Retinal Laser Photocoagulation Market Size, Share & Trends Analysis Report By Laser Type (Diode Laser, Green Laser), By Indication (Proliferative Diabetic Retinopathy), By Modality, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-349-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

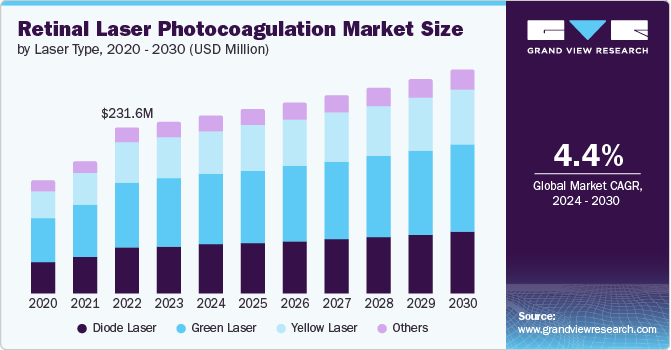

The retinal laser photocoagulation market size was estimated at USD 240.3 million in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. The market growth is driven by the rising prevalence of retinal disorders, such as diabetic retinopathy (DR), age-related macular degeneration (AMD), and retinal vein occlusion, necessitating effective treatment methods. The market growth is also fueled by the increasing emphasis on regular eye examinations and early detection of these conditions, leading to a higher demand for retinal laser photocoagulation procedures.

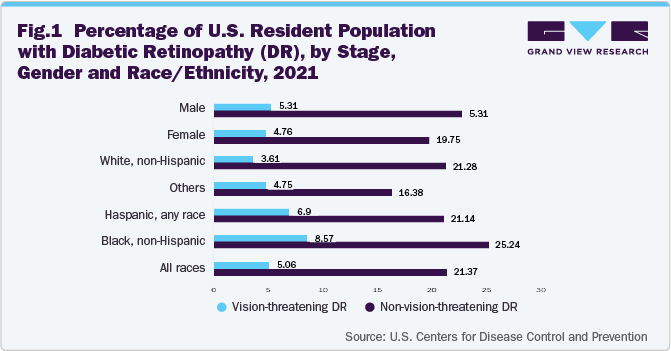

The rising prevalence of retinal diseases and the trend of minimally invasive treatments are driving industry growth. According to a 2021 study in JAMA Ophthalmology, 9.60 million people in the U.S. with diabetes, or 26.43% of the diabetic population, had DR, while 1.84 million people, or 5.06%, had vision-threatening diabetic retinopathy (VTDR). These figures underscore the profound impact of diabetes on eye health, highlighting the necessity for continued research and intervention strategies to manage DR and VTDR.

Increased awareness and early detection by focusing on screening & treating eye conditions early helps identify potential cases of retinal diseases at an earlier stage. Early detection is crucial for managing conditions like DR effectively, often through retinal laser photocoagulation. For instance, in December 2023, the International Centre for Eye Health (ICEH), along with Clinton Health Access Initiative, VisionSpring, and RestoringVision, received a total of around 5,98,443 USD from the Vision Catalyst Fund (VCF) to enhance eye health services in lower- and middle-income countries. This funding supports innovative projects, such as training primary health workers in Tanzania to treat childhood eye conditions, aiming to screen and treat thousands of children annually. The VCF, backed by an investment product developed with P1 Capital, seeks to expand its grants as investments grow, potentially impacting millions of children globally.

In addition, in October 2023, Prevent Blindness joined IAPB and other eye health organizations worldwide to highlight "Love Your Eyes at Work" during World Sight Day, emphasizing the importance of workplace eye protection. A report by the International Labour Organization and IAPB revealed that over 13 million people have work-related vision impairment, with 3.5 million annual workplace eye injuries. Despite 79% of U.S. civilian employees with access to vision care participating, only 28% had such plans available, highlighting disparities among wage levels and establishment sizes. Prevent Blindness called for employers, insurers, and policymakers to prioritize eye health, promoting expanded vision care access to boost worker productivity and economic well-being.

Technological advancements are significantly driving the market growth by introducing innovative lasers that offer multiple treatment modes, including continuous-wave and MicroPulse technology. These advancements enhance the precision & effectiveness of treatments and cater to the evolving needs of clinicians & patients. For instance, in January 2024, Iridex Corporation launched its next-gen Iridex 532 and Iridex 577 Lasers in the U.S. These lasers offer advanced treatment modes, including MicroPulse technology and an intuitive interface for optimized retinal disorder and glaucoma treatments. These advancements drive market growth by offering more precise, flexible, and effective treatments for retinal disorders and glaucoma, ultimately improving patient outcomes and experiences.

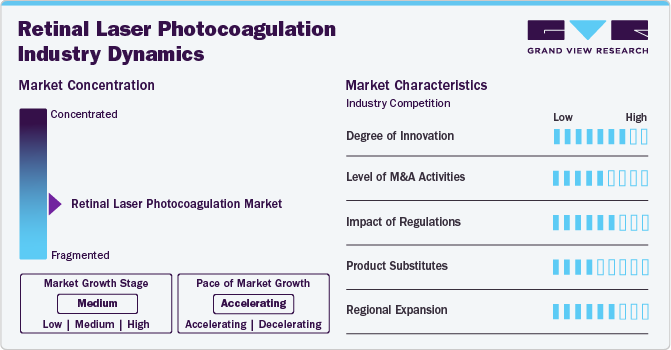

Market Concentration & Characteristics

The retinal laser photocoagulation market is characterized by steady growth, driven by technological advancements, artificial intelligence (AI) integration, and the adoption of telemedicine. The market is influenced by the rising prevalence of retinal disorders, favorable reimbursement policies, and the integration of imaging systems, such as OCT. Challenges include the high cost of specialized equipment and managing potential risks. Opportunities lie in combination therapies, patient-centered care, and remote diagnosis through telemedicine, especially in emerging regions such as China and South Korea.

The degree of innovation within the market is moderate, focusing on enhancing treatment efficacy, minimizing costs, and improving patient outcomes. Challenges, such as the high expense of specialized equipment and the need to mitigate potential risks, drive continuous R&D efforts, showing the development of safer and more effective solutions

Regulations significantly affect the market, influencing its growth and accessibility. Favorable reimbursement policies and insurance coverage across various countries have made the procedure more affordable, driving market expansion. However, the high cost of specialized equipment remains a challenge, particularly in regions with limited healthcare resources. In addition, regulations around safety and potential risks associated with the procedure necessitate careful consideration and management, affecting both healthcare professional and patient decision-making processes

The level of mergers and acquisitions (M&A) activity in the market is moderate, with strategic alliances and partnerships playing a significant role in shaping the industry landscape. These activities are aimed at enhancing product portfolios, expanding geographical reach, and integrating cutting-edge technologies to improve treatment outcomes. For instance, in June 2022, Norlase announced its first distributor partnerships in Latin America for its innovative laser systems, LEAF and LION, marking a significant expansion. These portable, next-gen lasers are designed for ease of use with features like voice control and wireless operation. Already adopted by leading ophthalmic institutions worldwide, Norlase aims to bring these advanced technologies to ophthalmologists across Argentina, Uruguay, Brazil, and beyond, enhancing patient care and practice efficiency

A substitute for retinal laser photocoagulation in the treatment of DR and macular edema is anti-vascular endothelial growth factor (VEGF) therapy. This pharmacological approach inhibits the growth of new blood vessels and leakage from existing ones, effectively reducing the severity of retinal damage. Anti-VEGF drugs, such as ranibizumab (Lucentis), bevacizumab (Avastin), and aflibercept (Eylea), have shown positive results in managing diabetic macular edema and are considered a viable alternative to laser treatment due to their ability to preserve vision and potentially improve visual acuity without the need for invasive procedures

The industry is expanding regionally due to rising global demand. Manufacturers are expanding their presence in emerging markets to meet growing needs for vision correction solutions. For instance, in December 2022, Norlase expanded its global distribution network, bringing its innovative ophthalmic lasers—LEAF, LION, and ECHO—to new markets including the Americas, Asia Pacific, Europe, and the Middle East. This move aims to increase access to Norlase's portable laser solutions, enhancing practice efficiency for ophthalmologists worldwide. The expansion includes countries, such as Ecuador, Bangladesh, Nepal, Pakistan, Israel, Sweden, and Switzerland, supported by regional directors and distribution partners committed to advancing ophthalmic care

Laser Type Insights

The green lasers segment accounted for the largest market share of 44.3% in 2023 due to their high absorption by hemoglobin and melanin, ensuring precise targeting of retinal tissue. This precision is crucial for effectively treating conditions like DR and retinal vein occlusions. The green wavelength (typically 532 nm) minimizes collateral damage to surrounding tissues, enhancing safety and efficacy. In addition, green lasers are versatile and suitable for both pan-retinal photocoagulation and focal/grid treatments. Their widespread adoption in ophthalmology is bolstered by robust clinical evidence supporting their effectiveness, leading to significant market revenue and continued preference among retinal specialists.

The yellow lasers segment is expected to register the fastest CAGR from 2024 to 2030. Yellow lasers, specifically in the subthreshold range, have gained attention for treating retinal diseases. Subthreshold laser treatment refers to the application of laser energy below the threshold for tissue damage, aiming to achieve therapeutic outcomes without causing visible scarring or structural changes to the retina. This approach allows for targeted treatment of various retinal conditions with minimal side effects. Using subthreshold yellow laser treatment, clinicians can target the choroidal neovascularization (CNV) associated with AMD without causing thermal damage to surrounding healthy tissues. This method has shown promise in stabilizing vision and even improving visual acuity in some cases, making it a valuable tool in managing AMD.

Indication Insights

The proliferative diabetic retinopathy (PDR) segment accounted for the largest share of 29.7% in 2023. Laser photocoagulation, particularly pan-retinal photocoagulation (PRP), is highly effective in reducing the risk of severe vision loss by targeting and sealing abnormal blood vessels, thus preventing further neovascularization and hemorrhage. The procedure's proven efficacy, combined with its ability to stabilize the disease and prevent progression, makes it an essential intervention in managing PDR. This demand propels growth and innovation within this market segment, ensuring sustained clinical importance.

The retinal lasers segment is expected to register the fastest CAGR from 2024 to 2030. By creating precise laser burns around the tear, the treatment promotes the formation of adhesive scar tissue, securing the retina in place. This minimally invasive approach is favored for its rapid recovery time and high success rates in preventing further retinal complications. The growing incidence of retinal tears, coupled with advancements in laser technology, supports the segment's expansion. Its ability to preserve vision and reduce the need for more invasive surgeries underscores its importance in ophthalmic care.

Modality Insights

The fixed modality segment accounted for the largest share of 71.8% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030.The precision offered by fixed systems ensures consistent and effective treatment outcomes, addressing the critical need for accurate targeting of retinal abnormalities. In addition, the fixed modality's ability to leverage real-time feedback and adjust treatments accordingly provides a level of care that is difficult to match with mobile solutions.

This combination of precision, reliability, and adaptability solidified the fixed modality's position as the leading treatment approach despite its inherent challenges, such as limited accessibility for patients in remote areas and high costs associated with establishing & maintaining facilities. Fixed modality's benefits, in terms of controlled environments and advanced technological capabilities, outweighed these drawbacks.

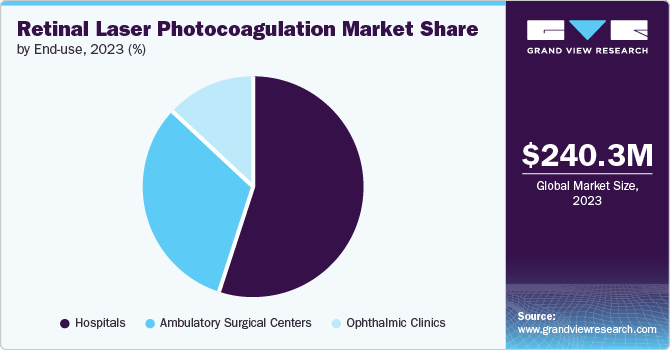

End-use Insights

The hospitals segment accounted for the largest market share of 54.7% in 2023. Hospitals are equipped with state-of-the-art laser systems and specialized staff, ensuring high-quality, safe, and effective treatments for various retinal conditions, including DR and retinal tears. The centralized nature of hospitals allows for comprehensive patient care, including diagnosis, treatment, and follow-up. As the prevalence of retinal disorders rises, hospitals play a crucial role in delivering timely interventions, fostering market growth through increased procedure volumes and continual adoption of cutting-edge laser technologies.

The ambulatory surgical centers (ASCs) segment is expected to register the fastest CAGR from 2024 to 2030. ASCs provide specialized care with shorter wait times and lower costs than traditional hospital settings, making them an attractive option for patients and providers. Equipped with advanced laser technologies, these centers offer high-quality treatment for retinal conditions, such as DR and retinal tears. Their ability to deliver outpatient care with minimal disruption to patients' lives contributes to their growing popularity and market share, driving the expansion of retinal laser photocoagulation services in these settings.

Regional Insights

The retinal laser photocoagulation market in North America dominated the global industry in 2023 and accounted for the largest revenue share of over 32.94% in 2023 and is experiencing growth, fueled by a rise in retinal disease cases, technological advancements, a shift toward minimally invasive treatments, and an increasing geriatric population in the region. Innovations in laser technology and the integration of AI in diagnostics and treatment planning are key drivers.

U.S. Retinal Laser Photocoagulation Market Trends

The U.S. retinal laser photocoagulation market is witnessing robust growth, propelled by an aging population prone to AMD and DR, technological advancements in laser systems, and the integration of AI for enhanced diagnostic accuracy and treatment planning.

Europe Retinal Laser Photocoagulation Market Trends

The retinal laser photocoagulation market in Europe is poised for growth, driven by the increasing prevalence of retinal disorders, technological advancements, and the integration of AI in the region. The market is also influenced by the growing emphasis on telemedicine, combination therapies, and favorable reimbursement policies in many countries.

The UK retinal laser photocoagulation market trends show growth, driven by the increasing incidence of retinal diseases, technological advancements, and the adoption of AI for diagnosis and treatment. The market is also influenced by the push towards personalized medicine, the integration of telemedicine for remote patient care, and the need for minimally invasive treatments.

The retinal laser photocoagulation market in France trends reflect growth, spurred by the rising prevalence of retinal disorders, technological advancements, and the integration of AI for enhanced diagnostics and treatment planning.

The Germanyretinal laser photocoagulation market indicates growth fueled by the increasing incidence of retinal diseases, technological progress, and the application of AI in diagnostics and treatment. The country's robust healthcare infrastructure, investment in R&D, and the demand for precise and minimally invasive treatments augment the market growth.

Asia Pacific Retinal Laser Photocoagulation Market Trends

The retinal laser photocoagulation market in Asia Pacific trends show promising growth, driven by the region's high prevalence of retinal diseases, especially in aging populations. Technological advancements, the integration of AI for enhanced diagnostics, and the demand for minimally invasive treatments are key drivers. Government initiatives promoting healthcare innovation and the increasing accessibility of eye care facilities contribute to market expansion.

The Japan retinal laser photocoagulation market is set to grow, driven by the rising prevalence of retinal disorders, technological advancements, and the integration of AI for enhanced diagnostics. The market is supported by navigated laser technology, which enhances treatment accuracy, and favorable reimbursement policies, making procedures more accessible to patients.

The retinal laser photocoagulation market in China is experiencing growth, propelled by the increasing prevalence of retinal diseases, particularly among the aging population. In addition, technological advancements and government initiatives supporting healthcare innovation help drive market growth. The market is also influenced by the demand for minimally invasive treatments and the expansion of healthcare facilities across the country.

The India retinal laser photocoagulation market trends indicate growth, driven by the rising prevalence of retinal disorders, and technological advancements. Government initiatives supporting healthcare innovation and the demand for minimally invasive treatments are key drivers, contributing to market expansion.

Latin America Laser Photocoagulation Trends

The retinal laser photocoagulation market in Latin America is experiencing robust growth, driven by technological innovations and the increasing prevalence of retinal diseases. Government investments in healthcare infrastructure and the demand for advanced, minimally invasive treatments are key drivers, contributing to market expansion.

Middle East & Africa Retinal Laser Photocoagulation Market Trends

The Middle East & Africa retinal laser photocoagulation market is experiencing growth driven by factors, such as the aging population, increasing prevalence of eye diseases, such as diabetic retinopathy and AMD, and advancements in technology leading to improved treatment outcomes. The prevalence of these conditions is notably high in the region, contributing significantly to the demand for retinal laser photocoagulation treatments. In addition, the rise in healthcare expenditure and government initiatives aimed at improving eye care services further stimulate market growth.

The retinal laser photocoagulation market in Saudi Arabia is influenced by an aging population, increased incidence of eye diseases, technological advancements, and rising healthcare spending. These factors drive demand for treatments, including retinal laser photocoagulation, to manage conditions, such as DR and AMD effectively.

The Kuwait retinal laser photocoagulation market growthis driven by an aging demographic, higher rates of eye diseases, technological innovation, and increased healthcare investments. These elements contribute to a growing need for advanced treatments, such as retinal laser photocoagulation, to address conditions, such as DR and AMD.

Key Retinal Laser Photocoagulation Company Insights

The global market is highly competitive, with key players, such as Alcon, Inc., Carl Zeiss, Quantel Medical, Lumenis, and IRIDEX Corporation, holding significant positions. The major companies are undertaking various organic as well as inorganic strategies, such as new product development, collaborations, acquisitions, mergers, and regional expansion, to serve the unmet needs of their customers. Nidek Co., Ltd. And Topcon Corp. among others are some of the emerging market participants. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Retinal Laser Photocoagulation Companies:

The following are the leading companies in the retinal laser photocoagulation market. These companies collectively hold the largest market share and dictate industry trends.

- Alcon, Inc.

- Carl Zeiss

- Quantel Medical

- Lumenis

- IRIDEX Corporation

- NIDEK CO., LTD.

- TOPCON CORPORATION

- Bausch & Lomb Incorporated

- Meridian Medical Group

Recent Developments

-

In May 2023, Norlase announced FDA 510(k) clearance and CE Mark approval for its ECHO Green Pattern Laser photocoagulator, a portable scanning laser photocoagulator using MEMS technology

-

In May 2023,Norlase secured USD 11 million in funding from West Hill Capital, marking its largest investment round. This capital infusion follows the FDA clearance and CE mark approval of the ECHO pattern laser, enabling Norlase to scale up production and meet global demand amid a surge in ophthalmological needs. The funding supports Norlase's expansion plans and continued R&D efforts to innovate laser treatment solutions for retina and glaucoma diseases

-

In July 2023, Alkem Laboratories, an Indian pharmaceutical company, ventured into the ophthalmology market with the launch of a range of retinal laser photocoagulation products, marking its first foray into this field

-

In February 2023, Meridian AG's Merilas product family and MR Q series received FDA approval, highlighting their safety and efficacy in treating retinal disorders and glaucoma

Retinal Laser Photocoagulation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 249.7 million |

|

Revenue forecast in 2030 |

USD 322.7 million |

|

Growth rate |

CAGR of 4.4% from 2024 to 2030 |

|

Actual Data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Laser type, indication, modality, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Alcon, Inc.; Carl Zeiss; Quantel Medical; Lumenis; Iridex Corp.; Nidek Co., Ltd.; Topcon Corp.; Bausch & Lomb Inc.; Meridian Medical Group |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Retinal Laser Photocoagulation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the retinal laser photocoagulation market report on the basis of laser type, indication, modality, end-use, and region:

-

Laser Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diode Laser

-

Green Laser

-

Yellow Laser

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Proliferative Diabetic Retinopathy (PDR)

-

Diabetic Macular Edema

-

Retinal Vein Occlusion

-

Retinal Tears

-

Others

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed

-

Mobile

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Ophthalmic Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global retinal laser photocoagulation market size was estimated at USD 240.3 million in 2023 and is expected to reach USD 249.7 million in 2024.

b. The global retinal laser photocoagulation market is expected to grow at a compound annual growth rate of 4.37% from 2024 to 2030 to reach USD 322.7 million by 2030.

b. Green laser held the largest market share of 44.3% in 2023 owing to high demand, preference and usage across the globe.

b. Major market players included in the retinal laser photocoagulation market are Alcon, Inc., Carl Zeiss, Quantel Medical, Lumenis, IRIDEX Corporation, NIDEK CO., LTD., TOPCON CORPORATION, Bausch & Lomb Incorporated, Meridian Medical Group

b. Key factors that are driving growth are rising prevalence of retinal disorders such as diabetic retinopathy, age-related macular degeneration, and retinal vein occlusion, which necessitate effective treatment methods.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."