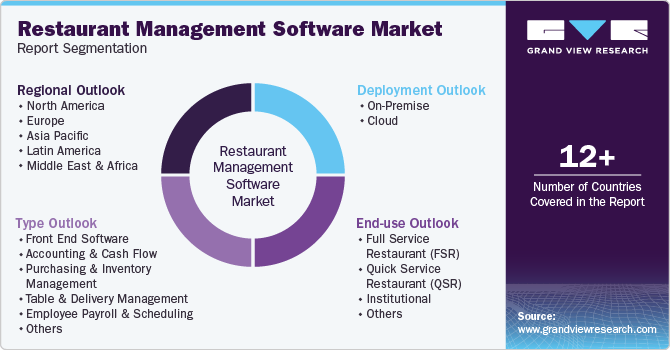

Restaurant Management Software Market Size, Share & Trends Analysis Report By Type, By Deployment (On-Premise, Cloud), By End-use (Full Service Restaurant (FSR), Quick Service Restaurant (QSR), Institutional), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-376-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

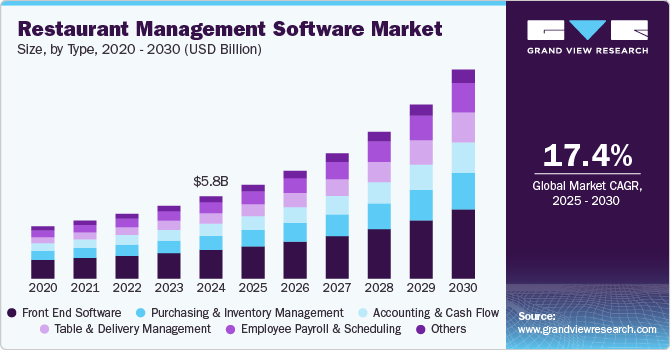

The global restaurant management software market size was estimated at USD 5.79 billion in 2024 and is projected to grow at a CAGR of 17.4% from 2025 to 2030. The growth can be attributed to the increasing number of restaurants worldwide, along with the widening usage of cloud-based technology and the growing acceptance of Quick Service Restaurant (QSR) services. The COVID-19 pandemic impacted the restaurant industry by causing temporary closures and a lack of dine-in customers. However, the use of point-of-sales (POS) solutions enabled restaurants to survive the pandemic by providing contactless payment options.

Restaurants, bars, and food service providers highly rely on Point of Sale (POS) technology to track sales, products, operations, and inventory. Touchscreen ordering solutions are preferred to guarantee accurate customer orders. POS technology tends to account for the largest portion of the IT budgets and investments of restaurants. Restaurant operators seek innovative ways to deliver higher levels of guest satisfaction. Mobile POS systems, for instance, allow employees to spend more time on the floor with customers rather than making several trips to the kitchen and admin sections. Thus, restaurants can create an optimized culture built on improved customer service. The growing adoption of mobile POS systems is expected to drive the industry’s growth.

Furthermore, food delivery websites, such as GrubHub, PostMates, and Zomato, are allowing restaurants to improve their online presence and providing them with an opportunity to gain new customers and generate extra revenue. At the same time, restaurant review sites are also helping restaurants build up their reputation. While advances in the software and applications related to the food service industry show no signs of abating, restaurants need to adapt to the changing ecosystem of their business and adopt management software to remain ahead of the competition. The scenario is anticipated to boost market growth.

The increasing smartphone and internet penetration and rising disposable incomes of consumers enable them to demand customized and personalized services from restaurants. Moreover, growing advancements in technology and the rising adoption of artificial intelligence, virtual assistants, the Internet of Things, and cloud-based solutions in restaurants allow owners to deliver the best customer services that could engage customers for longer durations.

For instance, food restaurant chains such as KFC, Pizza Hut, and Domino’s are installing voice-activated ordering systems and chatbots to provide a seamless customer experience. Mobile apps integrated with major virtual assistants such as Google Assistant and Alexa provide easy navigation to customers for placing orders using voice commands. These developments have helped these food restaurant chains achieve growth in customer engagement and retention deliver personalized customer experience and engage customers for longer periods.

Type Insights

The front-end software segment accounted for a market share of over 34% in 2024. The restaurant management software with Android support is widely adopted across the globe as it is cheaper than iOS-based software. Easy connectivity to smartphones and other connected devices, lower requirements for technical expertise, flexibility for multiple users to operate, and cost-effectiveness are some of the key factors that are triggering the adoption of Android software over iOS software. However, the growing advancements in cross-platform technologies are encouraging restaurant owners to opt for software solutions that effectively support both operating systems. This is expected to drive segment growth over the forecast period.

The table & delivery management segment is expected to register a CAGR of 19.6% from 2025 to 2030. The growth of segment can be attributed to the growing focus on delivering the best customer experiences to stay competitive in the global industry and the increasing need to maximize customer retention rate, which are enabling restaurant owners to opt for table & delivery management solutions. The rising use of the internet and smartphones has empowered customers to seek innovative services at restaurants. Thus, to cater to the increasing demand for better and timely food services at a table, restaurant owners are implementing restaurant management software solutions, thereby driving the segment growth.

Deployment Insights

Based on deployment, the market is segmented into on-premise and cloud. The cloud segment accounted for a largest market share of over 54.0% in 2024. The adoption of cloud-based restaurant management software has increased significantly over the past few years in the global restaurant industry. This software relies on remote networks of servers that are hosted on the internet to process, manage, and store data rather than on a local or on-premise server. For instance, in October 2024, Restroworks, a restaurant technology software provider, launched Analytics Cloud. Analytics Cloud is an insights platform accessible via a web browser and the Cockpit mobile app designed for enterprise restaurant chains. This platform offers restaurant operators a comprehensive 360-degree view of their business operations. Analytics Cloud seamlessly integrates data from POS systems, aggregators, and third-party applications, delivering both real-time and historical data analysis to support informed decision-making. Such developments would further drive the demand for cloud-based solutions for restaurant management software during the forecast period.

The on-premise segment is anticipated to register a CAGR of 13.8% during the projection period. The on-premise restaurant management software runs through a restaurant’s physical server. As it is located on-site, the restaurant has complete control over the server and its functioning & database. Large-size or full-service restaurants with huge assets and sensitive data prefer deploying on-premise software to meet compliance requirements and relevant legislation. Restaurants in remote locations with limited internet access demand on-premise restaurant management. However, with the growing awareness regarding cloud-based solutions and their advantages over on-premise software, this segment is expected to grow at a moderate pace over the forecasted period.

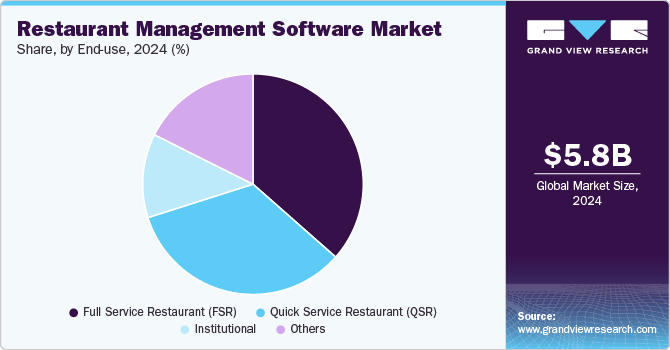

End-use Insights

The full service restaurant (FSR) segment accounted for the largest market share of 36.5% in 2024. FSR make significant investments in technology to deliver prompt and timely customer service. These restaurants have a broad menu, a variety of courses, and ample resources for managing business operations. Since they consistently require updated technologies, restaurant management software providers offer a variety of solutions that are customized to fit their requirements.

The quick service restaurant (QSR) segment is expected to register a significant growth rate of 18.8% from 2023 to 2030. Food quality and prompt customer service have long been hallmarks of the QSR industry. However, with rising customer expectations for easy and attractive services, QSR owners are investing heavily in technology to meet customer requirements. Customers of QSR particularly demand customized, accurate, and personalized dining experiences. Furthermore, restaurant managers must be able to maximize sales and streamline inventory management. As a result, QSR owners invest strategically in restaurant management software that meets the needs of their users, staff, and, indirectly, their customers. Thus, the segment is witnessing increased demand for centralized software.

Regional Insights

North America held the largest market share of more than 32% in 2024. The increasing preference for cloud-based restaurant management solutions is driving the market growth in the region. Traditional on-premise systems require significant IT infrastructure and maintenance, whereas cloud-based platforms offer greater scalability, remote access, and real-time data analytics. With the rise of online food ordering and delivery services, restaurant operators need seamless integration between in-house operations and third-party delivery platforms such as Uber Eats, DoorDash, and Grubhub. Cloud-based software solutions enable real-time tracking of orders, automated inventory updates, and enhanced customer engagement, making them an essential tool for modern restaurants.

The U.S. dominated the restaurant management software industry in 2024. The growing emphasis on data-driven decision-making is also fueling the demand for restaurant management software in the U.S. restaurants are leveraging artificial intelligence (AI) and machine learning (ML) to analyze customer behavior, optimize menu offerings, and forecast demand. AI-powered software can track dining trends, recommend dynamic pricing strategies, and help restaurants reduce food waste by predicting inventory needs. The ability to harness actionable insights from vast amounts of customer and operational data is enabling restaurants to improve profitability and maintain a competitive edge.

Europe Restaurant Management Software Industry Trends

The restaurant management software market in Europe is anticipated to register considerable growth from 2025 to 2030. The increasing use of digital payment solutions is also contributing to the expansion of the restaurant management software market in Europe. Contactless payments, mobile wallets, and self-service kiosks have become more prevalent, particularly after the COVID-19 pandemic accelerated the shift toward cashless transactions. Many restaurants are integrating their management software with digital payment gateways such as Apple Pay, Google Pay, and local European payment providers to enhance customer convenience and transaction security. As European consumers continue to prefer digital and contactless payment methods, the demand for integrated payment-enabled restaurant management software is expected to grow.

Germany dominated the restaurant management software industry in 2024. Germany's strong emphasis on food safety and hygiene regulations is driving the adoption of restaurant management software with built-in compliance tracking features. The country has strict food handling and storage laws, requiring restaurants to maintain detailed records of temperature monitoring, ingredient tracking, and hygiene practices. Advanced software solutions with HACCP (Hazard Analysis and Critical Control Points) compliance features help restaurant operators adhere to these regulations by automating record-keeping, sending real-time alerts, and ensuring proper documentation. As food safety remains a top priority in Germany, restaurant businesses are increasingly investing in software that simplifies compliance management.

Restaurant management software market in France is expected to grow significantly during the forecast period. The rising demand for omnichannel ordering and delivery solutions is driving the growth of the restaurant management software market in France. As consumer preferences shift towards convenience, many French restaurants are integrating their management software with online ordering platforms, mobile apps, and self-service kiosks. This trend is especially prominent in urban areas where food delivery services have surged in popularity. By adopting restaurant management software that supports multiple ordering channels, businesses can streamline operations, reduce order errors, and provide seamless dining experience for customers, whether they choose to dine in, pick up, or have their food delivered.

Asia Pacific Restaurant Management Software Industry Trends

Asia Pacific is expected to register the fastest CAGR of more than 20.4% over the forecast period. Asia Pacific has observed a rising number of SMEs that are widely adopting cloud computing technology. This, in turn, has created opportunities for the adoption of cloud QMS solutions. COVID-19 has also prompted the countries in the Asia Pacific to emphasize pharmaceutical manufacturing, transportation, and logistics while ensuring optimum quality. This has increased the demand for pharma QMS solutions, particularly in the emerging economies of the region. The growing awareness of quality management compliance and standards has also led to the increased demand for QMS in the manufacturing and transportation & logistics industries across the region. Similarly, there is an increased emphasis on robust supplier quality management within QMS software. Ensuring the quality of raw materials and components supplied by external vendors is critical for overall product quality. The increasing adoption of quality management system software in the manufacturing industry will help with the overall market growth.

China’s rapidly expanding manufacturing sector is driving the growth of the restaurant management software industry. The growing popularity of loyalty programs and personalized marketing strategies is also boosting the adoption of restaurant management software in China. Restaurants are increasingly leveraging customer relationship management (CRM) tools to analyze customer behavior, create targeted promotions, and enhance customer retention. Integrated loyalty programs within restaurant software enable businesses to offer discounts, track customer preferences, and encourage repeat visits. With Chinese consumers valuing personalized experiences, restaurants that utilize data-driven marketing strategies are more likely to build strong customer relationships and drive long-term profitability.

The India restaurant management software market is expected to grow rapidly during the forecast period. The rise of online food delivery services is driving the adoption of restaurant management software in India. The popularity of platforms such as Zomato and Swiggy has led restaurants to integrate their management systems with third-party delivery aggregators. This integration allows for seamless order tracking, automated menu updates, and efficient delivery management, helping restaurants cater to the growing demand for home-delivered food. The rise of cloud kitchens, or virtual restaurants, is further fueling the need for restaurant management software that can efficiently handle high volumes of digital orders without requiring traditional dine-in operations.

Key Restaurant Management Software Company Insights

Some of the key players operating in the market include Oracle Corporation, Block, Inc., and NCR Corporation, among others.

-

Oracle Corporation is a multinational corporation specializing in enterprise software, cloud computing, and database solutions. Oracle provides comprehensive restaurant management software through its Oracle MICROS solutions. Oracle MICROS is a provider of point-of-sale (POS), back-office management, and cloud-based restaurant technology that helps businesses improve operational efficiency, enhance customer experiences, and optimize food service management. These solutions cater to various solutions of establishments, including quick-service restaurants (QSRs), fine dining, cafes, bars, and hotel restaurants.

-

Block, Inc. is a financial technology and digital payments company. The company operates a diverse ecosystem that includes Square, Cash App, Afterpay, Spiral, TIDAL, and TBD, catering to businesses and consumers alike. Block provides comprehensive restaurant management software through its Square for Restaurants platform. This cloud-based point-of-sale and restaurant management system is designed to help food service businesses manage their operations efficiently, from order taking and payment processing to menu management and staff coordination. The software is optimal for a variety of establishments, including quick-service restaurants (QSRs), full-service dining, bars, cafes, and food trucks.

Jolt, Revel Systems, TouchBistro, among others are the emerging participants operating in the restaurant management software market.

-

Jolt is an operations management software provider that specializes in helping restaurants and other food service businesses streamline their daily operations. The company serves a wide range of businesses, including quick-service restaurants (QSRs), full-service restaurants, cafes, franchises, and multi-location food service chains. Jolt’s restaurant management software provides an all-in-one solution for managing food safety, employee productivity, compliance, and operational consistency.

Key Restaurant Management Software Companies:

The following are the leading companies in the restaurant management software market. These companies collectively hold the largest market share and dictate industry trends.

- Fiserv, Inc.

- Fishbowl Inc.

- Fourth Enterprises LLC.

- Jolt

- NCR Corporation

- OpenTable, Inc.

- Oracle Corporation

- Revel Systems

- Block, Inc.

- TouchBistro

View a comprehensive list of companies in the Restaurant Management Software Market

Recent Developments

-

In October 2024, Fiserv, Inc. partnered with foodpanda, a subsidiary of Delivery Hero, a local delivery company. This collaboration extends across online, mobile, and digital wallet payments, establishing Fiserv as foodpanda’s payment acquirer in Singapore and Hong Kong. Through this partnership, Fiserv is enhancing foodpanda’s eCommerce payment capabilities, enabling faster and more efficient transactions across multiple markets, starting with Singapore and Hong Kong.

-

In September 2024, TouchBistro launched Inventory Management and Labor Management solutions for restaurant operators following its acquisition of restaurant management software Peachworks. These new solutions enhance TouchBistro’s extensive suite of back-of-house (BOH) tools, enabling restaurateurs to boost profitability, optimize operations, and enhance guest experience.

-

In June 2024, Revel Systems partnered with BRIX Holdings, a multi-brand franchising company specializing in food service chains. As part of this collaboration, BRIX Holdings will implement Revel's platform across all locations of its brands, including Red Mango Yogurt & Smoothie Café, Smoothie Factory Juice Bar + Kitchen, Pizza Jukebox, Souper Salad, and Orange Leaf Frozen Yogurt. With Revel's open API, BRIX Holdings can seamlessly integrate top-tier solutions into the platform, creating a customized system tailored to their specific needs.

Restaurant Management Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.60 million |

|

Revenue Forecast in 2030 |

USD 14.70 million |

|

Growth rate |

CAGR of 17.4% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, deployment, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain China; Japan; India; South Korea; Australia; Thailand Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE |

|

Key companies profiled |

Fiserv, Inc.; Fishbowl Inc.; Fourth Enterprises LLC.; Jolt; NCR Corporation; OpenTable, Inc.; Oracle Corporation; Revel Systems; Block, Inc.; TouchBistro |

|

Customization Scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Restaurant Management Software Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global restaurant management software market based on type, deployment, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Front End Software

-

Accounting & Cash Flow

-

Purchasing & Inventory Management

-

Table & Delivery management

-

Employee Payroll & Scheduling

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Cloud

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Full Service Restaurant (FSR)

-

Quick Service Restaurant (QSR)

-

Institutional

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global restaurant management software market size was estimated at USD 5.79 billion in 2024 and is expected to reach USD 6.60 billion in 2025.

b. The global restaurant management software market is expected to grow at a compound annual growth rate of 17.4% from 2025 to 2030 to reach USD 14.70 billion by 2030.

b. North America dominated the restaurant management software market with a share of 32.9% in 2024. This is attributable to the demand for solutions such as table management, menu management, and kitchen management, among others across a large number of restaurants in the region.

b. Some key players operating in the restaurant management software market include NCR Corporation; Jolt, Square Inc.; Toast, Inc.; HotSchedules; Revel Systems Inc.; Touch Bistro; and ShopKeep.

b. The technological advancements in the restaurant industry and the rising need for restaurant-specific software such as billing and payment, inventory management, and table management are expected to foster the growth of the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."