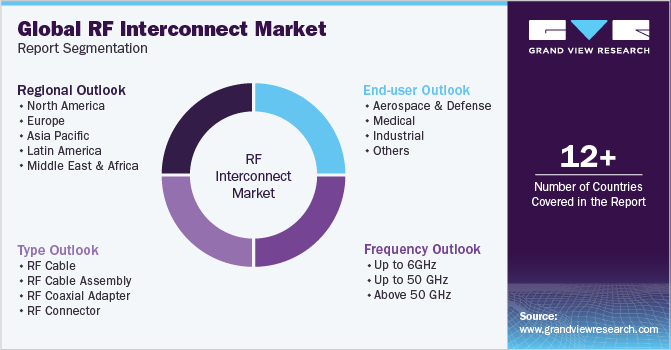

RF Interconnect Market Size, Share & Trends Analysis Report By Type (RF Cable, RF Cable Assembly), By Frequency (Up To 50 GHZ, Above 50 GHZ), By End-user (Medical, Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-018-0

- Number of Report Pages: 254

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Report Overview

The global RF interconnects market size was estimated at USD 29.12 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.6%% from 2023 to 2030. RF interconnect is used in numerous electronic products where signal transmission quality is critical. It is critical in applications utilizing high-speed digital signals. A Radio Frequency interconnect is the complete path that connects one device to another. One of the significant factors for the increasing demand for RF cable assemblies is the increasing use of radio frequency cables in aerospace, telecommunication, and military applications. In military applications, radio frequency cable assemblies are vital in mission-critical military electronic systems. RF cables are used in stressful and hostile environments, offering fast communication and low loss.

Additionally, radio frequency cable assemblies are used in laboratory and test measurement equipment owing to their reliable and fast performance. These benefits drive the use of RF cables in military applications, driving the RF cable assembly market growth.

The RF interconnect market has experienced significant growth in recent years, driven by the increasing demand for high-speed wireless communication and the rapid advancement of technologies such as the Internet of Things (IoT), 5G, and autonomous vehicles. RF interconnects play a critical role in enabling efficient and reliable transmission of signals between various electronic components and systems, making them essential in a wide range of applications. One key driver of the RF interconnect industry growth is the widespread adoption of 5G technology. As 5G networks continue to roll out globally, there is a need for high-frequency RF interconnect solutions to support the increased data rates and bandwidth requirements.

Smart cities utilize Information and Communication Technology (ICT) to enhance operational efficiency, provide better citizen welfare and government service, and share information with the public. The primary objective of a smart city is to encourage economic growth and optimize city functions while enhancing the citizens’ quality of life using data analysis and smart technologies. Rapid advancements in data analysis, the Internet of Things, and better connectivity are powering new applications and driving innovation.

Cities worldwide are implementing new technologies and transforming how people play, work, live, and get around. RF technology is increasingly essential for smart technology infrastructure owing to the increase in the use of sensors and devices for data collection. The use of real-time information improves efficiency across industries. RF cable assemblies, adapters, and connectors enable wireless connectivity for nearly all smart city initiatives requiring wireless connectivity to transmit data.

COVID-19 Impact

The outbreak of the COVID-19 pandemic took a severe toll on several industries and industry verticals, and the RF Interconnect industry vertical was not an exception. The outbreak of the pandemic forced several governments worldwide to impose lockdowns and restrictions on the movement of people and goods as part of the efforts to arrest the spread of coronavirus. As a result, the global demand for RF cables plummeted significantly due to inconsistent operations and expansion activities, especially among the incumbents of the heavy-duty industry.

Having realized that companies are incurring severe losses in the wake of the outbreak of the pandemic, several governments announced economic stimulus packages to invigorate the overall economy and drive the demand for various commodities. The stimulus packages are expected to play a niche, long-term role in stimulating the demand over the forecast period. For example, in November 2020, the government of Canada announced investments worth about USD 134.84 million (CAD 175 million) to facilitate high-speed data connectivity for individuals and businesses. Plans envisaged connecting about 98% of Canadians to high-speed internet networks by 2026 and all the residents by 2030.

By implementing these economic stimulus packages, governments intend to boost economic activity and promote the adoption of advanced technologies that require reliable RF interconnect solutions. The investments in high-speed data connectivity align with the growing need for seamless communication and data transmission, particularly in remote work setups and digital communication technologies. Such initiatives can drive the demand for RF interconnect products and services, creating opportunities for industry players to recover and grow in the post-pandemic period.

It is worth noting that these paragraphs provide specific examples of government initiatives and their potential impact on the RF interconnect industry. However, the overall impact of the pandemic and the effectiveness of these stimulus packages may vary across different regions and timeframes. To obtain the most up-to-date and accurate information regarding the current state of the RF interconnect industry and the impact of government initiatives, it is recommended to refer to recent industry reports, market research studies, and expert analysis.

Type Insights

Based on type, the market is classified into RF cable, RF cable assembly, RF coaxial adapter, and RF connector. The RF cable assembly segment held the largest revenue share of more than 33.0% in 2022 and is expected to witness a CAGR of 7.0% during the forecast period. Cable assembly refers to assembling one or more cables enclosed in a single tube. RF cable assemblies serve as communication lines for RF signals crossing from one point in a system to another (for example, equipment to equipment, equipment to the antenna, PC board to the antenna, PC board to a PC board, etc.).

This cable assembly normally consists of radio frequency coaxial connectors, which are mechanically attached to a coaxial cable. Several variables need to be considered when designing radio frequency coaxial cable assemblies, including mechanical considerations (length, weight, and size), environmental considerations, shielding effectiveness, electrical performance (return loss, insertion loss, and impedance), frequency, connector types, and materials and construction.

The RF coaxial adapter is anticipated to witness the fastest CAGR of 8.8% throughout the forecast period. These are passive coaxial components that transfer signals from one connector interface to another. They can be utilized to transition signals from a Sub-Miniature A (SMA) connector to an N-Type connector interface of Bayonet Neill-Concelman (BNC) connectors to Threaded Neill-Concelman (TNC) connectors, etc. Adapters and connectors are similar in terms of functionality.

These are also used for providing connections across a network from various devices. Like most adapters, plugs/sockets, and connectors, RF adapters can also be identified by gender. Female RF adapters are usually recognized by their pin, also called the plug, and male RF adapters have an opening designed for attaching the pin or plug on female connectors, which is used to join the two individual parts together. Male RF adapters are also referred to as jacks.

Frequency Insights

Based on frequency, the market is classified into up to 6GHz, above 50 GHz, and up to 50 GHz segments. The up to 50 GHz segment dominated with a revenue share of 41.7% in 2022 and is expected to grow at a CAGR of 7.1% during the forecast period. This range of frequency is known as the Super High Frequency (SHF). SHF is the International Telecommunication Union designation for RF within the range of 3 and 50 GHz. Since the wavelengths range from 1-10 cm, this frequency band is also called the centimeter band or centimeter wave.

SHF is also called microwave because the radio waves of these frequencies are within the microwave band. The small wavelength of microwaves permits SHF to be directed in thin beams by aperture antennas, which makes them suitable for data links, point-to-point communication, and radar. Most satellite phones (S-band), satellite communication, wireless LANs, microwave radio relay lines, radar transmitters, and multiple short-range terrestrial data links operate within this frequency range. They are also utilized for heating to cook food in microwave ovens, microwave hyperthermia to treat cancer, medical diathermy, and industrial microwave heating.

The up to 6 GHz segment is anticipated to witness the fastest growth, growing at a CAGR of 8.6% throughout the forecast period. This range of frequency is known as Ultra High Frequency (UHF). UHF connectors are radio frequency connectors that transmit frequencies up to 6 GHz. These connectors contain non-constant surge impedance and are typically used for radio applications such as ham radio, marine VHF radio, and amateur radio.

The increasing demand for higher data rates has been a driving force behind this growth. With the widespread adoption of wireless communication devices and the rapid expansion of the Internet of Things (IoT), there is a growing need for faster and more reliable data transmission. The up to 6GHz frequency range provides sufficient bandwidth to support these requirements, making it a popular choice for RF interconnect solutions.

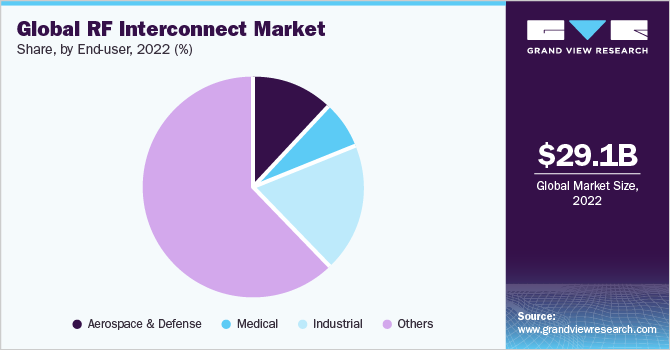

End-user Insights

Based on end-user, the RF interconnect market is classified into aerospace & defense, medical, industrial, and others. Among these, the others segment dominated in 2022, gaining a revenue share of 61.7%, and is expected to witness a CAGR of 7.5% throughout the forecast period. Industries such as construction, IT & telecommunication, consumer electronics, manufacturing, and automobile are covered under the others category.

The consumer electronics sector is projected to provide promising growth opportunities to the global radio frequency cable industry owing to the ongoing development of high-tech products and the growing demand for HVAC equipment with advanced features. The growing demand for flexible, highly durable, high-performance RF systems for efficient signal processing in military applications, such as Electronic Warfare (EW), is expected to support the aerospace and defense segment outlook. Furthermore, increasing investments in digitization initiatives across industries are expected to drive the demand for power transmission and distribution networks.

The industrial segment is anticipated to witness the most rapid growth at a CAGR of 8.8% throughout the forecast period. High-frequency connectors connect cables, printed circuit boards, and devices to transmit extremely high frequencies. Connectors in the market range from miniature to large and heavy connectors. Connectors are not only necessary for enabling existing and forthcoming technologies, but they must also be able to withstand the ever-increasing transmission rates, adapt to economic and ecological conditions, and continually satisfy the demand for reliability and performance, even in tough conditions.

As transmission rates continue to increase, high-frequency connectors must be capable of handling higher frequencies without compromising signal integrity. The demand for faster data transmission and communication necessitates connectors that can support higher data rates and bandwidths. This significantly challenges connector manufacturers to develop innovative designs and materials that can meet these demanding requirements.

Regional Insights

Asia Pacific led the overall market in 2022, with a revenue share of 44.16%. The Asia Pacific RF interconnect industry has experienced remarkable growth in recent years, fueled by various factors specific to the region. One key driver of this growth is the rapidly expanding telecommunications sector. Asia Pacific is home to some of the largest and fastest-growing telecommunications markets, such as China and India. The increasing demand for high-speed data transmission, mobile communication, and internet connectivity has led to a surge in the deployment of advanced RF interconnect solutions.

The emergence of 5G technology has also played a significant role in driving the growth of the RF interconnect industry in the Asia Pacific. The region has been at the forefront of 5G deployment, with several countries actively rolling out 5G networks. This transition to 5G requires a higher density of antennas and increased network capacity, which, in turn, drives the need for efficient RF interconnect technologies to support the increased data rates and frequencies associated with 5G.

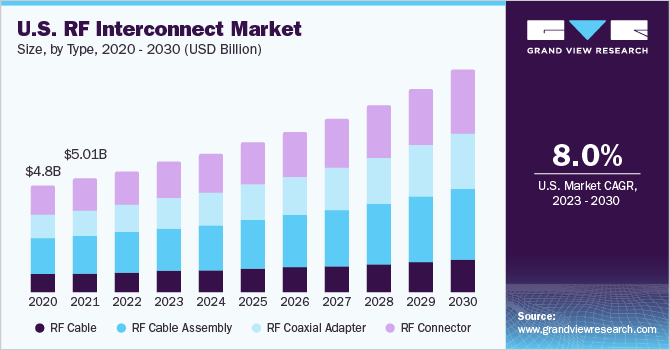

North America is anticipated to witness the most rapid growth, growing at a CAGR of 8.4% throughout the forecast period. Different administrations' growing interest in providing high-speed internet service to citizens, new oil and gas development potential, and stringent laws for RF systems are some of the fundamental factors driving the growth of the RF interconnect in the North America region.

Moreover, the region's potential for new oil and gas development has also contributed to the growth of the RF interconnect industry. As the industry seeks to optimize production and improve operational efficiency, deploying RF interconnect solutions becomes essential for reliable communication and control systems in remote and harsh environments. For instance, the U.S. Federal Communications Commission has implemented several policies on RF devices' operation and their impacts on the human environment. The division has also implemented several rules and uses special software to detect radio frequency density near broadcasting towers to observe the installations.

Key Companies & Market Share Insights

The RF interconnect industry is highly fragmented, with several players operating globally, regionally, and locally. The existing players compete based on the quality, efficiency, and precision of RF interconnector components. This competition is aimed at gaining maximum traction from various industries. Key players focus on partnerships, product upgrades, and collaborations to gain a competitive edge over their peers and capture a significant market share.

For instance, In September 2022, Microchip Technology Inc. unveiled a fresh lineup of META-DX2+ PHYs designed for various networking systems such as enterprise ethernet switches, security appliances, cloud interconnect routers, and optical transport systems. This significant expansion is driving the adoption of 112G PAM4 (Pulse Amplitude Modulation 4-level) connectivity beyond cloud data centers and telecom service provider switches and routers, extending it to enterprise ethernet switching platforms. Some prominent players in the global RF interconnect market include:

-

Penn Engineering Components

-

Jupiter Microwave Components Inc.

-

Quantic Electronics

-

Amphenol RF

-

Delta Electronics, Inc.

-

Samtec

-

Cobham Advanced Electronic Solutions

-

Ducommun Incorporated

-

ETL Systems Ltd.

-

Smiths Interconnect

-

DigiLens Inc.

-

Corning Incorporated

-

Global Invacom

-

Radiall

-

HUBER + SUHNER

-

W.L. Gore & Associates, Inc.

-

Flann Microwave Ltd.

RF Interconnector Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 31.01 billion |

|

Revenue forecast in 2030 |

USD 51.76 billion |

|

Growth rate |

CAGR of 7.6% from 2023 to 2030 |

|

Historical year |

2017 - 2021 |

|

Base year for estimation |

2022 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

Aug - 2023 |

|

Quantitative units |

Revenue in USD million/billion, CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Type, frequency, end-user, region |

|

Regional scope |

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; UK; France; China; India; Japan; Mexico; Brazil |

|

Key companies profiled |

Penn Engineering Components; Jupiter Microwave Components Inc.; Quantic Electronics; Amphenol RF; Delta Electronics, Inc; Samtec; Cobham Advanced Electronic Solutions; Ducommun Incorporated; ETL Systems Ltd.; Smiths Interconnect; DigiLens Inc.; Corning Incorporated; Global Invacom, Radiall; HUBER + SUHNER; W.L. Gore & Associates, Inc.; Flann Microwave Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global RF Interconnect Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global RF Interconnect market report based on type, frequency, end-user, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

RF Cable

-

RF Cable Assembly

-

RF Coaxial Adapter

-

RF Connector

-

-

Frequency Outlook (Revenue, USD Million, 2017 - 2030)

-

Up to 6GHz

-

Up to 50 GHz

-

Above 50 GHz

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Aerospace & Defense

-

Medical

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global RF interconnect market size was estimated at USD 29.12 billion in 2022 and is expected to reach USD 31.01 billion in 2023.

b. The global RF interconnect market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach 51.76 billion by 2030.

b. The RF cable assembly segment dominated the overall market, gaining a market share of 33.1% in 2022 and witnessing a CAGR of 7.0% during the forecast period. RF cable assemblies serve as transmission lines for RF signals traversing from one point in a system to another (for example, equipment to equipment, equipment to the antenna, PC board to the antenna, PC board to a PC board, etc.).

b. Some key players operating in the RF Interconnect market include Delta Electronics, Inc.; Corning Incorporated; Amphenol Corporation; Microchip Technology Inc.; and Qualcomm Technologies, Inc.

b. Key factors that are driving the RF Interconnect market growth include the increasing demand for RF cable assemblies is the increasing use of radio frequency cables in aerospace, telecommunication, and military applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."