Ride Sharing Market Size, Share & Trends Analysis Report By Service (Electric Vehicle, ICE Vehicle, CNG/LPG Vehicle, Micro-mobility Vehicle), By Vehicle, By Business Model, By Platform, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-062-0

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Ride Sharing Market Size & Trends

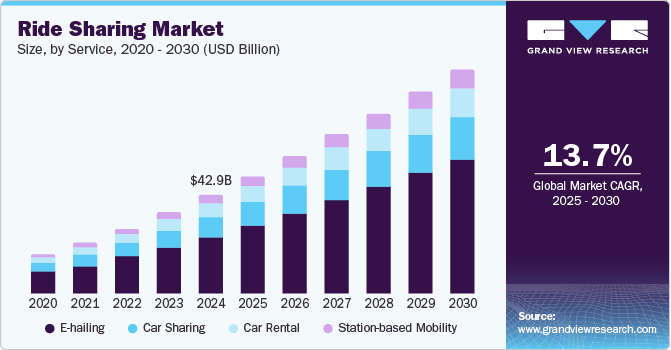

The global ride sharing market size was valued at USD 42.9 billion in 2024 and is projected to grow at a CAGR of 13.7% from 2025 to 2030. Growing attempts to reduce carbon emissions, unceasing urbanization, trends such as limited liability, and the lack of efficient public transport services in multiple countries are some of the key growth driving factors for this market.

The increase in the cost of vehicle ownership is one of the key growth drivers for this market. As companies feature the latest technologies, battery-driven engines, and developments such as advanced driver assistance systems (ADAS) in their offerings, the price of passenger cars has increased significantly. For instance, applauded brands such as Tata Motors, KIA, and others announced plans for price hikes in 2024.

Multiple cities across various regions lack effective public transport services. In addition, an unprecedented increase in road traffic, growing travel time, and a rise in road accidents have shaped recent consumer behavior, with individuals preferring limited or lowest liability in terms of passenger cars or other vehicles.

The availability of ride sharing services offered by numerous companies in prime cities such as New York, Tokyo, London, Seoul, Los Angeles, Zurich, Shanghai, Abu Dhabi, Berlin, Istanbul, Mumbai, and others is expected to generate growth for this marketing in approaching years. Furthermore, benefits such as reduced travel costs, lower demand for parking space, and others assist this market in terms of growth.

Service Insights

Based on service, the e-hailing segment accounted for the largest revenue share of the global market and accounted for 57.9 % in 2024. An increase in the use of smartphones, growing accessibility & availability of the internet, improved safety offered by e-hailing services, real-time tracking features, consumer trends such as zero ownership or limited liability, and increasing awareness about carbon emissions, and sustainability are some of the key growth drivers for this segment.

The station-based mobility segment is expected to experience a significant CAGR of 13.9% over the forecast period. This segment is mainly influenced by the reduced search times, enhanced order and structure of operations, higher security offered by the service, improved data privacy, and others. The station-based mobility services include pick up and return of vehicles in the same spot, which adds clarity and reduces waiting time or search time, which bothers consumers while using e-hailing.

In addition, digital transformation embraced by service providers for processes such as registration, driving license verification, criminal record background checks, payment validation, and more is expected to enhance the growth of this segment in the coming years.

Vehicle Insights

The internal Combustion Engines (ICE) vehicle segment dominated the global market with a revenue share of 57.8% in 2024, attributed to factors such as ease of availability and accessibility, lower maintenance costs, and the fleet's existing share of ICE vehicles. Electric cars are continuously replacing ICE vehicles. However, the type remains the highest revenue share generator for this market. Ease of operations, the present number of ICE vehicles in fleets, and the reduction of existing dependability on fuel alternatives such as CNG, petrol, and others are expected to assist this segment in further growth.

The electric vehicles segment is projected to experience the fastest CAGR of 22.3% from 2025 to 2030. Ride-sharing companies prefer electric vehicles due to numerous aspects, including the cost efficiency of battery-driven cars, rising concerns regarding carbon emissions, awareness about sustainability, and supportive government policies and regulations. Multiple companies are increasingly adopting electric vehicles to significantly reduce the expenses incurred in fuel dependency and minimize the fleet's carbon footprint. The enhanced availability of well-liked electric cars is adding to the growth opportunities for this segment.

Platform Insights

The app-based platform segment dominated the market in terms of revenue share in 2024 driven by the increasing use of smartphones, the growing availability and accessibility of high-speed internet connections, and features offered by the type of platform, such as ease of use, convenience, user-friendly experience, and more. This sort of platform has enhanced engagements for multiple companies. Customers also prefer app-based experiences for easy payments, data privacy, and data safety.

The web and app-based segment is expected to experience lucrative growth during the forecast period attributed to the benefits of platform-related technology, such as multiple device accessibility, faster developments, easy updates and maintenance, less memory space, versatile user experiences, safe transactions, and others.

Business Model Insights

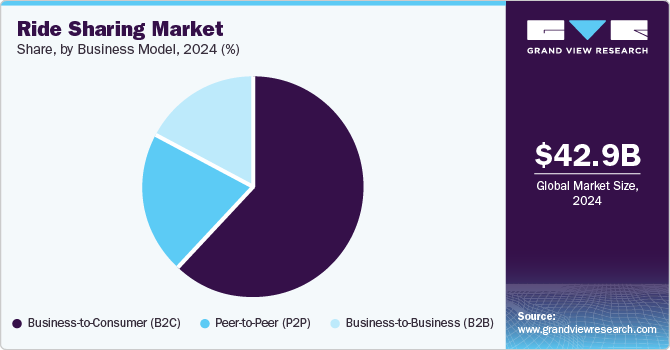

Based on the business model, the business-to-consumer (B2C) segment held the largest revenue share of the global industry in 2024 attributed to factors such as the rising use of ride-sharing applications and services by consumers in urbanized areas, trends such as minimized liability or no ownership, service differentiation strategies adopted by the key companies, effective personalization of services through mobile applications, and ease of use coupled with convenience feature offered by the model. The emergence of numerous ride-sharing businesses ensures the availability of multiple alternatives for consumers.

The business-to-business (B2B) segment is anticipated to experience noteworthy growth over the forecast period mainly driven by the growing focus of businesses on offering welfare benefits to their resources through the availability of such services. In addition, to ensure employee safety during travel, companies appoint service providers from ride-sharing businesses. Advanced technology-assisted features offered by the B2B model, such as customized access, automated programs, permissions, advanced booking dashboards, cost tracking, and more, are projected to increase demand for this segment during the forecast period.

Regional Insights

Asia Pacific dominated the global ride-sharing market and accounted for a revenue share of 49.3% in 2024 attributed to numerous aspects, including the existing number of customers in countries such as India, China, Japan, South Korea, and others, unprecedented growth in the availability and accessibility of technology in the region, the presence of countries with enormous populations, and lack of well-organized public transport services in multiple crowded cities in the area. Numerous consumers and businesses extensively use ride-sharing services in cities such as Mumbai, Guangzhou, Tokyo, Seoul, Sydney, and Melbourne.

India Ride Sharing Market Trends

India ride sharing market is expected to experience the fastest CAGR from 2025 to 2030 mainly driven by factors such as the large population of the country, rising use of smartphones, increased accessibility of high-speed internet, growth in the cost of car ownership, enormous pressure on existing public transport facilities and other infrastructural systems in major cities such as Delhi, Mumbai, Bengaluru, Chennai, Hyderabad, Kolkata, and others.

North America Ride Sharing Market Trends

North America is identified as a lucrative region for global ride sharing market in 2024 primarily influenced by the presence of multiple key players in the market in this region, growing demand for limited liability services, rising service innovation embraced by the companies, and increasing adoption in densely populated cities in the area. Growing awareness regarding carbon emissions and sustainability also influences the demand for ride-sharing services in North America.

The U.S. ride sharing market accounted for a significant market share in North America in 2024 driven by the presence of multiple cities where ride-sharing is extensively used, such as New York, Boston, Chicago, Los Angeles, Miami, Washington DC, Seattle, San Francisco, and others. Service innovation, customized business-to-business services offered by companies, and increased awareness regarding the impacts of carbon emissions are expected to enhance the demand for ride-sharing services in this market.

Middle East & Africa Ride Sharing Market Trends

The Middle East and Africa ride-sharing market is projected to experience significant growth during the forecast period. This market is mainly influenced by factors such as the increasing number of travelers visiting the Middle East and Africa for different purposes, including religious, safari, business, lifestyle, medical, and more. In addition, the organization of multiple sports events and international events for businesses and governments in the region is expected to drive growth for this market in the approaching years.

The ride sharing market in UAE is anticipated to experience noteworthy growth from 2025 to 2030 driven by growing mindfulness regarding climate change and the need for reduced carbon emissions. This has encouraged governments and companies to ensure the availability of environment-friendly mobility solutions and services. Strict regulations, customer behavior trends, and the availability of multiple ride-sharing alternatives are generating demand for the ride-sharing market in the UAE. In addition, an increase in international visitors also contributes to the upsurge in demand. For instance, 10.62 million international visitors visited the UAE from January to July 2024. The number was 9.83 million during January to July 2024.

Key Ride Sharing Company Insights

Some of the key companies in the global ride-sharing market include Uber Technologies, Inc., Lyft, Inc., Didi Chuxing Technology Co., Ltd., Ola Electric Mobility Ltd., and others. To address competition, key companies are adopting strategies such as service differentiation, enhanced customer assistance, automation, embracing innovation, and more.

-

Uber Technologies, Inc., one of the prominent players in ride sharing industry, operates in multiple countries worldwide and has millions of active monthly users for its ride sharing services. It also engages in other services, including food delivery in some of the markets. In ride hailing and ride sharing its offerings include UberX Share, UberX, Uber Green, Uber Taxi, Uber Reserve, Uber Intercity, and others.

-

Didi Chuxing Technology Co., Ltd., a major market participant in the mobility technology industry, offers an extensive range of services through app-based technology in multiple countries, including Argentina, Australia, Brazil, Cost Rica, Ecuador, Egypt, New Zealand, Peru, Mexico, Japan, Chile and more.

Key Ride Sharing Companies:

The following are the leading companies in the ride sharing market. These companies collectively hold the largest market share and dictate industry trends.

- Uber Technologies, Inc.

- Lyft, Inc.

- Via Transportation, Inc.

- Zoox, Inc.

- Didi Chuxing Technology Co., Ltd.

- Ola Electric Mobility Ltd.

- Grab

- Gett

- Revel

- BlaBlaCar

Recent Developments

-

In October 2024, Uber Technologies Inc., a prominent company in the ride-sharing industry, launched Uber Pet in Bengaluru, one of the prime cities in the Indian market. This novel offering for pet parents seeking hassle-free transportation options for their pets is exclusively available for pre-booking in Bengaluru through the company’s smartphone app.

-

In September 2024, Uber announced the launch of Uber Safari, one of its latest offerings under its ‘Go Anywhere’ series product portfolio. The limited edition experience is available for consumers in Cape Town, South Africa, till January 2025.

-

In July 2024, Spacer Technologies Pty Ltd, a key company in technology applications, acquired Scoop Commute, a workstation carpooling platform, to further its business expansion strategy of becoming a mobility company.

Ride Sharing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 51.1 billion |

|

Revenue forecast in 2030 |

USD 96.9 billion |

|

Growth Rate |

CAGR of 13.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

October 2024 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, vehicle, business model, platform, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Singapore, Brazil, Saudi Arabia, UAE, South Africa |

|

Key companies profiled |

Uber Technologies, Inc., Lyft, Inc., Via Transportation, Inc., Zoox, Inc., Didi Chuxing Technology Co., Ltd., Ola Electric Mobility Ltd., Grab, Gett, Revel, BlaBlaCar |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Ride Sharing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ride sharing market report based on service, vehicle, business model, platform, and region.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

E-hailing

-

Car Sharing

-

Car Rental

-

Station-based Mobility

-

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Electric Vehicle

-

ICE Vehicle

-

CNG/LPG Vehicle

-

Micro-mobility Vehicle

-

-

Business Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Business-to-Consumer (B2C)

-

Business-to-Business (B2B)

-

Peer-to-Peer (P2P)

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Web-based

-

App-based

-

Web & App Based

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."