- Home

- »

- Beauty & Personal Care

- »

-

Retinol Beauty Products Market Size And Share Report, 2030GVR Report cover

![Retinol Beauty Products Market Size, Share & Trends Report]()

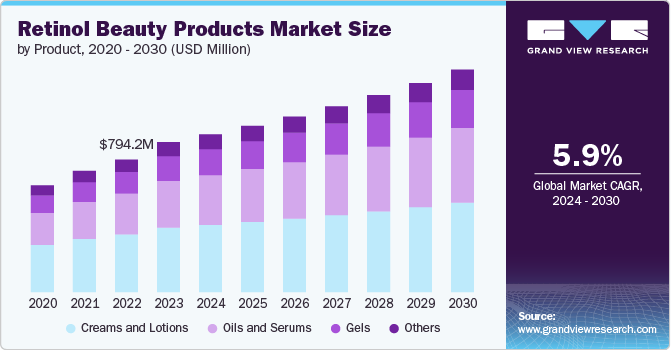

Retinol Beauty Products Market Size, Share & Trends Analysis Report By Product (Creams And Lotions, Oils And Serums, Gels), By End Use (Men, Women), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-373-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Retinol Beauty Products Market Trends

The global retinol beauty products market size was valued at USD 898.4 million in 2023 and is expected to grow at a CAGR of 5.9% from 2024 to 2030. The global demand for retinol beauty products is experiencing significant growth, driven by increasing consumer awareness and understanding of retinol’s efficacy in skincare. Retinol is renowned for its potent anti-aging properties, which include reducing fine lines, wrinkles, and age spots. As consumers become more educated about the benefits of incorporating retinol into their skincare routines, there is a noticeable shift toward products that promise youthful and healthier-looking skin. This trend is particularly pronounced among aging populations in developed countries, where maintaining a youthful appearance is a high priority, thereby fueling the demand for retinol-based products.

The proven benefits of retinol in skincare are significantly driving consumer purchasing decisions and contributing to overall market growth. Retinol's ability to effectively reduce wrinkles, fine lines, and hyperpigmentation, while improving skin texture and collagen production, appeals to consumers seeking visible and long-term results. Its dermatologically validated efficacy in addressing various signs of aging has established retinol as a trusted ingredient among skincare enthusiasts and professionals alike. Furthermore, the versatility of retinol across different product formulations, such as creams, serums, and masks, ensures that consumers can integrate it seamlessly into their daily skincare routines. Based on statistics from WorldMetrics.org, consumers aged under 35 represent the most rapidly expanding demographic in the retinol product market. Retinol products ranging from 0.3% to 1% concentration are particularly favored among consumers. As awareness of retinol's benefits continues to grow through positive consumer experiences and endorsements from dermatologists, the demand for retinol beauty products is expected to expand, driving market growth and fostering innovation within the skincare industry.

The growing trend toward preventive skincare is another key factor contributing to the rising demand for retinol beauty products. Younger demographics are increasingly adopting skincare routines aimed at preventing signs of aging before they appear. This proactive approach to skincare is being driven by social media influencers, dermatologists, and beauty experts who advocate for early intervention and the long-term benefits of using retinol. As a result, there is a surge in demand from younger consumers looking to incorporate retinol into their daily skincare regimen to maintain healthy and youthful skin over the long term.

Market expansion in emerging economies is significantly boosting the demand for retinol beauty products. Rapid urbanization, rising disposable incomes, and increasing beauty consciousness among consumers in countries such as China, India, and Brazil are creating lucrative opportunities for skincare brands. As the middle-class population in these regions grows, there is an increased willingness to spend on premium and effective skincare products. Retinol, with its proven benefits and growing reputation, is becoming a popular choice among these consumers, further driving market growth.

The rise of e-commerce and digital marketing has greatly facilitated the growth of the retinol beauty products market. Online platforms provide consumers with easy access to a wide range of retinol products, along with detailed information and reviews that help in making informed purchasing decisions. Additionally, targeted digital marketing campaigns and social media endorsements have significantly increased brand visibility and consumer engagement. This digital transformation in retail is enabling skincare brands to reach a global audience more effectively, thus amplifying the demand for retinol beauty products worldwide.

Advancements in skincare ingredients are playing a crucial role in boosting the demand for retinol beauty products worldwide. Innovations in ingredient technology have led to the development of more potent and stable formulations of retinol, addressing previous concerns such as skin irritation and sensitivity. These advancements have enhanced the efficacy of retinol products, making them more appealing to a broader range of consumers seeking effective solutions for skin aging and other concerns. For instance, in February 2023, Givaudan announced the introduction of RetiLife, a groundbreaking molecule for anti-aging, marking a significant advancement in the cosmetic industry. This innovative active ingredient represented the first 100% naturally sourced retinol, offering a sustainable alternative to chemically synthesized versions. Developed through advanced biotechnology, RetiLife was produced using microorganisms in a fermentation process from plant sugars. It was combined with natural antioxidants to ensure stability, even at high concentrations, providing comparable anti-wrinkle efficacy to synthetic retinol. RetiLife's introduction has the potential to significantly contribute to the growth of the market by meeting increasing consumer demand for sustainable and effective skincare solutions. Its natural sourcing and proven efficacy offer consumers a compelling choice in anti-aging skincare, aligning with growing preferences for environmentally friendly and ethical beauty products.

Social media platforms and celebrity endorsements play a crucial role in shaping beauty trends and consumer preferences. The endorsement of retinol-based products by influencers and celebrities amplifies their visibility and desirability, spurring demand. Dermatologists frequently recommend retinol for its effectiveness in skin rejuvenation and anti-aging. These professional endorsements lend credibility to retinol products, encouraging more consumers to incorporate them into their skincare routines. Enhanced retail infrastructure, including the proliferation of e-commerce platforms, has made retinol products more accessible to a global audience. Convenient access and the ability to compare and review products online are driving higher purchase rates.

Product Insights

Retinol creams and lotions accounted for a market share of 43.10% in 2023. The demand for retinol creams and lotions is experiencing robust growth, driven by a confluence of strategic factors. Foremost among these is the heightened consumer awareness of retinol’s efficacy in addressing various skin concerns, particularly signs of aging such as wrinkles, fine lines, and uneven skin tone. Retinol creams and lotions, being widely recognized for their potent anti-aging properties, have become essential components of many skincare regimens. This increased consumer knowledge and preference for scientifically proven ingredients are fueling the demand for these products.

The demand for retinol oils and serums is projected to grow at a CAGR of 7.1% from 2024 to 2030. One primary reason for this growth is the increasing popularity of lightweight and fast-absorbing formulations among consumers. Retinol oils and serums offer concentrated doses of retinol in lightweight textures that are easily absorbed into the skin, making them suitable for both daytime and nighttime use. This convenience factor appeals to modern consumers who prioritize effective skincare without the heaviness or greasiness associated with traditional creams. Furthermore, retinol oils and serums are favored for their targeted treatment benefits. These formulations often feature higher concentrations of retinol, allowing for more intensive treatment of specific skin concerns such as fine lines, wrinkles, and skin texture irregularities. The precise application and potent active ingredients make retinol oils and serums highly effective in delivering visible results, which contributes to their growing popularity among discerning skincare enthusiasts seeking advanced anti-aging solutions.

End Use Insights

The demand for retinol beauty products among women held a market share of 75.92% in 2023. Women are becoming more aware of the benefits of retinol, particularly its efficacy in addressing aging signs such as wrinkles, fine lines, and uneven skin tone. This heightened awareness is driving more informed and intentional purchasing decisions. The contemporary beauty landscape, heavily influenced by social media and celebrity endorsements, places significant emphasis on youthful, radiant skin. Retinol, known for its potent anti-aging properties, aligns well with these aesthetic preferences, prompting higher adoption among women seeking to maintain or enhance their appearance. Over 40% of women aged 30 and above have integrated retinol into their skincare routines for its anti-aging benefits. This substantial adoption rate is expected to significantly propel market growth, as it reflects a strong consumer preference for effective, anti-aging skincare solutions.

The men’s segment is anticipated to grow with a CAGR of 7.0% from 2024 to 2030. The demand for retinol cosmetics among men is anticipated to experience significant growth in the coming years driven by an increase in male consumer awareness regarding skincare and anti-aging benefits. Men are becoming more educated about the advantages of retinol, such as its effectiveness in reducing wrinkles, and fine lines, and improving overall skin texture. This growing awareness is translating into a higher propensity to invest in skincare products that offer tangible results. Societal perceptions of male grooming and skincare are evolving.

The stigma around men engaging in comprehensive skincare routines is diminishing, leading to greater acceptance and normalization of using advanced skincare products. Brands are launching retinol products that cater specifically to male skin, which tends to be thicker and more prone to oiliness. For instance, The Man Company, a prominent player in men's grooming, offers a 1% Retinol Anti-Aging Face Serum tailored for men. This product is crafted using natural ingredients such as Aloe Vera, Peony Root Extract, and Liquorice, aimed at diminishing wrinkles, and fine lines, and promoting an even skin tone. Enhanced product availability through both online and offline retail channels ensures that men have easier access to these tailored solutions.

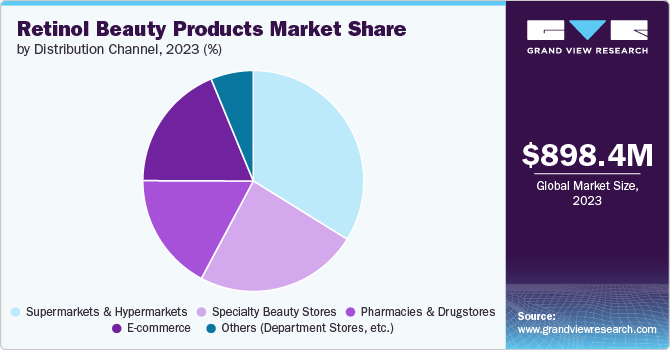

Distribution Channel Insights

Sales through supermarkets and hypermarkets accounted for a share of 33.84% in 2023. These retail outlets cater to a wide demographic of consumers who prioritize convenience and accessibility in their shopping experiences. By stocking retinol products on their shelves, supermarkets and hypermarkets make it easier for customers to incorporate these skincare solutions into their regular shopping routines without needing to visit specialized beauty stores. Moreover, supermarkets and hypermarkets often offer competitive pricing strategies and promotional activities, making retinol products more affordable and attractive to a broader audience. This pricing advantage encourages impulse purchases and repeat buys among consumers who are budget-conscious yet seeking effective skincare solutions.

The e-commerce segment is projected to grow at a CAGR of 7.6% over the forecast period of 2024 - 2030. The convenience and accessibility offered by online platforms resonate deeply with modern consumers. Shopping for retinol products online allows customers to browse a wide variety of brands and formulations from the comfort of their homes or on the go, without the constraints of physical store hours or locations. Digital platforms offer sophisticated targeting capabilities that allow companies to reach specific consumer segments based on demographics, interests, and purchasing behavior. Through targeted advertising campaigns, sponsored listings, and influencer partnerships, companies can effectively promote their products to relevant audiences, increasing visibility and driving sales. For instance, in December 2023, COSRX, renowned in skincare for its award-winning product lineup addressing acne, fine lines, and sensitive skin, launched The Retinol 0.3 Cream on Amazon. This new retinol cream is uniquely formulated to mitigate dryness concerns by integrating a specialized blend of ingredients that hydrate, soothe, and shield the skin. This makes it particularly suitable for individuals seeking effective anti-aging benefits without experiencing dryness, enhancing its appeal in the competitive skincare market.

Regional Insights

North America retinol beauty products market held a market share of 34.47% of the global revenue in 2023. The market dynamics are shaped by a growing emphasis on skincare as part of overall health and wellness routines, with consumers seeking advanced formulations that offer visible anti-aging benefits. In addition to traditional retail channels, e-commerce platforms play a pivotal role in driving market growth by offering convenience, product variety, and competitive pricing. The region’s diverse climate conditions also influence product preferences, with formulations tailored to address specific skincare needs ranging from dryness in northern regions to sun damage in sunnier climates.

U.S. Retinol Beauty Products Market Trends

The retinol beauty products market in the U.S. is expected to grow at a CAGR of 6.1% from 2024 to 2030. The skincare industry’s emphasis on preventive skincare routines has further bolstered demand, with retinol creams, serums, and oils becoming staple products in many beauty regimens. Moreover, the U.S. market benefits from a strong retail infrastructure and widespread availability of retinol products across online platforms and brick-and-mortar stores, catering to a diverse demographic ranging from millennials to aging baby boomers.

Asia Pacific Retinol Beauty Products Market Trends

The retinol beauty products market in Asia Pacific accounted for a revenue share of around 22.49% in 2023. Countries like South Korea and Japan, known for their advanced skincare innovations, are driving market innovation with new formulations that combine retinol with traditional skincare ingredients. The regional market is characterized by a strong preference for lightweight, non-greasy textures suitable for humid climates, alongside a rising demand for products addressing hyperpigmentation and uneven skin tone.

Europe Retinol Beauty Products Market Trends

The retinol beauty products market in Europe is projected to grow at a CAGR of 6.2% from 2024 to 2030. The European market's growth is further supported by innovative product formulations that cater to specific skin concerns, such as sensitive skin variants and enhanced anti-aging treatments. As consumer preferences continue to evolve toward personalized skincare solutions, retinol cosmetics remain poised for sustained growth across the diverse markets of Europe.

Key Retinol Beauty Products Company Insights

In the competitive matrix, several key factors shape the landscape and dynamics among industry players. Brand reputation and recognition play a critical role, with established names like Neutrogena, RoC, and Paula’s Choice leveraging their long-standing presence and trust among consumers. These brands often lead with extensive product lines that cater to various skin concerns and demographics, from sensitive skin formulations to advanced anti-aging treatments, bolstering their market positioning through comprehensive consumer education and dermatologist endorsements.

Additionally, strategic partnerships with retailers and digital platforms amplify market reach, facilitating targeted marketing campaigns and promotional activities that capitalize on shifting consumer preferences and market trends. As competition intensifies, companies are increasingly focusing on differentiation through unique value propositions, technological advancements, and strategic market expansion to maintain competitive advantage in the dynamic market.

Key Retinol Beauty Products Companies:

The following are the leading companies in the retinol beauty products market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson

- L'Oréal Group

- Procter & Gamble

- Unilever

- Estée Lauder Companies

- Shiseido Company, Limited

- Beiersdorf AG

- Amorepacific Corporation

- Kao Corporation

- Colgate-Palmolive Company

Recent Developments

-

In June 2024, Dermalogica, a global skincare brand, expanded its product portfolio in Israel by introducing a powerful new retinol serum designed to combat early signs of aging effectively. This treatment features a distinctive blend of 3.5% retinoids and advanced technology, targeting multiple layers of the skin at varying speeds to reduce common signs of aging. Additionally, it integrates potent moisturizers and soothing agents to mitigate irritation, nourish the skin, and enhance its natural protective barrier.

-

In April 2024, Re’equil, a prominent Indian beauty company, launched new 'RetinolCream' products featuring 0.3% and 0.5% concentrations of retinol. These formulations are specifically designed to enhance skin cell recovery and expand the company’s skincare portfolio. Aimed at improving skin smoothness, and texture, and preventing acne, these new products complement Re’equil’s existing 0.1% retinol formula. By offering a range of retinol concentrations, Re’equil aims to strengthen its position as India’s leading cosmeceutical brand. The products are now available on Re’equil’s direct-to-consumer e-commerce platform, with prices starting at Rs 450.

Retinol Beauty Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 945.3 million

Revenue forecast in 2030

USD 1.33 billion

Growth Rate

CAGR of 5.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Johnson & Johnson; L'Oréal Group; Procter & Gamble; Unilever; Estée Lauder Companies; Shiseido Company, Limited; Beiersdorf AG; Amorepacific Corporation; Kao Corporation; and Colgate-Palmolive Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retinol Beauty Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global retinol beauty products market report on the basis of product, end use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Creams and Lotions

-

Oils and Serums

-

Gels

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets and Hypermarkets

-

Specialty Beauty Stores

-

Pharmacies and Drugstores

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global retinol beauty products market was estimated at USD 898.4 million in 2023 and is expected to reach USD 945.3 million in 2024.

b. The global retinol beauty products market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 1.33 billion by 2030.

b. North America dominated the retinol beauty products market with a share of over 34.47% in 2023. The regional market dynamics are shaped by a growing emphasis on skincare as part of overall health and wellness routines, with consumers seeking advanced formulations that offer visible anti-aging benefits.

b. Some of the key players operating in the retinol beauty products market include Johnson & Johnson; L'Oréal Group; Procter & Gamble; Unilever; Estée Lauder Companies; Shiseido Company, Limited; Beiersdorf AG; Amorepacific Corporation; Kao Corporation; and Colgate-Palmolive Company.

b. Key factors that are driving the retinol beauty products market growth are increasing consumer awareness and understanding of retinol’s efficacy in skincare, rising demand for beauty products that improve skin texture and boost collagen production, and a growing trend towards preventive skincare.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."