- Home

- »

- Medical Devices

- »

-

Resuscitative Endovascular Balloon Occlusion Of The Aorta Market Report, 2030GVR Report cover

![Resuscitative Endovascular Balloon Occlusion Of The Aorta Market Size, Share & Trends Report]()

Resuscitative Endovascular Balloon Occlusion Of The Aorta Market Size, Share & Trends Analysis Report By End-use (Cardiac Arrest, Aortic Occlusion, Tactical Combat Casualty Care), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-433-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

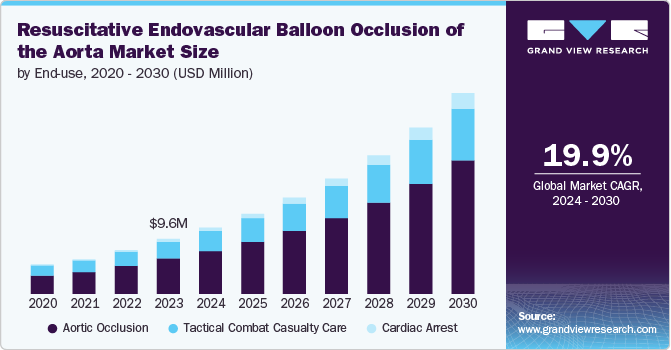

The global resuscitative endovascular balloon occlusion of the aorta market size was valued at USD 9.58 million in 2023 and is projected to grow at a CAGR of 19.9% from 2024 to 2030. The market is driven by several key factors that influence its growth and adoption in clinical settings. These drivers include the increasing prevalence of traumatic injuries, advancements in medical technology, a growing emphasis on trauma care protocols, rising awareness among healthcare professionals, and supportive government initiatives. Each of these elements plays a crucial role in shaping the market landscape and enhancing the utilization of REBOA as a life-saving intervention.

The rising incidence of traumatic injuries, particularly those resulting from road accidents, falls, and violence, is a significant driver for the Resuscitative Endovascular Balloon Occlusion of the Aorta (REBOA) market. As trauma cases often lead to hemorrhagic shock, the demand for effective resuscitation techniques has surged. REBOA provides a minimally invasive option that can be rapidly deployed in emergency situations, making it an attractive choice for trauma surgeons and emergency medical services. In June 2024, the World Health Organization reported that injuries, both unintentional and violence-related, significantly contribute to trauma, leading to 4.4 million deaths annually. Exposure to trauma, especially during childhood, can heighten the risk of mental health issues, substance abuse, chronic diseases, and social problems.

Technological advancements in medical devices have significantly enhanced the efficacy and safety of REBOA procedures. Innovations such as improved balloon designs, better catheter systems, and enhanced imaging technologies facilitate more precise placement and monitoring during procedures. These advancements not only improve patient outcomes but also encourage healthcare providers to adopt REBOA as a standard practice in trauma care. In June 2024, Emergency Scientific, a Utah-based firm, announced the first use of its Landmark REBOA catheter, following its FDA 510(k) clearance. This device is for temporary occlusion of large vessels in emergency hemorrhage control. The Landmark catheter is designed to enhance the precision of occlusion while minimizing complications associated with traditional methods.

There is an increasing awareness among healthcare professionals regarding the benefits of REBOA in managing traumatic hemorrhage. Alongside this awareness, specialized training programs are being developed to educate clinicians on the proper use of REBOA techniques. This growing emphasis on education ensures that more healthcare providers are equipped with the knowledge and skills necessary to implement this life-saving procedure effectively. In March 2024, an article was published in the Journal of Emergency Medicine detailing A Pilot Study on A Novel REBOA Training Curriculum designed for Emergency Medicine Residents. This cutting-edge curriculum was designed to advance the competencies and understanding of Emergency Medicine residents in applying the REBOA technique, with the aim of bettering patient outcomes in life-threatening scenarios.

The regulatory environment surrounding medical devices has become increasingly supportive of innovative solutions like REBOA. Regulatory bodies are recognizing the importance of rapid intervention techniques in trauma care and are streamlining approval processes for new devices. This supportive stance encourages manufacturers to invest in research and development, further propelling market growth. In February 2024, Neurescue announced that it raised USD 7.27 million in a Series A funding round. This investment was spearheaded by West Hill Capital, a London-based investment firm.

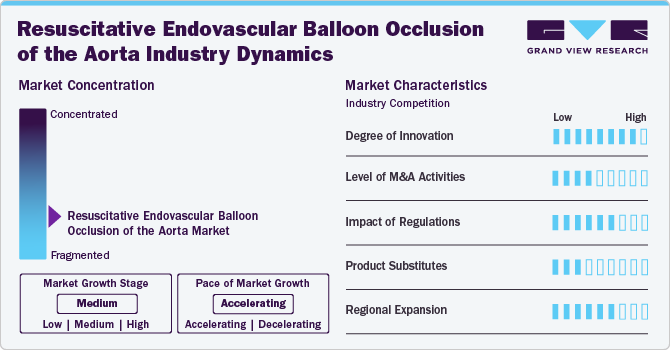

Market Concentration & Characteristics

The degree of innovation in the REBOA market is high. This is primarily due to ongoing advancements in medical technology and techniques aimed at improving trauma care and hemorrhage control. Innovations include the development of new balloon designs, materials that enhance biocompatibility, and integrated systems that allow for real-time monitoring during procedures. In July 2024, QXMédical announced, its Boosting Catheter, a leading guide extension for complex Percutaneous Coronary Interventions (PCI) and Chronic Total Occlusions (CTOs), has obtained EU Medical Device Regulation (MDR) certification

The level of mergers & acquisitions in the REBOA market is moderate. While there have not been many notable mergers and acquisitions among companies specializing in vascular devices and trauma care technologies, the market remains relatively niche compared to broader medical device sectors.Companies increasingly look to consolidate resources, enhance their technological capabilities, and expand their market reach through strategic acquisitions.

The influence of regulatory frameworks on the resuscitative endovascular balloon occlusion of the aorta (REBOA) market is significant. Organizations such as the U.S. Food and Drug Administration (FDA) and the European entities responsible for CE marking enforce strict standards regarding the safety and effectiveness of devices before they are allowed on the market. These requirements lead to the need for detailed clinical trials and thorough documentation, potentially postponing the introduction of new products. However, this process is vital for ensuring that new innovations adhere to the highest safety criteria.

The presence of product substitutes in the REBOA market is low. While there are alternative methods for managing traumatic hemorrhagic shock-such as traditional surgical interventions or other forms of endovascular techniques-none offer the same combination of benefits provided by REBOA specifically for occluding blood flow temporarily during resuscitation efforts. This unique positioning reduces competitive pressure from substitutes, allowing REBOA to maintain a strong foothold within its niche.

The Resuscitative Endovascular Balloon Occlusion of the Aorta (REBOA) market is experiencing moderate expansion across various regions, driven by advancements in trauma care and increasing awareness among healthcare professionals regarding its benefits in managing hemorrhagic shock. In North America, particularly the U.S., REBOA has gained significant traction due to robust healthcare infrastructure and a high incidence of trauma cases. Meanwhile, Europe is witnessing moderate growth, with countries such as Germany leading the adoption of this technology, supported by ongoing clinical studies and training programs

End-use Insights

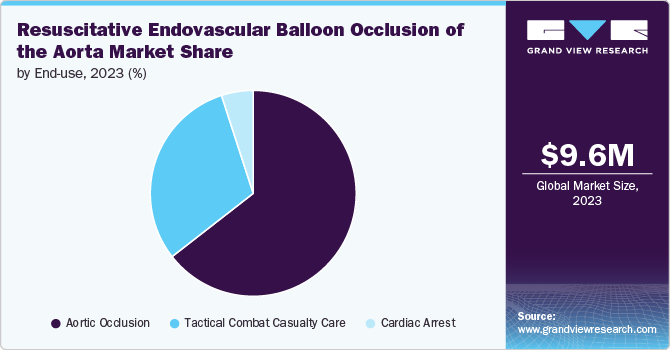

Aortic occlusion accounted for the largest market share of 64.5% in 2023. It refers to the medical procedure that involves temporarily blocking blood flow through the aorta, typically using devices such as resuscitative endovascular balloon occlusion of the aorta (REBOA) to control hemorrhage in trauma patients. The market for aortic occlusion is driven by several factors, including the rising incidence of traumatic injuries and the increasing demand for advanced trauma care solutions.The integration of innovative technologies and improved training programs for emergency medical personnel further enhances the adoption of aortic occlusion devices, making them essential tools in modern trauma management. In May 2024, Front Line Medical Technologies Inc. reached a significant milestone by obtaining CE marking for its innovative COBRA-OS (Control of Bleeding, Resuscitation, Arterial Occlusion System) in accordance with the new European Medical Device Regulations. This ultra-low profile aortic occlusion device is the first to be approved under the new MDR system and is now available to healthcare providers in the EU.

Tactical Combat Casualty Care (TCCC) refers to a set of guidelines designed to provide effective medical care during combat situations, emphasizing rapid treatment and evacuation of injured personnel. The market for tactical combat casualty care related to resuscitative endovascular balloon occlusion of the aorta is significantly influenced by factors such as increased military spending on advanced medical technologies and an emphasis on improving survival rates among wounded soldiers. The collaboration between military and civilian sectors in developing training programs and equipment tailored for battlefield conditions also drives market growth, ensuring that combat medics are well-equipped to implement these life-saving interventions effectively. In June 2021, Red One Medical partnered exclusively with Prytime Medical Devices, Inc. (The REBOA Company) to enhance the delivery of life-saving medical devices to the U.S. military. This collaboration combines Red One's expertise as a government contractor with Prytime's focus on minimally invasive trauma solutions, supporting the operational medicine needs of military personnel and Veterans Affairs.

Regional Insights

North America resuscitative endovascular balloon occlusion of the aorta (REBOA) market accounted for a significant share in 2023. The North American market is driven by an increasing incidence of trauma cases and advancements in medical technology. The U.S. leads this trend with a strong emphasis on emergency medicine and trauma care protocols that incorporate REBOA as a critical intervention for hemorrhagic shock. The presence of key players and ongoing clinical trials are fostering innovation and expanding product offerings, which is expected to enhance market penetration. In March 2023, Prytime Medical Inc. was awarded USD 6 million by the U.S. Department of Defense through the Medical Technology Enterprise Consortium (MTEC). This funding will support a study on the clinical utility of Partial REBOA at eight trauma centers across the U.S. and Canada, utilizing the pREBOA-PRO catheter, the first designed specifically for Partial REBOA.

U.S. Resuscitative Endovascular Balloon Occlusion Of The Aorta Market Trends

The resuscitative endovascular balloon occlusion of the aorta (REBOA) market in the U.S. held the largest share in the North American region in 2023 and is expected to grow rapidly over the forecast period. The U.S. REBOA market is characterized by a rising adoption rate among trauma surgeons and emergency physicians due to its effectiveness in controlling non-compressible torso hemorrhage. The integration of REBOA into standard trauma protocols, supported by training programs and educational initiatives, has led to increased awareness and utilization. In December 2023, Prytime Medical Devices, Inc., known as The REBOA Company, announced a significant achievement with the 500th patient use of its pREBOA-PRO catheter. This milestone was reached when a patient, initially stable but with life-threatening injuries, was admitted to Northeast Georgia Medical Center, where their blood pressure began to decline rapidly.

Europe Resuscitative Endovascular Balloon Occlusion Of The Aorta Market Trends

The resuscitative endovascular balloon occlusion of the aorta (REBOA) market in Europe is marked by a diverse regulatory landscape that varies significantly across countries. Countries such as Germany and Norway are at the forefront of adopting this technology due to their robust healthcare systems and focus on improving trauma care outcomes. In July 2024, QXMédical announced that its Boosting Catheter, a leading guide extension for complex Percutaneous Coronary Interventions (PCI) and Chronic Total Occlusions (CTOs), has obtained EU Medical Device Regulation (MDR) certification. This milestone highlights the company’s commitment to high-quality standards and ensures that this advanced product is accessible to healthcare providers and patients throughout Europe

The UK resuscitative endovascular balloon occlusion of the aorta (REBOA) market is primarily driven by the growing recognition of REBOA’s potential in pre-hospital settings as well as within hospitals. The National Health Service (NHS) has begun integrating REBOA into its trauma management protocols, particularly in major trauma centers. Research studies demonstrating improved patient outcomes have further fueled interest among clinicians. In October 2023, the UK-REBOA Randomized Clinical Trial was published, examining the mortality impact of combining REBOA with standard care versus standard care alone in trauma patients with severe bleeding. Conducted from October 2017 to March 2022 at 16 UK trauma centers, it involved patients aged 16 and older, with follow-up lasting 90 days.

The resuscitative endovascular balloon occlusion of the aorta (REBOA) market in France is expected to grow rapidly over the forecast period. France’s market for REBOA is evolving with increasing interest from both clinicians and researchers exploring its applications in severe trauma cases. French hospitals are beginning to implement REBOA techniques following successful pilot programs that showcased its efficacy in managing traumatic hemorrhages. The French government’s investment in emergency medical services also supports the adoption of innovative technologies such as REBOA; however, there remains a need for comprehensive guidelines and standardized training programs to ensure widespread implementation

Asia Pacific Resuscitative Endovascular Balloon Occlusion Of The Aorta Market Trends

The resuscitative endovascular balloon occlusion of the aorta (REBOA) market in Asia Pacific is anticipated to grow at a significant rate over the forecast period due to rising trauma cases and an increasing focus on emergency medicine. The growing number of trauma centers and investments in healthcare infrastructure are also contributing to market growth. Collaborations between local manufacturers and international companies are enhancing the availability of REBOA devices.In 2024, a Trauma Surgery and Acute Care Open article based in Thailand analyzed 1158 trauma patients from a level I trauma center during 2020-2021, highlighting the significant role of Resuscitative Endovascular Balloon Occlusion of The Aorta (REBOA) in trauma care. The study focused on comparing patient outcomes between those transported to the trauma resuscitation area (TTRA group) and those who died at the scene (DAS group) to identify potential REBOA candidates and crucial contraindications.

China resuscitative endovascular balloon occlusion of the aorta (REBOA) market is driven by a high incidence of traumatic injuries and a burgeoning healthcare sector. The government’s initiatives to improve emergency care services and trauma management protocols have led to increased training for medical professionals in advanced techniques such as REBOA. The rise of urbanization has resulted in higher accident rates, necessitating innovative solutions for trauma care.In July 2024, the National Medical Products Administration (NMPA) granted marketing approval to the aortic occlusion balloon catheter, a device designed for temporary blood flow obstruction in the aorta. This approval was given to the China-based Shanghai MicroPort Endovascular MedTech Co., Ltd.

The resuscitative endovascular balloon occlusion of the aorta (REBOA) market in Japan is expected to grow over the forecast period. Japan’s aging population presents unique challenges that have spurred interest in REBOA as a critical intervention for managing traumatic hemorrhages. The Japanese healthcare system is known for its technological advancements, which facilitate the integration of REBOA into existing emergency protocols. Ongoing research and clinical trials focusing on optimizing REBOA techniques are expected to enhance its application in trauma care across the country.In May 2024, an article in the National Library of Medicine discussed a study that analyzed data from the Japan Trauma Data Bank. This retrospective observational study encompassed all instances where resuscitative endovascular balloon occlusion of the aorta (REBOA) was applied from January 2004 through December 2021. It presented a nationwide descriptive examination of the use and effectiveness of REBOA in trauma cases across Japan over a span of 18 years.

Key Resuscitative Endovascular Balloon Occlusion Of The Aorta Company Insights

The competitive landscape of the REBOA market is marked by rapid advancements in technology and increasing awareness of its benefits among healthcare professionals. Companies are continually investing in research and development to enhance their product offerings, improve safety profiles, and expand indications for use. This competition drives innovation, leading to more effective devices that can be integrated into trauma protocols.

Key Resuscitative Endovascular Balloon Occlusion Of The Aorta Companies:

The following are the leading companies in the resuscitative endovascular balloon occlusion of the aorta market. These companies collectively hold the largest market share and dictate industry trends.

- Prytime Medical Devices, Inc.

- NEURESCUE

- Emergency Scientific, LLC

- Qx Médical

- Front Line Medical Technologies

- Reboa Medical As

Recent Developments

-

In June 2024, Emergency Scientific, LLC successfully utilized its Landmark catheter for the first time in resuscitative endovascular occlusion of the aorta (REBOA). This innovative device, recently granted FDA 510(k) clearance, is designed for temporary occlusion of large vessels to manage emergency hemorrhage control.

-

In March 2024, Front Line Medical Technologies Inc. announced that it has received a NATO/National Stock Number (NSN) for its pioneering COBRA-OS (Control of Bleeding, Resuscitation, Arterial Occlusion System). This important milestone highlights the device's effectiveness and cost-efficiency in military medical contexts, where quick response and operational efficiency are crucial for saving lives.

-

In November 2022, Emergency Scientific received clearance from the United States Food and Drug Administration (FDA) to commercialize the Landmark REBOA Catheter system. This approval marks a significant advancement in the field of emergency medicine, particularly in the management of severe hemorrhaging.

Resuscitative Endovascular Balloon Occlusion Of The Aorta Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.7 million

Revenue forecast in 2030

USD 34.9 million

Growth Rate

CAGR of 19.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Regional scope

North America; Europe; Asia Pacific

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan

Key companies profiled

Prytime Medical Devices; Inc, NEURESCUE; Emergency Scientific, LLC; Qx Médical; Front Line Medical Technologies; Reboa Medical As

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Resuscitative Endovascular Balloon Occlusion Of The Aorta Market Report Segmentation

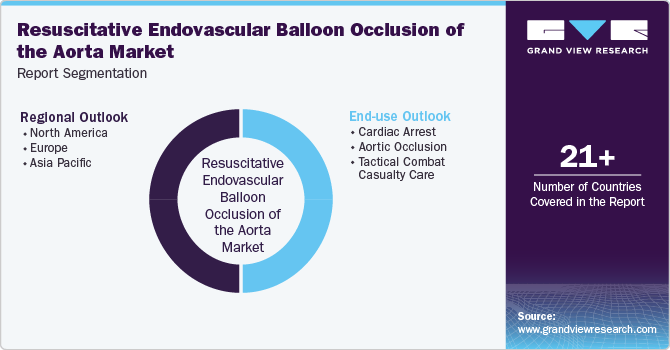

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global resuscitative endovascular balloon occlusion of the aorta market report based on end-use, and region:

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac Arrest

-

Aortic Occlusion

-

Tactical Combat Casualty Care

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

-

Frequently Asked Questions About This Report

b. The global resuscitative endovascular balloon occlusion of the aorta market size was estimated at USD 9.58 million in 2023 and is expected to reach USD 11.7 million in 2030.

b. The global resuscitative endovascular balloon occlusion of the aorta market is expected to grow at a compound annual growth rate of 19.9% from 2024 to 2030 to reach USD 34.9 million by 2030.

b. Aortic occlusion accounted for the largest share of 64.5% in 2023. The market for aortic occlusion is driven by several factors, including the rising incidence of traumatic injuries and the increasing demand for advanced trauma care solutions.

b. Some prominent players in the resuscitative endovascular balloon occlusion of the aorta (REBOA) market include: • Prytime Medical Devices, Inc • NEURESCUE • Emergency Scientific, LLC • Qx Médical • Front Line Medical Technologies • Reboa Medical As

b. The REBOA market is driven by several key factors that influence its growth and adoption in clinical settings. These drivers include the increasing prevalence of traumatic injuries, advancements in medical technology, a growing emphasis on trauma care protocols, rising awareness among healthcare professionals, and supportive government initiatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."