- Home

- »

- Healthcare IT

- »

-

Revenue Cycle Management Market, Industry Report, 2033GVR Report cover

![Revenue Cycle Management Market Size, Share & Trends Report]()

Revenue Cycle Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Software, Services), By Type (Integrated, Standalone), By Delivery Mode, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-433-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Revenue Cycle Management Market Summary

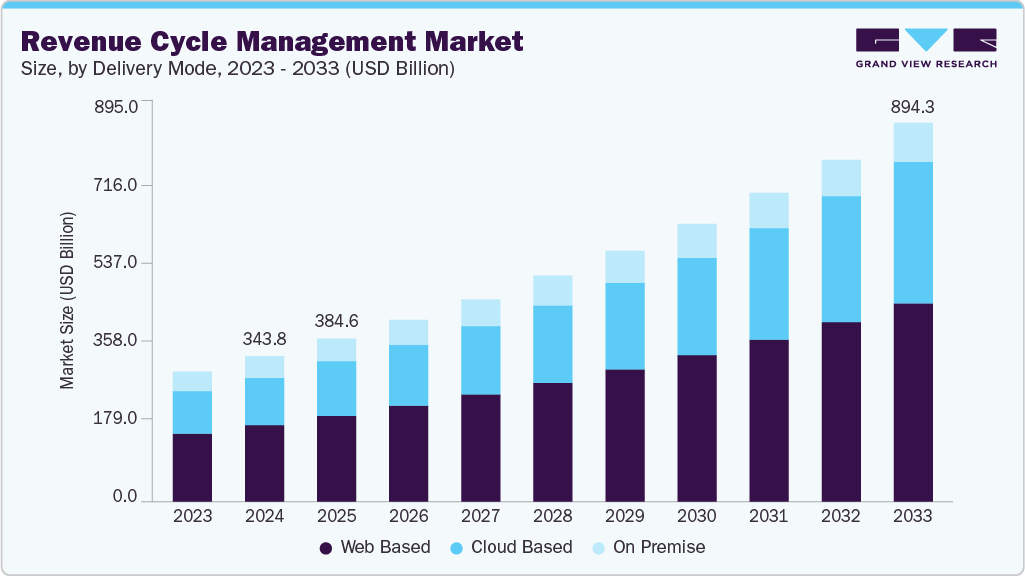

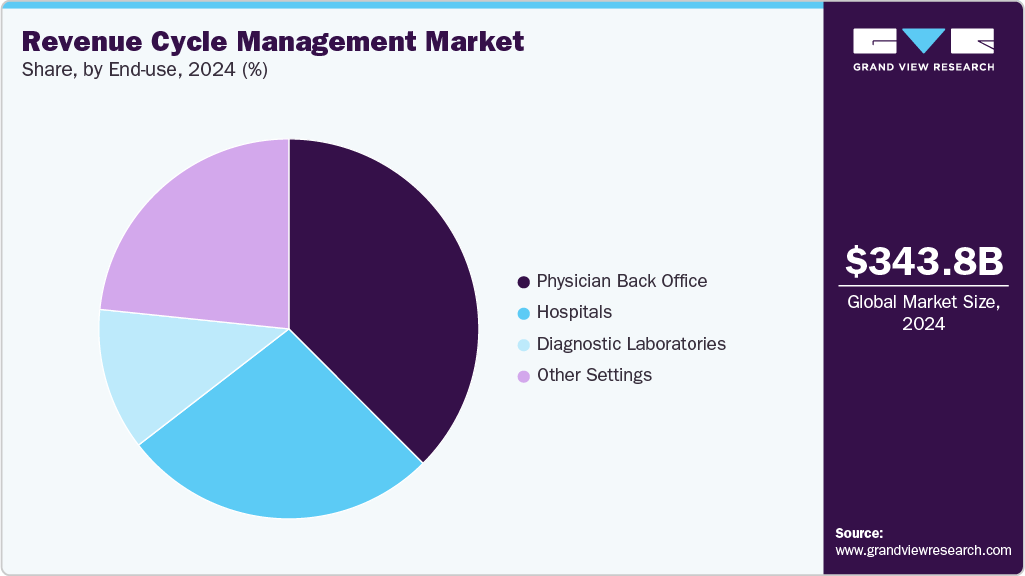

The global revenue cycle management market size was estimated at USD 343.78 billion in 2024 and is projected to reach USD 894.25 billion by 2033, growing at a CAGR of 11.12% from 2025 to 2033. The healthcare industry is rapidly moving towards digitalization, creating demand for advanced revenue cycle management (RCM) solutions.

Key Market Trends & Insights

- North America dominated the revenue cycle management market with the largest share of 54.56% in 2024.

- The U.S. dominated theNorth America revenue cycle management industry in 2024.

- Based on Product, The services segment dominated the revenue cycle management with the largest share of 67.39% in 2024.

- Based on Delivery Mode, The web-based delivery mode segment dominated the revenue cycle management industry with the largest share of 52.79% in 2024.

- Based on Type, The integrated segment dominated the revenue cycle management market with the largest share of 70.75% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 343.78 Billion

- 2033 Projected Market Size: USD 894.25 Billion

- CAGR (2025-2033): 11.12%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing number of data silos and unorganized workflows in healthcare settings is leading to market development and growth. RCM involves third-party payers, payment models, guidelines, and codes. The success of a healthcare practice depends on obtaining the right assets. As payment for medical services becomes more complex, it becomes increasingly valuable to have an efficient RCM solution.The revenue cycle management industry growth in healthcare organizations is expected to be driven by the increasing demand for workflow optimization with the adoption of synchronized management software systems. The healthcare industry is constantly evolving with regular technological advancements, and as a result, many healthcare payers and providers are rapidly adopting these advancements. For instance, in November 2023, the Healthcare Financial Management Association (HFMA) partnered with FinThrive, Inc. to launch a five-stage RCM technology adoption model (RCMTAM). This model helps health systems assess current RCM technology maturity and build best-practice plans using industry benchmarks.

Moreover, innovations and advancements in the RCM solutions have played a key role in improving provider-patient relations and include the implementation of ICD-10 for classifying, coding, and reporting data on disease diagnosis and treatment procedures, which directly helps healthcare systems enhance care delivery. Healthcare facilities are outsourcing RCM software solutions owing to the multiple advantages associated such as easy availability of trained and skilled professionals, enhanced efficiency, compliance, and adherence to required regulations, and cost-effectiveness.

A survey by Salucro Healthcare Solutions in January 2024, involving 176 healthcare professionals, found that 50% of respondents are generally satisfied with their organization's revenue cycle management, with 34% considering it somewhat efficient and 16% very efficient. However, hands-on revenue cycle leaders are less likely to view the system as efficient compared to executive leaders. Timely patient collections, staff hiring/training, managing denials, security/compliance, and data analytics/reporting are key challenges.

Moreover, increasing initiatives and investments supporting healthcare IT, mHealth, and digital health are receiving significant support from venture capitalists, private equity firms, and healthcare organizations. The global landscape of health-tech investment experienced a substantial surge in 2021, surpassing USD 44 billion, marking a twofold increase compared to the previous year. This influx of capital highlights the increasing significance of technological innovation in healthcare. Noteworthy is the emergence of major tech-enabled platform companies as key players, offering the potential to improve hospital and health system efficiencies, swiftly expand operations, and modernize existing systems and delivery models. Furthermore, these platforms are poised to play a crucial role in addressing concerns regarding health equity through a comprehensive and inclusive approach to healthcare delivery.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including industry competition, degree of innovation, level of M&A activities, impact of regulations, and regional expansion. For instance, the market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is high, and the level of M&A activities is medium. The impact of regulations on the revenue cycle management industry and the regional expansion of the market is medium.

The global revenue cycle management market is characterized by constant innovation, with a strong focus on convenient telehealth technologies. These innovations aim to streamline the implementation process for both patients and healthcare providers. The prevalent use of mobiles and tablets allows suitable access to improve and accelerate reimbursements, arrest revenue leakage, prevent denials, and improve the patient experience. Furthermore, various prominent players are launching advanced solutions and services to sustain a competitive advantage. For instance, in September 2022, AGS Health introduced a connected solution that blends automation and artificial intelligence (AI) called AGS AI Platform, which aims to deliver seamless integration and robust process automation to ease labor shortages and allow flexible, scalable growth.

Several companies in the revenue cycle management industry are currently involved in merger and acquisition activities. These companies want to expand their reach and explore new territories through M&A deals. For instance, in January 2024, Veradigm LLC acquired Koha Health, a full-service revenue cycle management (RCM) service provider. This acquisition aims to strengthen Veradigm and further add to its depth of offerings and expertise to serve the needs of the market better.

The regulations governing the use of healthcare IT vary across different countries and regions. However, having a well-structured regulatory framework can positively impact market accessibility, growth, and compliance. For instance, the regulatory landscape for the MEA market is complex and diverse. This is due to differences in healthcare systems, regulatory priorities, and technological adoption across different countries. Saudi Arabia, the UAE, Qatar, and other key MEA countries have established regulatory frameworks for telemedicine, digital health, & data protection.

The regional expansion of the revenue cycle management industry is relatively low due to changes in regulatory frameworks, specific demands of healthcare organizations, and varying reimbursement policies across different regions. However, with the increasing adoption of digital healthcare solutions and the growing need for efficient revenue cycle management, the market is expected to witness significant growth in the coming years.

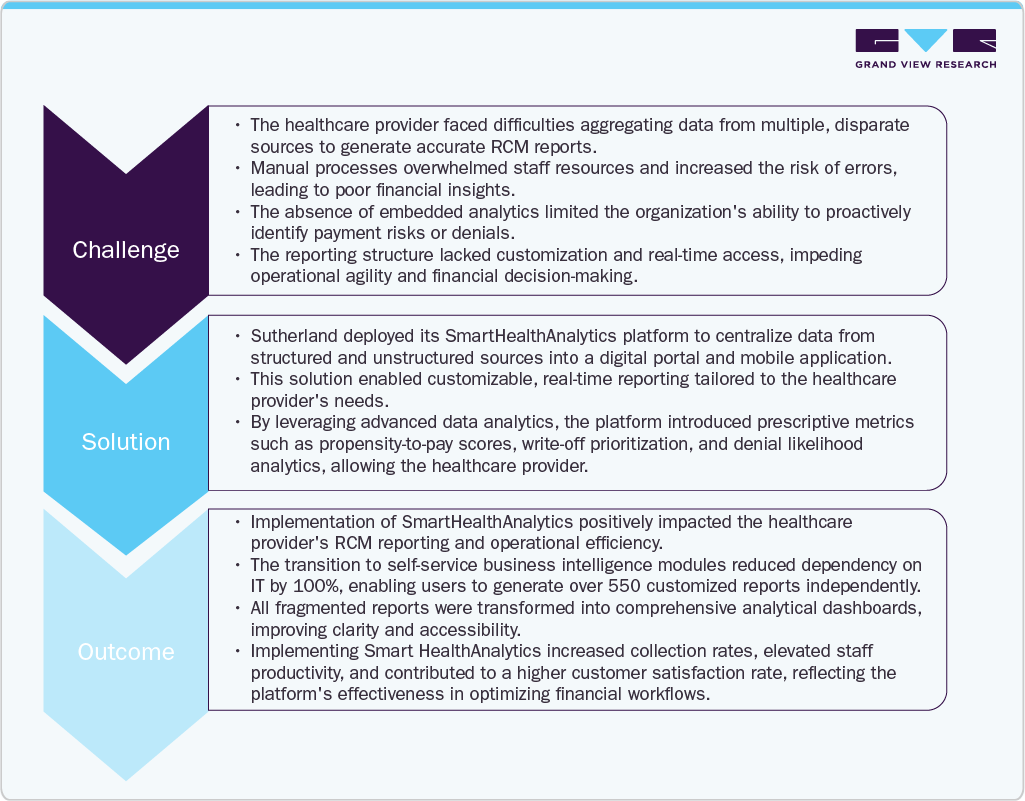

Case Study Insights: Enhancing Revenue Cycle Management with SmartHealthAnalytics for a Leading Healthcare Provider

A prominent healthcare provider serving over 670,000 patients annually across more than 20 health centers and hospitals encountered significant challenges managing its Revenue Cycle Management (RCM) processes.

The complex task of consolidating data from various sources relied heavily on manual efforts, which proved resource-intensive, error-prone, and lacked advanced analytic capabilities. The provider sought a technology-driven solution to address these inefficiencies to streamline reporting, enhance accuracy, and improve overall financial performance.

Product Insights

The services segment dominated the revenue cycle management with the largest share of 67.39% in 2024, owing to the growing trend of outsourcing these services to healthcare facilities. In addition, this segment is expected to grow at the fastest CAGR from 2025 to 2033. There has been an increase in outsourcing of services as many healthcare services mandatorily require resources and skillsets for the implementation of RCM solutions. Either the entire process is outsourced, or a part of it in the form of a long-term contract. RCM services make sure healthcare procedures achieve an optimum return on their investment.

An increasing amount of data generated from multiple healthcare functions is driving the need for process digitalization and streamlining workflows for enhanced efficiencies and improved patient care. The growing amount of unorganized data requires consolidation, supporting the growing need for RCM software solutions. Multiple data silos reduce the ability to accurately analyze data and increase the risk of data loss.

Moreover, this segment is anticipated to grow at the fastest CAGR over the forecast period. For instance, in March 2025, Titan Health launched Revenue Cycle Management as a Service (RCMAAS), combining AI and industry-leading RCM practices to accelerate recovery times and improve financial outcomes.

"In our 20+ year history, today's launch of RCMaaS represents one of our biggest steps forward. By combining our deep industry expertise with SaaS and AI technologies, we’re setting new standards for time to recovery and recovery rates-the true benchmarks of RCM performance.”

- Todd Hisey, CEO of Titan Health.

Delivery Mode Insights

The web-based delivery mode segment dominated the revenue cycle management industry with the largest share of 52.79% in 2024, owing to the growing implementation of web-based solutions. Web-based solutions are becoming increasingly popular due to their affordability and ease of deployment. Unlike on-premises solutions, web-based solutions do not require additional hardware or storage and can be installed off-site and managed by a third party. This has led to a rise in the adoption of web-based solutions over on-premises solutions.

The cloud-deployed segment is expected to experience the fastest growth during the forecast period, due to its higher flexibility and cost-effectiveness for end users. Cloud-based solutions have made medical data-sharing easy and secure, automating backend processes and enabling the creation and protection of telehealth apps. Additionally, cloud-deployed solutions help healthcare institutions manage patient portals, electronic medical records, big data analytics, and mobile applications, avoiding additional costs for maintaining servers. Cloud-based products have been developed to improve resource procurement, enhance infrastructure dependability, and strengthen operations.

Type Insights

The integrated segment dominated the revenue cycle management market with the largest share of 70.75% in 2024, owing to the growing preference for volume-based payments over value-based payments. Integrated solutions offer a streamlined and synchronized format for various financial activities via a single platform, resulting in a standardized data collection and analysis process. Integrated revenue cycle management provides a number of benefits, from growing collections to planning alternative payment and reimbursement methodologies.

Successful integration schemes allow healthcare workers to improve productivity, decrease costs, increase collections, and increase net operating margins. The integrated type of services is anticipated to register the fastest growth owing to the growing demand for enhancing healthcare systems’ efficiency, increasing healthcare facilities, and growing healthcare costs. Moreover, the growing need to minimize or eliminate human errors and accelerate administrative functions is anticipated to boost the growth of an integrated type of service.

End Use Insights

The hospitals segment accounted for the largest share of 37.52% in 2024, owing to the rising number of protocols and guidelines introduced by regulatory bodies with respect to patient safety. The growing demand for streamlining hospitals’ workflows and enhancing productivity and efficiency is driving the adoption of RCM solutions in hospitals. For instance, in March 2025, Titan Health launched Revenue Cycle Management as a Service (RCMaaS) for healthcare providers, providing them with tailored revenue cycle management solutions. By integrating advanced technology and expert support, it aims to optimize revenue recovery, reduce claim denials, and improve overall financial performance.

Hospitals commonly use an integrated type of RCM system, bringing patients and providers collectively into a single platform. Through this platform, providers, payers, and patients are updated on medications billed to a patient and enabling the maintenance of a complete database of patient purchase history.

The physician back-office segment is anticipated to register the fastest CAGR in the coming years. The rising focus on increasing the number of physicians and medical facilities across the region is expected to drive the RCM market. Private physician offices undergo numerous economic challenges, such as physician reimbursement, increasing operating expenses, and patient content. Private physician offices are outsourcing RCM solutions and services to align with medical and financial needs.

Regional Insights

North America dominated the revenue cycle management market with the largest share of 54.56% in 2024. This is due to the growing presence of physicians’ offices in the U.S. Regulatory reforms, such as amendments in ICD-10, have led to a digital transformation in healthcare systems, and there has been a significant surge in demand for healthcare IT solutions such as RCM systems to enhance efficiency and improve care delivery. Moreover, the presence of large, renowned hospitals and well-established facilities, the increasing need to minimize healthcare costs, and favorable regulations are posing lucrative opportunities for the market in the region.

U.S. Revenue Cycle Management Market Trends

The U.S. dominated the North America revenue cycle management industry in 2024. This is due to the growing trend of outsourcing healthcare RCM solutions, driven by the benefits of value addition, business prospects, and finances. The healthcare industry in the U.S. is rapidly growing and evolving, owing to the increasing expenditure, rising number of well-established facilities, advancing healthcare IT infrastructure, and emphasis on the patient-provider relationship. For instance, in May 2025, Infinx acquired i3 Verticals, a U.S. healthcare RCM firm, for USD 96 million, strengthening its presence in academic medical centers.

Europe Revenue Cycle Management Market Trends

The Europe revenue cycle management industry is expected to witness significant growth over the forecast period due to the supportive government policies. For instance, the Digital Single Market Strategy initiated by the European Commission facilitates consumer & business access to online services and goods all over Europe, creating the right conditions for digital networks and services to flourish and maximizing the growth potential of the European economy.

The Germany revenue cycle management market is one of the largest healthcare markets in Europe. The high number of hospitals in Germany is a prime driving factor for the growth of RCM market in the country. In addition, the healthcare delivery system in Germany is streamlined and efficient. As per the Commonwealth Fund, around 85% of the German population is covered by Social Health Insurance (SHI) and 10% by supplementary private health insurance. The growing demand for digitalization and increasing support by government and private initiatives are likely to drive market growth.

Asia Pacific Revenue Cycle Management Market Trends

The Asia Pacific revenue cycle management industry is anticipated to register the fastest CAGR during the forecast period, owing to growing favorable government initiatives and support, growing demand to improve care delivery quality, increasing digital literacy, growing adoption of healthcare IT solutions, advancing healthcare infrastructure, rising healthcare IT spending, and rising unmet healthcare needs of emerging economies. Furthermore, the Asia Pacific market offers low manufacturing costs and the availability of a cost-effective workforce, which increases the ease of doing business.

China revenue cycle management market is expected to witness significant growth owing to rising patient volume and the consequent increase in health insurance claims. Moreover, the growing adoption of cloud-deployed RCM is due to its flexibility and cost-effectiveness. Cloud-based technologies facilitate secure data sharing, enhance telehealth applications, automate backend processes, and reduce server maintenance costs, thereby driving market growth.

Middle East and Africa Revenue Cycle Management Market Trends

The revenue cycle management industry in the Middle East and Africa (MEA) is expected to see significant growth in the coming years. The growth is anticipated to the well-developed healthcare infrastructure in the region plays a significant role in driving the market growth. Moreover, the supportive regulatory frameworks and regulations in the MEA region contribute to the growth by ensuring compliance and facilitating smooth operations.

The Saudi Arabia revenue cycle management market is undergoing substantial growth. The introduction of mandatory health insurance in the public sector, as part of Vision 2030 and the National Transformation Program, is driving the need for new capabilities in revenue generation under the new reimbursement system. This transformation of the healthcare sector is expected to significantly impact the reimbursement system of health services, leading to the development of new capabilities for revenue generation.

Latin America AI in Revenue Cycle Management Market Trends

The Latin America revenue cycle management industry is expected to grow significantly over the forecast years. Countries such as Brazil and Argentina are investing in digital health infrastructure, promoting the adoption of RCM tools to enhance operational efficiency and reduce administrative burdens. Moreover, supportive government initiatives and increasing adoption of integrated healthcare systems contribute to market growth further.

Key Revenue Cycle Management Company Insights

The key participants in the market are divided into various strategic initiatives to expand their business footprint and gain a competitive edge. Some emerging companies include MD Clarity, Guidehouse, Waystar, Ensemble Health Partners, and FinThrive.

Key Revenue Cycle Management Companies:

The following are the leading companies in the revenue cycle management market. These companies collectively hold the largest market share and dictate industry trends.

- The SSI Group, Inc.

- Veradigm LLC (AllScripts Healthcare, LLC)

- athenahealth, Inc.

- Experian Information Solutions, Inc.

- R1 RCM Inc.

- Epic Systems Corporation

- McKesson Corporation

- NXGN Management, LLC

- CareCloud Corporation

- Quest Diagnostics, Inc.

- Oracle (Cerner Corporation)

Recent Developments

-

In July 2025, Omega Healthcare expanded its collaboration with Microsoft to launch over 20 generative and agentic AI solutions to transform revenue cycle management (RCM) for healthcare providers. These AI-powered solutions, integrated through Microsoft Azure AI Foundry and Omega’s proprietary Omega Digital Platform, automate complex workflows such as medical coding, denial management, appeal filing, correspondence processing, and call center support.

-

In June 2025, Harris & Harris launched ACTION RCM, a dedicated healthcare revenue cycle management (RCM) subsidiary offering integrated RCM services, including patient engagement, claims, denials management, and collections.

-

In May 2025, New Mountain Capital launched Smarter Technologies, a unified AI-enabled revenue cycle management (RCM) platform, combining its portfolio companies Access Healthcare, SmarterDx, and Thoughtful.ai. The platform automates hospital administrative workflows and optimizes financial performance, serving 200+ clients, including 60+ hospitals.

-

In March 2025, Knack RCM acquired PPM Partners, leveraging its anesthesia revenue cycle management portfolio.

"By combining PPM's specialized expertise with our existing anesthesia services footprint, we are further strengthening our ability to optimize revenue cycle performance for anesthesia practices while maintaining the exceptional service and client-focused approach that define both our organizations."

-Arvind Ramakrishnan, CEO of Knack RCM

-

In February 2025, Cibolo Health, a healthcare services company, selected TruBridge, Inc. as a preferred partner for revenue cycle management technology and services

-

In February 2025, Athelas partnered with Resilient Healthcare to provide RCM services, ambient AI support, and EMR integration.

-

In December 2024, Care.fi launched RevNow in India. RevNow is an AI-powered RCM platform designed for hospitals in managing insurance claims.

-

In July 2024, Thoughtful AI, a provider of AI-powered RCM solutions, received USD 20 million to launch AI Agents for healthcare RCM.

-

In January 2024, R1 RCM Inc. acquired Acclara from Providence, a health systems provider. This acquisition aims to strengthen R1 RCM Inc.'s revenue cycle management market and enable the company to implement state-of-the-art technology solutions and enhance execution, which enables to improve outcomes for both patients and customers.

Revenue Cycle Management Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 384.63 billion

The revenue forecast in 2033

USD 894.25 billion

Growth rate

CAGR of 11.12% from 2025 to 2033

Base year for estimation

2024

Actual estimates

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion & CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, type, delivery mode, end use, and region

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

The SSI Group, Inc.; Veradigm LLC (AllScripts Healthcare, LLC); athenahealth, Inc.; Experian Information Solutions, Inc.; R1 RCM Inc.; Epic Systems Corporation; McKesson Corporation; NXGN Management, LLC; CareCloud Corporation;Quest Diagnostics, Inc.; Oracle (Cerner Corporation)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Revenue Cycle Management Market Report Segmentation

This report forecasts revenue growth at the global, regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the revenue cycle management market report based on product, type, delivery mode, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Type (Revenue, USD Million, 2021 - 2033)

-

Integrated

-

Standalone

-

-

Delivery Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Web-based

-

Cloud-based

-

On-premise

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Physician Back Offices

-

Hospitals

-

Diagnostic Laboratories

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global revenue cycle management market size was estimated at USD 343.78 billion in 2024 and is expected to reach USD 384.63 billion in 2025.

b. The global revenue cycle management market is expected to grow at a compound annual growth rate of 11.12% from 2025 to 2033 to reach USD 894.25 billion by 2033.

b. Key factors that are driving the RCM market growth include rising regulatory mandates for the adoption of Healthcare Information Technology (HIT) systems in healthcare settings and the failure of the traditional billing systems to provide insights about ongoing billing operations. In addition, the increasing number of data silos and unorganized workflows in healthcare settings is leading to market development and growth.

b. The services segment dominated the revenue cycle management market with a share of over 67% in 2024. There has been an increase in outsourcing of services as many healthcare services mandatorily require resources and skillsets for implementation of revenue cycle management solutions.

b. Some key players operating in the revenue cycle management market include The SSI Group, Inc.; Veradigm LLC (AllScripts Healthcare, LLC); Experian Information Solutions, Inc.; R1 RCM Inc.; McKesson Corporation; athenahealth, Inc; Epic Systems Corporation; NXGN Management, LLC; CareCloud Corporation; Quest Diagnostics, Inc. and Oracle (Cerner Corporation)

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.