Reusable Water Bottle Market Size, Share & Trends Analysis Report By Material (Plastic, Stainless Steel, Glass), By Distribution Channel (Supermarkets & Hypermarkets, Online, Specialty Stores), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-273-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Reusable Water Bottle Market Size & Trends

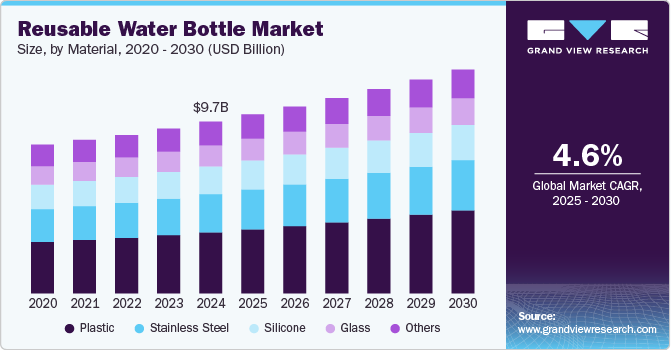

The global reusable water bottle market size was estimated at USD 9.67 billion in 2024 and is expected to grow at a CAGR of 4.6% from 2025 to 2030. Increasing environmental awareness has led consumers to shift away from single-use plastics in favor of more sustainable options, such as reusable bottles. The growing focus on reducing plastic waste, coupled with rising health consciousness and the demand for eco-friendly products, has fueled this trend. In addition, heightened demand for kitchenware, including reusable bottles, surged during the COVID-19 pandemic as people spent more time at home and invested in long-term, sustainable household items.

According to a blog post by Klarna, millennials and Generation X used a large portion of their income on home and garden products during the COVID-19 lockdown. These items included drinkware, kitchenware, as well as other household products.

Reusable water bottles are becoming more and more popular across target markets worldwide, especially in homes, offices, and schools. These reusable bottles lessen the amount of plastic that ends up in landfills, which is what mostly contaminates groundwater. Also, the usage of reusable water bottles is being encouraged by rising awareness of the negative environmental effects of non-disposable and single-use plastic bottles as well as a major rise in the amount of plastic garbage in seas and landfills.

Also, governments around the world are taking steps to discourage the use of single-use plastic water bottles and encourage the use of reusable bottles made of glass, metal, and other environmentally benign and secure materials. For instance, the prohibition on single-use plastic water bottles in Australia, Canada, the United States, and some Indian states have created new growth opportunities for reusable bottles.

Also, a high propensity for picnics and outdoor recreation in city parks, local green spaces, and public trails suggests promising growth potential for reusable bottles of all kinds. For instance, the 2021 Maru Voice Canada poll found that 52% of Canadians are more likely to participate in outdoor leisure activities more frequently.

The trend of sustainability has had a significant impact on the reusable water bottle industry. Consumers are increasingly aware of the environmental impact of single-use plastic bottles and are opting for sustainable alternatives. This has led to a surge in demand for reusable water bottles that are made from recycled materials and are recyclable. To meet this demand, market players have been responding by introducing sustainable product lines that use recycled materials, reducing their carbon footprint, and promoting environmental-friendly manufacturing processes.

Material Insights

Plastic reusable water bottle sales accounted for a revenue share of over 35% in 2024. This is attributed to the low cost of manufacturing by producers. The greater life expectancy of plastic reusable water bottles has increased consumers’ interest in the consumption of reusable water bottles, which is supporting the growth of the segment. Over conventional plastic bottles, reusable bottles have a benefit. Moreover, over a million plastic bottles are bought in the United States every minute, according to the blog written by Earth Day organizers in 2023.

Stainless steel water bottle sales are projected to grow at a CAGR of 4.8% from 2025 to 2030. Stainless steel coated with copper is widely preferred among consumers owing to the numerous health benefits associated with copper. Stainless steel and copper-lined vacuum wood bottles are some of the latest trends in the product category.

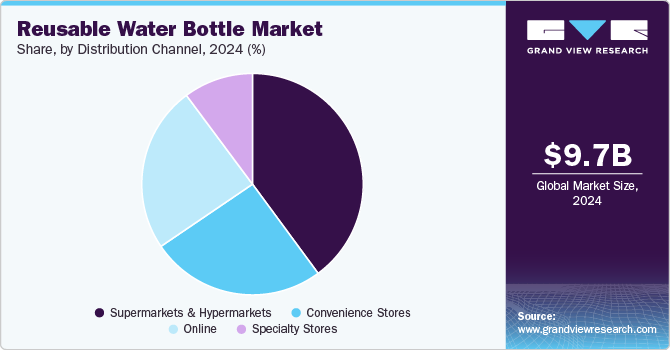

Distribution Channel Insights

Supermarkets/hypermarket-driven sales accounted for a revenue share of over 39% in 2024, driven by their widespread accessibility, extensive product variety, and competitive pricing. These retail formats offer consumers the convenience of purchasing reusable water bottles alongside everyday essentials, appealing to a broad demographic. The ability to showcase products physically allows buyers to assess quality, design, and functionality firsthand, further boosting sales. In addition, supermarkets and hypermarkets frequently run promotional campaigns and discounts, making them a preferred choice for budget-conscious consumers, thereby solidifying their dominant share in the market.

Online sales are projected to grow at a CAGR of 5.2% from 2025 to 2030. Increased e-commerce and smart device adoption, together with simple payment methods and promotional offers, are driving this market's growth. Several producers use this route of distribution due to the simplicity of selling reusable bottles through custom logo printing. Manufacturers are offering their products through online channels due to consumers' growing demand for online purchasing in order to access a larger consumer base.

Regional Insights

The North America reusable water bottle market accounted for a share of 27.58% of the global market revenue in 2024. Urbanization and changes in lifestyle are the factors that are contributing to market growth across the world. People are moving toward a healthy lifestyle and are thinking of a sustainable environment, thus preferring reusable water bottles against ordinary disposable ones. Moreover, initiatives taken across the world to save marine life from the harmful plastic that is disposed of in the oceans are driving the market.

U.S. Reusable Water Bottle Market Trends

The U.S. reusable water bottle market is expected to grow at a CAGR of 4.5% from 2025 to 2030. The U.S. is a major shareholder in the reusable water bottle market in North America. Growing environmental concerns among consumers regarding the usage of single-use plastic bottles is driving the demand for reusable water bottles in the country. The U.S. being the dominant market in North America, is characterized by design innovations in the marketspace. The presence of well-established brands as well as co-branding efforts by companies has also been driving the adoption of reusable bottles as an alternative to single-use PET bottles.

Europe Reusable Water Bottle Market Trends

Europe reusable water bottle market accounted for a share of over 20% of the global market revenue in 2024. The European Union’s strict regulations on reducing the usage of single-use plastics and its encouragement for the usage of reusable materials for drinking and dining as a sustainable means to reduce plastic waste has been driving the demand for reusable water bottles. There is also a growing interest in engaging in athleisure and outdoor activities, particularly among the millennial and Gen Z population.

Asia Pacific Reusable Water Bottle Market Trends

The Asia Pacific reusable water bottle market is expected to grow at a CAGR of 5.1% from 2025 to 2030. In Asian countries like India, though most of the PET bottles are or claim to be 100% recyclable, inadequate recycling facilities pose a threat to the environment. It is estimated that only 9% of the plastic produced has been recycled till now, leaving the vast majority to be accumulated in landfills or oceans. Realizing the dangers of plastic water bottles, the government is actively pushing bottle makers to use eco-friendly and sustainable materials, a trend that is likely to drive consumers to actively use reusable water bottles.

Key Reusable Water Bottle Company Insights

The industry is highly fragmented and is characterized by the presence of a few established players, including Tupperware Brands Corporation, SIGG Switzerland AG, and CamelBak Products, LLC, in addition to several small and medium companies such as S’well, Hydro Flask, Nalgene, Klean Kanteen, Contigo, Aquasana Inc., and Hydaway. A majority of the new companies in the market are focusing on establishing a portfolio of stainless-steel bottles as they are naturally BPA-free and an excellent alternative to single-use plastics, to remain compliant with the stringent regulatory frameworks in the industry.

Key Reusable Water Bottle Companies:

The following are the leading companies in the reusable water bottle market. These companies collectively hold the largest market share and dictate industry trends.

- Tupperware Brands Corporation

- SIGG Switzerland AG, GmbH

- CamelBak Products, LLC

- Klean Kanteen

- Contigo

- Aquasana Inc.

- Hydaway

- Nalgene

- S’well

Recent Developments

-

In April 2023. Nalgene revealed that it has switched its reusable bottle production process to Eastman's Tritan Renew, a certified 50% recycled material using the mass balance technique of determination. The conversion process from copolyester to Tritan Renew began in 2020 and was completed by January 2023. The company repurposed over 2.35 million pounds of plastic waste during the conversion process.

-

In February 2023, SIGG Switzerland AG took part in the ABN AMRO Open tennis tournament to provide all players with reusable drinking bottles which took place at Rotterdam Ahoy in the Dutch city of Rotterdam. The bottles provided were made out of Tritan Renew, a super high impact- and scratch-resistant material. The Tritan used for these bottles is certified by the ISCC - International Sustainability and Carbon Certification

-

In December 2022, Klean Kanteen and other outdoor drinkware companies like MiiR, Stanley, and YETI joined forces to create the Drinkware CoLab. They aim to decrease carbon emissions in their supply chain and support the Outdoor Industry Association’s (OIA) goal to become the first climate-positive industry by 2030. The four brands are part of OIA’s Climate Action Corps, which seeks to generate a net-positive benefit, going beyond net zero.

-

In August 2022, S’well launched its Elements Collection of bottles which consists of three high-gloss bottles named 'Blue Marble', 'Charcoal Granite', and 'Opal Marble'. The collection features earthy shades and tones. These double-walled, stainless steel insulated bottles can keep the contents cold for 24 hours and hot for 12 hours. The design prevents condensation, features drip-free sipping and has a wide mouth that accommodates the addition of ice.

Reusable Water Bottle Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 10.08 billion |

|

Revenue forecast in 2030 |

USD 12.60 billion |

|

Growth rate |

CAGR of 4.6% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa; Saudi Arabia |

|

Key companies profiled |

Tupperware Brands Corporation; SIGG Switzerland AG, GmbH; CamelBak Products, LLC; Klean Kanteen; Contigo; Aquasana Inc.; Hydaway; Nalgene; S’well |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Reusable Water Bottle Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global reusable water bottle market based on the material, distribution channel, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Stainless Steel

-

Glass

-

Silicone

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global reusable water bottle market was estimated at USD 9.67 billion in 2024 and is expected to reach USD 10.09 billion in 2025.

b. The global reusable water bottle market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030 to reach USD 12.61 billion by 2030.

b. Asia Pacific dominated the reusable water bottle market with a share of around 34% in 2024. This is owing to the people are moving toward a healthy lifestyle and are thinking of a sustainable environment, thus preferring reusable water bottles against the ordinary disposable ones

b. Some of the key players in the reusable water bottle market include Under Tupperware Brands Corporation, SIGG Switzerland AG, GmbH, CamelBak Products, LLC, Klean Kanteen, Contigo, Aquasana Inc., Hydaway, Nalgene, and S’well.

b. Key factors driving the reusable water bottle market growth include rising awareness of the negative environmental effects of non-disposable and single-use plastic bottles and a major rise in the amount of plastic garbage in seas and landfills.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Materials & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Information & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Material Outlook

2.3. Distribution Channel Outlook

2.4. Regional Outlook

2.5. Competitive Landscape Snapshot

Chapter 3. Reusable Water Bottle Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint Analysis

3.3.3. Market Opportunities

3.3.4. Market Challenges

3.4. Industry Analysis Tools

3.4.1. Porter’s Five Forces Analysis

3.5. Market Entry Strategies

Chapter 4. Consumer Behavior Analysis

4.1. Demographic Analysis

4.2. Consumer Trends & Preferences

4.3. Factors Affecting Buying Behavior

4.4. Consumer Product Adoption Trends

4.5. Observations & Recommendations

Chapter 5. Reusable Water Bottle Market: Material Estimates & Trend Analysis

5.1. Reusable Water Bottle Market, By Material: Key Takeaways

5.2. Material Movement Analysis & Market Share, 2024 & 2030

5.3. Market Estimates & Forecasts, by Material, 2018 - 2030 (USD Million)

5.3.1. Plastic

5.3.1.1. Market estimates and forecast, 2018 - 2030 (USD Million)

5.3.2. Stainless Steel

5.3.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

5.3.3. Glass

5.3.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

5.3.4. Silicone

5.3.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

5.3.5. Others

5.3.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

Chapter 6. Reusable Water Bottle Market: Distribution Channel Estimates & Trend Analysis

6.1. Reusable Water Bottle Market, By Distribution Channel: Key Takeaways

6.2. Distribution Channel Movement Analysis & Market Share, 2024 & 2030

6.3. Market Estimates & Forecasts, by distribution channel, 2018 - 2030 (USD Million)

6.3.1. Supermarkets/Hypermarkets

6.3.1.1. Market estimates and forecast, 2018 - 2030 (USD Million)

6.3.2. Specialty Stores

6.3.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

6.3.3. Convenience Stores

6.3.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

6.3.4. Online

6.3.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

Chapter 7. Reusable Water Bottle Market: Regional Estimates & Trend Analysis

7.1. Reusable Water Bottle Market: Regional Outlook

7.2. Regional Marketplaces: Key Takeaways

7.3. Market Estimates & Forecasts, by region, 2018 - 2030 (USD Million)

7.3.1. North America

7.3.1.1. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.1.2. U.S.

7.3.1.2.1. Key country dynamics

7.3.1.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.1.3. Canada

7.3.1.3.1. Key country dynamics

7.3.1.3.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.1.4. Mexico

7.3.1.4.1. Key country dynamics

7.3.1.4.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.2. Europe

7.3.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.2.2. Germany

7.3.2.2.1. Key country dynamics

7.3.2.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.2.3. UK

7.3.2.3.1. Key country dynamics

7.3.2.3.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.2.4. France

7.3.2.4.1. Key country dynamics

7.3.2.4.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.2.5. Italy

7.3.2.5.1. Key country dynamics

7.3.2.5.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.2.6. Spain

7.3.2.6.1. Key country dynamics

7.3.2.6.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.3. Asia Pacific

7.3.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.3.2. China

7.3.3.2.1. Key country dynamics

7.3.3.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.3.3. India

7.3.3.3.1. Key country dynamics

7.3.3.3.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.3.4. Japan

7.3.3.4.1. Key country dynamics

7.3.3.4.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.3.5. Australia

7.3.3.5.1. Key country dynamics

7.3.3.5.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.4. Central & South America

7.3.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.4.2. Brazil

7.3.4.2.1. Key country dynamics

7.3.4.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.5. Middle East & Africa

7.3.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.5.2. South Africa

7.3.5.2.1. Key country dynamics

7.3.5.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

7.3.5.3. Saudi Arabia

7.3.5.3.1. Key country dynamics

7.3.5.3.2. Market estimates and forecast, 2018 - 2030 (USD Million)

Chapter 8. Reusable Water Bottle Market: Competitive Analysis

8.1. Recent developments & impact analysis, by key market participants

8.2. Company Categorization

8.3. Participant’s Overview

8.4. Financial Performance

8.5. Product Benchmarking

8.6. Company Market Share Analysis, 2024 (%)

8.7. Company Heat Map Analysis

8.8. Strategy Mapping

8.9. Company Profiles

8.9.1. Tupperware Brands Corporation

8.9.1.1. Company Overview

8.9.1.2. Financial Performance

8.9.1.3. Product Portfolios

8.9.1.4. Strategic Initiatives

8.9.2. SIGG Switzerland AG, GmbH

8.9.2.1. Company Overview

8.9.2.2. Financial Performance

8.9.2.3. Product Portfolios

8.9.2.4. Strategic Initiatives

8.9.3. CamelBak Products, LLC

8.9.3.1. Company Overview

8.9.3.2. Financial Performance

8.9.3.3. Product Portfolios

8.9.3.4. Strategic Initiatives

8.9.4. Klean Kanteen

8.9.4.1. Company Overview

8.9.4.2. Financial Performance

8.9.4.3. Product Portfolios

8.9.4.4. Strategic Initiatives

8.9.5. Contigo

8.9.5.1. Company Overview

8.9.5.2. Financial Performance

8.9.5.3. Product Portfolios

8.9.5.4. Strategic Initiatives

8.9.6. Aquasana Inc.

8.9.6.1. Company Overview

8.9.6.2. Financial Performance

8.9.6.3. Product Portfolios

8.9.6.4. Strategic Initiatives

8.9.7. Hydaway

8.9.7.1. Company Overview

8.9.7.2. Financial Performance

8.9.7.3. Product Portfolios

8.9.7.4. Strategic Initiatives

8.9.8. Nalgene

8.9.8.1. Company Overview

8.9.8.2. Financial Performance

8.9.8.3. Product Portfolios

8.9.8.4. Strategic Initiatives

8.9.9. S’well

8.9.9.1. Company Overview

8.9.9.2. Financial Performance

8.9.9.3. Product Portfolios

8.9.9.4. Strategic Initiatives

8.9.10. Hydro Flask

8.9.10.1. Company Overview

8.9.10.2. Financial Performance

8.9.10.3. Product Portfolios

8.9.10.4. Strategic Initiatives

List of Tables

Table 1 Reusable water bottle market: Key market driver analysis

Table 2 Reusable water bottle market: Key market restraint analysis

Table 3 Reusable water bottle market estimates & forecast, by material, 2018 - 2030 (USD Million)

Table 4 Plastic reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Table 5 Stainless steel water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Table 6 Glass water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Table 7 Silicone reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Table 8 Other reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Table 9 Reusable water bottle market estimates & forecast, by distribution channel, 2018 - 2030, (USD Million)

Table 10 Reusable water bottle market estimates & forecast, through supermarkets/hypermarkets, 2018 - 2030 (USD Million)

Table 11 Reusable water bottle market estimates & forecast, through specialty stores, 2018 - 2030 (USD Million)

Table 12 Reusable water bottle market estimates & forecast, through convenience stores, 2018 - 2030 (USD Million)

Table 13 Reusable water bottle market estimates & forecast, through online channel, 2018 - 2030 (USD Million)

Table 14 Reusable water bottle market estimates & forecast, by region, 2018 - 2030 (USD Million)

Table 15 North America reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 16 North America reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 17 North America reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 18 U.S. macro-economic outlay

Table 19 U.S. reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 20 U.S. reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 21 U.S. reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 22 Canada macro-economic outlay

Table 23 Canada reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 24 Canada reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 25 Canada reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 26 Mexico macro-economic outlay

Table 27 Mexico reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 28 Mexico reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 29 Mexico reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 30 Europe reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 31 Europe reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 32 Europe reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 33 Germany macro-economic outlay

Table 34 Germany reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 35 Germany reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 36 Germany reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 37 UK macro-economic outlay

Table 38 UK reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 39 UK reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 40 UK reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 41 France macro-economic outlay

Table 42 France reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 43 France reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 44 France reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 45 Italy macro-economic outlay

Table 46 Italy reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 47 Italy reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 48 Italy reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 49 Spain macro-economic outlay

Table 50 Spain reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 51 Spain reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 52 Spain reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 53 Asia Pacific reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 54 Asia Pacific reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 55 Asia Pacific reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 56 China macro-economic outlay

Table 57 China reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 58 China reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 59 China reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 60 Japan macro-economic outlay

Table 61 Japan reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 62 Japan reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 63 Japan reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 64 India macro-economic outlay

Table 65 India reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 66 India reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 67 India reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 68 Australia macro-economic outlay

Table 69 Australia reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 70 Australia reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 71 Australia reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 72 Central & South America reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 73 Central & South America reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 74 Central & South America reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 75 Brazil macro-economic outlay

Table 76 Brazil reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 77 Brazil reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 78 Brazil reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 79 Middle East & Africa reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 80 Middle East & Africa reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 81 Middle East & Africa reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 82 South Africa macro-economic outlay

Table 83 South Africa reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 84 South Africa reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 85 South Africa reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 86 Saudi Arabia macro-economic outlay

Table 87 Saudi Arabia reusable water bottle market estimates and forecast, 2018 - 2030 (USD Million)

Table 88 Saudi Arabia reusable water bottle market estimates and forecast, by material, 2018 - 2030 (USD Million)

Table 89 Saudi Arabia reusable water bottle market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

Table 90 Recent developments & impact analysis, by key market participants

Table 91 Company market share, 2024

Table 92 Company heat map analysis

Table 93 Companies implementing key strategies

List of Figures

Fig. 1 Reusable water bottle market segmentation

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Primary research approaches

Fig. 5 Primary research process

Fig. 6 Market snapshot

Fig. 7 Segment snapshot

Fig. 8 Regional snapshot

Fig. 9 Competitive landscape snapshot

Fig. 10 Parent industry and reusable water bottle market size, 2024 (USD Million)

Fig. 11 Reusable water bottle market: Value chain analysis

Fig. 12 Reusable water bottle market: Dynamics

Fig. 13 Reusable water bottle market: Porter’s five forces analysis

Fig. 14 Factors affecting buying decisions in the reusable water bottle market

Fig. 15 Reusable water bottle market, by material: Key takeaways

Fig. 16 Reusable water bottle market: Material movement analysis, 2024 & 2030 (%)

Fig. 17 Plastic reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 18 Stainless steel water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 19 Glass water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 20 Silicone reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 21 Other reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 22 Reusable water bottle market, by distribution channel: Key takeaways

Fig. 23 Reusable water bottle market: Distribution channel movement analysis, 2024 & 2030 (%)

Fig. 24 Reusable water bottle market estimates & forecast, through supermarkets/hypermarkets, 2018 - 2030 (USD Million)

Fig. 25 Reusable water bottle market estimates & forecast, through specialty stores, 2018 - 2030 (USD Million)

Fig. 26 Reusable water bottle market estimates & forecast, through convenience stores, 2018 - 2030 (USD Million)

Fig. 27 Reusable water bottle market estimates & forecast, through online channel, 2018 - 2030 (USD Million)

Fig. 28 Reusable water bottle market: Regional outlook, 2024 & 2030, (USD Million)

Fig. 29 Regional marketplace: Key takeaways

Fig. 30 North America reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 31 US reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 32 Canada reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 33 Mexico reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 34 Europe reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 35 Germany reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 36 UK reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 37 France reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 38 Italy reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 39 Spain reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 40 Asia Pacific reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 41 China reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 42 Japan reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 43 India reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 44 Australia reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 45 Central & South America reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 46 Brazil reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 47 Middle East & Africa reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 48 South Africa reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 49 Saudi Arabia reusable water bottle market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 50 Key company categorization

Fig. 51 Company market share analysis, 2024

Fig. 52 Strategic framework of reusable water bottle market

Market Segmentation

- Reusable Water Bottle Material Outlook (Revenue, USD Million, 2018 - 2030)

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Reusable Water Bottle Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Supermarkets & Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Reusable Water Bottle Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- North America reusable water bottle market, by distribution channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- U.S.

- U.S. reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- U.S. reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- U.S. reusable water bottle market, by material

- Canada

- Canada reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Canada reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Canada reusable water bottle market, by material

- Mexico

- Mexico reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Mexico reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Mexico reusable water bottle market, by material

- North America reusable water bottle market, by material

- Europe

- Europe reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Europe reusable water bottle market, by distribution channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Germany

- Germany reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Germany reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Germany reusable water bottle market, by material

- UK

- UK reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- UK reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- UK reusable water bottle market, by material

- France

- France reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- France reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- France reusable water bottle market, by material

- Italy

- Italy reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Italy reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Italy reusable water bottle market, by material

- Spain

- Spain reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Spain reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Spain reusable water bottle market, by material

- Europe reusable water bottle market, by material

- Asia Pacific

- Asia Pacific reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Asia Pacific reusable water bottle market, by distribution channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- China

- China reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- China reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- China reusable water bottle market, by material

- India

- India reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- India reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- India reusable water bottle market, by material

- Japan

- Japan reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Japan reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Japan reusable water bottle market, by material

- Australia

- Australia reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Australia reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Australia reusable water bottle market, by material

- Asia Pacific reusable water bottle market, by material

- Central & South America

- Central & South America reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Central & South America reusable water bottle market, by distribution channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Brazil

- Brazil reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Brazil reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Brazil reusable water bottle market, by material

- Central & South America reusable water bottle market, by material

- Middle East & Africa

- Middle East & Africa reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Middle East & Africa reusable water bottle market, by distribution channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- South Africa

- South Africa reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- South Africa reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- South Africa reusable water bottle market, by material

- Saudi Arabia

- Saudi Arabia reusable water bottle market, by material

- Plastic

- Stainless Steel

- Glass

- Silicone

- Others

- Saudi Arabia reusable water bottle market, by distribution channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Saudi Arabia reusable water bottle market, by material

- Middle East & Africa reusable water bottle market, by material

- North America

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

Research Methodology

Grand View Research employs comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For comprehensive understanding of the market, it is essential to understand the complete value chain and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia and trade journals. Technical data is also gathered from intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development and pricing trends is fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, and industry experience and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of technology landscape, regulatory frameworks, economic outlook and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restrains, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030

We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, on face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts and buyers so as to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation, but also provide critical insights into the market, current business scenario and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market leading companies

• Raw material suppliers

• Product distributors

• Buyers

The key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight in to the current market and future expectations

Data Collection Matrix

|

Perspective |

Primary research |

Secondary research |

|

Supply side |

|

|

|

Demand side |

|

|

Industry Analysis Matrix

|

Qualitative analysis |

Quantitative analysis |

|

|

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."