-robotics play a vital role in ensuring high-quality, scalable production. This trend highlights the industry's reliance on precision-focused robotic integration for next-gen electronics.

Application Insights

The logistics & warehouse automation segment captured a significant revenue share in 2024. The logistics industry is witnessing a rise in fully automated robotic fulfillment systems that handle everything from order picking to packing and shipping. Robotics system integrators play a crucial role in creating synchronized ecosystems that integrate conveyors, vision-guided robots, automated guided vehicles (AGVs), and software platforms. These systems significantly reduce cycle times and improve accuracy in high-demand environments such as online retail. As consumer expectations for faster deliveries grow, end-to-end automation is becoming a competitive necessity. This trend is transforming traditional warehouses into smart fulfillment centers driven by robotics intelligence.

The material handling & packaging segment is expected to witness the highest CAGR from 2025 to 2030. The robotics system integration industry is seeing strong demand for automated palletizing and depalletizing systems to streamline material handling operations. Industries such as FMCG, food and beverage, and logistics are turning to robotic arms for stacking and unstacking products efficiently and accurately. System integrators are developing tailored end-of-line solutions with multi-axis robots, vision systems, and conveyor integration. These systems help reduce manual labor, prevent injuries, and accelerate throughput in high-volume facilities. As companies seek to optimize their supply chains, palletizing automation is becoming a standard investment.

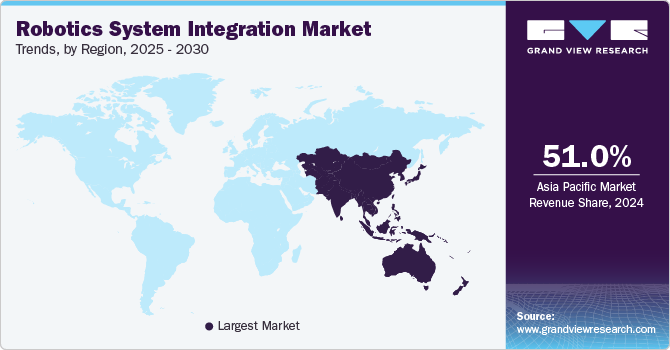

Regional Insights

The robotics system integration market in North America generated a significant revenue share, accounting for 21% in 2024. North America is witnessing strong growth in robotics system integration due to increased automation across automotive, logistics, and electronics sectors. Companies are investing heavily in smart factories and collaborative robots to boost efficiency and maintain global competitiveness. Integration of AI and IoT with robotics is a key driver in reshaping industrial automation across the region.

U.S. Robotics System Integration Market Trends

The U.S. robotics system integration market held a dominant position in 2024. The U.S. robotics system integration market is being propelled by the rapid adoption of automation in warehousing, aerospace, and defense industries. Major players are collaborating with system integrators to deploy advanced robotics solutions powered by machine learning and vision systems. Government support for reshoring manufacturing is further accelerating demand for integrated automation solutions.

Europe Robotics System Integration Market Trends

The Europe robotics system integration market was identified as a lucrative region in 2024. Europe is focused on integrating robotics to support smart manufacturing and green production goals, especially in the automotive and electronics industries. Robotics system integrators are enabling a seamless transition to Industry 5.0 with collaborative robots and human-centric automation. Regulatory frameworks around worker safety and energy efficiency are influencing integration strategies across the continent.

The robotics system integration market in the UK is gaining traction in response to labor shortages and the need for post-Brexit manufacturing efficiency. The logistics and food processing industries are particularly driving demand for integrated automation solutions. Increased government support for digital transformation is fueling adoption across SMEs and large enterprises alike.

Germany robotic system integration market is a global leader in industrial automation, leveraging robotics system integration for precision manufacturing and high-efficiency production lines. The country’s strong automotive and machine tools sectors are major adopters of robotics, with integrators enhancing flexible production cells. Investments in AI-integrated robotics and research collaborations are keeping Germany at the forefront of innovation.

Asia-Pacific Robotics System Integration Market Trends

The robotics system integration market in the Asia Pacific region is expected to grow at the highest CAGR of 10.2% from 2025 to 2030. Asia Pacific is the fastest-growing region for robotics system integration, driven by massive investments in manufacturing automation and smart infrastructure. The region’s strong electronics, automotive, and consumer goods industries are embracing end-to-end integrated robotics. Local governments are heavily supporting industrial digitalization through incentives and innovation programs.

China robotics system integration market is growing due to the increasing shifts of Chinese manufacturers toward local robotics system integrators to reduce dependence on foreign technology and costs. This surge is fueled by the rising technical capabilities of domestic integrators and government incentives promoting homegrown innovation. The trend reflects China’s focus on technological self-reliance and rapid scaling of robotics deployment across sectors.

The robotics system integration market in India is growing due to the rising integration of robotic systems in country’s healthcare, and pharmaceutical industries for lab automation, packaging, and material handling in sterile environments. Integrators are deploying robots in hospital logistics and pharma manufacturing to boost speed and compliance. This trend is being driven by the post-pandemic push for resilience, hygiene, and operational efficiency.

MEA Robotics System Integration Market Trends

The MEA robotics system integration marketis emerging strongly in the oil & gas, construction, and industrial logistics sectors. Countries are investing in smart city infrastructure and digital transformation, creating new opportunities for robotic-driven automation. The market is driven by the need for operational efficiency, workforce safety, and economic diversification.

The robotic system integration market in UAE is rapidly adopting robotics system integration in logistics, manufacturing, and public service sectors as part of its smart city and AI vision. Integrators are working on solutions that combine robotics with IoT and analytics for real-time performance optimization. Government-led innovation hubs and mega-projects are stimulating demand for advanced integrated automation systems.

Key Robotics System Integration Company Insights

Some key players operating in the market include Hitachi Ltd. and IPG Photonics Corporation

-

Hitachi Ltd. is a global conglomerate with strong capabilities in industrial automation and robotic system integration. In the robotics integration market, Hitachi focuses on smart factory solutions, AI-driven automation, and collaborative robotics. The company is leveraging IoT and big data to offer intelligent automation solutions for manufacturing and logistics. Hitachi is currently driving innovations in Industry 4.0 ecosystems, making it a dominant and mature player.

-

IPG Photonics Corporation is a leading developer of high-performance fiber lasers and photonics-based systems. The company integrates robotic systems for applications such as precision welding, cutting, and marking, especially in automotive and aerospace. Their laser-based robotic integration solutions are known for improving efficiency and reducing cost in complex industrial settings. IPG continues to innovate in high-speed laser automation, reinforcing its mature presence in the market.

CNC Robotics Ltd. and United Robotics Inc. are some emerging participants in the robotics system integration industry.

-

CNC Robotics Ltd. is a UK-based company specializing in robotic machining and automation for non-traditional materials. They focus on robotic integration in creative industries, aerospace prototyping, and composite manufacturing. The company is gaining traction by offering highly flexible robotic CNC systems that replace traditional machines. As demand rises for complex, cost-efficient machining solutions, CNC Robotics is emerging rapidly in niche automation markets.

-

United Robotics Inc. offers robotic system integration solutions primarily for industrial automation and assembly lines in North America. The company focuses on collaborative robots (cobots), vision systems, and turnkey robotic solutions for small and mid-sized manufacturers. United Robotics is building a reputation for affordability and ease-of-integration in the SME segment. Its growing portfolio and adaptability to customs need mark it as a promising emerging player.

Key Robotics System Integration Companies:

The following are the leading companies in the robotics system integration market. These companies collectively hold the largest market share and dictate industry trends.

- Hitachi Ltd.

- Burke Porter Group

- Mitsui & Co., Ltd.

- Scott Technology Ltd.

- IPG Photonics Corporation

- Concept Systems Inc.

- Midwest Engineered Systems Inc.

- Motion Controls Robotics Inc.

- United Robotics Inc.

- JH Robotics, Inc.

- Phoenix Control Systems Ltd.

- CNC Robotics Ltd.

Recent Developments

-

In March 2025, Hitachi announced significant advancements from its collaboration with NVIDIA, initiated a year prior, focusing on AI-driven transformation in industrial sectors. This partnership led to the establishment of an Industrial AI Advisory Council and the launch of an AI Center of Excellence, which developed prototypes such as Line Builder for factory assembly line design and the Power Grid Optimization Solver for enhancing grid operations. These initiatives underscore Hitachi's commitment to integrating AI technologies to improve efficiency and performance in physical and industrial applications.

-

In October 2024, Mitsui & Co. invested in Numa, a developer of AI-powered business transformation tools for U.S. car dealerships. Numa's AI solutions automate tasks such as customer communications and service scheduling, reducing response times by over 90% and enhancing customer satisfaction. This investment aligns with Mitsui's strategy to focus on Industrial Business Solutions in its Medium-Term Management Plan 2026.

-

In October 2024, Motion Controls Robotics, Inc. (MCRI) secured funding from Signature Bank NA to support its strategic growth and pursue acquisitions in key Eastern U.S. markets. The company is actively seeking to acquire businesses specializing in packaging, custom machine building, or controls engineering, with revenues up to USD 10 million, particularly in the Philadelphia, PA, and Charlotte, NC areas. Scott Lang, CEO and sole owner of MCRI, stated that this funding allows for strategic growth and partnerships that extend beyond acquisitions, aiming to create lasting value and success.

Robotics System Integration Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 82.32 billion |

|

Revenue forecast in 2030 |

USD 130.41 billion |

|

Growth rate |

CAGR of 9.6% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end use, regional |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Hitachi Ltd.; Burke Porter Group; Mitsui & Co., Ltd.; Scott Technology Ltd.; IPG Photonics Corporation; Concept Systems Inc.; Midwest Engineered Systems Inc.; Motion Controls Robotics Inc.; United Robotics Inc.; JH Robotics, Inc.; Phoenix Control Systems Ltd.; CNC Robotics Ltd. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Robotics System Integration Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global robotics system integration market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Robots

-

Service Robots

-

Collaborative Robots

-

Autonomous Robots

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Material Handling & Packaging

-

Welding & Assembly

-

Painting & Dispensing

-

Inspection & Quality Control

-

Logistics & Warehouse Automation

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electronics & Semiconductor

-

Food & Beverage

-

Pharmaceuticals & Healthcare

-

Aerospace & Defense

-

E-commerce & Retail

-

Agriculture

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global robotics system integration market size was estimated at USD 74.56 billion in 2024 and is expected to reach USD 82.32 billion in 2025.

b. The global robotics system integration market is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2030 to reach USD 130.41 billion by 2030.

b. Asia Pacific dominated the robotics system integration market with a share of 51.0% in 2024. The growing demand for smart and connected robotics in the Asia-Pacific region is being propelled by the integration of IoT and AI technologies, enabling real-time monitoring, predictive maintenance, and enhanced operational efficiency across various industries.

b. Some key players operating in the robotics system integration market include Hitachi Ltd., Burke Porter Group, Mitsui & Co., Ltd., Scott Technology Ltd., IPG Photonics Corporation, Concept Systems Inc., Midwest Engineered Systems Inc., Motion Controls Robotics Inc., United Robotics Inc., JH Robotics, Inc., Phoenix Control Systems Ltd., CNC Robotics Ltd.

b. Key factors that are driving the market growth include increasing demand for industrial automation, advancements in AI and machine learning, and rising adoption across small and medium enterprises.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."