- Home

- »

- Next Generation Technologies

- »

-

Retail Banking Market Size And Share, Industry Report, 2033GVR Report cover

![Retail Banking Market Size, Share & Trends Report]()

Retail Banking Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Public Sector Banks, Private Sector Banks, Foreign Banks, Community Development Banks), By Service (Saving & Checking Account, Transactional Account), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-074-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Retail Banking Market Summary

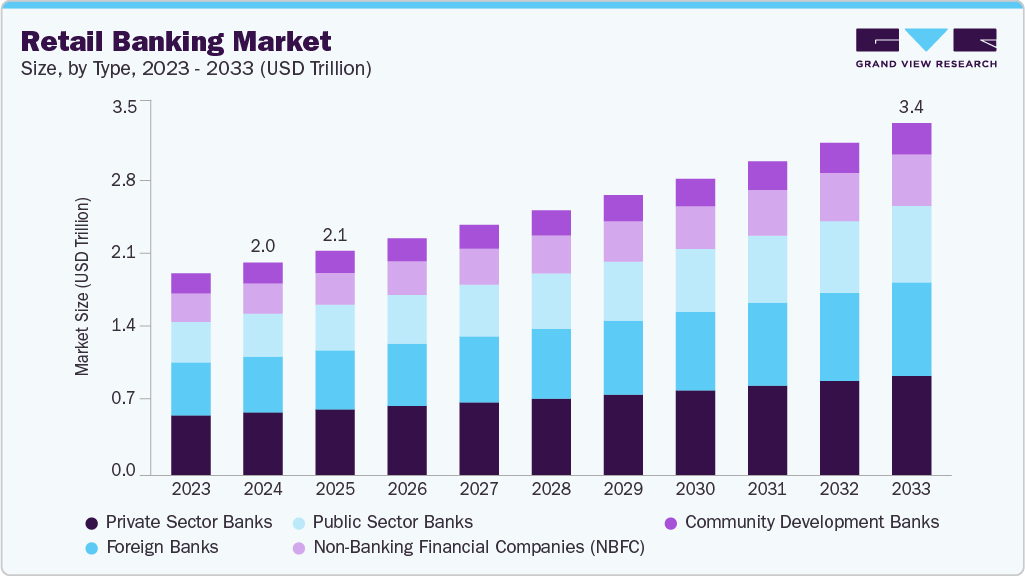

The global retail banking market size was estimated at USD 2,039.25 billion in 2024, and is projected to reach USD 3,373.43 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The growth is driven by rapid technological advancements shaping the market’s dynamics and growth potential. The progress in digital technologies has transformed the way customers interact with banks.

Key Market Trends & Insights

- Asia Pacific retail banking market accounted for a 33.7% share of the overall market in 2024.

- The retail banking industry in China held a dominant position in 2024.

- By type, the private sector banks segment accounted for the largest share of 29.7% in 2024.

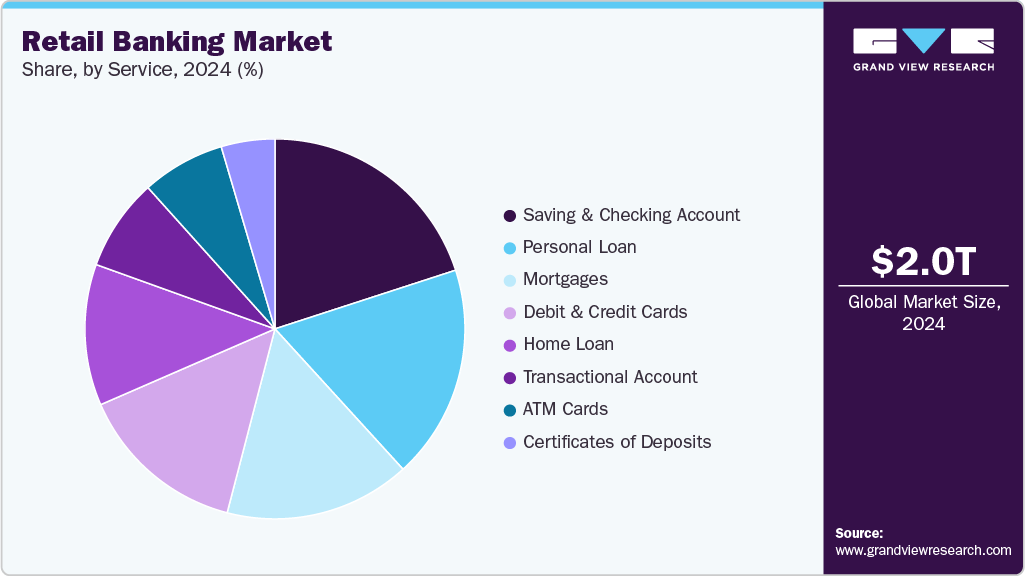

- By service, the saving and checking account segment held the largest market share in 2024.

- By end use, the residential segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,039.25 Billion

- 2033 Projected Market Size: USD 3,373.43 Billion

- CAGR (2025-2033): 5.8%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest Market

The rise of online and mobile banking has made banking services more accessible and convenient for customers, allowing them to conduct transactions, check balances, and access a wide range of services at their fingertips. Another significant driver is changing customer expectations. Customers nowadays expect personalized and tailored banking experiences. They demand seamless integration across various channels, including online, mobile, and physical branches. Banks that can adapt and provide a superior customer experience through personalized services, innovative products, and efficient processes are likely to thrive in the competitive market. Moreover, demographic shifts are impacting the retail banking industry. The growing middle class in emerging economies creates new opportunities for banks to create customer’s banking requirements.

In addition, competition within the retail banking sector is intensifying. Traditional banks face competition from fintech startups and technology players entering the financial services space. These new players leverage technological innovations, such as deep learning and blockchain, to offer disruptive products and services. Traditional banks are focusing on embracing digital transformation, collaborating with fintech firms, or developing innovative solutions to stay competitive.

Regulatory changes also play a crucial role in shaping the retail banking landscape. Governments and regulatory bodies worldwide impose strict regulations to enhance consumer protection, ensure financial stability, and promote fair practices in the banking industry. Compliance with these regulations requires banks to invest in robust risk management systems, data protection measures, and regulatory reporting capabilities. Moreover, transparency, security, and ethical practices can gain a competitive advantage for the market players and foster long-term customer relationships, driving the market growth further.

However, the market growth is obstructed by the threat of increasing cybersecurity risks. As digitalization expands, banks face a growing number of cyber threats, including data breaches, identity theft, and fraudulent activities. These risks not only harm the customers but also damage the reputation of the banks. To overcome this challenge, banks need to prioritize cybersecurity measures and invest in robust systems to protect customer data. Implementing multi-factor authentication, encryption techniques, and continuous monitoring can help mitigate risks.

Type Insights

The private sector banks segment held the largest share of 29.5% in 2024. The private sector banks have leveraged their agility and flexibility to adapt to changing market conditions and customer preferences. Unlike public sector banks, they are not burdened by bureaucratic processes and enjoy greater autonomy in decision-making, enabling them to respond swiftly to market demands and introduce innovative products and services. Moreover, private sector banks have been successful in creating a customer-centric approach. They prioritize delivering a superior customer experience by offering personalized services, convenient banking channels, and quick turnaround times.

The public sector banks segment is anticipated to register the fastest growth over the forecast period. The public sector banks enjoy a vast network and presence across various regions, including rural and semi-urban areas. This extensive branch network enables them to tap into a large customer base and reach underserved markets, contributing to their growth. Moreover, public sector banks often prioritize financial inclusion and social objectives. They are committed to serving the unbanked and underprivileged sections of society, promoting inclusive banking practices. By offering affordable and accessible banking services, such as basic savings accounts and government welfare schemes, public sector banks are expanding their customer base and deepening their penetration in previously untapped segments.

Service Insights

The saving and checking account segment held the largest market in 2024. Saving and checking accounts are the foundation of personal banking. They provide customers with a secure place to deposit and manage their funds, making them essential for everyday financial transactions and savings goals. As a result, the demand for saving and checking accounts remains consistently high among individuals and businesses. Moreover, saving and checking accounts offer liquidity and accessibility. Customers can easily deposit and withdraw funds as needed, making them highly convenient for day-to-day financial activities. The ability to access funds through ATMs, online banking, and mobile apps has further enhanced the appeal and popularity of these accounts.

The debit and credit cards segment is anticipated to register the fastest growth over the forecast period. Debit and credit cards offer convenience and flexibility in making transactions. They eliminate the need for carrying cash, allowing customers to make purchases easily and securely. The widespread acceptance of debit and credit cards by merchants and the integration of contactless payment technology have further propelled the growth of this segment. Moreover, debit and credit cards provide users with various benefits and rewards programs. Banks offer cashback, loyalty points, airline miles, and other incentives to encourage card usage. These rewards attract customers and incentivize them to choose cards as their preferred payment method, driving the growth of this segment.

Regional Insights

The retail banking industry in North America is mature, yet evolving rapidly with a strong emphasis on customer experience, personalization, and technology integration. Banks across the region are focusing on omnichannel strategies and leveraging data analytics to enhance product offerings and improve customer retention. Regulatory compliance, cybersecurity, and ESG (environmental, social, and governance) initiatives are also key areas shaping strategic decisions in the region’s retail banking landscape.

U.S. Retail Banking Market Trends

The retail banking industry In the U.S. remains highly competitive with a mix of large national banks, regional players, and digital-first challengers. Consumer preferences are shifting towards mobile-first banking, prompting traditional institutions to accelerate their digital transformation efforts. In addition, rising interest rates, tightening credit conditions, and changing regulatory dynamics are influencing banks’ lending strategies, fee structures, and overall customer engagement models.

Asia Pacific Retail Banking Market Trends

Asia Pacific retail banking industry dominated globally with a revenue share of 33.7% in 2024. The region has a large and rapidly growing population, with a rising middle class and increasing disposable income. This demographic trend has led to a higher demand for banking services, including savings accounts, loans, and investment products. Moreover, the region has experienced significant economic growth and urbanization, leading to the expansion of businesses and increased financial activity. As a result, there is a greater need for banking services to support commercial and personal transactions.

The retail banking industry in China is undergoing rapid digital transformation, driven by widespread adoption of mobile banking and fintech innovation. Major state-owned and commercial banks are investing heavily in AI, big data, and cloud infrastructure to streamline customer onboarding and improve cross-selling. The market is also witnessing intensifying competition from digital-only banks and tech giants like Ant Group and Tencent, which continue to expand their financial services portfolios.

Middle East & Africa Retail Banking Market Trends

Middle East & Africa retail banking industry is expected to emerge as the fastest-growing market over the forecast period. The region has a large and rapidly expanding population, with a significant portion of the population being young and tech-savvy. This demographic dividend presents a tremendous growth opportunity for retail banking, as these individuals seek convenient and accessible banking solutions to meet their financial needs. Moreover, there is a growing emphasis on financial inclusion in the MEA region. Governments and regulatory authorities are actively promoting initiatives to improve access to banking services for underserved populations, including those in rural areas and low-income segments. This focus on financial inclusion is driving the adoption of retail banking and contributing to the region's rapid growth.

Key Retail Banking Company Insights

Some of the key companies in the retail banking industry include BNP Paribas, Citigroup, Inc., and JPMorgan Chase & Co., among others. In the competitive landscape of the retail banking industry, various players employ different strategies to gain market share and establish a competitive edge. Traditional banks strive to enhance their digital capabilities and customer-centric approach. They invest in technology infrastructure, develop user-friendly mobile apps and online platforms, and offer personalized services to provide a seamless and convenient banking experience. By adapting to changing customer preferences and embracing digital transformation, traditional banks aim to retain existing customers and attract new ones.

-

BNP Paribas operates a comprehensive retail banking portfolio primarily across Europe, with strong positions in France, Italy (through BNL), Belgium, and Luxembourg. The bank provides a full suite of retail financial services, including personal banking, mortgages, consumer credit, insurance, and wealth management. Its retail strategy emphasizes digital transformation, sustainable finance, and cross-selling across its universal banking model.

-

Citigroup’s retail banking portfolio is focused on select high-growth and high-margin markets, following its strategic exit from consumer banking operations in multiple international locations. The bank now concentrates retail operations primarily in the U.S., where it offers credit cards, checking and savings accounts, personal loans, and wealth management services through Citi-branded branches and digital channels.

Key Retail Banking Companies:

The following are the leading companies in the retail banking market. These companies collectively hold the largest market share and dictate industry trends.

- BNP Paribas

- Citigroup, Inc.

- HSBC Group

- ICBC

- JP Morgan Chase & Co.

- Bank of America Corporation

- Barclays

- China Construction Bank

- Deutsche Bank AG

- Mitsubishi UFJ Financial Group, Inc.

- Wells Fargo

Recent Developments

-

In February 2024, Barclays acquired the retail banking operations of Tesco Bank from UK supermarket giant Tesco in a transaction valued at £600 million. Under the terms of the agreement, Barclays will assume control of Tesco Bank’s portfolio comprising personal loans, credit cards, customer savings, and deposit accounts. In addition, the two companies have entered into a long-term exclusive partnership, enabling Barclays to offer a suite of Tesco-branded financial products, including credit cards, personal loans, and savings solutions.

-

In April 2023, Regions Bank, a bank based in the U.S., partnered with Temenos to upgrade and modernize its core banking services. Regions Bank aims to enhance its customer experiences and provide personalized banking products and services through this collaboration. The partnership will play a crucial role in assisting individuals and businesses in accomplishing their financial objectives.

Retail Banking Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,150.56 billion

Revenue forecast in 2033

USD 3,373.43 billion

Growth rate

CAGR of 5.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

BNP Paribas; Citigroup, Inc.; HSBC Group; ICBC; JP Morgan Chase & Co.; Bank of America Corporation; Barclays; China Construction Bank; Deutsche Bank AG; Mitsubishi UFJ Financial Group, Inc.; Wells Fargo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retail Banking Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest Industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global retail banking market report based on type, service, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Public Sector Banks

-

Private Sector Banks

-

Foreign Banks

-

Community Development Banks

-

Non-banking Financial Companies (NBFC)

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Saving and Checking Account

-

Transactional Account

-

Personal Loan

-

Home Loan

-

Mortgages

-

Debit and Credit Cards

-

ATM Cards

-

Certificates of Deposits

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global retail banking market size was estimated at USD 2,039.25 billion in 2024 and is expected to reach USD 2,150.56 billion in 2023.

b. The global retail banking market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 3,373.43 billion by 2033.

b. Asia Pacific dominated the retail banking market with a share of 33.7% in 2024. The region has a large and rapidly growing population, with a rising middle class and increasing disposable income. This demographic trend has led to a higher demand for banking services, including savings accounts, loans, and investment products.

b. Some key players operating in the retail banking market include BNP Paribas; Citigroup, Inc.; HSBC Group; ICBC; JP Morgan Chase & Co.; Bank of America Corporation; Barclays; China Construction Bank; Deutsche Bank AG, Mitsubishi UFJ Financial Group, Inc., and Wells Fargo.

b. Key factors that are driving the retail banking market growth include rapid technological advancements and evolving customer expectations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.