RNA Targeting Small Molecule Drug Discovery Market Size, Share & Trends Analysis Report By Indication (Cancer, Infectious Diseases, Metabolic Diseases, Neurological Diseases), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-049-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

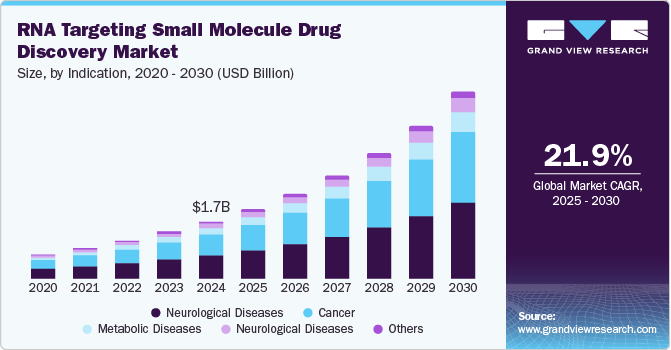

The global RNA targeting small molecule drug discovery market size was estimated at USD 1.66 billion in 2024 and is projected to grow at a CAGR of 21.9% from 2025 to 2030. The increasing demand for RNA-targeted small molecule drugs due to their ability to target a broad range of diseases, such as cancer, neurological disorders, and genetic disorders, is expected to drive market growth. Additionally, advancements in RNA-targeted drug discovery technologies and increased government funding for RNA research are also contributing to market growth.

The RNA targeting small molecules drug discovery industry is expected to transform the way the healthcare industry currently treats several diseases. These medications function by specifically targeting RNA molecules, which are appealing drug development targets since they are essential for controlling gene expression. Drugs that target RNA offer the potential to address conditions that have historically been challenging to treat with traditional medications. These include conditions that are caused by mutations in particular genes. Owing to the recently validated advantages of RNA-targeting small molecules, several companies are investing in this novel emerging field. There are several drug candidates in the pipeline, which are anticipated to be launched by 2024 and later.

The RNA targeting small molecules drug discovery industry promises a bright future. However, there are still several obstacles that pose a challenge to its growth. These include the exorbitant cost of medication research. This can reach billions of dollars and is one of the main obstacles. Creating RNA-targeted medications necessitates specialized knowledge and cutting-edge technology, which further raises the price of drug development. Moreover, it may be challenging to find prospective therapeutic candidates due to the intricacy of RNA-based drug discovery, which could add to the expense and length of time needed for drug development. Pharmaceutical corporations are heavily spending on research and development to address these issues, and they are collaborating with academic institutions and contract research groups to hasten the drug discovery and development process.

Significant investments in research and development (R&D) by pharmaceutical and biotechnology companies have also played a crucial role in driving market growth. Companies such as Moderna and Vertex Pharmaceuticals are collaborating on RNA-targeted therapies, highlighting the industry’s commitment to exploring this promising field. Increased government funding for RNA research, coupled with favorable regulatory frameworks implemented by agencies such as the FDA, EMA, and Health Canada, have further encouraged innovation and investment in this area. For instance, in May 2024, Avalere reported at least 21 FDA-approved RNA-based therapies on the U.S. market, with a robust pipeline of 131 therapies in clinical trials as of January 31, 2024, indicating strong growth in this therapeutic area.

Indication Insights

Neurological diseases dominated the market and accounted for a share of 40.3% in 2024. Researchers have been actively pursuing RNA-targeting therapies for neurological disorders. This includes developing small molecules to address repeat expansion disorders such as Huntington’s Disease and ALS, and modulating RNA splicing for conditions such as SMA. Efforts to enhance drug delivery to the brain and utilize AI for target identification and drug design are also advancing, promising increased precision and efficacy in treating neurological diseases linked to RNA dysfunction. For instance, in April 2024, Ipsen and Skyhawk Therapeutics announced a collaboration to discover and develop RNA-targeting small-molecule drugs for rare neurological diseases. The agreement included an option for Ipsen to acquire exclusive global rights to two development candidates.

The cancer segment is expected to grow at the fastest CAGR of 22.3% over the forecast period. RNA-targeted medications are advantageous for treating cancer as they can target cancer cells only and are made to specifically target cancer-related genetic alterations, which increases their efficacy and minimizes adverse effects. Many pharmaceutical companies are investing heavily in RNA-targeted drug discovery for cancer treatment, which is expected to drive market growth in the coming years. While the cancer segment is expected to witness considerable growth, the market is also expected to diversify as more RNA-targeted drugs are developed for other indications, such as genetic disorders and viral infections.

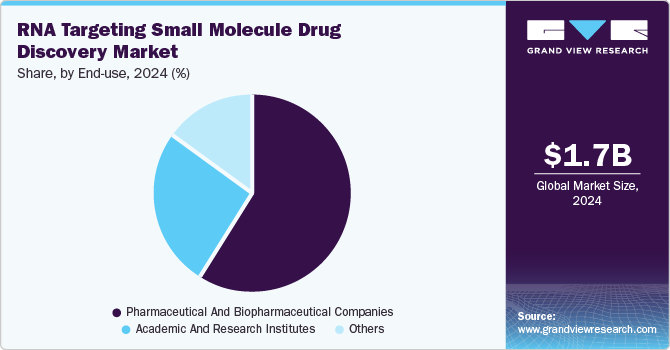

End-use Insights

The pharmaceutical and biopharmaceutical companies segment led the market with a revenue share of 59.4% in 2024. Pharmaceutical companies are driving advancements in RNA-targeting drug discovery through heavy R&D investment, strategic collaborations (such as Evotec and Takeda’s), and technological advancements such as AI integration and advanced sequencing. For instance, in December 2024, Rgenta Therapeutics and GSK announced a strategic alliance to develop RNA-targeted small molecule splice modulators for various diseases, including oncology. Pharmaceutical companies are also developing innovative platforms, exploring diverse RNA targets, and focusing on personalized medicine approaches. Emerging biotech startups and RNA editing technologies are further contributing to this rapidly evolving field.

Academic and research institutes are projected to grow lucratively over the forecast period. With new players entering the market, collaborations between pharmaceutical companies and academic institutions are becoming increasingly common, thereby supporting the growth of academic and research institutes in this field. The integration of advanced technologies, such as artificial intelligence and DNA-encoded library technology, is also driving innovation in the market. As the RNA-targeting small molecule drug discovery industry evolves, it presents exciting opportunities for research institutes to develop new drugs and technologies targeting RNA, which could revolutionize the treatment of various diseases.

Regional Insights

North America RNA targeting small molecule drug discovery market dominated the global market with a revenue share of 60.7% in 2024. North America’s dominance in the RNA-targeting drug discovery market is attributed to the strong presence of leading pharmaceutical companies such as Skyhawk Therapeutics, Ribometrix, and Arrakis Therapeutics. These companies possess extensive resources and expertise in RNA-targeted drug development and commercialization. The region’s well-established healthcare infrastructure and strong relationships with regulatory agencies further support market growth.

U.S. RNA Targeting Small Molecule Drug Discovery Market Trends

The RNA targeting small molecule drug discovery market in U.S. dominated the North America market with a revenue share of 93.1% in 2024. Market growth in the country is driven by a robust research and development landscape, significant investments by pharmaceutical and biotechnology companies, and a favorable regulatory environment. The presence of leading academic institutions and research centers further contributes to the growth of this market. Moreover, the increasing prevalence of chronic diseases and the demand for innovative therapies fuel the development of RNA-targeting small molecule drugs in the U.S.

Europe RNA Targeting Small Molecule Drug Discovery Market Trends

The European RNA-targeting small molecule drug discovery market held a substantial market share in 2024, fueled by increasing government initiatives to support research and development in RNA-targeted therapies, a growing focus on personalized medicine, and a rising prevalence of chronic diseases. Collaborations between pharmaceutical companies and academic institutions are also contributing to the growth of this market. The presence of a skilled workforce and advanced research infrastructure further strengthens the European RNA-targeting small molecule drug discovery market.

The RNA targeting small molecule drug discovery market in Germany is expected to grow lucratively in the forecast period, supported by a strong research infrastructure, a high concentration of pharmaceutical and biotechnology companies, and increasing government funding for RNA research. The country’s aging population and the subsequent rise in age-related diseases further contribute to the demand for innovative therapies, including RNA-targeting small-molecule drugs.

Asia Pacific RNA Targeting Small Molecule Drug Discovery Market Trends

Asia Pacific RNA targeting small molecule drug discovery market is expected to register the fastest CAGR of 6.1% in the forecast period. Market growth in the region is driven by the growing healthcare sector, increasing investments in research and development, and a rising prevalence of chronic diseases. The large patient pool and unmet medical needs in the region further contribute to the growth of this market. Government initiatives to promote drug discovery and development, coupled with a growing awareness of RNA-targeted therapies, are expected to fuel the market’s growth in the Asia Pacific region.

The RNA-targeting small molecule drug discovery market in India is projected to grow at the fastest rate of 22.0% in the Asia Pacific region over the forecast period. India’s market is driven by a large patient population, increasing healthcare expenditures, and a growing number of clinical trials for RNA-targeted therapies. The country’s expanding pharmaceutical industry and the availability of skilled researchers further contribute to the market’s growth.

Key RNA Targeting Small Molecule Drug Discovery Company Insights

Some key companies operating in the market include ACCENT THERAPEUTICS; Anima Biotech Inc.; Arrakis Therapeutics; and AstraZeneca; among others. The industry is dynamic and highly competitive, with several key players and new entrants expected to drive further growth and innovation in the coming years.

-

Accent Therapeutics focuses on developing RNA-targeting small molecule therapies for cancer. The company leverages its expertise in RNA-modifying proteins (RMPs) to identify and exploit vulnerabilities in cancer cells, leading to the development of targeted therapies with the potential to treat various types of cancer.

-

AstraZeneca is actively exploring the potential of RNA-targeting small molecule drugs for various therapeutic areas, including oncology and respiratory diseases. The company is investing in research and development to discover and develop innovative RNA-targeting therapies that can address unmet medical needs and improve patient outcomes.

Key RNA Targeting Small Molecule Drug Discovery Companies:

The following are the leading companies in the RNA targeting small molecule drug discovery market. These companies collectively hold the largest market share and dictate industry trends.

- ACCENT THERAPEUTICS

- Anima Biotech Inc.

- Arrakis Therapeutics

- AstraZeneca

- Epics Therapeutics

- Expansion Therapeutics

- F. Hoffmann-La Roche Ltd

- PTC Therapeutics, Inc.

- Ribometrix

- LES LABORATOIRES SERVIER

- Skyhawk Therapeutics

Recent Developments

-

In March 2025, Arrakis Therapeutics presented preclinical data for its RNA-targeted small molecule drug program for the treatment of myotonic dystrophy type 1 (DM1) at the Muscular Dystrophy Association (MDA) conference in Dallas, Texas.

-

In October 2024, Anima Biotech announced its machine learning platform, Lightning, which identifies mRNA drug targets and screens for potential small molecule therapies. The company had identified 20 therapeutic candidates across various disease areas.

-

In July 2024, Citeline, in collaboration with the American Society of Gene & Cell Therapy, approved two RNA therapies-Rytelo for myelodysplastic syndrome and mRESVIA for RSV prophylaxis-in the U.S.

-

In April 2024, Ribometrix presented data at the AACR Annual Meeting 2024, validating its RNA-targeting platform and demonstrating the potential of its EIF4E program for cancer treatment.

RNA Targeting Small Molecule Drug Discovery Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.02 billion |

|

Revenue forecast in 2030 |

USD 5.42 billion |

|

Growth rate |

CAGR of 21.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Indication, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

ACCENT THERAPEUTICS; Anima Biotech Inc.; Arrakis Therapeutics; AstraZeneca; Epics Therapeutics; Expansion Therapeutics; F. Hoffmann-La Roche Ltd; PTC Therapeutics, Inc.; Ribometrix; LES LABORATOIRES SERVIER; Skyhawk Therapeutics |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global RNA Targeting Small Molecule Drug Discovery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global RNA targeting small molecule drug discovery market report based on indication, end-use, and region:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Infectious Diseases

-

Metabolic Diseases

-

Neurological Diseases

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biopharmaceutical Companies

-

Academic and Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global RNA targeting small molecule drug discovery market size was estimated at USD 1.1 billion in 2022 and is expected to reach USD 1.4 billion in 2023.

b. The global RNA targeting small molecule drug discovery market is expected to grow at a compound annual growth rate of 20.9% from 2023 to 2030 to reach USD 5.1 billion by 2030.

b. By indication, the neurological diseases segment held a market share of 40.1% in 2022. The increasing pipeline of RNA-targeting small molecule drugs for neruological conditions is one of the prominant factors supporting the segment's high shares.

b. Some key players operating in the RNA targeting small molecule drug discovery market include Skyhawk Therapeutics, Inc., Arrakis Therapeutics, Ribometrix and a few others.

b. Increasing pipeline along with growing private and public funding for the discovery and development of RNA-targeting small molecule drugs are some of the key factors supporting the growth of the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."