- Home

- »

- Next Generation Technologies

- »

-

Reverse Mortgage Market Size, Share & Growth Report 2030GVR Report cover

![Reverse Mortgage Market Size, Share & Trends Report]()

Reverse Mortgage Market Size, Share & Trends Analysis Report By Type, By Application (Debt, Healthcare Related, Renovations, Income Supplement, Living Expenses), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-439-0

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Reverse Mortgage Market Size & Trends

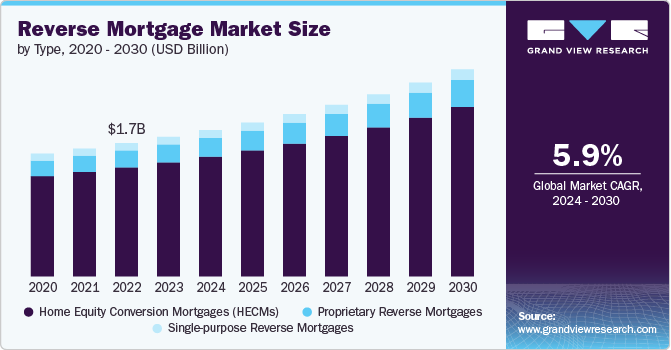

The global reverse mortgage market size was estimated USD 1.83 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. A reverse mortgage is a financial product designed for seniors, typically aged 62 and older that allows them to convert part of their home equity into loan proceeds while retaining ownership of their home. The aging population retirement funding needs, and increasing home values and equity are major factors behind the growth of the market. In addition, increased awareness and education about reverse mortgages are contributing to their popularity, as more retirees become informed about how these products can enhance their financial stability.

The population across the globe is rapidly aging, with the number of people aged 65 and above expected to double by 2050. This demographic shift is a major driver of reverse mortgage demand, as retirees seek to supplement fixed incomes and cover rising healthcare costs. As home equity remains the largest asset for many seniors, reverse mortgages provide a way to access this wealth without selling or moving out of their homes. The need for alternative retirement funding solutions will continue to fuel growth in this market.

Reverse mortgage providers are continuously innovating and introducing new product features to meet the evolving needs of borrowers. The introduction of more flexible loan options, such as adjustable-rate mortgages and jumbo reverse mortgages for high-value homes, has expanded the potential customer base. Streamlined application processes and enhanced consumer education efforts have also helped to reduce the stigma associated with reverse mortgages and make them more appealing to a broader range of seniors. In addition, innovations such as virtual consultations, automated underwriting, and digital document management are reducing processing times and increasing accessibility. These technological developments are further attracting tech-savvy seniors and making the process more transparent and efficient, thereby driving the market’s growth.

Governments and regulators in many countries are taking initiatives to create a more favorable environment for reverse mortgages. In the U.S., for instance, the Federal Housing Administration (FHA) has made several changes to the Home Equity Conversion Mortgage (HECM) program to improve consumer protections and reduce risk for lenders. These measures include mandatory financial assessments for borrowers, limits on upfront fees, and restrictions on the amount of equity that can be withdrawn initially. Similar regulatory reforms in other markets are expected to boost consumer confidence and lender participation in the reverse mortgage industry, which in turn, expected to boost market growth.

The high costs and fees associated with these reverse mortgage products could hamper the growth of the market. Reverse mortgages often come with substantial upfront costs, including origination fees, closing costs, and ongoing insurance premiums, which can deter potential borrowers. In addition, the complexity of reverse mortgage agreements and the potential impact on heirs' inheritance can create concern among seniors considering these options. Furthermore, seniors exploring reverse mortgages are at risk of exploitation by unscrupulous individuals, such as those promoting dubious investments, family members facing financial difficulties, or deceitful caretakers. Thus, the risk of exploitation could further hinder the market’s growth.

Type Insights

The Home Equity Conversion Mortgages (HECMs) segment dominated the market in 2023 and accounted for an 81.8% share of global revenue. HECMs offer a reliable and secure option for seniors, with features such as flexible disbursement methods and non-recourse terms, which limit the borrower's repayment liability to the value of the home. The growing acceptance of HECMs is driven by increased awareness among retirees about their benefits, including the ability to convert home equity into cash without requiring monthly mortgage payments. In addition, regulatory improvements and enhanced consumer education initiatives have made HECMs more accessible and appealing, contributing to their rising popularity among seniors looking for a stable financial solution during retirement.

The proprietary reverse mortgages segment is projected to witness significant growth from 2024 to 2030. Proprietary reverse mortgages are gaining traction as an alternative to HECMs, particularly for homeowners with higher-value properties. The increasing home values in many markets have made proprietary reverse mortgages more appealing, as they enable seniors to access a greater portion of their home equity. This segment is appealing to affluent seniors who require more funds for healthcare, living expenses, or other financial needs. As awareness of proprietary reverse mortgages grows and lenders continue to innovate with product offerings, this segment is expected to experience significant growth, catering to a demographic that seeks flexibility and higher borrowing limits.

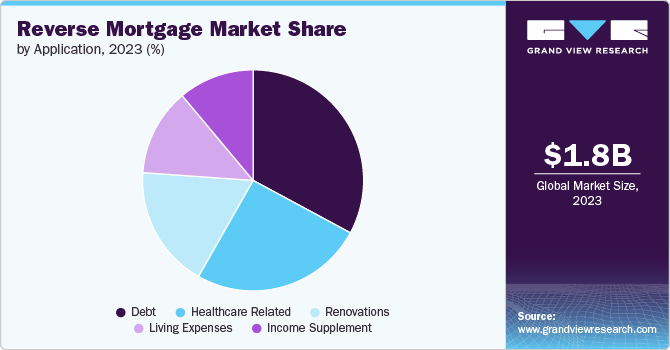

Application Insights

The debt segment dominated the market in 2023. Many seniors reach retirement age and still carry significant debt, such as outstanding mortgages, credit card balances, or loans. As their income declines in retirement, servicing this debt becomes increasingly challenging. Reverse mortgages provide a solution by allowing seniors to access their home equity to pay off existing debts. This can significantly reduce their monthly expenses and financial stress in retirement. As the population ages and more retirees carry debt into their later years, the demand for reverse mortgages as a debt repayment tool is expected to rise. Lenders are also increasingly marketing reverse mortgages as a way for seniors to consolidate debt and improve their financial flexibility in retirement.

The healthcare related segment is projected to witness significant growth from 2024 to 2030. The segment growth is driven by the rising costs of medical and long-term care. As healthcare expenses continue to escalate, many seniors are turning to reverse mortgages to cover these essential costs. The flexibility of reverse mortgages allows retirees to access a lump sum or line of credit to address medical bills, in-home care, or other health-related expenses that are not fully covered by insurance or government programs. This trend is fueled by an aging population with increasing healthcare needs and a growing awareness of how reverse mortgages can provide financial support.

Regional Insights

North America reverse mortgage marketheld the market share of 35.2% in 2023. The market is expected to continue growing, driven by demographic trends and the increasing need for retirement funding solutions. The region is experiencing a demographic shift with a growing proportion of the population entering retirement age. This has increased the demand for financial products that can support a longer retirement period, thereby fueling the growth of the reverse mortgage market in the region.

The U.S. Reverse Mortgage Market Trends

Reverse mortgage market in the U.S. is primarily driven by the Home Equity Conversion Mortgage (HECM) program insured by the Federal Housing Administration (FHA), has been growing steadily, fueled by the aging population, rising home values, and the increasing need for retirement income solutions.

Europe Reverse Mortgage Market Trends

Reverse mortgage market in Europe is still in its early stages compared to more developed markets. In countries such as the UK, Spain, and Italy, reverse mortgages, often referred to as equity release products, have gained some traction, particularly among older homeowners looking to supplement their retirement income. As Europe's population continues to age and pension systems face pressure, there is potential for growth in the reverse mortgage market.

Asia Pacific Reverse Mortgage Market Trends

The Asia Pacific reverse mortgage market is witnessing the highest CAGR, driven by aging populations, rising property values, and the increasing need for retirement income solutions.In countries such as Japan, South Korea, and Australia, reverse mortgages have gained attention as a viable option for seniors to unlock the value of their homes without selling them. Governments and financial institutions are beginning to promote these products to address retirees' financial needs, especially in societies where traditional family support structures are changing. With growing awareness and the development of more tailored products, the reverse mortgage market in the Asia-Pacific region is poised for expansion as it addresses the financial challenges of an aging demographic.

Key Reverse Mortgage Company Insights

The prominent market players are focusing on numerous strategic initiatives, including new product development, geographic expansion, and partnerships & collaborations to gain a competitive advantage over their rivals.

Key Reverse Mortgage Companies:

The following are the leading companies in the reverse mortgage market. These companies collectively hold the largest market share and dictate industry trends.

- American Advisors Group

- Finance of America Reverse,

- Reverse Mortgage Funding

- Liberty Home Equity Solutions

- One Reverse Mortgage

- Mutual of Omaha Mortgage

- HighTechLending

- Fairway Independent Mortgage Corporation

- Open Mortgage

- Longbridge Financial

Recent Developments

-

In April 2024, Portfolio+ Inc., a Canadian provider of financial technologies, expanded its lending solutions portfolio by introducing a new reverse mortgage product. This innovative offering empowers lenders to provide their clients aged 55 and older with a valuable retirement planning tool, allowing them to access tax-free equity in their homes. This strategic move strengthens Portfolio+'s position as a comprehensive provider of financial services systems and technologies.

Reverse Mortgage Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.91 billion

Revenue forecast in 2030

USD 2.71 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

American Advisors Group; Finance of America Reverse; Reverse Mortgage Funding; Liberty Home Equity Solutions; One Reverse Mortgage; Mutual of Omaha Mortgage; HighTechLending; Fairway Independent Mortgage Corporation; Open Mortgage; Longbridge Financial.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Reverse Mortgage Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global reverse mortgage market based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Equity Conversion Mortgages (HECMs)

-

Single-purpose Reverse Mortgages

-

Proprietary Reverse Mortgages

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Debt

-

Healthcare Related

-

Renovations

-

Income Supplement

-

Living Expenses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global reverse mortgage market size was estimated at USD 1.83 billion in 2023 and is expected to reach USD 1.91 billion in 2024.

b. The global reverse mortgage market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 2.71 billion by 2030.

b. North America dominated the reverse mortgage market with a share of 35.2% in 2023. North American reverse mortgage market is expected to continue growing, driven by demographic trends and the increasing need for retirement funding solutions.

b. Some key players operating in the reverse mortgage market include American Advisors Group, Finance of America Reverse, Reverse Mortgage Funding, Liberty Home Equity Solutions, One Reverse Mortgage, Mutual of Omaha Mortgage, HighTechLending, Fairway Independent Mortgage Corporation, Open Mortgage, and Longbridge Financial.

b. Key factors driving market growth include the aging population, retirement funding needs, and increasing home values and equity.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."