Robotic Palletizers And De-palletizers Market Size, Share & Trends Analysis Report By Product (Robotic Palletizers, Robotic De-palletizers), By End-use, By Payload Capacity, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-438-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

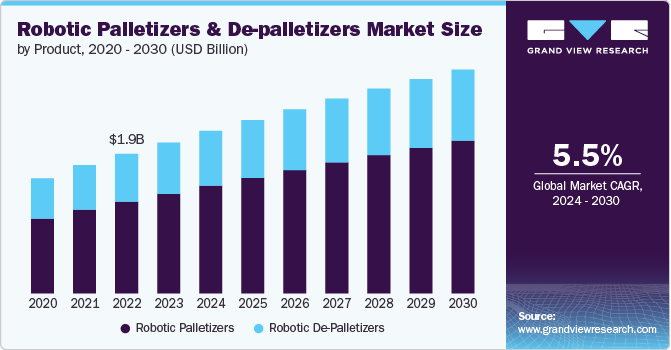

The global robotic palletizers and de-palletizers market size was estimated at USD 2.10 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. The growing demand for automation across various industries, including food and beverage, pharmaceuticals, consumer goods, and logistics, is driving the market growth.

Companies are increasingly adopting automated solutions to enhance operational efficiency, reduce labor costs, and improve safety in their facilities. The need for faster production rates and the ability to handle high volumes of products with precision are pushing manufacturers to invest in robotic systems that can streamline their packaging processes, which is expected to further fuel the market growth in the coming years.

The rapid growth of e-commerce has created a surge in demand for efficient warehousing and distribution solutions. Retailers are increasingly relying on automated systems to manage inventory levels effectively while ensuring timely order fulfillment. Robotic palletizers and de-palletizers are essential components in modern warehouses as they facilitate the quick handling of products from storage to shipping areas. This trend is expected to continue as online shopping becomes more prevalent, driving investments in automation technologies within the retail sector.

Innovations such as artificial intelligence (AI), machine learning, and advanced vision systems have significantly improved the capabilities of robotic systems. These technologies enable robots to perform complex tasks with greater accuracy and flexibility, allowing them to adapt to varying product sizes, shapes, and weights. As these technologies continue to evolve, they will further enhance the functionality of robotic palletizers and de-palletizers, making them more attractive to businesses seeking efficient solutions.

The ongoing labor shortages and rising labor costs is significantly driving the market growth across various industries.With the global workforce facing challenges such as aging populations and a declining number of workers willing to take on physically demanding jobs, companies are turning to robotic solutions to fill the gap. Robotic palletizers and de-palletizers not only reduce the need for manual labor but also minimize the risk of workplace injuries, making them an attractive option for businesses looking to maintain operational efficiency while managing labor-related challenges.

Moreover, companies are seeking eco-friendly packaging solutions that reduce waste and lower carbon footprints. Robotic systems that can efficiently handle recyclable or biodegradable packaging materials are in high demand. In addition, the ability to optimize pallet patterns to maximize space utilization and reduce shipping costs aligns with broader environmental sustainability goals, making robotic systems an integral part of green logistics strategies. Such strategies by companies are expected to further drive market growth in the coming years.

Product Insights

The robotic palletizers segment led the market with the largest revenue share of 65.99% in 2023, owing to the widespread adoption of these systems across various industries for their efficiency in automating the stacking of products on pallets. Moreover, the increasing demand for automation to enhance production efficiency, reduce labor costs, and ensure consistency in product handling is fueling the market growth. The versatility of robotic palletizers to adapt to different packaging types and sizes also makes them indispensable in modern supply chains, thereby driving segmental growth.

The robotic de-palletizers segment is expected to witness at a significant CAGR of over 4% from 2024 to 2030, driven by the growing need for efficient and automated solutions in the unpacking and handling of goods across various industries. In addition, advancements in robotic technology, such as improved vision systems and AI-driven software, are enhancing the capabilities of robotic de-palletizers, making them more adaptable and efficient in handling a wide range of products. This growing demand for automation in de-palletizing operations is expected to propel the segment's growth in the coming years.

End-use Insights

Based on end use, the food and beverage segment led the market with the largest revenue share of 29.81% in 2023. This growth can be attributed to the sector's continuous need for efficiency, hygiene, and consistency in handling products. The industry deals with a high volume of goods, often packaged in various sizes and materials, requiring precise and reliable automation solutions. Robotic palletizers and de-palletizers are essential in maintaining the speed and accuracy needed to keep up with production demands, while also adhering to strict hygiene standards.

The logistics and warehousing segment is anticipated to record at the fastest CAGR from 2024 to 2030, owing to the explosive growth of e-commerce and the increasing complexity of global supply chains. Robotic palletizers and de-palletizers play a critical role in automating the handling of a wide variety of goods, reducing labor costs, and improving throughput in fulfillment centers. This growing need for automation to manage increasing volumes and optimize warehouse space is driving the rapid adoption of robotic solutions in the logistics and warehousing sector.

Payload Capacity Insights

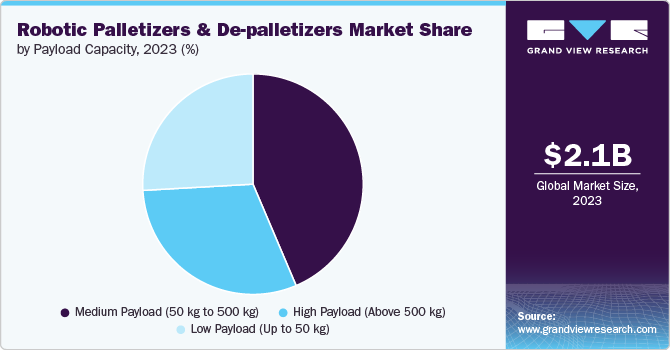

Based on payload capacity, the medium payload (50 kg to 500 kg) segment led the market with the largest revenue share of 43.6% in 2023. This growth can be attributed to its versatility and widespread application across various industries. This segment is particularly favored in industries such as food and beverage, pharmaceuticals, and consumer goods, where handling larger and heavier packages is common. The medium payload robots offer a balance between strength and speed, making them ideal for operations that require the efficient handling of moderate to heavy loads. Their ability to manage a broad range of packaging types and sizes has made them a preferred choice for companies seeking to optimize their palletizing and de-palletizing processes, thereby driving segmental growth.

The low payload (up to 50 kg) segment is expected to grow at the fastest CAGR from 2024 to 2030. This growth can be attributed to the increasing demand for automation in sectors dealing with lighter products and smaller packages. The rise of e-commerce, which often involves the handling of lightweight parcels, is a key factor contributing to the growth of this segment. In addition, advancements in robotics technology are making low payload robotic systems more affordable and accessible to small and medium-sized enterprises (SMEs), which are increasingly adopting these systems to enhance operational efficiency.

Regional Insights

The robotic palletizers and de-palletizers market in North America accounted for the revenue share of 29% in 2023. The market is driven primarily by the increasing demand for automation in the manufacturing and logistics sectors. Companies are investing in advanced technologies to enhance operational efficiency, reduce labor costs, and improve safety standards. The presence of major players in the robotics industry, along with a strong focus on innovation and technological advancements, further propelling the market growth.

U.S. Robotic Palletizers And De-palletizers Market Trends

The robotic palletizers and de-palletizers market in U.S. is projected to grow at the fastest CAGR of 4% from 2024 to 2030. The rising trend of e-commerce has led to increased warehousing activities, necessitating efficient palletizing solutions to manage high volumes of goods, thereby driving the market growth in the region.

Europe Robotic Palletizers And De-palletizers Market Trends

The robotic palletizers and de-palletizers market in Europe is anticipated to grow at a CAGR of 5% from 2024 to 2030. This growth is driven by stringent regulations regarding workplace safety and labor conditions. European manufacturers are increasingly adopting automation solutions to comply with these regulations while also addressing labor shortages in various sectors. The region’s emphasis on sustainability and reducing carbon footprints drives investments in energy-efficient robotic systems.

Asia-Pacific Robotic Palletizers And De-palletizers Market Trends

Asia Pacific dominated the robotic palletizers and de-palletizers market with the largest revenue share of 35.1% in 2023, owing to the rapid industrialization and urbanization. Countries of the region are witnessing a surge in manufacturing activities across various sectors such as food & beverage, pharmaceuticals, and consumer goods. This industrial expansion creates a substantial need for automated solutions to streamline production processes and enhance supply chain efficiency. In addition, increasing foreign investments in manufacturing facilities within this region contributes to the adoption of advanced robotics technology.

Key Robotic Palletizers And De-palletizers Company Insights

Some of the key players operating in the market include FANUC CORPORATION and KION Group AG, among others.

-

FANUC CORPORATION is a global manufacturer of automation products and solutions, including robotics. The company specializes in industrial robots, CNC systems, and factory automation technologies. The company’s robotic palletizers and de-palletizers are designed to enhance efficiency in material handling processes across various industries such as food and beverage, pharmaceuticals, and consumer goods

-

KION Group AG is a German manufacturer of industrial trucks and supply chain solutions. The company operates under several well-known brands including Linde Material Handling and STILL. The company has expanded its portfolio to include automated systems such as robotic palletizers and de-palletizers that optimize logistics operations within warehouses and distribution centers. Their solutions are characterized by advanced technology that enhances productivity while ensuring safety and flexibility in material handling tasks

Doosan Robotics, Inc. and Omron Corporation are some of the emerging market participants in the market.

-

Doosan Robotics, Inc., specializes in collaborative robots (cobot) designed for various applications including palletizing. Established with a vision to revolutionize automation through user-friendly robotic solutions, Doosan Robotics focuses on creating robots that can work alongside humans safely

-

Omron Corporation is a company operating in automation technology. The company offers a wide range of products including sensors, controllers, and industrial robots tailored for various sectors such as automotive, electronics, food processing, and logistics. Omron’s robotic palletizing solutions leverage sophisticated control algorithms and machine learning techniques to improve operational efficiency while reducing labor costs

Key Robotic Palletizers And De-palletizers Companies:

The following are the leading companies in the robotic palletizers and de-palletizers market. These companies collectively hold the largest market share and dictate industry trends.

- FANUC CORPORATION

- KION GROUP AG

- KUKA AG

- ABB Ltd.

- Krones AG

- Schneider Packaging Equipment Company, Inc.

- Honeywell International Inc.

- Kaufman Engineered Systems

- Doosan Robotics, Inc.

- Omron Corporation

Recent Developments

-

In June 2024, Doosan Robotics, Inc. partnered with Rocketfarm AS to enhance palletizing efficiencies by integrating Rocketfarm's Pally software with Doosan's collaborative robots (cobots). This collaboration aims to streamline operations across various industries, including automotive and food and beverage, by providing a user-friendly and flexible palletizing solution

-

In January 2024, FANUC CORPORATION launched several new products, including the M-950iA/500 palletizing robot, the M-710iD/50M with advanced vision and AI capabilities, and the LASER SCANNER LS3Di-A. Other notable additions include the CRX-10iA/L Paint collaborative robot and enhancements to its CNC and IoT systems, showcasing the company's commitment to innovation across its robotics and automation divisions

-

In March 2023, Omron Corporation launched a new cobot palletizing solution designed to enhance flexibility in production while minimizing programming time. Built on the NX1 series modular machine controller, this solution features a specialized Palletizing Function Block that allows for quick pallet pattern definition and easy setup through a step-by-step teaching process. The cobot can operate safely alongside humans without additional safety fencing, making it suitable for various industries

Robotic Palletizers And De-palletizers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.26 billion |

|

Revenue forecast in 2030 |

USD 3.11 billion |

|

Growth rate |

CAGR of 5.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report Component |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, payload capacity, regional |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

FANUC CORPORATION; KION GROUP AG; KUKA AG; ABB Ltd.; Krones AG; Schneider Packaging Equipment Company, Inc.; Honeywell International Inc.; Kaufman Engineered Systems; Doosan Robotics, Inc.; Omron Corporation |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Robotic Palletizers And De-palletizers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global robotic palletizers and de-palletizers market report based on product, end-use, payload capacity, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Robotic Palletizers

-

Robotic De-palletizers

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Pharmaceuticals

-

Consumer Goods

-

Automotive

-

Chemical

-

Electronics

-

Logistics and Warehousing

-

Others

-

-

Payload Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Payload (up to 50 kg)

-

Medium Payload (50 kg to 500 kg)

-

High Payload (above 500 kg)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global robotic palletizers and de-palletizers market size was estimated at USD 2.10 billion in 2023 and is expected to reach USD 2.26 billion in 2024.

b. The global robotic palletizers and de-palletizers market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 3.11 billion by 2030.

b. North America accounted for a market revenue share of 29% in 2023, driven primarily by the increasing demand for automation in the manufacturing and logistics sectors. Companies are investing in advanced technologies to enhance operational efficiency, reduce labor costs, and improve safety standards

b. Some key players operating in the robotic palletizers and de-palletizers market include FANUC CORPORATION, KION GROUP AG, KUKA AG, ABB Ltd., Krones AG, Schneider Packaging Equipment Company, Inc., Honeywell International Inc., Kaufman Engineered Systems, Doosan Robotics, Inc., Omron Corporation.

b. The key factors driving the robotic palletizers & de-palletizers market include growing demand for automation across various industries, innovations such as artificial intelligence (AI), machine learning, and advanced vision systems, and ongoing labor shortages and rising labor costs.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."