- Home

- »

- Beauty & Personal Care

- »

-

Reusable Baby Diapers And Training Pants Market ReportGVR Report cover

![Reusable Baby Diapers And Training Pants Market Size, Share & Trends Report]()

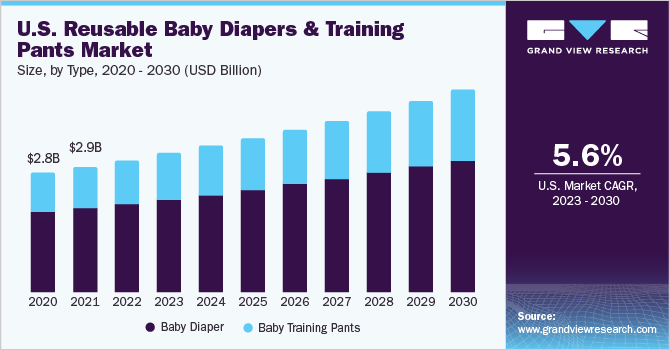

Reusable Baby Diapers And Training Pants Market Size, Share & Trends Analysis Report By Type (Baby Diaper, Baby Training Pants), By Size (Small & Extra Small, Medium, Large, Extra Large), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-088-1

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global reusable baby diapers and training pants market size was valued at USD 12.02 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Increased awareness about environmental sustainability and the impact of disposable diapers on the environment has led many parents to choose reusable diapers and training pants. Moreover, such products are seen as a more eco-friendly option as they reduce waste generation and landfill usage. Several manufacturers in the industry are focusing on developing new products to meet the evolving consumer demands. For instance, in November 2022, SuperBottoms, an Indian infant care company, introduced 100% eco-friendly, machine-washable, and soft cloth diapers for infants.

Increasing disposable income and consumer spending power are major factors triggering the growth of the reusable diapers & training pants market. The number of people working has increased discretionary income, especially in rising economies in the Middle East and Africa, Central and South America, and Asia Pacific. Most families with babies or toddlers fall under the mid-30s to mid-40s age group, where most individuals are financially stable. This contributes to the increased spending on baby care products.

According to The United Nations Environment Programmes (UNEP) Single-Use Nappies and their Alternatives report 2021, Vanuatu was the first nation to ban single-use diapers after it was discovered that they make up 27% of the country's solid waste. According to the same report, in the European Union (EU), 33 billion single-use diapers are used yearly, producing 6.7 million tons of garbage. As a more sustainable option to single-use ones, reusable cloth alternatives are encouraged, which is expected to accelerate the market growth over the forecast period.

The growing demand for sustainable materials, comfort, absorbency, and easy-to-clean features offers new growth opportunities for the reusable baby diaper & training pants market. In response to this, manufacturers are focusing on providing sustainable infant care products to consumer. For instance, in July 2021, Modibodi launched The "Most Absorbent Reusable Nappy Ever". These are most absorbent reusable nappy ever and have a capacity of more than one liter. These factors are expected to accelerate the market growth over the forecast period

One-size reusable baby diapers that expand as the child grows are also becoming popular among parents. These are also used during potty training. Moreover, companies in the reusable baby diapers and training pants market are offering convenient closure options, such as buttons or Velcro, to easily adjust the size. For instance, Indian reusable diaper brand Just Bumm offers a free-size cloth baby diaper that can fit from a 3-month baby to a 3-years toddler and has adjustable bottoms.

Diaper subscriptions have recently become incredibly popular among parents. The supplies are delivered to the client’s doorsteps on a weekly or monthly basis under this model. In December 2022, Charlie Banana, a subsidiary of Procter & Gamble, collaborated with TerraCycle's Loop, a program for reusable packaging, to introduce Loop Diaper Service, the first cloth diaper delivery service in the U.S. Every order comes with premium Charlie Banana reusable diapers, premium cloth inserts, and a cutting-edge anti-odor diaper bin. Families on the go have the freedom to schedule a pick-up in order to return the used diapers from anywhere in the continental U.S.

Type Insights

The baby diapers segment dominated the market and accounted for 66% of the market share in 2022. One of the key factors driving the demand for reusable baby diapers, is their reusability. Cloth diapers are a convenient alternative to disposable ones as they can be used multiple times. The demand for these products mainly stems from consumers who cannot afford to spend much on disposable diapers that need to be changed frequently. However, the demand for reusable diapers is also growing among parents who are increasingly concerned about protecting their babies’ delicate skin from harmful chemicals and synthetic materials.

The baby training pants segment is projected to expand at a CAGR of 7.3%. Parents and caregivers are actively seeking training pants that are made from sustainable materials, such as organic cotton or bamboo, and are free from harmful chemicals and additives. U.S.-based Hive Brands, Inc. offers Ecoriginals Eco-Friendly Baby Training Pants, which are made with biodegradable materials and free of chemicals & irritants. The training pants are available in the sizes-crawler (13lb to 24lb), toddler (22lb to 31lb), walker (29lb to 40lb), and junior (above 35lb).

Size Insights

In 2022, the small and extra small sizes segment dominated the market and accounted for revenue share of 36.6%. Many companies offer small and extra-small reusable baby diapers and training pants in a range of designs, prints, styles, fabrics, thickness, and absorbency capabilities. For instance, India-based FirstCry offers the Babyhug set of extra-small and small muslin cloth nappies for newborn babies. The cloth diapers-available in various colors and prints-are reusable and can withstand many wash cycles.

The medium size type segment is set to expand at a CAGR of 7.4%. Medium-sized diapers and training pants are preferred by parents as babies grow and gain weight, requiring a larger and more accommodating fit. These products are designed to offer both adequate absorbency and increased mobility, making them a popular choice. Consequently, manufacturers are focusing on providing medium-sized options that effectively combine absorbency and movement. U.S.-based Thirsties Baby offers medium-sized trainer pants with stretchable elastic along the legs and waist for comfort and functionality.

Distribution Channel Insights

The supermarkets and hypermarkets segment dominated the market with a share of about 40% in 2022 majorly due to its easy availability and accessibility. Such stores have been expanding their own product lines. For instance, in 2021, Walmart demonstrated its commitment to meeting the needs of parents by expanding its baby products range with the introduction of 600 new baby products and brands. Notable brands available at Walmart, such as Hello Bello, Zarbees, and Live Clean, have gained popularity among parents due to their reputation for offering reliable and trusted baby care solutions.

Pharmacy and drug stores are projected to expand at a CAGR of 7.7% in the forecast period. Such channels are trusted sources of healthcare products, and parents may rely on the expertise and guidance of pharmacists when selecting the right diapers or training pants for their babies. The combination of accessibility, variety, trusted reputation, and the growing demand for sustainable products for babies makes pharmacies and drug stores the fastest-growing channel in the reusable baby diaper and training pants market.

Regional Insights

The North America region dominated the industry with a share of over 30% in 2022. Several manufacturers in the region offer hybrid diapers, which provide the convenience of disposable diapers and are eco-friendly as well. For instance, in May 2021, Pampers announced the launch of Pure Protection Hybrid Diaper that uses 25% less disposable materials and provides improved dryness and leak protection. The collection is available in 14 playful prints and can be customized. Increasing disposable incomes and continued penetration of a will continue to boost demand in this region.

The Asia Pacific region is expected to expand at the highest CAGR of 8.1%. The continuously increasing population and the rising import and export of consumer goods in the region are the prime factors contributing to the growth of the reusable baby diapers and training pants market in Asia Pacific. Companies have been collaborating with regional online retailers and providing a market for their products through online distribution channels. Close Parent, a Singapore-based brand, offers reusable cloth diapers in attractive colors and designs. The brand provides its products through online retail channels like Agape Babies and Mums and Babes in Singapore.

Key Companies & Market Share Insights

The market for reusable baby diaper and training pants is still in its growing stage with different market players entering the space. Major focus of these companies has been towards new product launches, mergers & acquisitions, and acquiring investments.

-

For instance, in February 2023, TotsBots was brought back by its original owners after three years of it being acquired by True Global, where it was merged with Frugi Organic Childrenswear. The original owners plan to bring all its production processes back to the U.K., with an added focus on launching new products.

-

For instance, in September 2021, Bambino Mio received an investment of about USD 17 million from Business Growth Fund, a U.K.-based investment firm. Bambino Mio aims to drive multi-channel growth and boost marketing spending with this investment.

Some of the prominent players in the global reusable baby diapers and training pants market include: -

-

Procter & Gamble

-

ALVABABY

-

Bumkins

-

bumGenius

-

GroVia

-

Kanga Care, LLC

-

Gerber Childrenswear

-

Nicki’s Diapers

-

Bambino Mio

-

Thirsties

-

Buttons Cloth Diapers

-

Bumpadum

-

Blueberry Diapers

-

TotsBots

-

Smart Bottoms

Reusable Baby Diapers And Training Pants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.80 billion

Revenue forecast in 2030

USD 20.33 billion

Growth Rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, size, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Australia; Brazil; South Africa

Key companies profiled

Procter & Gamble; ALVABABY; Bumkins; bumGenius; GroVia; Kanga Care, LLC; Gerber Childrenswear; Nicki’s Diapers; Bambino Mio; Thirsties; Buttons Cloth Diapers; Bumpadum; Blueberry Diapers; TotsBots; Smart Bottoms

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Reusable Baby Diapers And Training Pants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global reusable baby diapers and training pants market report on the basis of type, size, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Baby Diaper

-

Baby Training Pants

-

-

Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Small & Extra Small

-

Medium

-

Large

-

Extra Large

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Pharmacy & Drug Stores

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global reusable baby diapers and training pants market was estimated at USD 12.02 billion in 2022 and is expected to reach USD 12.80 billion in 2023.

b. The global reusable baby diapers and training pants market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 20.33 billion by 2030.

b. North America region dominated the reusable baby diapers and training pants market with a share of around 31% in 2022. This is owing to the increasing awareness about environment conservation, growing birth rates, technological innovations, the advent of subscription-based diapering systems, and the cost-effectiveness of such products.

b. Some key players operating in the reusable baby diapers and training pants market include Procter & Gamble; ALVABABY; Bumkins; bumGenius; GroVia; Kanga Care, LLC; Gerber Childrenswear; Nicki’s Diapers; Bambino Mio; Thirsties; Buttons Cloth Diapers; Bumpadum; Blueberry Diapers; TotsBots; Smart Bottoms.

b. Key factors that are driving the reusable baby diapers and training pants market growth include environmental consciousness, cost savings, improved product design and performance, and health and safety concerns, coupled with rising supportive initiatives and campaigns.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."