- Home

- »

- Medical Devices

- »

-

Retinal Detachment Diagnostic Market Size Report, 2030GVR Report cover

![Retinal Detachment Diagnostic Market Size, Share & Trends Report]()

Retinal Detachment Diagnostic Market Size, Share & Trends Analysis Report, By Disease Type (Tractional Retinal Detachment, Rhegmatogenous Retinal Detachment), By Diagnostics (Fundus Photography, Ophthalmoscopy), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-193-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

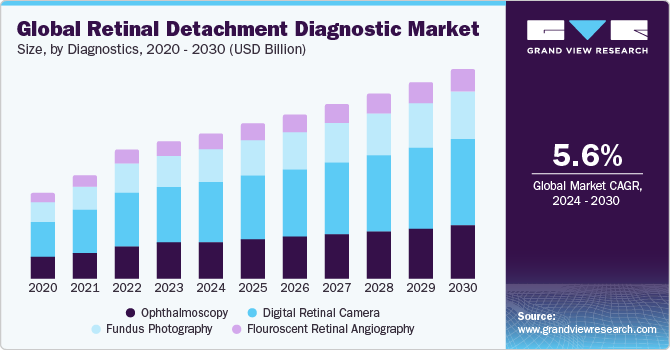

The global retinal detachment diagnostic market size is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2030. The increasing number of cataract surgeries, the rising geriatric population, and the increasing prevalence of myopia are major factors anticipated to foster market growth. In addition, government initiatives to improve public health and awareness is estimated to contribute towards the overall market growth.

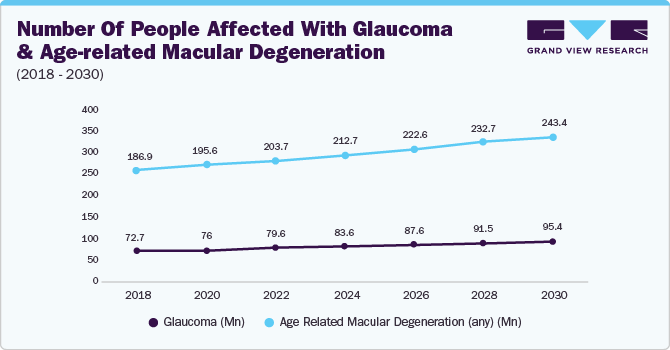

Currently, retinal implants are approved for treating RP and end-stage AMD. According to LambdaVision article, published in November 2020, retinitis pigmentosa (RP) affects nearly 100,000 people in the U.S. and roughly 1.5 million individuals worldwide. Moreover, age-related macular degeneration (AMD), has been quoted as being the prominent cause of legal blindness and irreversible vision loss in people over 55 years of age and affects nearly 30 million individuals worldwide.

As per the article released by Cleveland Clinic, in May 2022, one in every 4,000 people in the U.S. and Europe and 2 million individuals globally were diagnosed with retinitis pigmentosa (RP). In addition, according to the International Agency for the Prevention of Blindness (IAPB), in 2020, approximately 55 million individuals with vision loss in Middle East and North America, and out of these, around 3 million individuals were blind.

Favorable regulatory environments and incentives for research and development encourage companies to invest in retinal detachment solutions.Collaboration between healthcare providers, pharmaceutical companies, and medical device manufacturers is driving research and development efforts in the field.Growing investment in ophthalmic research and development is leading to the development of new therapies and devices for retinal detachment treatment.

Diagnostics Insights

Based on the diagnostics, the market is segmented into ophthalmoscopy, digital retinal camera, fundus photography, and flouroscent retinal angiography. The digital retinal camera segment held the largest market share in 2023. The prevalence of eye diseases such as diabetic retinopathy, age-related macular degeneration (AMD), glaucoma, and retinal detachment is on the rise globally. Digital retinal cameras play a crucial role in early diagnosis and monitoring of these conditions.

Disease Type Insights

Based on disease type, the market is segmented into exudative serous or secondary retinal detachment, tractional retinal detachment and rhegmatogenous retinal detachment. The rhegmatogenous retinal detachment segment is expected to grow at the fastest CAGR during the forecast period. As individuals age, the risk of RRD increases. This is due to natural changes in the vitreous gel and retina, making them more susceptible to tearing or detachment. People with myopia have elongated eyeballs, which can lead to thinner retinas. Thin retinas are more prone to developing tears, thereby increasing the risk of retinal detachment diagnostic in myopic individuals. In addition, several eye surgeries, such as cataract surgery or previous retinal detachment repair, can increase the risk of RRD.

Regional Insights

In 2023, North America dominated the market in terms of revenue owing to the high prevalence of degenerative conditions and technological advancements. In addition, rise in the number of AMD cases in the U.S. is also expected to boost regional expansion. The growing collective efforts of key players to improve their product portfolios and ensure high-quality standards are expected to boost the regional market growth.

Diabetic patients are at an elevated risk of developing retinal detachment, so the rising prevalence of diabetes has driven the need for more frequent retinal examinations.Rising healthcare expenditure in North America has improved access to diagnostic services, including retinal examinations. This has led to more individuals seeking evaluation for retinal detachment.

Competitive Insights

Key players operating in the market are Essilor International S.A., HealPros LLC, Millennium Surgical Corp, ONL Therapeutics, Peek Vision Ltd, Synergy Medical, Canon Medical Systems Corporation, Carl Zeiss, Eyenuk Inc., Centervue SpA. Key players are launching new products and acquiring smaller companies to expand their product portfolios and gain access to new technologies.

-

In April 2022, Carl Zeiss Meditec announced the acquisition of Katalyst Surgical LLC and Kogent Surgical LLC, both surgical instruments manufacturers) to improve its position as a solution provider.

-

In March 2022, Topcon Corporation announced opening a new office in India to expand its sales and marketing operations in the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."