Robotic Platform Market Size, Share & Trends Analysis Report By Robot (Industrial Robots, Service Robots), By Deployment (On-premises, Cloud), By Type (Mobile, Stationary), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-477-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Robotic Platform Market Size & Trends

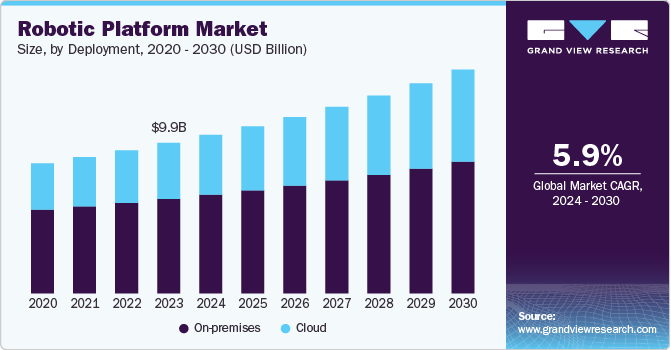

The global robotic platform market size was estimated at USD 9.97 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. The shift towards cloud-based robotic solutions is gaining momentum as businesses seek to enhance their operational efficiency and reduce costs. Cloud technology allows for centralized data storage and processing, enabling robots to leverage real-time analytics and machine learning capabilities. This transition facilitates easier updates and maintenance of robotic systems, reducing downtime and operational disruptions. As more companies adopt cloud solutions, the demand for robotic platforms that integrate seamlessly with cloud technologies is expected to rise, driving market growth.

The integration of artificial intelligence (AI) and machine learning (ML) into robotic platforms is transforming their functionality and adaptability. These technologies enable robots to learn from their environment, improve their performance over time, and make autonomous decisions based on data analysis. Incorporating AI and ML enhances the capabilities of robotic platforms in various applications, from industrial automation to service robots in healthcare settings. As businesses recognize the value of intelligent robotics, the demand for AI-driven robotic solutions is anticipated to grow significantly.

The demand for service robots designed to assist humans in non-manufacturing settings is growing rapidly. These robots have advanced software platforms that enhance their capabilities and enable more intelligent interaction with their environment and users. Service robots incorporate features like natural language processing, machine learning, and advanced navigation, making them suitable for patient care, surgical assistance, and medical supply distribution. As service robots become more affordable and their capabilities expand, their use is expected to extend to other sectors, such as education, hospitality, and personal assistance.

There has been a significant rise of robotic platforms within fixed systems, enabling remote monitoring and maintenance capabilities. These systems provide precise motion control, simulation, programming, sensor integration, user-friendly interfaces, machine learning, and AI integration. Robotic platforms in fixed systems contributes to increased efficiency, productivity, quality, and flexibility in industrial and manufacturing environments. As businesses seek to optimize their operations and reduce downtime, the demand for robotic platforms in fixed systems is expected to grow.

Emerging markets are witnessing a rapid expansion of robotics adoption, driven by economic growth and increasing industrialization. Countries in Asia-Pacific, Latin America, and parts of Africa are investing heavily in automation technologies to enhance productivity and competitiveness. The rising labor costs in these regions are prompting businesses to explore robotic solutions to maintain efficiency while controlling expenses. As these markets continue to develop, the demand for robotic platforms tailored to local needs is expected to surge, creating new opportunities for growth in the global robotics market.

Robot Insights

The industrial robots segment dominated the market in 2023 with a market share of above 66%. Integrating AI and machine learning technologies into industrial robots is revolutionizing their capabilities and applications. These advancements enable robots to learn from their environments, optimize their performance over time, and make autonomous decisions based on data analysis. As AI-driven robotics become more sophisticated, they can handle increasingly complex tasks across various industries, from precision manufacturing to quality control in pharmaceuticals. The continuous development in AI technology is expected to drive further innovation in the industrial robotics market.

The service robots segment is estimated to have the highest growth rate from 2024 to 2030. The integration of artificial intelligence (AI) into service robots is transforming their functionality and performance. AI enables robots to learn from their environments, adapt to new tasks, and make autonomous decisions based on data analysis. This advancement allows service robots to perform complex functions more efficiently, such as navigating dynamic environments or interacting with customers in real-time. As AI technology advances, service robots will become increasingly capable of handling diverse applications across various sectors, from healthcare to hospitality.

Deployment Insights

The on-premises segment held the largest revenue share in 2023. On-premises robotic platforms deliver faster processing times and lower latency, which is crucial for industries requiring real-time decision-making. Manufacturing and automotive sectors, where robotics are integral to assembly lines, benefit from the immediate data processing capabilities of on-premises systems. Robots in these environments often require split-second responses to changes, which cloud-based systems may not provide due to potential connectivity delays. On-premises solutions eliminate the risk of internet outages or slowdowns, ensuring uninterrupted robotic operations. This real-time performance is a key driver for companies seeking reliability and efficiency in time-sensitive applications.

The cloud segment is estimated to register the fastest growth rate from 2024 to 2030. Cloud platforms enable the seamless collection of vast amounts of data from robotic systems in real-time. This data can be analyzed for actionable insights, allowing businesses to optimize robot performance and workflow efficiency. Predictive analytics, made possible through cloud integration, helps companies anticipate maintenance needs, reducing downtime and repair costs. Furthermore, cloud systems provide a centralized data hub, enabling cross-location data sharing and collaboration. This holistic approach to data management supports continuous improvement and faster decision-making in dynamic environments.

Type Insights

The stationary segment held the largest revenue share in 2023. Stationary robotic platforms are highly valued for their precision and consistency, making them ideal for industries such as automotive, electronics, and pharmaceuticals. These robots are designed to perform repetitive tasks with minimal deviation, ensuring quality control in mass production. The demand for increased automation and improved product quality continues to drive the adoption of stationary systems in high-precision manufacturing environments. Moreover, the integration of advanced sensors and feedback mechanisms allows these platforms to achieve even greater accuracy, further boosting their appeal in sectors where error margins are critical. As industries evolve toward more automated processes, stationary robots will remain essential for delivering reliable and accurate results.

The mobile segment is estimated to have the fastest growth rate from 2024 to 2030. The adoption of autonomous mobile robots (AMRs) is rapidly increasing, particularly in the logistics, warehousing, and e-commerce sectors. These robots can navigate complex environments without human intervention, using advanced sensors and mapping technologies. AMRs are used for tasks like transporting goods, inventory management, and order fulfillment, which enhance efficiency and reduce operational costs. As businesses seek to automate processes and manage rising labor costs, AMRs are becoming a cornerstone of modern supply chains. The ability to scale operations quickly and improve overall productivity is driving strong demand for mobile robots in these industries.

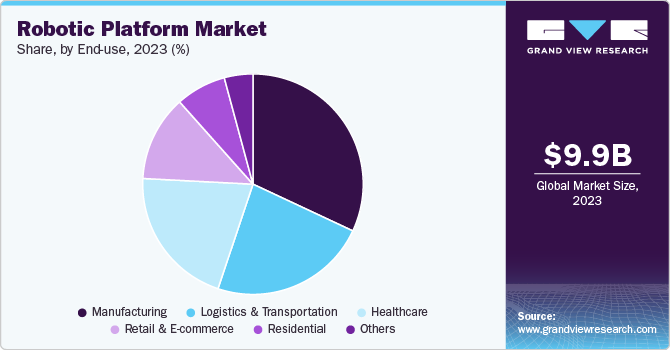

End Use Insights

The manufacturing segment held the largest revenue share in 2023. Manufacturers are increasingly prioritizing sustainability and energy efficiency in their operations, and robotic platforms play a key role in this shift. Robots are being designed to consume less energy, operate more efficiently, and reduce waste in production processes. This is particularly relevant in industries like consumer goods and automotive, where environmental concerns and regulatory pressures are mounting. By optimizing resource use and minimizing human error, robotic systems help manufacturers reduce their carbon footprint while maintaining high productivity levels. As sustainability becomes a core focus for global manufacturers, energy-efficient robotic platforms will continue to see strong demand.

The healthcare segment is estimated to register the fastest growth rate from 2024 to 2030. Healthcare facilities are increasingly adopting robotic platforms for patient care and assistance, particularly in areas like elderly care and rehabilitation. Robots are used for tasks such as patient lifting, mobility assistance, and medication delivery, helping to reduce the physical strain on healthcare workers and improve patient comfort. Robotic rehabilitation systems are also gaining popularity, providing personalized therapy and tracking progress in patients recovering from strokes, injuries, or surgeries. The ability of robots to assist with routine tasks frees up medical staff to focus on more critical aspects of care. As the demand for healthcare services rises, especially in aging populations, robotic platforms for patient care are expected to grow in importance.

Regional Insights

The robotic platform market in North America accounted for a revenue share of above 35% in 2023. The North American market is at the forefront of innovation, particularly in industries like healthcare and logistics, where robotic platforms enhance operational efficiency. The region sees strong adoption of collaborative robots (cobots), especially in small and medium-sized enterprises (SMEs), due to their flexibility and ease of integration. Additionally, the growing focus on AI and machine learning integration in robotic systems drives advancements in autonomous robotics across various sectors.

U.S. Robotic Platform Market Trends

The robotic platform market in the U.S. is anticipated to grow at a CAGR of above 4% from 2024 to 2030. The market is growing rapidly, particularly in the fields of healthcare and defense. There is increasing use of robotic systems in surgical procedures and telemedicine, enhancing precision and accessibility in medical services. Furthermore, the U.S. defense sector is investing heavily in autonomous robotic platforms for surveillance, unmanned systems, and battlefield operations, driven by the need for enhanced capabilities in national security.

Europe Robotic Platform Market Trends

The robotic platform market in Europe is experiencing steady growth in 2023, driven by a strong focus on Industry 4.0 and smart manufacturing initiatives. European manufacturers are increasingly investing in robotic automation to optimize production and reduce labor costs, particularly in countries like Germany and France. Additionally, the region is leading in the development of sustainable robotics, with an emphasis on energy-efficient and environmentally friendly robotic solutions, in line with the EU's green initiatives.

Asia Pacific Robotic Platform Market Trends

The robotic platform market in Asia Pacific is anticipated to grow at the fastest CAGR of over 8% from 2024 to 2030, driven by the rapid industrialization and the increasing need for automation in manufacturing. Countries like China, Japan, and South Korea are leading in the adoption of advanced robotic platforms in sectors like electronics, automotive, and logistics. Moreover, the region is seeing a surge in the development of AI-powered robots, particularly in service industries, to meet the rising demand for automation in urban centers.

Key Robotic Platform Company Insights

The robotic platform market is competitive, with prominent players like IBM Corporation, NVIDIA Corporation, Amazon.com, Inc., Google LLC, Microsoft, and ABB LTD., leading the industry as of 2023. These companies are growing their market presence through strategic moves, such as acquisitions, collaborations, mergers, and the launch of latest advanced products and technologies. For instance, In June 2024, ANYbotics partnered with Energy Robotics to integrate their robotic platforms for enhanced automated inspections in the energy sector. This collaboration is designed to provide comprehensive end-to-end inspection solutions and facilitate seamless data integration. The partnership aims to improve asset monitoring capabilities, elevating operational efficiency within the energy industry.

Key Robotic Platform Companies:

The following are the leading companies in the robotic platform market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- NVIDIA Corporation

- Amazon.com, Inc.

- Google LLC

- Microsoft

- ABB LTD.

- KUKA AG

- Universal Robots

- KEBA

- Dassault Systèmes

- Rethink Robotics

- Cyberbotics

- CloudMinds

- Clearpath Robotics

Recent Developments

-

In March 2024, IBM unveiled Robotic Process Automation version 23.0.15, which introduced various enhancements and fixes.Among the key updates were the addition of time zone support in scheduling, compliance with the Federal Information Processing Standards (FIPS), and tools to manage User Management Services (UMS). This release also addressed previously identified issues, as outlined in the APAR documentation.

-

In March 2024, Cognizant and Google Cloud expanded their existing partnership to enhance software development efficiency by adopting the Gemini platform for Google Cloud. This initiative focuses on equipping Cognizant associates with training on Gemini for software development tasks and integrating its advanced features into Cognizant's internal operations. The strategic collaboration aims to boost productivity across development teams significantly.

-

In March 2024, Addverb, a prominent player in robotics and warehouse automation, partnered with DHL Supply Chain in North America. The collaboration includes the deployment of 52 Zippy sorting robots along with an Addverb software solution at a DHL distribution center in Columbus, Ohio. By leveraging Addverb's enterprise software platform, this implementation is expected to enhance facility throughput and scalability.

-

In March 2024, LG Electronics invested USD 60 million in Bear Robotics, a notable Silicon Valley startup specializing in AI-driven autonomous service robots. This investment reflects LG's commitment to advancing its service robotics capabilities. The collaboration aims to foster innovation in delivery and logistic applications through these advanced robotic solutions.

Robotic Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 10.51 billion |

|

Revenue forecast in 2030 |

USD 14.82 billion |

|

Growth rate |

CAGR of 5.9% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

|

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

IBM Corporation; NVIDIA Corporation; Amazon.com Inc.; Google LLC; Microsoft; ABB LTD.; KUKA AG; Universal Robots; KEBA; Dassault Systèmes; Rethink Robotics; Cyberbotics; CloudMinds; and Clearpath Robotics. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Robotic Platform Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global robotic platform market report based on robot, deployment, type, end use, and region.

-

Robot Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Robots

-

Service Robots

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile

-

Stationary

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Automotive

-

Electrical & Electronics

-

Food & Beverages

-

Pharmaceuticals

-

Plastic, Rubber, and Chemicals

-

Metals & Machinery

-

Others

-

-

Healthcare

-

Logistics and Transportation

-

Retail and E-commerce

-

Residential

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global robotic platform market size was estimated at USD 9.97 billion in 2023 and is expected to reach USD 10.51 billion in 2024.

b. The global robotic platform market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 14.82 billion by 2030.

b. North America dominated the robotic platform market with a share of 35.4% in 2023. The North American market is at the forefront of innovation, particularly in industries like healthcare and logistics, where robotic platforms are used to enhance operational efficiency.

b. Some key players operating in the robotic platform market include IBM Corporation, NVIDIA Corporation, Amazon, Google LLC, Microsoft, ABB, KUKA, Universal Robots, KEBA, Dassault Systèmes, Rethink Robotics, Cyberbotics, CloudMinds, and Clearpath Robotics.

b. Key factors that are driving the market growth include increasing government investments in robotics R&D, a surge in demand for automation across various industries, and advancements in technologies such as artificial intelligence and machine learning that enhance robotic capabilities.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."