Rice Syrup Market Size, Share & Trends Analysis Report By Type (Organic Rice Syrup, Conventional Rice Syrup), By Application, By Form (Liquid, Powder), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-435-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Rice Syrup Market Size & Trends

The global rice syrup market size was estimated at USD 2.09 billion in 2023 and is expected to grow at a CAGR of 5.1% from 2024 to 2030. The demand and consumption of rice syrup are on the rise, driven by a growing health consciousness among consumers. As more people seek natural and healthier alternatives to refined sugar and high-fructose corn syrup, rice syrup has emerged as a preferred choice. Its natural origin, derived from rice, aligns well with the trend towards cleaner, more natural food products. Additionally, the rising popularity of vegan and organic foods has further boosted rice syrup's appeal, particularly as it fits seamlessly into the diets of those who avoid animal products and prefer non-GMO options.

Rice syrup’s gluten-free nature also makes it an attractive option for individuals with celiac disease or those adhering to gluten-free diets. This has expanded its market, particularly in regions where gluten intolerance is more prevalent. Furthermore, its versatility in the food and beverage industry has contributed to its rising demand. Rice syrup is used in a wide range of products, from baked goods and cereals to snacks and beverages, due to its mild flavor and ability to enhance texture. Its inclusion in infant formula and nutritional supplements is also growing, as it is perceived as a safe and nutritious sweetener.

Another factor driving the rise in rice syrup consumption is the increasing awareness of food allergies and sensitivities. Rice syrup is hypoallergenic, making it a preferred sweetener for those who need to avoid common allergens like honey. This trend is part of a broader movement towards allergen-free and clean-label products, where consumers demand transparency in ingredient sourcing and processing. Rice syrup, often seen as less processed and more natural, fits well into this demand for clean label products.

The market for rice syrup is also expanding in emerging markets, driven by the growing middle class's demand for processed and convenience foods. In regions like Asia-Pacific, where rice syrup is more culturally familiar, this trend is particularly strong. Additionally, sustainability and ethical considerations are influencing consumer choices, with more people favoring products that are sustainably sourced. Rice syrup, which can be produced through sustainable agricultural practices, is gaining traction among eco-conscious consumers.

Type Insights

Conventional rice syrup accounted for a share of 65.3% in 2023. Conventional rice syrup is highly versatile and can be used in a wide range of food products, from snacks and baked goods to beverages. Its mild flavor and consistent quality make it a popular choice for various applications, driving up its demand. Additionally, as processed and convenience foods continue to be popular, especially in emerging markets, the demand for conventional rice syrup is rising. It is commonly used as a sweetener in these products, contributing to its increased consumption.

Organic rice syrup is expected to grow at a CAGR of 5.5% from 2024 to 2030. The rise in demand for clean label products, which emphasize transparency and simplicity in ingredients, is boosting the popularity of organic rice syrup. Organic rice syrup, free from synthetic pesticides and chemicals, appeals to those seeking healthier and more natural food options. Consumers who want to avoid artificial additives and GMOs often choose organic options, driving demand.

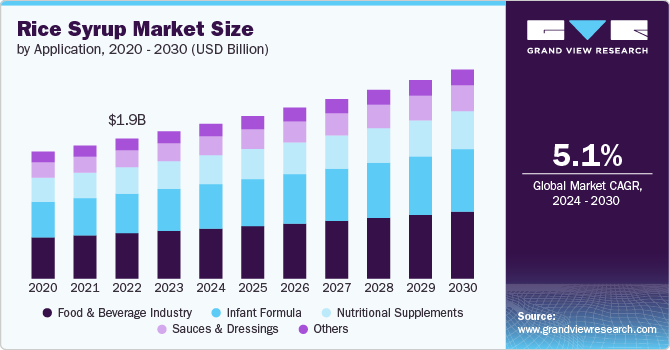

Application Insights

Food & beverage accounted for a revenue share of 32.4% in 2023. Rice syrup's mild flavor and smooth texture make it an ideal ingredient in a wide range of products, including baked goods, cereals, snacks, and beverages. Its ability to enhance texture, moisture retention, and shelf life without overpowering other flavors contributes to its rising popularity in the industry. Rice syrup, being a natural sweetener with a lower glycemic index, is increasingly favored in the formulation of various food and beverage products.

Infant formula is expected to grow at a CAGR of 5.9% from 2024 to 2030. Rice syrup is easily digestible, which is essential for infants whose digestive systems are still developing. Its simple carbohydrate composition is gentle on the stomach, reducing the risk of gastrointestinal discomfort in infants. As parents become more health-conscious and seek natural, clean-label products for their babies, rice syrup serves as a preferable alternative to artificial sweeteners or corn syrup solids often found in infant formulas. It aligns with the growing demand for more natural and minimally processed ingredients in baby foods.

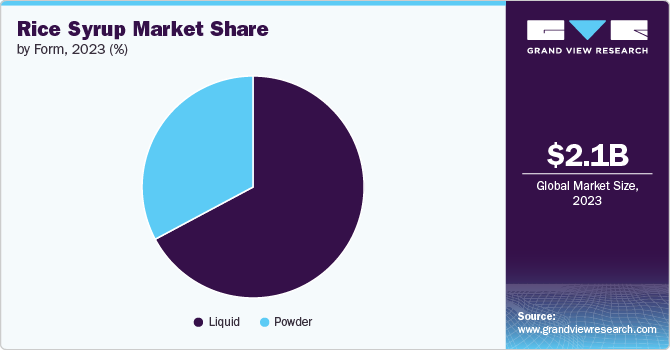

Form Insights

Powdered rice syrup accounted for a share of 67.2% in 2023. The powdered form of rice syrup can be easily dissolved or mixed into formulations, ensuring consistent sweetness and texture in final products. This enhanced solubility is beneficial for applications in baking, snacks, and instant beverages where uniformity is crucial.

Liquid rice syrup is expected to grow at a CAGR of 5.5% from 2024 to 2030. Liquid rice syrup can contribute to a product's flavor profile more effectively than powdered forms. It provides a mild, pleasant sweetness and can enhance the overall taste and mouthfeel of products, making it a popular choice in a wide range of applications. Many consumers and manufacturers prefer liquid sweeteners for their ease of use and versatility. Liquid rice syrup is convenient for direct application and mixing, which aligns with the preferences of both consumers and food producers.

Distribution Channel Insights

Supermarkets & hypermarkets accounted for a revenue share of 39.9% in 2023. Supermarkets and hypermarkets typically stock a range of rice syrup products, catering to diverse consumer preferences and needs. Whether consumers are looking for conventional rice syrups in the form of powders and liquids. This variety allows consumers to compare different brands and products in one place, enhancing the shopping experience.

Online is expected to grow at a CAGR of 6.2% from 2024 to 2030. Online shopping offers the convenience of purchasing rice syrup from the comfort of home. Consumers can access a diverse selection of brands, flavor profiles, and formats (such as liquid, powder) from around the world. This extensive variety allows consumers to find exactly what they’re looking for, catering to specific dietary needs or culinary preferences.

Regional Insights

The rice syrup market in North America accounted for a revenue share of over 26% in 2023 of the global market. The clean label trend, which emphasizes transparency and simplicity in food ingredients, is gaining momentum. Rice syrup, perceived as a more natural and less processed sweetener compared to high-fructose corn syrup and artificial sweeteners, fits well into this movement, appealing to consumers looking for cleaner and more recognizable ingredients.

U.S. Rice Syrup Market Trends

The rice syrup market in the U.S. is facing intense competition due to innovation in rice syrup varieties. There is growing awareness and demand for gluten-free and allergy-friendly foods in U.S. Rice syrup, being gluten-free and hypoallergenic, is an attractive option for manufacturers producing products for individuals with dietary restrictions and allergies.

Europe Rice Syrup Market Trends

The rice syrup market in Europe is expected to grow at a CAGR of 5.3% during the forecast period. European consumers are becoming more health-conscious and are increasingly seeking natural, lower-glycemic alternatives to refined sugars and high-fructose corn syrup. Rice syrup, with its perceived health benefits and natural origins, aligns well with these dietary preferences.

Asia Pacific Rice Syrup Market Trends

The rice syrup market in Asia Pacific is expected to grow at a CAGR of 5.7% from 2024 to 2030. The growing middle class and rapid urbanization in countries like China and India are driving demand for processed and convenience foods, which often use rice syrup as a sweetener. This demographic shift is contributing to the increased use of rice syrup in various food and beverage products.

Key Rice Syrup Company Insights

The rice syrup market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality product.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Rice Syrup Companies:

The following are the leading companies in the rice syrup market. These companies collectively hold the largest market share and dictate industry trends.

- Axiom Foods Inc.

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Wuhu Deli Foods Co., Ltd.

- Habib-ADM Limited

- ABF Ingredients (ABFI)

- Nature Bio-Foods Ltd.

- WaiLana

- Khatoon Industries

- California Natural Products

Rice Syrup Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.19 billion |

|

Revenue forecast in 2030 |

USD 2.96 billion |

|

Growth rate |

CAGR of 5.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, form, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; UAE |

|

Key companies profiled |

Axiom Foods Inc.; Archer Daniels Midland Company (ADM); Cargill, Incorporated; Wuhu Deli Foods Co., Ltd.; Habib-ADM Limited; ABF Ingredients (ABFI); Nature Bio-Foods Ltd.; WaiLana; Khatoon Industries; California Natural Products |

|

Customization scope |

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Rice Syrup Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global rice syrup market report based on type, application, form, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic Rice Syrup

-

Conventional Rice Syrup

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Infant Formula

-

Nutritional Supplements

-

Sauces & Dressings

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global rice syrup market size was estimated at USD 2.09 billion in 2023 and is expected to reach USD 2.19 billion in 2024.

b. The global rice syrup market is expected to grow at a compounded growth rate of 5.1% from 2024 to 2030 to reach USD 2.96 billion by 2030.

b. Conventional rice syrup accounted for a share of 65.3% in 2023. Conventional rice syrup is more widely available than organic alternatives. This broader availability ensures that manufacturers can easily source it in large quantities, which is crucial for meeting the growing demand in the food and beverage industry.

b. Some key players operating in rice syrup market include Axiom Foods Inc., Archer Daniels Midland Company (ADM), Cargill, Incorporated, and others.

b. Key factors that are driving the market growth include rising demand for natural sweeteners, popularity of plant-based and clean-label products, and increasing health consciousness among consumers

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."