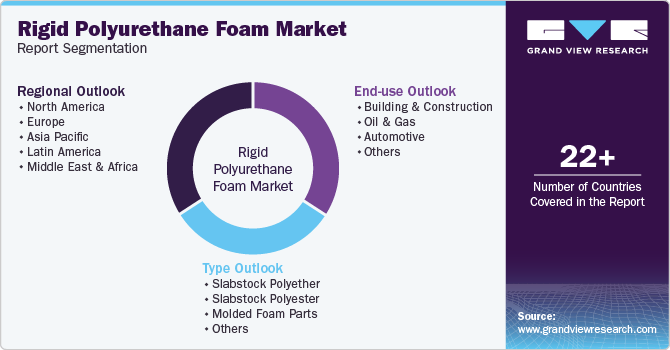

Rigid Polyurethane Foam Market Size, Share & Trends Analysis Report By Type (Slabstock Polyether, Slabstock Polyester, Molded Foam Parts), By End-use (Building & Construction), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-060-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2020

- Industry: Bulk Chemicals

Rigid Polyurethane Foam Market Trends

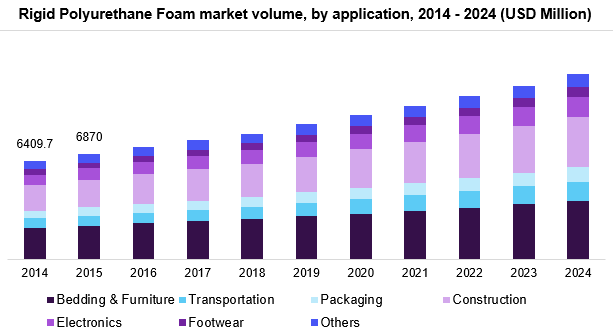

The global rigid polyurethane foams market size was estimated at a value of USD 20.69 billion in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. The construction industry’s rapid growth has primarily fueled the demand for rigid polyurethane (PU) foam. Since energy efficiency has become paramount in construction, the polyurethane foams market witnessed a major demand owing to the material’s enhanced insulation properties. It helps reduce energy consumption and overall infrastructure costs.

Moreover, the material provides structural support that benefits from increasing residential and commercial construction activities. The demand is also expected to persist due to increasing interest in green buildings and global energy conservation regulations. Another significant market driver is the innovations made in the automotive industry. Rigid polyurethane foam complemented with flexible polyurethane by providing structural support, insulation, and durability. The material significantly helps optimize automotive components for safety, comfort, and energy efficiency. As automakers strive to improve fuel efficiency and reduce emissions, they utilize these foams to make lightweight vehicles and enhance fuel economy. In addition, the material’s insulation properties also help maintain optimal cabin temperatures, reducing the load on air conditioning systems.

The rigid polyurethane foam is used in appliances including refrigerators and freezers. Demand for rigid polyurethane foam in this segment increases as the appliances sector grows with consumers prioritizing energy-efficient products. In addition, these foams find applications in various products such as household or solar water heaters, beer keg interlayers and more, owing to their favorable strength-to-weight ratio. This further contributes to the market demand.

Furthermore, environmental initiatives aimed at reducing fossil fuel consumption along with subsidy schemes and tax incentives aimed at motivating the manufacturing sector have sparked interest in alternative insulation materials. This has further augmented the global polyurethane foam market.

Type Insights

Slabstock polyether has dominated the market with 45.4% of the global share in 2023 owing to the growing demand from the robust construction sector which drove the need for flexible foam materials. Slabstock polyether serves as an ideal material for bonding, filling, sealing, and insulation. Its strong thermal and acoustic insulation capabilities make it suitable for applications including water pipe insulation, roof and wall bonding, and door & frame installation. In addition, the growing automotive industry also added to the market growth. Slabstock polyether, with its versatility and cushioning properties, are extensively applied in car seats, mattresses, and furniture. Furthermore, the rising demand for refrigerators and freezers, which require effective insulation drives the slabstock polyether segment significantly.

Slabstock polyester is emerging as the fastest-growing type segment during the forecast period. It plays a crucial role in the construction industry due to its high-performance insulation properties. These foams minimize heat transfer and reduce energy consumption in building constructions. In addition, the increased urbanization and infrastructure development activities have considerably driven slab stock polyester foam demand in the furniture industry. These foams are widely used for cushioning and padding purposes in furniture and mattresses. Moreover, manufacturers are increasingly collaborating with research institutions to innovate and improve slabstock polyester formulations to enhance product quality and performance.

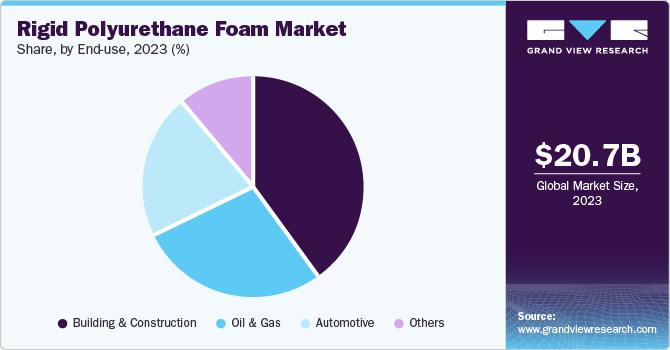

End Use Insights

Building & construction has secured 39.8% of the global market share in 2023. As construction practices prioritize sustainability, the demand for materials that contribute to better insulation and reduced energy consumption rises. Green building trends have progressively gained momentum with rising environmental awareness which propelled the demand for eco-friendly insulation materials. It has led rigid polyurethane foam manufacturers to increasingly focus on developing formulations that align with regulatory requirements, meeting the market’s demand for environment-friendly solutions.

The oil & gas industry is emerging as the fastest-growing segment during the forecast period. Rigid PU foam plays a critical role in insulating both onshore and offshore pipelines in the oil & gas industry. These foams ensure the smooth functioning of operations by maintaining optimal temperatures and preventing heat loss during transportation. In addition, the material’s exceptional thermal insulation properties help minimize heat transfer and reduce energy consumption in various applications within the oil and gas sector.

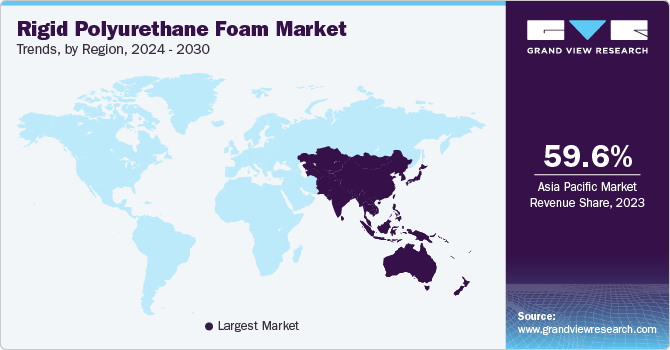

Regional Insights

The rigid polyurethane foams market in North America was primarily propelled by foreign direct investment in emerging economies which drove increased construction activities. Builders have increasingly applied PU foam sealants to minimize sound transmission through gaps in walls, floors, and roofs, contributing to noise reduction in buildings.

U.S. Rigid Polyurethane Foam Market Trends

The U.S. rigid polyurethane foams market boasts a robust ecosystem with manufacturers, suppliers, and distributors, particularly in the automotive sector. In modern cars, open and closed-cell foams are applied in automotive cushions and seats. The rigid polyurethane foam's lightweight and durable nature contributes to greater vehicle mileage by reducing overall car weight, enhancing fuel efficiency, and minimizing environmental impact. In addition, in the aerospace industry, these foams are used in structural components such as ceilings passenger cabin walls, lavatory elements, baggage sections, class dividers, and flight deck pads.

Europe Rigid Polyurethane Foam Market Trends

The rigid polyurethane foams market in Europe in 2023, was driven by the expanding construction industry along with stringent building codes that emphasize energy efficiency. In turn, this resulted in a demand for insulation materials that can contribute to better thermal performance. Furthermore, environmental regulations that propel the demand for eco-friendly solutions have led manufacturers to invest in R&D activities to come up with improved manufacturing processes and enhanced product solutions.

Asia Pacific Rigid Polyurethane Foam Market Trends

Asia Pacific rigid polyurethane foams market dominated the global share with 59.6% in 2023. The demand primarily stems from the construction industry where thermal insulation properties are crucial for increased efficiency. The market was further driven by elastomers who have significantly gained traction with industries including synthetic leather, footwear, and spandex. In addition, the furnishing sector has further stimulated the market demand. Despite strict environmental regulations related to rigid PU foam manufacturing, APAC continues to be the largest market due to its large population, rising urbanization, and extensive utilization across industries.

The rigid polyurethane foams market in China dominated the market with a 53.4% in Asia Pacific share owing to the rising appliances sector. These foams have become a preferred choice for insulation in appliances such as refrigerators and freezers as consumers prioritize energy-efficient products with a favorable strength-to-weight ratio.

Rigid Polyurethane Foam Company Insights

The rigid PU foams market’s competitive landscape stems from concentrated global industries, leading to increased acquisitions, mergers, and strategic collaborations. It features key players, focusing on polymer development for PU foam production to meet the rising demand in the construction and oil & gas industry.

-

BASF SE is a leading chemical company, actively involved in rigid PU foam production. They significantly invest in R&D to create cutting-edge PU foam formulations and enhance properties for insulation efficiency, fire resistance, and durability. In addition, they actively explore bio-based raw materials, reduce emissions during production, and promote circular economy principles. Their eco-efficient foams align with global environmental goals, making them a preferred choice for environmentally conscious consumers and industries.

Key Rigid Polyurethane Foam Companies:

The following are the leading companies in the rigid polyurethane foam market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Covestro AG

- Dow Inc.

- Huntsman Corporation

- Recticel NV/SA

- Armacell International S.A.

- Bayer Material Science LLC

- Carpenter Co.

- Sekisui Chemical Co., Ltd.

- INOAC Corporation

Recent Developments

-

In September 2022, Saint-Gobain obtained the necessary approvals from relevant authorities to acquire GCP Applied Technologies Inc., a significant player in construction chemicals within North America. This strategic acquisition has bolstered Saint-Gobain’s recognition and presence in the construction chemicals industry.

-

In March 2022, Dow introduced a new product extension of VORASURF - the low cyclics, low volatile silicone surfactants. This is aimed to support innovative rigid PU foam formulations and address key energy efficiency and sustainability trends in construction and spray applications.

Rigid Polyurethane Foam Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 21.80 billion |

|

Revenue forecast in 2030 |

USD 30.58 billion |

|

Growth rate |

CAGR of 5.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Indonesia, Vietnam, Brazil, Argentina, Saudi Arabia, Kuwait, UAE, South Africa |

|

Key companies profiled |

BASF SE; Covestro AG; Dow Inc., Huntsman Corporation; Recticel NV/SA; Armacell International S.A.; Bayer Material Science LLC; Carpenter Co.; Sekisui Chemical Co., Ltd.; INOAC Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Rigid Polyurethane Foam Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rigid polyurethane foam market report based on type, end use, and region:

-

Type Outlook (Revenue, USD billion, 2018 - 2030) (Volume in Kilotons)

-

Slabstock Polyether

-

Slabstock Polyester

-

Molded Foam Parts

-

Others

-

-

End Use Outlook (Revenue, USD billion, 2018 - 2030) (Volume in Kilotons)

-

Building & Construction

-

Oil & Gas

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD billion, 2018 - 2030) (Volume in Kilotons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Kuwait

-

UAE

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."