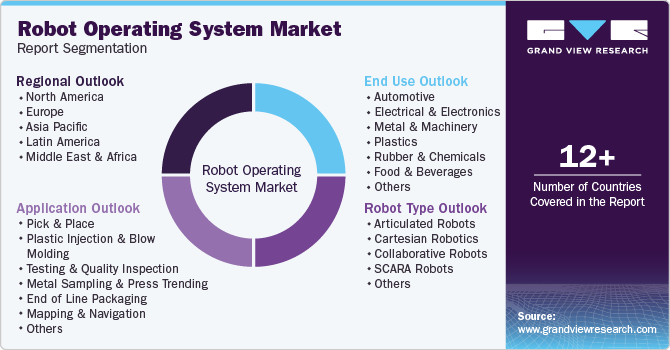

Robot Operating System Market Size, Share & Trends Analysis Report By Robot Type (Articulated Robots, Cartesian Robotics, Collaborative Robots, SCARA Robots), By Application, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-336-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range:

- Forecast Period: 1 - 2030

- Industry: Technology

Robot Operating System Market Trends

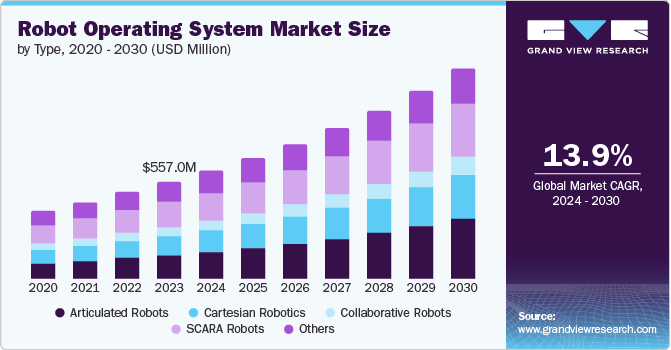

The global robot operating system market size was estimated at USD 557.0 million in 2023 and is expected to grow at a CAGR of 13.9% from 2024 to 2030. This growth is attributed to the robotic systems that are increasingly taking over or enhancing various human roles. The robot operating system (ROS), an open-source standard in the robotics industry, facilitates tasks such as locomotion, manipulation, navigation, and recognition by integrating sensors, motors, and controllers into reusable modules within a distributed messaging framework. As dependence on robotic systems grows, they become valuable targets, especially in applications like autonomous vehicles where human safety is at stake.

The increasing demand for automation across various industries is driving the adoption of ROS for efficient robot operation and management. As the need for streamlined robot operations and management rises, ROS stands out as the preferred choice. Its versatile framework allows for seamless integration and control of robotic systems across multiple sectors. By enhancing productivity, cost-effectiveness, and scalability, ROS is gaining widespread adoption and establishing itself as a key technology in the automation landscape. Moreover, as robotics advances with innovations like AI and sensor integration, ROS is crucial in supporting complex functionalities. Its adaptability enables developers to manage cutting-edge capabilities, ensuring the smooth integration of technological advancements. The growing demand for ROS as a robust platform highlights its importance in the development and operation of advanced robotic systems within the constantly evolving robotics landscape.

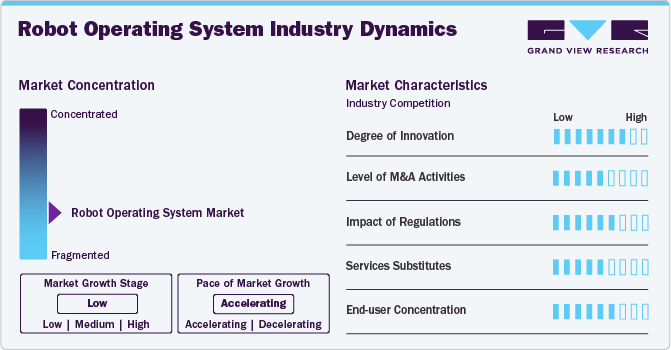

Market Concentration & Characteristics

The robot operating system (ROS) continues to be a hotbed of innovation in the robotics field, driving significant advancements in development and applications. Its modular and reusable architecture, coupled with hardware abstraction capabilities, has revolutionized how robotic systems are designed and implemented. This has led to dramatic reductions in development cycles, as exemplified by Porsche Engineering's ability to integrate new sensors in their JUPITER test vehicles within a week. ROS's distributed computing architecture and cross-platform compatibility have further expanded its utility across diverse robotic applications, from industrial automation to autonomous vehicles. The platform's integration with simulation and visualization tools has enhanced the testing and refinement process, allowing developers to perfect their applications in virtual environments before real-world deployment.

The robot operating system industry is characterized by a high level of merger and acquisition (M&A) activity. For instance, in June 2024, ABB is intensifying its efforts to revolutionize the construction industry through robotic automation by announcing a new collaboration with SAMSUNG E&A. This partnership will involve deploying ABB robots in SAMSUNG E&A’s Smart Shops to construct prefabricated modules for building projects globally.

The regulatory landscape surrounding the robot operating system is complex and multifaceted, reflecting the diverse applications and potential impacts of this technology. While specific information about regulatory changes in 2023 is not readily available, the general regulatory framework for ROS encompasses several key areas. Safety standards are paramount, particularly for ROS-based systems used in industrial and service robotics, ensuring that these systems meet rigorous safety requirements.

Data privacy and security regulations also play a crucial role, given ROS's function in facilitating communication between various robotic components. Industry-specific regulations further shape the implementation of ROS in sectors such as healthcare, automotive, and manufacturing. Efforts towards standardization aim to ensure interoperability and consistency across different ROS implementations, potentially influenced by regulatory bodies. Liability considerations are increasingly important as ROS is utilized in autonomous systems, affecting its adoption and implementation. Export control regulations may impact the international distribution and use of ROS, given the advanced nature of robotics technology.

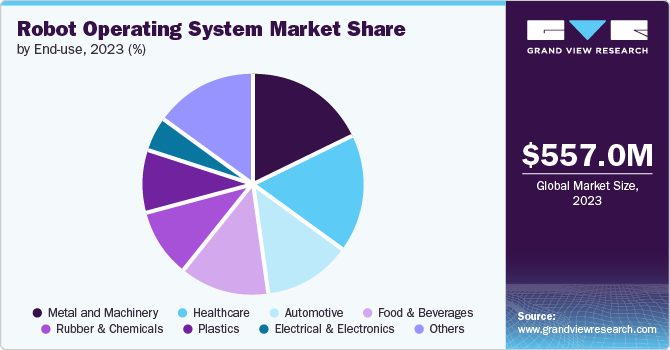

The Robot operating system has had a significant impact on end users across various industries, particularly in the automotive, electrical and electronics, metal and machinery, plastics, rubber and chemicals, food and beverages, healthcare, and other sectors. In the automotive industry, ROS has enabled the development of advanced driver assistance systems (ADAS) and autonomous vehicles, enhancing safety and efficiency. For electrical and electronics manufacturers, ROS has facilitated the creation of more intelligent and adaptable production systems, improved quality control and reducing downtime. In the metal and machinery sector, ROS has revolutionized automation processes, enabling more precise and flexible manufacturing operations.

Robot Type Insights

The SCARA robots segment led the market and accounted for 26.1% of the global revenue in 2023. This growth is driven by several factors, including increasing adoption across various industries such as automotive, electronics, pharmaceuticals, and consumer goods. SCARA robots are highly valued for their flexibility, speed, precision, and compact design, making them ideal for manufacturing and assembly processes. The rising demand for automation in developing countries, coupled with increasing labor costs, is further fueling market expansion. Technological advancements are playing a crucial role in market expansion, with the integration of AI and IoT technologies creating new opportunities for SCARA robot applications. These innovations, coupled with improvements in vision systems and end-of-arm tooling, are enhancing the robots' capabilities and ease of use. The rising labor costs in developing countries are also contributing to the increased adoption of SCARA robots as a cost-effective solution for repetitive tasks.

The articulated robots segment is estimated to grow significantly over the forecast period. The integration of advanced technologies such as artificial intelligence and machine learning is enhancing the capabilities of articulated robots, allowing for more adaptive and efficient operations. Additionally, the emergence of collaborative robots is expanding the use of articulated systems in industries requiring human-robot interaction. Moreover, the increasing demand for automation, rising labor costs, and the need for improved efficiency in manufacturing processes are key factors fueling this growth. However, the market faces some challenges, including competition from alternative robotic systems like SCARA and Cartesian robots. Despite these challenges, the articulated robot market is poised for continued expansion across various industries, driven by technological advancements and the ongoing trend of industrial automation.

Application Insights

The mapping and navigation segment dominated the market in 2023. The mapping and navigation capabilities within Robot Operating Systems (ROS) are experiencing significant growth, driven by a confluence of technological advancements and increasing demand across various industries. As autonomous robots become more prevalent in sectors such as manufacturing, logistics, and services, the need for sophisticated mapping and navigation solutions within ROS has intensified. This growth is fueled by continuous improvements in Simultaneous Localization and Mapping (SLAM) algorithms, which enable robots to create more accurate maps and navigate complex environments with greater efficiency. The integration of advanced sensor technologies, such as LiDAR and high-resolution cameras, is further enhancing the perception and mapping abilities of ROS-based robots. The open-source nature of ROS fosters a collaborative ecosystem, accelerating innovations in mapping and navigation packages.

The home automation and security segment is projected to grow significantly over the forecast period. The growth is driven by a convergence of technological advancements and increasing consumer demand for smart home solutions. As homeowners seek more sophisticated ways to manage their living spaces, ROS-based systems are gaining traction due to their ability to offer advanced control over various household functions, from lighting and climate control to appliance management. The integration of artificial intelligence and machine learning capabilities within ROS is enabling the development of more intelligent and adaptive home automation systems that can learn and anticipate user preferences. In the realm of security, ROS's flexibility allows for the seamless integration of diverse sensors and devices, creating comprehensive and customizable home security solutions.

End Use Insights

The metal and machinery segment accounted for the largest market revenue share in 2023. is experiencing significant growth in the adoption of Robot Operating System (ROS) applications, driven by the increasing demand for industrial automation and the need for more flexible, efficient manufacturing processes. ROS provides a robust and adaptable platform for developing sophisticated robotic solutions in this sector, offering seamless integration of advanced sensors, vision systems, and specialized tools crucial for complex manufacturing operations. The modular architecture of ROS allows for scalable and customizable automation solutions, enabling manufacturers to easily adapt their systems as production needs evolve. The open-source nature of ROS fosters a collaborative environment, accelerating innovation and knowledge sharing among developers and researchers in the field.

The automotive segment is expected to foresee significant growth in the forecast period. This growth is driven by the increasing demand for automation and the need for more precise, efficient manufacturing processes. This growth is fueled by the integration of Industry 4.0 technologies, with ROS providing a flexible platform for developing intelligent and adaptive robotic systems that enhance quality control, enable predictive maintenance, and improve overall manufacturing efficiency. The adoption of ROS-based systems helps automotive manufacturers reduce labor costs and address workforce shortages while offering modular and scalable solutions that can be easily customized to meet changing production needs. The rise of collaborative robots (cobots) based on ROS is expanding the use of robotics in areas requiring human-robot interaction.

Regional Insights

North America held a significant market share of 30.7% in 2023. The Robot Operating System (ROS) is experiencing significant growth in North America, driven by a combination of factors that highlight its increasing importance in the region. The rising demand for automation across various industries in this region, including manufacturing, logistics, and healthcare, is a key driver, as ROS provides a flexible and robust platform for developing and implementing automated systems. The integration of advanced technologies such as artificial intelligence and machine learning with ROS is further enhancing the capabilities of robots, leading to increased adoption. ROS is being utilized in a diverse range of sectors, from agriculture and construction to retail, showcasing its versatility and adaptability. North America's strong focus on research and development, coupled with government initiatives and funding for robotics and AI research, is providing a supportive environment for the growth of ROS.

U.S. Robot Operating System Market Trends

The robot operating system is experiencing significant growth in the U.S., driven by a confluence of factors that highlight its increasing importance in the region. The rising demand for automation across various industries, including manufacturing, logistics, and healthcare, is a key driver, as ROS provides a flexible and robust platform for developing and implementing automated systems. The integration of advanced technologies such as artificial intelligence and machine learning with ROS is further enhancing the capabilities of robots, leading to increased adoption.

Europe Robot Operating System Market Trends

Europe's strong focus on research and development, coupled with government initiatives and funding for robotics and AI research, is providing a supportive environment for the growth of ROS. Collaboration and partnerships between academia, research institutions, and industry players are also contributing to the advancement of ROS in the region. The growing demand for service robots and autonomous systems in Europe is another factor driving the adoption of ROS, as it enables the development and control of these sophisticated systems.

The robot operating system market in the UK is gaining traction, driven by the country's focus on advanced manufacturing and robotics research. The UK has a strong focus on robotics research, with several universities and research institutions actively contributing to the development of ROS. For example, the University of Cambridge and the University of Oxford have research groups dedicated to ROS and its applications.

The France robot operating system market is expected to grow significantly over the forecast period. Companies in France are collaborating with research institutions to develop ROS-based solutions for their specific needs. This collaboration helps to bridge the gap between academic research and industrial applications.

The robot operating system market in Germany held the largest share of the Europe market. Germany is seeing growth in the adoption of ROS for service robotics applications, such as healthcare and assisted living. Companies are developing ROS-based solutions to address challenges in these sectors and improve the quality of life for individuals.

Asia Pacific Robot Operating System Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region has a thriving startup ecosystem focused on robotics and automation. Many startups are developing ROS-based solutions for various applications, contributing to the growth of the ROS community in the region. Moreover, Companies and research institutions in the Asia Pacific region are collaborating with global players in the robotics industry to develop and deploy ROS-based solutions. This collaboration helps to share knowledge and best practices, further driving the growth of ROS in the region

China robot operating system market is expected to grow significantly over the forecast period. Governments in the Asia Pacific region is actively promoting the development and adoption of robotics technologies. For instance, China's "Made in China 2025" initiative aims to upgrade the country's manufacturing capabilities, which includes the use of ROS-based systems

The robot operating system market in India is expected to grow substantially over the forecast period. India has a thriving startup ecosystem focused on robotics and automation, with many startups utilizing ROS as the foundation for their products and services. These startups are developing innovative ROS-based solutions for diverse applications, ranging from industrial automation to service robotics.

The Japan robot operating system market is expected to grow significantly over the forecast period. Japanese companies and research institutions are collaborating with global players in the robotics industry to develop and deploy ROS-based solutions. These collaborations help to share knowledge and best practices, further driving the growth of ROS in Japan.

Middle East & Africa (MEA) Robot Operating System Market Trends

With the significant growth of the oil & gas industry in several countries of the MEA region, Governments in the MEA region is launching initiatives to promote the adoption of advanced technologies, including robotics and automation. For instance, the United Arab Emirates (UAE) has launched the "UAE Robotics for Good" initiative to encourage the development and use of robotics solutions for social good.

Kingdom of Saudi Arabia (KSA) robot operating system market is expected to grow significantly over the forecast period. Saudi Arabia is investing in talent development programs to ensure a steady supply of engineers and developers proficient in ROS and other robotics technologies. The Saudi Digital Academy and the Technical and Vocational Training Corporation (TVTC) are offering courses and training programs in robotics and automation.

The robot operating system market in the United Arab Emirates (UAE) is expected to grow substantially over the forecast period. The UAE is investing in skill development programs to ensure a steady supply of engineers and developers proficient in ROS and other robotics technologies. Educational institutions and training centers are offering courses and workshops on ROS, catering to the growing demand for ROS-skilled professionals.

Key Robot Operating System Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in May 2024, ABB Robotics signed a Memorandum of Understanding with Pulmuone Co Ltd, a Seoul-based food processing company, to develop automation solutions for researching and producing a novel range of lab-grown foods. Pulmuone, which owns several food brands including Nasoya tofu products and Monterey Gourmet Foods, is creating a new generation of seafood products using cell cultivation technology.

Key Robot Operating System Companies:

The following are the leading companies in the robot operating system market. These companies collectively hold the largest market share and dictate industry trends.

- Universal Robotics

- ABB Ltd.

- FANUC

- KUKA AG

- Yaskawa Electric Corporation

- Denso

- Microsoft

- Omron Corporation

- iRobot Corporation

- Clearpath Robots

Recent Developments

-

In June 2024, FANUC America, a global leader in robotics and automation, unveiled the new SR-12iA/C Food Grade SCARA robot, a cutting-edge solution designed specifically for food processing, packaging, and cleanroom applications. In addition to its lightning-fast operation, the new SR-12iA/C Food Grade SCARA robot features a 12kg payload, compact footprint, durable construction, corrosion resistance, easy cleaning, and compliance with food safety regulations, making it a reliable and efficient solution for food companies.

-

In April 2024, Yaskawa Europe, the European subsidiary of the Japanese technology group Yaskawa Electric, held a groundbreaking ceremony in Kočevje, southern Slovenia, on April 24, 2024, to mark the start of construction for a new European Robotics Distribution Centre and an assembly hall for robot welding systems. This new distribution center will serve as a central hub for receiving and fulfilling robot orders across Europe, the Middle East, and Africa (EMEA).

Robot Operating System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 622.0 million |

|

Revenue forecast in 2030 |

USD 1,214.9 million |

|

Growth rate |

CAGR of 13.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Robot type, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Universal Robotics; ABB Ltd.; FANUC; KUKA AG; Yaskawa, Electric Corporation; Denso; Microsoft; Omron Corporation; iRobot Corporation; Clearpath Robots |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Robot Operating System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global robot operating system market report based on robot type, application, end use, and region:

-

Robot Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Articulated Robots

-

Cartesian Robotics

-

Collaborative Robots

-

SCARA Robots

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Pick and Place

-

Plastic Injection and Blow Molding

-

Testing and Quality Inspection

-

Metal Sampling and Press Trending

-

End of Line Packaging

-

Mapping and Navigation

-

Inventory Management

-

Home Automation and Security

-

Personal Assistance

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Electrical and Electronics

-

Metal and Machinery

-

Plastics

-

Rubber and Chemicals

-

Food and Beverages

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Robot Operating System market size was estimated at USD 557.0 million in 2023 and is expected to reach USD 622.0 million in 2024.

b. The global Robot Operating System market is expected to grow at a compound annual growth rate of 13.9% from 2024 to 2030 to reach USD 1214.9 million by 2030.

b. North America dominated the Robot Operating System market with a share of 30.7% in 2023. The rising demand for automation across various industries in this region, including manufacturing, logistics, and healthcare, is a key driver, as ROS provides a flexible and robust platform for developing and implementing automated systems.

b. Some key players operating in the Robot Operating System market include: Universal Robotics, ABB Ltd., FANUC, KUKA AG, Yaskawa Electric Corporation, Denso, Microsoft, Omron Corporation, iRobot Corporation, Clearpath Robots

b. Key factors that are driving the market growth is attributed to the Robotic systems that are increasingly taking over or enhancing various human roles.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."