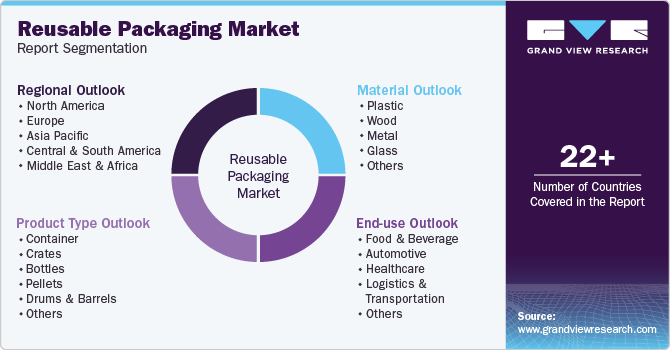

Reusable Packaging Market Size, Share & Trends Analysis Report By Material (Plastic, Wood, Metal, Glass), By Product Type (Container, Crates, Bottles, Pellets), By End-use (Food & Beverage, Automotive, Healthcare), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-548-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Reusable Packaging Market Size & Trends

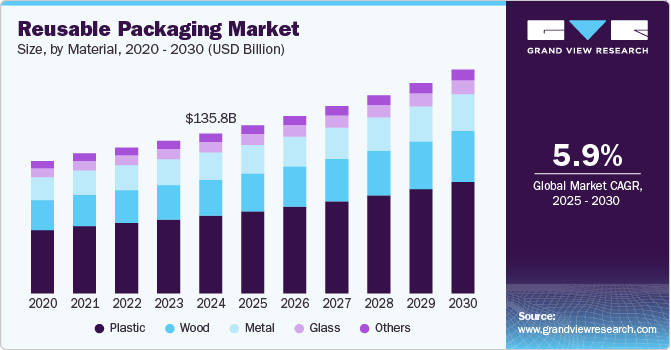

The global reusable packaging market size was estimated at USD 135.8 billion in 2024 and is expected to grow at a CAGR of 5.9% from 2025 to 2030. One of the primary growth drivers of the reusable packaging industry is the increasing global awareness of sustainability and environmental conservation. Governments and regulatory bodies worldwide are imposing stringent regulations on single-use plastics, leading industries to shift towards eco-friendly alternatives. Reusable packaging significantly reduces waste generation, carbon footprint, and resource depletion, making it a preferred choice for businesses looking to align with sustainability goals. Consumers are also becoming more conscious of environmentally friendly products, driving demand for packaging solutions that promote circular economies.

Reusable packaging offers significant cost advantages over single-use packaging in the long run. Although the initial investment in durable packaging materials such as plastic, wood, metal, and glass is higher, businesses benefit from reduced repurchasing costs, waste management expenses, and lower dependency on raw materials. Industries such as food & beverage, automotive, and logistics experience increased profitability as reusable packaging enhances efficiency in supply chain management, reducing overall operational costs.

The development of high-quality and durable materials such as reinforced plastics, advanced composites, and sustainable metals has significantly improved the lifespan and usability of reusable packaging solutions. Innovations in smart packaging, including RFID tracking, IoT-enabled containers, and tamper-proof features, enhance supply chain visibility and security. These technological advancements make reusable packaging more attractive to industries requiring efficient storage, handling, and distribution.

Governments across various regions are promoting circular economy models, where products and materials are continuously reused and recycled to minimize waste. Policies and incentives encouraging businesses to adopt sustainable practices, such as extended producer responsibility (EPR) programs and bans on single-use packaging, are driving the market for reusable packaging. Companies are increasingly focusing on closed-loop supply chains, where packaging materials are collected, cleaned, and reused multiple times, reducing their environmental footprint.

Furthermore, with rapid urbanization and infrastructural development worldwide, industries require robust and sustainable packaging solutions for large-scale transportation of goods. The demand for reusable drums, barrels, and pallets is increasing in construction, chemical, and industrial applications. As economies invest in better logistics and supply chain infrastructure, the adoption of reusable packaging solutions is expected to witness substantial growth.

Additionally, businesses are increasingly adopting sustainable practices as part of their corporate social responsibility (CSR) initiatives. Companies that implement reusable packaging solutions enhance their brand image and appeal to environmentally conscious consumers and investors. Many global corporations are setting ambitious sustainability goals, including reducing packaging waste, adopting circular economy models, and minimizing environmental impact, which further drives the demand for reusable packaging solutions.

Material Insights

The plastic material segment recorded the largest revenue share of over 48.7% in 2024. One of the key factors making plastic dominate the reusable packaging industry is its durability. Unlike glass or metal, which can be prone to breakage, plastic offers a lightweight yet robust structure that can withstand repeated use in various industries. High-density polyethylene (HDPE), polypropylene (PP), and polyethylene terephthalate (PET) are commonly used plastics that provide excellent resistance to impact, moisture, and harsh environmental conditions. This makes plastic ideal for industries such as food & beverage, logistics, and healthcare, where packaging needs to endure long transportation cycles and frequent handling.

Plastic is significantly more cost-effective compared to other materials like metal, wood, or glass. The lower production cost, coupled with its long lifespan in reusable applications, makes plastic a financially viable choice for businesses. The initial investment in plastic-based reusable packaging is relatively lower than in metal or glass, and its lightweight nature reduces shipping and logistics costs.

Furthermore, Plastic outperforms materials like wood and metal in terms of resistance to moisture, chemicals, and corrosion. Wood-based packaging can absorb moisture, leading to microbial growth and deterioration, while metal is prone to rust and oxidation. Plastic, on the other hand, is non-porous and does not degrade easily in humid or chemical-exposed environments. This makes it particularly suitable for industries like healthcare, food & beverage, and chemical manufacturing, where hygiene and contamination resistance are crucial.

Product Type Insights

The containers segment is expected to dominate the industry with a major revenue share of 37.1% in 2024 and is forecasted to grow rapidly in the coming years. Containers are the most widely used product type in reusable packaging because they serve diverse functions across various industries. Whether in food & beverage, automotive, healthcare, or logistics, containers provide a flexible solution for transporting and storing different types of goods. Unlike other packaging products such as crates or pallets, which are often specific to certain applications, containers can be designed to hold both solid and liquid products, making them the most adaptable reusable packaging option.

One of the major advantages of containers is their ability to provide superior protection for goods. Containers are designed to be rigid, impact-resistant, and durable, ensuring that products remain intact during transportation and storage. This is especially critical in industries like food & beverage and healthcare, where maintaining hygiene and product integrity is essential. In contrast to crates or pallets, which primarily support stacking and transport, containers fully enclose the products, preventing contamination, spills, and exposure to external elements.

Additionally, the rise in circular economy practices has further fueled the demand for reusable containers. Many companies are shifting to closed-loop supply chains, where packaging is collected, sanitized, and reused multiple times. Governments and businesses are encouraging the adoption of recyclable and reusable packaging to reduce waste and carbon footprints. Containers, being highly durable and recyclable, align perfectly with these sustainability goals.

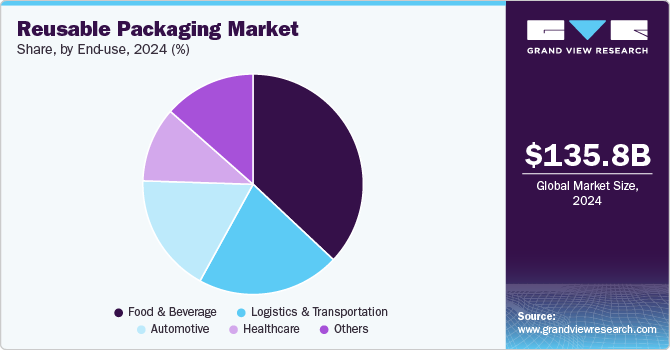

End-use Insights

The food & beverage segment recorded the largest market share of over 38.7% in 2024 and is projected to grow at the fastest CAGR during the forecast period. The food & beverage industry is under immense pressure to reduce its environmental footprint, leading to a strong shift toward reusable packaging. Governments and regulatory bodies worldwide are enforcing restrictions on single-use plastics, pushing food and beverage companies to adopt sustainable alternatives. Reusable packaging solutions, such as plastic crates, glass bottles, and durable food containers, help companies reduce packaging waste, lower carbon emissions, and comply with environmental regulations.

Food and beverage products require high standards of hygiene and safety to prevent contamination and ensure product integrity. Reusable packaging solutions, especially those made of plastic, glass, and metal, provide airtight, moisture-resistant, and contamination-proof storage, preserving food freshness and quality. Compared to disposable packaging, which can be easily damaged or compromised, reusable packaging offers better protection against bacteria, moisture, and external contaminants, making it the preferred choice in the industry.

The rapid growth of online grocery shopping, food delivery services, and cloud kitchens has increased the demand for secure, reusable packaging solutions. Companies in the food & beverage sector are moving towards durable plastic and insulated containers to transport food safely while reducing packaging waste. Many meal delivery companies are adopting returnable containers to minimize environmental impact, reinforcing the dominance of reusable packaging in this sector.

The beverage industry is a major driver of reusable packaging, with many companies using glass bottles, plastic crates, and kegs for transportation and distribution. Large beverage manufacturers, including soft drink, beer, and dairy companies, have well-established bottle return systems that allow for the collection, cleaning, and reuse of packaging materials. This circular economy model helps reduce packaging waste, conserve raw materials, and lower production costs, further solidifying the dominance of the food & beverage sector in the reusable packaging market.

Region Insights

North America dominated the reusable packaging industry and accounted for the largest revenue share of over 34.4% in 2024. It is anticipated to grow at a CAGR of 5.6% over the forecast period. North America, particularly the United States and Canada, has seen a significant push toward sustainable and reusable packaging solutions due to increasing environmental concerns and stringent government regulations. Both federal and state governments are implementing policies to reduce single-use plastics, encourage recycling programs, and promote circular economy initiatives. Programs such as Extended Producer Responsibility (EPR) laws in Canada and various U.S. states are compelling businesses to adopt reusable packaging as part of their sustainability strategies. These regulatory efforts have accelerated the adoption of reusable containers, pallets, and crates across industries.

U.S. Reusable Packaging Market Trends

Growth of the U.S. reusable packaging industry can be attributed to several interconnected factors. The country's massive population of 1.4 billion people, combined with rapid urbanization and a growing middle class, has created significant demand for single-serve and on-the-go products. This trend is particularly evident in personal care items, food condiments, and household products. Additionally, the country’s robust manufacturing infrastructure and advanced packaging technology capabilities have contributed to its market growth. The country has invested heavily in flexible packaging production facilities, particularly in regions such as Guangdong and Zhejiang provinces.

Europe Reusable Packaging Market Trends

Europe reusable packaging industry is expanding rapidly due to stringent EU environmental policies, a strong focus on circular economy practices, and growing consumer preference for eco-friendly packaging. Many European brands are shifting to deposit-return systems, reusable glass bottles, and collapsible transport containers to comply with sustainability targets. Additionally, the rise of zero-waste retail stores, refillable packaging programs, and corporate-led green initiatives is reinforcing the region’s leadership in reusable packaging adoption.

The reusable packaging market in Germany is fueled by its strong circular economy policies, high recycling rates, and advanced packaging innovations. With stringent EU regulations and Germany’s Packaging Act (VerpackG), companies are shifting to returnable crates, pallets, and glass containers to comply with sustainability mandates. Furthermore, Germany's automotive and food & beverage industries are embracing reusable packaging solutions to enhance efficiency and meet carbon neutrality targets, positioning the country as a leader in sustainable packaging practices.

Asia Pacific Reusable Packaging Market Trends

The Asia Pacific reusable packaging industry is experiencing significant growth, due to booming urbanization, increasing middle-class consumption, and aggressive government policies against plastic waste. Countries like India, Japan, and South Korea are investing in sustainable packaging solutions as part of their environmental commitments. The region’s dominance in manufacturing, food exports, and cross-border trade is also driving demand for durable, cost-efficient, and stackable reusable packaging in logistics and warehousing.

The China reusable packaging market growth is driven by the country’s rapid industrialization, expanding e-commerce sector, and government-led sustainability initiatives. The country’s "Zero-Waste Cities" initiative and strict regulations on single-use plastics are compelling businesses to adopt returnable transport packaging (RTP) solutions. Additionally, China's dominance in global manufacturing and logistics requires durable, cost-effective, and reusable packaging materials to optimize supply chain efficiency while reducing environmental impact.

Key Reusable Packaging Company Insights

The global reusable packaging market is highly competitive, with key players focusing on innovation, material advancements, and sustainability-driven solutions to gain a competitive edge. Key players such as Smart Crates, Schoeller Arca Systems, Reusable Packaging Group, Polymer Logistics, Reusable Transit Packaging, Mauser Packaging Solutions, ORBIS Corp, Smurfit Kappa, RPP Containers, Schoeller Allibert, Schutz, SSI Schaefer, Tri-pack Packaging Systems, and Tri-Wall.

Many of these companies are expanding their product portfolios with RFID-enabled, IoT-integrated, and AI-powered tracking solutions, allowing for real-time monitoring of reusable packaging assets in supply chains. Additionally, mergers, acquisitions, and strategic partnerships are common, with players collaborating with logistics providers, sustainability organizations, and tech firms to enhance the efficiency and reach of reusable packaging solutions globally.

-

In August 2024, ALPLA and zerooo unveiled a standardized solution for cosmetics, launching reusable PET bottles designed for shampoo, shower gel, and other personal care products. This initiative promotes sustainability through a circular economy model, featuring digital labeling for transparency and an efficient return system for consumers in Germany and Austria.

-

In August 2024, Berry Global partnered with Aquafigure to launch a new line of reusable 330ml water bottles made from BPA-free Tritan. Designed with interchangeable bottle cards for personalization, the initiative targets young consumers and promotes sustainable water consumption. The bottles feature a design for interchangeable, 3D bottle cards, to promote water consumption among young people. The 330ml bottles are made from bisphenol A (BPA)-free Tritan, a recyclable, food-approved copolyester capable of withstanding hundreds of dishwasher cycles. This collaboration reinforces Berry’s commitment to advancing the circular economy.

Key Reusable Packaging Companies:

The following are the leading companies in the reusable packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Smart Crates

- Schoeller Arca Systems

- Reusable Packaging Group

- Polymer Logistics

- Reusable Transit Packaging

- Mauser Packaging Solutions

- ORBIS Corp

- Smurfit Kappa

- RPP Containers

- Schoeller Allibert

- Schutz

- SSI Schaefer

- Tri-pack Packaging Systems

- Tri-Wall

Reusable Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 142.7 billion |

|

Revenue forecast in 2030 |

USD 190.1 billion |

|

Growth rate |

CAGR of 5.9% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, product type, end-use, region |

|

States scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Key companies profiled |

Smart Crates; Schoeller Arca Systems; Reusable Packaging Group; Polymer Logistics; Reusable Transit Packaging; Mauser Packaging Solutions; ORBIS Corp; Smurfit Kappa; RPP Containers; Schoeller Allibert; Schutz; SSI Schaefer; Tri-pack Packaging Systems; Tri-Wall |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Reusable Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global reusable packaging market report based on material, product type, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Wood

-

Metal

-

Glass

-

Others

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Container

-

Crates

-

Bottles

-

Pellets

-

Drums & Barrels

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Automotive

-

Healthcare

-

Logistics & Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global reusable packaging market was valued at USD 135.75 billion in 2024 and is expected to reach USD 135.75 billion by 2025.

b. The global reusable packaging market is expected to grow at a CAGR of 5.9% from 2025 to 2030 to reach USD 190.1 billion by 2030.

b. The food & beverage segment recorded the largest market share of over 38.7% in 2024 on account of initiatives taken to reduce its environmental footprint, leading to a strong shift toward reusable packaging.

b. Some key players operating in the Reusable Packaging market include Smart Crates, Schoeller Arca Systems, Reusable Packaging Group, Polymer Logistics, Reusable Transit Packaging, Mauser Packaging Solutions, ORBIS Corp, Smurfit Kappa, RPP Containers, Schoeller Allibert, Schutz, SSI Schaefer, Tri-pack Packaging Systems, and Tri-Wall.

b. One of the primary drivers of the reusable packaging market is the increasing global awareness of sustainability and environmental conservation.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."