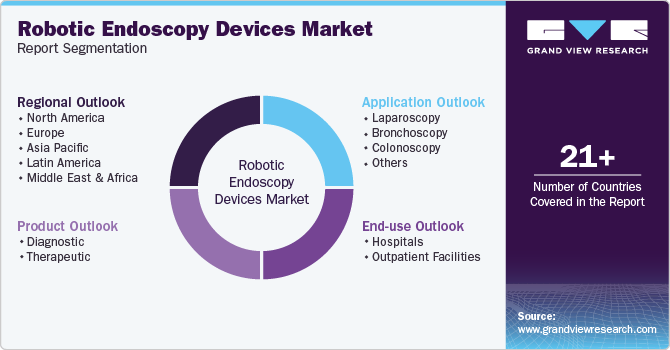

Robotic Endoscopy Devices Market Size, Share & Trends Analysis Report By Product (Diagnostic, Therapeutic), By Application (Laparoscopy, Bronchoscopy, Colonoscopy, Others), By End-Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-984-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Robotic Endoscopy Devices Market Trends

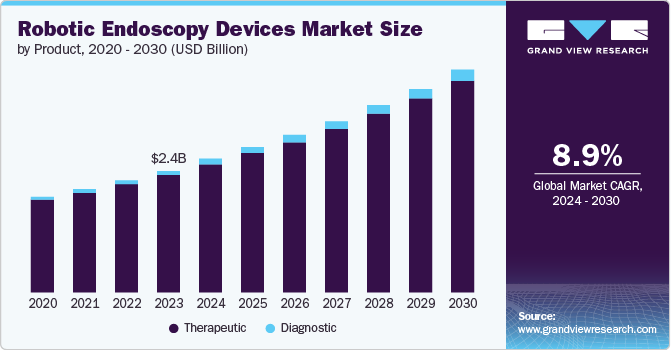

The global robotic endoscopy devices market size was valued at USD 2.44 billion in 2023 and is projected to grow at a CAGR of 8.9% from 2024 to 2030. The increasing prevalence of gastrointestinal diseases, such as colorectal cancer and gastroesophageal reflux disease (GERD), is one of the primary factors fueling the demand for robotic endoscopy devices. In addition, the advancements in technology leading to the development of more efficient and precise devices have also contributed to the market growth.

The adoption of minimally invasive procedures over traditional open surgeries is another significant factor. These procedures offer benefits such as reduced pain, lower risk of infection, shorter hospital stays, and quicker recovery times, making them a preferred choice for both doctors and patients. Furthermore, the growing healthcare expenditure and the increasing awareness about early diagnosis and treatment of various diseases are also expected to propel the market growth.

Inflammatory bowel disease, which is estimated to affect 5-10% of the global population across all genders and age groups, is driving the demand for robotic endoscopy devices in its treatment. Furthermore, the prevalence of pancreatic cancer and gastroesophageal reflux diseases is shifting patient preferences towards surgical methods, thereby leading to a surge in demand for these devices and significantly expanding the market.

The increase in investments and grants from governments and other organizations is heightening the focus of hospitals and other healthcare organizations on adopting robotic endoscopic technologies. The improved diagnostic accuracy and treatment outcomes resulting from these technologies are also fueling their demand, thus contributing to significant market growth.

Product Insights

Therapeutic product segment dominated the market and accounted for a share of 96.2% in 2023 owing to the rise in gastrointestinal disorder cases, which necessitate advanced diagnostics and therapeutic innovations, thereby significantly increasing the demand for this segment. Moreover, technological advancements in this segment have enhanced the overall effectiveness of endoscopic procedures, resulting in reduced recovery time, shorter hospital stays, lower risk of complications, and increased patient satisfaction.

The diagnostics product segment is anticipated to witness the fastest growth at a CAGR of 11.0% from 2024 to 2030. The growth drivers for this segment include the critical role played by diagnostic products in minimally invasive surgical procedures, such as early disease detection, assistance in personalized treatment based on patient needs, and enhancement of the overall treatment process, leading to better results.

Application Insights

The laparoscopy applications segment accounted for the largest market revenue share at 47.8% in 2013. This growth is attributed to the improved outcomes of surgeries compared to alternative technologies. These results are changing consumer preferences and increasing the adoption of these technologies in this application. Furthermore, technological advancements and innovations, such as machine learning algorithms and AI, are enhancing the capabilities of these technologies.

The colonoscopy applications segment is projected to grow at a CAGR of 9.9% from 2024 to 2030. This growth is attributed to the features offered by the technologies in this application, such as enhanced maneuverability, improved visualization, superior accuracy, and precision compared to alternative technologies. These features reduce discomfort for patients during treatment, driving the demand for the product and significantly growing the market in this application.

End-use Insights

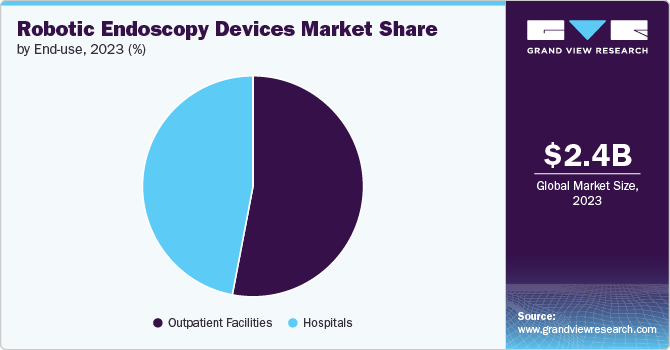

The outpatient facilities segment dominated the market in 2023. The growth drivers for this segment are technological advancements that have enhanced treatment with cost-effective features. These include reduced hospital stays, the convenience of patients being treated at home, and enhanced diagnostic capabilities due to increased accuracy.

The hospital end use segment is anticipated to witness significant growth with a CAGR of 8% from 2024 to 2030. The growth driver for this segment is the competitive market of hospitals, which has led to the provision of innovative, state-of-the-art services, superior technicians, and medical expertise. These factors surpass those of other end-use segments, thereby increasing the demand for these technologies in this segment.

Regional Insights

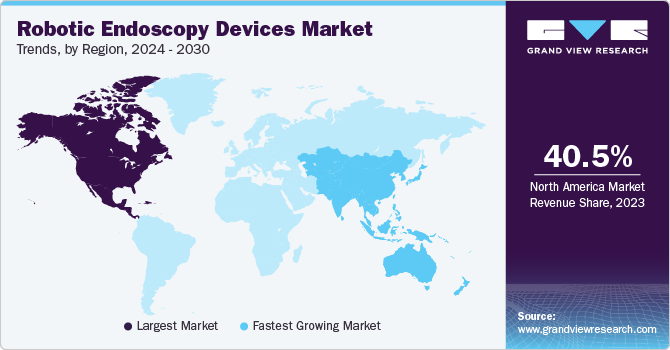

North American robotic endoscopy devices market dominated the market with revenue share of 40.54% in 2023 attributed to the increasing cases of chronic diseases, key innovations by industry players in the region, and an enhanced focus on healthcare efficiency, all of which are significantly expanding the market in this region.

U.S. Robotic Endoscopy Devices Market Trends

The U.S. robotic endoscopy devices market dominated the North American market with a share of 85.3% in 2023. This dominance is due to technological advancements, supportive government policies, and growing awareness of environmental sustainability, as this technology reduces carbon emissions compared to other technologies

The robotic endoscopy devices market in Mexico is expected to grow at a CAGR of 6.3% from 2024 to 2030. The growth drivers for this market are the shifting patient preferences towards robotic endoscopy device technologies for minimally invasive surgeries, and regulatory support aimed at expanding the market in the country.

Europe Robotic Endoscopy Devices Market Trends

Europe's robotic endoscopy devices market was identified as a lucrative region in 2023. This growth is attributed to substantial investments in the development of healthcare infrastructure, an increase in cases of gastrointestinal diseases, and the improved accuracy and results derived from the use of this technology. These factors have significantly contributed to the market’s expansion in the region.

The UK robotic endoscopy devices market is projected to experience rapid growth in the coming years. This growth is driven by an increase in cases of chronic diseases that necessitate surgeries, thereby escalating the demand for these products. The approval of products by regulatory agencies such as the Medicines and Healthcare products Regulatory Agency (MHRA), advancements in endoscopic procedures in the country, and the increasing adoption of these technologies are significantly contributing to the market’s growth.

Asia Pacific Robotic Endoscopy Devices Market Trends

The Asia Pacific robotic endoscopy devices market is expected to grow at a CAGR of 10.1% from 2024 to 2030 owing to the rising cases of urological, respiratory, and gastrointestinal diseases, which necessitate diagnosis and thus increase the demand for these products. The expansion of the overall healthcare industry in the region provides opportunities for the adoption of these technologies, significantly contributing to the market’s growth.

China's robotic endoscopy devices market held a substantial market share in 2023 attributed to an increased focus on medical specialists and automated endoscopy reprocessing, innovations aimed at patient safety, such as the extensive use of single-use instruments, and continuous advancements in endoscopic technologies in the country. These factors are significantly contributing to the market growth in China.

Key Robotic Endoscopy Devices Company Insights

Some of the key companies in the robotic endoscopy devices market include Medtronic, Intuitive Surgical, Asensus Surgical US, Inc., and Olympus Corporation, and many more companies. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Robotic Endoscopy Devices Companies:

The following are the leading companies in the robotic endoscopy devices market. These companies collectively hold the largest market share and dictate industry trends.

- Intuitive Surgical

- Asensus Surgical US, Inc.

- Novus Health Products R&D Consultancy

- Medtronic

- Olympus Corporation

- CMR Surgical Ltd.

- KARL STORZ SE & Co. KG, Tuttlingen

- Virtuoso Surgical, Inc.

- Brainlab AG

Recent Developments

-

In March 2024, Intuitive Surgical received FDA clearance for its next-generation multiport robotic system, the da Vinci 5. Building upon the established foundation of the da Vinci Xi, which has been utilized in over 7 million procedures worldwide, the da Vinci 5 represents a significant advancement in surgical technology.

-

In December 2023 Medtronic announced a strategic partnership with Cosmo Intelligent Medical Devices. This collaboration centered on the development of the GI Genius intelligent endoscopy module, a device designed to enhance patient care and clinical outcomes. Both companies expressed a shared commitment to leveraging AI technology to develop innovative medical equipment that will improve patient outcomes.

Robotic Endoscopy Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.68 billion |

|

Revenue forecast in 2030 |

USD 4.46 billion |

|

Growth rate |

CAGR of 8.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; Kuwait; South Africa |

|

Key companies profiled |

Intuitive Surgical.; Asensus Surgical US, Inc.; Novus Health Products R&D Consultancy; Medtronic; Olympus Corporation; CMR Surgical Ltd.; Richard Wolf GmbH.; KARL STORZ SE & Co. KG, Tuttlingen; Virtuoso Surgical, Inc.; Brainlab AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Robotic Endoscopy Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global robotic endoscopy devices market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic

-

Therapeutic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Laparoscopy

-

Bronchoscopy

-

Colonoscopy

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."