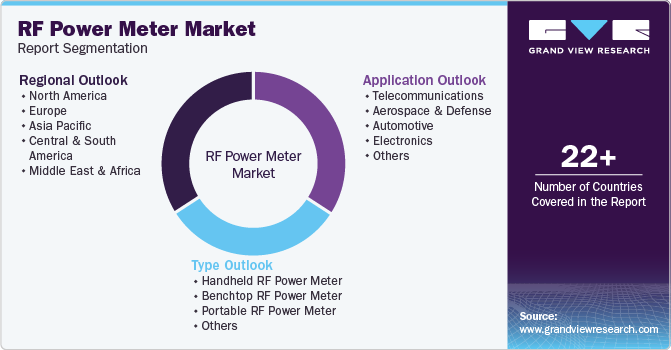

RF Power Meter Market Size, Share & Trends Analysis Report By Type (Handheld, Benchtop, Portable), By Application (Telecommunications, Automotive, Aerospace & Defense, Electronics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-520-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

RF Power Meter Market Size & Trends

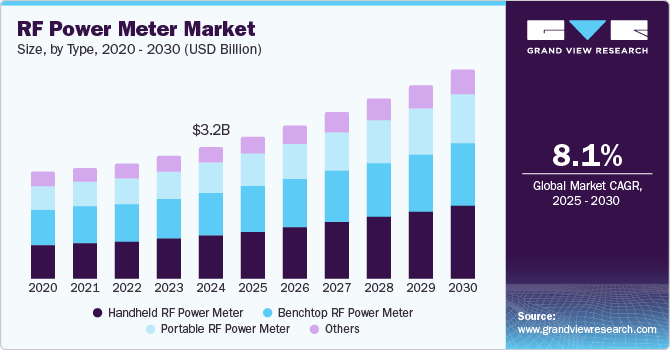

The global RF power meter market was valued at USD 3.15 billion in 2024 and is projected to grow at a CAGR of 8.1% from 2025 to 2030. Demand for RF power meters in telecommunications and aerospace is likely to emerge as a key factor for industry growth over the forecast period. The increased adoption of 5G networks and wireless communication technologies is projected to drive the demand for accurate power measurement tools in the coming years.

The growing demand for reliable power measurement equipment in military and defense applications is expected to provide significant growth opportunities for the RF power meter sector. According to the U.S. Department of Defense, military expenditure in 2023 reached approximately USD 877 billion, contributing to the increased demand for precision testing equipment such as RF power meters. Additionally, the expansion of IoT and smart city initiatives is anticipated to boost market growth by driving demand for wireless infrastructure testing and monitoring solutions.

Drivers, Opportunities & Restraints

The rising demand for wireless communication technologies and the deployment of 5G infrastructure have significantly boosted the RF power meter industry. According to the International Telecommunication Union, global 5G connections surpassed 1.5 billion in 2023, fueling the need for advanced power measurement tools. The aerospace & defense sector also plays a crucial role in driving demand for RF power meters due to the increased adoption of radar and satellite communication systems.

Opportunities are emerging in the automotive industry, with the growing integration of RF technology in electric vehicles and advanced driver-assistance systems. The expansion of autonomous vehicle technology is expected to further augment demand for RF power meters. For instance, according to the Society of Automotive Engineers report, there is a 15% increase in global spending on vehicle electronics in 2023.

However, the market faces challenges due to high product costs and fluctuating prices of components such as semiconductors, which are critical for manufacturing RF power meters. In 2023, the global semiconductor shortage caused a significant delay in the production and delivery of testing equipment, impacting the market's growth trajectory.

Type Insights

The handheld RF power meter segment dominated the market due to its versatility, portability, and cost-effectiveness across various industries, particularly in telecommunications, aerospace & defense, and electronics sectors. These devices are highly preferred for field testing and on-site measurements, offering ease of use and accuracy in real-time applications. Their growing adoption in 5G infrastructure deployment, along with increasing use in maintenance and testing activities in the broadcasting sector, is expected to drive segment growth.

The benchtop RF power meters segment is anticipated to grow steadily, driven by their high accuracy and broader functionality in research labs and industrial environments. These meters are widely used in R&D activities and production testing in sectors like aerospace & defense, and telecommunications. The increasing focus on developing next-generation communication systems and advanced military communication equipment is likely to bolster the demand for benchtop RF power meters in the coming years.

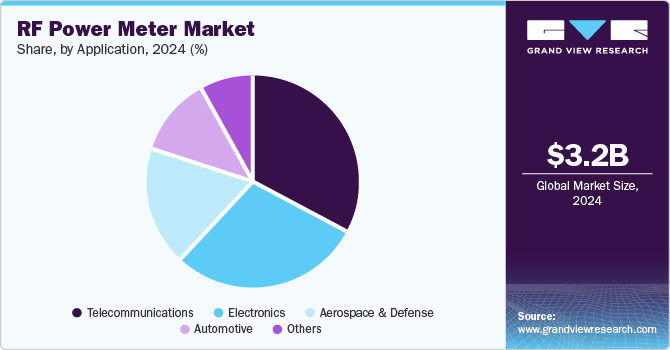

Application Insights

The telecommunications segment accounted for the largest share of the RF power meter industry due to the ongoing expansion of 5G networks and the increasing number of connected devices worldwide. The International Data Corporation reported that global spending on 5G infrastructure reached USD 13 billion in 2023, further driving the demand for RF testing solutions.

The aerospace & defense segment is expected to grow steadily, driven by the increased deployment of advanced radar systems and satellite communication networks. Military organizations in regions such as North America and Europe are heavily investing in upgrading communication infrastructure, further boosting market demand.

The automotive segment is witnessing growing interest due to the integration of wireless communication technologies in connected and electric vehicles. The development of vehicle-to-everything (V2X) communication systems is anticipated to offer significant growth opportunities for RF power meter manufacturers.

Regional Insights

North America held the largest revenue share in 2024, driven by the presence of key manufacturers and extensive investment in 5G infrastructure. The U.S. government’s emphasis on strengthening communication networks and the defense sector has been a key factor in driving market growth. For example, the Federal Communications Commission (FCC) allocated an additional USD 9 billion for 5G Fund initiatives in rural areas, creating a robust demand for RF power meters.

U.S. RF Power Meter Market Trends

The U.S. RF power meter market is driven by the growing demand for high-precision measurements in telecommunications, aerospace, and electronics industries. Increasing advancements in 5G technology and the rise of IoT applications present significant opportunities for market growth, fueling the need for accurate RF power measurement solutions.

Asia Pacific RF Power Meter Market Trends

The Asia Pacific region is expected to witness the fastest growth over the forecast period due to rapid industrialization and the expanding telecommunications sector in countries such as China, Japan, and South Korea. China, in particular, leads the region in 5G infrastructure development. According to the China Academy of Information and Communications Technology, the country added over 800,000 5G base stations in 2023, creating significant opportunities for RF power meter manufacturers.

Europe RF Power Meter Market Trends

Europe’s RF power meter market is anticipated to grow at a steady pace, driven by advancements in the automotive and aerospace sectors. The European Union's investments in smart transportation and communication technologies are likely to support market growth. Germany, known for its robust automotive industry, is increasingly adopting RF testing solutions in electric vehicle manufacturing and autonomous driving systems.

Central & South America RF Power Meter Market Trends

In Central and South America, the growing adoption of wireless communication technologies and government initiatives to enhance connectivity are expected to drive market growth. Brazil and Mexico are key markets in the region, with increased spending on telecommunications and defense sectors supporting the demand for RF power meters.

Middle East & Africa RF Power Meter Market Trends

The Middle East & Africa region is experiencing growing demand for RF power meters due to expanding telecommunications infrastructure and military modernization programs. Countries such as the UAE and Saudi Arabia are investing heavily in 5G technology and advanced radar systems for defense, creating significant market opportunities.

Key RF Power Meter Company Insights

Some of the key players operating in the market include Rohde & Schwarz, and Keysight Technologies, and Anritsu.

-

Keysight Technologies is a global leader in electronic measurement solutions, offering a wide range of RF power meters for telecommunications, aerospace & defense applications. The company is known for its cutting-edge technology and reliable testing solutions.

-

Rohde & Schwarz specializes in test and measurement equipment for wireless communication, broadcasting, and aerospace sectors. The company’s RF power meters are widely used for accurate power measurements in 5G networks and radar systems.

-

Anritsu is a leading provider of RF testing solutions, focusing on innovation in mobile communications, automotive radar, and IoT testing technologies.

Key RF Power Meter Companies:

The following are the leading companies in the radio frequency power meter market. These companies collectively hold the largest market share and dictate industry trends.

- Rohde & Schwarz

- Keysight Technologies

- Anritsu

- Bird

- Emerson Electric Co.

- TEKTRONIX, INC.

- Wireless Telecom Group, Inc.

- Aim-TTi

- Cobham Limited

- Fluke

Recent Developments

-

In October 2024, Keysight Technologies and the UK’s National Physical Laboratory announced a breakthrough in cryogenic RF power measurement technology. This collaboration has developed the industry’s first traceable cryogenic RF power measurement system, enabling accurate measurements at extremely low temperatures, essential for quantum computing and advanced communication systems.

-

In April 2024, Anritsu introduced a new IQ capture and IQ streaming option for its Field Master MS2080A RF spectrum analyzer, enhancing real-time data analysis capabilities for 5G, IoT, and aerospace applications. This new feature allows users to capture and stream IQ data for comprehensive post-processing and signal analysis, improving troubleshooting and performance evaluation.

RF Power Meter Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.40 billion |

|

Revenue forecast in 2030 |

USD 5.01 billion |

|

Growth rate |

CAGR of 8.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative Units |

Volume in kilotons, revenue in USD million/billion,, and CAGR from 2025 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE |

|

Key companies profiled |

Rohde & Schwarz; Keysight Technologies; Anritsu; Bird; Emerson Electric Co.; Wireless Telecom Group, Inc.; TEKTRONIX, INC.; Cobham Limited; Aim-TTi, Fluke |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global RF Power Meter Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global RF power meter market report on the basis of type, application, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Handheld RF Power Meter

-

Benchtop RF Power Meter

-

Portable RF Power Meter

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Telecommunications

-

Aerospace & Defense

-

Automotive

-

Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global RF power meter market size was estimated at USD 3.15 billion in 2024 and is expected to reach USD 3.40 billion in 2025.

b. The global RF power meter market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030 to reach USD 5.01 billion by 2030.

b. Based on type segment, handheld RF power meter held the largest revenue share of more than 32.0% in 2024 owing to high price and application in telecommunications and automotive.

b. Some of the key vendors of the global RF power meter market are Rohde & Schwarz, Keysight Technologies, Anritsu, Bird, Emerson Electric Co., Wireless Telecom Group, Inc., TEKTRONIX, INC., Cobham Limited, among others.

b. The key factors driving the RF power meter market include the rising demand in telecommunications, aerospace, and defense sectors for accurate power measurement and monitoring. The increasing adoption of wireless communication technologies and expanding 5G infrastructure present significant growth opportunities for manufacturers, positioning the market for robust growth over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."