Risk Analytics Market Size, Share & Trends Analysis Report By Component (Software, Solutions), By Risk Type Application, By Deployment Type, By Industry Vertical (BFSI, Telecom & IT), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-267-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Risk Analytics Market Size & Trends

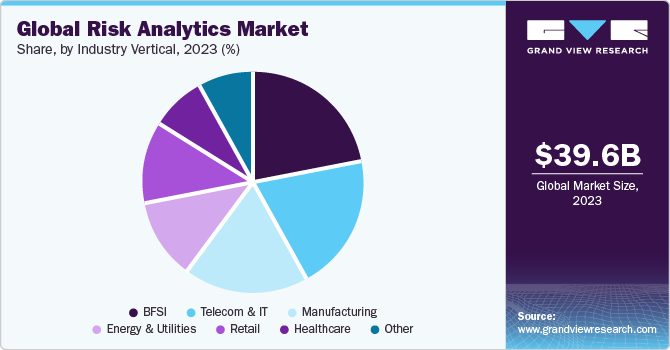

The global risk analytics market size was estimated at USD 39.64 billion in 2023 and is expected to grow at a CAGR of 12.7% from 2024 to 2030. The growth of the market is attributed to rising government regulations and compliances, the threat of cyber-attacks, and the increasing complexity of business due to big data handling. The continuous evolution of technology has played a crucial role with the advent of advanced algorithms, machine learning, and big data analytics. Organizations use tools to process, analyze, and interpret large volumes of data more efficiently, leading to better risk management decisions.

Stringent regulatory requirements across various industries are driving the risk analytics solutions market. These requirements are imposed by regulatory bodies to ensure the stability and integrity of financial markets, protect consumers, and prevent financial crimes such as money laundering, fraud, and terrorist financing. Organizations operating in these industries must adhere to these regulatory standards to maintain their legitimacy and avoid penalties that could include hefty fines, loss of licenses, or even legal actions. For example, the General Data Protection Regulation (GDPR) is a law that was introduced in the European Union (EU) in May 2018. It aims to provide EU residents better control over their personal data and establish consistent data privacy regulations across Europe. GDPR applies to all organizations, regardless of location, that handle the personal data of individuals in the EU.

The integration of risk analytics with Artificial Intelligence (AI) and Internet of Things (IoT) technologies has significantly expanded the capabilities of risk management solutions and opened up new opportunities for the market. By combining these advanced technologies, organizations can gather and analyze data from a wide range of sources, leading to more accurate and comprehensive risk assessments and better overall risk management.

The rise of 5G technology significantly increases the number of IoT devices and creates new security challenges. 5G networks use new protocols, encryption, and APIs that can introduce vulnerabilities. Many IoT devices have weak authentication and outdated firmware, making them easy targets for attackers. Additionally, physical security vulnerabilities arise from deploying IoT devices in unsecured environments, which boosts the adoption of risk analytics solutions. According to a 5G Americas and Omdia study, the global 5G connection was expected to reach 1.8 billion by 2023 and 7.9 billion by 2028. This growth can be attributed to implementing 5G-Advanced network improvements and completing work towards 6G.

The COVID-19 pandemic has positively impacted various industries, highlighting the importance of risk analytics in managing crises and uncertainty. As businesses and governments worldwide struggled to cope with the unprecedented challenges posed by COVID-19, risk analytics played a crucial role in helping make informed decisions. Moreover, the pandemic accelerated the shift towards remote work and digital transformation across various industries, creating new opportunities for risk analytics providers to offer cloud-based and remote solutions. It has also introduced unknown risks and challenges, such as increased cyber threats and data privacy concerns. It intensified awareness and adoption of risk analytics, increasing the demand for these solutions and driving market growth.

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market is characterized by an active and rapidly evolving landscape driven by technological advancements, diverse risk-type applications, and a supportive ecosystem.

The market is highly competitive, with numerous players offering various products and services. This competition drives innovation and encourages companies to develop more advanced and efficient risk analytics solutions to stay ahead of competitors. The market is constantly evolving, driven by technological advancements and the growing demand for risk management solutions. As businesses become more aware of the importance of risk analytics in their operations, the market continues to expand, incorporating new tools, techniques, and methodologies. The global presence of companies has led to increased collaboration and knowledge-sharing among market participants. For instance, in June 2023, Microsoft and Moody's Corporation announced a new strategic partnership to deliver global next-generation financial services and knowledge workers solutions. The partnership uses Moody's data and analytical abilities and Microsoft Azure's OpenAI Service to create offerings that improve insights into corporate intelligence and risk assessment. The partnership is anchored by Moody's proprietary data, analytics, and research and powered by Microsoft AI.

Component Insights

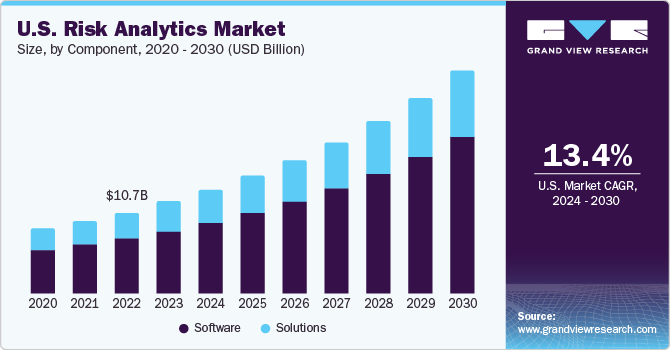

Based on components, the software segment dominated the market with the largest revenue share of 66.3% in 2023 and is anticipated to witness the fastest growth during the forecast period. This growth is driven by the rising demand for customized risk analytics solutions. Many organizations struggle with the increasing complexity of risk analytics tools and technologies due to a lack of internal expertise and resources to implement and manage these solutions effectively. Therefore, businesses use services to maximize risk analytics investments and use the latest tools and technologies to manage risk effectively. Such factors further fuel the growth of this segment.

The solution segment is anticipated to witness significant growth from 2024 to 2030. Key factors contributing to its growth include the rising demand for customized risk management solutions, digital transformation leading to increased data analysis, enhanced accessibility for smaller businesses, and raising awareness about risk analytics' benefits.

Risk Type Application Insights

The operational risk segment accounted for the largest revenue share in 2023. Operational risk is a chain reaction where small control failures and overlooked issues can harm a company's efficiency and reputation due to cyber-attacks and supply chain disruptions. Technological advancements in AI, machine learning, and data analytics have enabled accurate identification and assessment of operational risks, providing insights for better risk management decision-making. Such kind of advancements are increasing demand for this segment in the market.

The compliance risk segment is anticipated to witness significant growth from 2024 to 2030 due to increasing regulatory complexity across various industries. As governments impose stricter regulatory frameworks to ensure transparency, accountability, and consumer protection, organizations adopt compliance risk management solutions to stay compliant and avoid penalties.

Industry Vertical Insights

Based on industry vertical, the market is further bifurcated into BFSI, retail, manufacturing, telecom & IT, energy and utilities, healthcare, and others. The BFSI segment accounted for the largest revenue share in 2023 and is anticipated to witness the fastest growth during the forecast period. The growing prevalence of cyber threats and financial fraud requires BFSI companies to invest in advanced risk analytics solutions equipped with machine learning algorithms and artificial intelligence capabilities. Such trends are propelling the market growth trajectories for this segment.

The manufacturing segment is anticipated to witness significant growth during the forecast period. The increasing adoption of Industry 4.0 initiatives, emphasizing automation and digitization, further accentuates the demand for risk analytics solutions to support data-driven decision-making and improve operational resilience. In addition, with the growing complexity of global supply chains, which increases the exposure to various risks such as geopolitical uncertainties, supplier disruptions, and demand fluctuations, the demand for risk analytics tools is rising.

Deployment Type Insights

The on-premises segment accounted for the largest revenue share in 2023. These deployments allow organizations to customize risk analytics solutions according to their business requirements and risk management strategies. On-premise deployment remains preferred for organizations with specific security, compliance, customization, performance, and control requirements across different industries and regions.

The cloud segment is anticipated to witness the fastest growth during the forecast period. The increasing adoption of cloud-based solutions across various industries is driving the demand for on-cloud deployment of risk analytics tools. Cloud deployment offers scalability, flexibility, and cost-effectiveness, enabling organizations to efficiently manage and analyze large volumes of data to identify and mitigate risks. In addition, the COVID-19 pandemic has accelerated the digital transformation initiatives of many organizations, further driving the adoption of cloud-based risk analytics solutions.

Regional Insights

North America dominated the market with a share of 39.0% in 2023 and is projected to grow at a CAGR of 13.0% over the forecast period. This is attributable to industrialization and the growing emphasis on industrial safety consciousness. Global financial markets' increasing density and interconnectedness have intensified the need for advanced risk management solutions. Businesses face risks, including cyber threats, regulatory compliance challenges, and market volatility with the prevalence of digital transformation and data production.

Cyber threats have encouraged demand for analytics tools that provide real-time insights into potential risks and vulnerabilities. For instance, according to a report by Allianz Group, cyber events are the top risk faced by financial services providers in 17 countries, including the U.S., and the second-biggest threat in Canada. The resurgence of ransomware attacks in 2023 has added to concerns for organizations in both countries. Insurance claims activity related to ransomware has increased by more than 50% compared to last year.

The U.S. Risk Analytics Market Trends

The risk analytics market in the U.S. is expected to grow over the forecast period as Environmental, Social, and Governance (ESG) factors have become critical determinants of business success and long-term sustainability and organizations are increasingly incorporating ESG considerations into their risk management frameworks to address risks related to climate change, social responsibility, ethical business practices, and corporate governance. For instance, in October 2023, Bloomberg partnered with Riskthinking.AI to launch physical risk indicators considering all Intergovernmental Panel on Climate Change (IPCC) endorsed climate scenarios. The indicators combine Bloomberg's asset data with Riskthinking.AI's climate projections to evaluate climate vulnerabilities such as floods, droughts, and wildfires.

Europe Risk Analytics Market Trends

The risk analytics market in Europe is expected to grow over the forecast period as the increasing adoption of risk analytics in non-financial sectors such as healthcare, energy, and transportation is expanding the market opportunities in Europe. Organizations in these industries use analytics to optimize resource allocation, improve patient outcomes, enhance safety measures, and ensure regulatory compliance, driving the adoption of risk analytics solutions across diverse sectors. For instance, in December 2023, WHO/Europe and the European Commission partnered to improve health information systems and data governance in the WHO European Region. The USD 15.05 Billion project aims to enhance the quality and interoperability of health information systems and support health care services for nearly 1 billion people across 53 countries.

The UK risk analytics market is expected to grow over the forecast period as the emergence of new technologies and business models, such as fintech, insurance technology, and digital banking, is disrupting traditional risk management practices in the country. These innovations introduced new risks, including technological risks, data privacy concerns, and regulatory compliance challenges. Risk analytics solutions that leverage cutting-edge technologies such as artificial intelligence, blockchain, and cloud computing

enable organizations to adapt to these changes, identify emerging risks, and capitalize on new opportunities while maintaining strong risk management frameworks.

The risk analytics market in Germany is expected to grow over the forecast period. The automotive industry is undergoing a significant transformation characterized by technological innovations such as electric vehicles, autonomous driving, and connected car technologies. These advancements introduced new risks related to cybersecurity, data privacy, and regulatory compliance. Risk analytics tools enable automotive companies to identify, assess, and mitigate these risks effectively, ensuring their vehicles' and systems' safety, security, and reliability.

Asia Pacific Risk Analytics Market Trends

The risk analytics market in Asia Pacific is expected to grow over the forecast period. Digital transformation initiatives have led to increased data generation and new cyber threats. It has created a demand for advanced risk analytics solutions to detect anomalies, predict threats, and mitigate potential damages.

The China risk analytics market is expected to grow over the forecast period. China's development initiatives, such as the Belt and Road Initiative and the Made in China 2025 strategy, involve significant investments and domestic and global collaborations. These initiatives bring about diverse risks, including geopolitical, regulatory, and operational, necessitating comprehensive risk analytics solutions to effectively assess and mitigate potential threats.

Key Risk Analytics Company Insights

Some of the key players operating in the market include Oracle Corporation., Moody's Analytics, and IBM:

-

Oracle Corporation offers risk analytics solutions as part of its financial services analytics and cloud services. The company's Risk Management Cloud, an Oracle Fusion Cloud ERP module, utilizes modern data science and AI techniques to automate analysis, monitoring, and control of ERP security, configurations, and transactions.

-

Moody's Analytics provides financial intelligence and analytical tools to support decision-making across various industries. They offer solutions, including research, data, software, and professional services designed to address critical business issues.

Key Risk Analytics Companies:

The following are the leading companies in the risk analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- ACL Services Ltd.

- AxiomSL

- dba Galvanize

- Eurorisk Systems Ltd

- Fidelity National Information Services

- Gurucul

- IBM

- Moody's Analytics

- OneSpan

- Oracle Corporation

- Risk Edge Solutions

- SAS Institute

- Verisk Analytics

Recent Developments

-

In June 2023, Mindware announced a partnership with OneSpan to commercialize and distribute its security solutions, which include identity verification, transaction signing, mobile security, e-signature workflows, and secure video collaboration tools. OneSpan aims to provide secure and easy digital agreement experiences to accelerate customers' digital revenue streams and efficiencies.

-

In May 2023, Gurucul launched its Security Analytics and Operations platform on Snowflake Data Cloud, offering Next-Gen SIEM, Open XDR, UEBA, and Identity Analytics solutions. The platform consolidates enterprise and security data into one location, enabling real-time threat detection and automated response to data breaches. Gurucul also has deep technology integrations with leading providers to deliver integrated security solutions.

-

In April 2023, Moody's Analytics and MIT/CRE announced a partnership to study the correlation between climate events and commercial real estate. They aim to provide insights for lenders, investors, municipalities, and other industries on the built environment's vulnerability to extreme weather threats resulting from climate change.

Risk Analytics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 44.55 billion |

|

Revenue forecast in 2030 |

USD 91.33 billion |

|

Growth Rate |

CAGR of 12.7% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, risk type application, deployment type, industry vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Accenture; ACL Services Ltd.; AxiomSL; dba Galvanize; Eurorisk Systems Ltd; Fidelity National Information Services; Gurucul; IBM; Moody's Analytics; OneSpan; Oracle Corporation; Risk Edge Solutions; SAS Institute; Verisk Analytics |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Risk Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global risk analytics marketreport based on, component, risk type application, deployment type, industry vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Software

-

Solutions

-

-

Risk Type Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Operational risk

-

Financial risk

-

Compliance risk

-

Strategic risk

-

Others

-

-

Deployment Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-premise

-

Cloud

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Retail

-

Manufacturing

-

Telecom & IT

-

Energy and utilities

-

Healthcare

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global risk analytics market size was estimated at USD 39.64 billion in 2023 and is expected to reach USD 44.55 billion in 2024

b. The global risk analytics market is expected to grow at a compound annual growth rate of 12.7% from 2024 to 2030 to reach USD 91.33 billion by 2030

b. North America dominated the risk analytics market with a share of 39.0% in 2023. The increasing density and interconnectedness of global financial markets have intensified the need for advanced risk management solutions.

b. Some key players operating in the risk analytics market Accenture, ACL Services Ltd., AxiomSL, dba Galvanize, Eurorisk Systems Ltd, Fidelity National Information Services, Gurucul, IBM, Moody's Analytics, OneSpan, Oracle Corporation, Risk Edge Solutions, SAS Institute, Verisk Analytics

b. Factors such as increasing regulatory requirements, cybersecurity concerns, and growing importance of sustainability and ESG factors in decision-making processes are driving the market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."