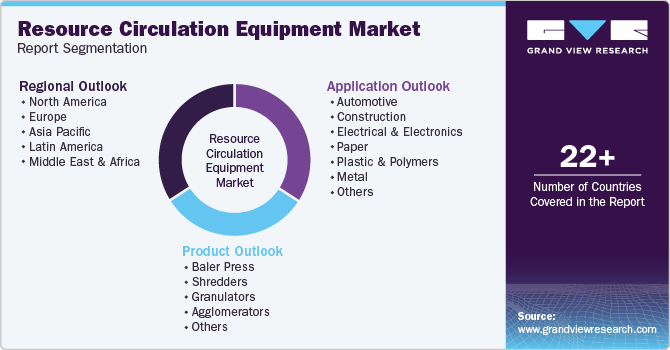

Resource Circulation Equipment Market Size, Share & Trends Analysis Report By Product (Baler Press, Shredders, Shears), By Application (Automotive, Construction, Paper, Electrical & Electronics, Plastic & Polymers, Metal), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-225-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

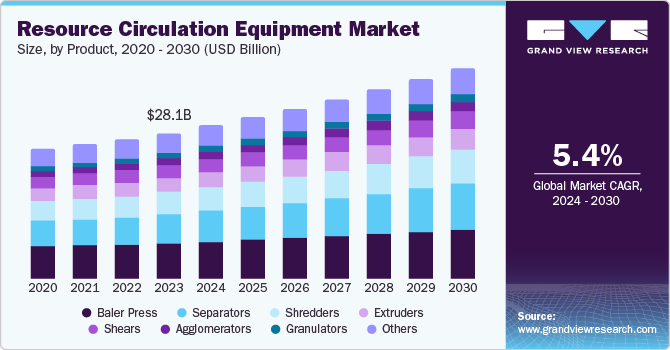

The global resource circulation equipment market size was valued at USD 28.12 billion in 2023 and is expected to grow at a CAGR of 5.4% from 2024 to 2030. Stricter environmental regulations and policies worldwide push industries to adopt sustainable practices, including efficient waste management and recycling systems. Furthermore, rapid urbanization and industrialization generate significant waste, especially in emerging economies, necessitating advanced waste management solutions.

Resource circulation equipment is primarily used for the processing of solid waste. The recovery of raw materials using recycling is a key function of resource circulation equipment. Resource circulation equipment is mainly used to recover valuable materials and also to generate energy from waste. Resource circulation equipment finds applications across various end-user industries such as automotive, construction, electrical & electronics, and oil & gas.

Some of the major applications of RCE include tire recycling, solid waste processing, rubber powder production, landfilling and gas recycling facilities among others. The quest to reduce carbon footprint by industries on account of stringent regulatory scenarios across various nations coupled with increasing importance for efficient environmentally friendly technologies has propelled the growth of the recycling market.

Technological advancements, such as automated sorting systems and advanced material recovery techniques, make resource circulation more efficient and cost-effective. Additionally, increasing consumer awareness and demand for sustainable products encourage companies to invest in resource circulation equipment to enhance their environmental footprint.

Product Insights

The baler press segment dominated the market with the largest revenue share of 24.7% in 2023. This significant share is attributed to the increasing use of baler presses, which compress recyclable materials such as paper, cardboard, aluminum, plastic, and non-ferrous metals into dense bundles known as bales. Baler presses' efficiency and effectiveness in managing and reducing the volume of recyclable materials make them a crucial component in the recycling process.

The separators segment is expected to grow at the fastest CAGR over the forecast period. The regulatory push towards water treatment and waste management is a significant driver as governments worldwide implement stricter regulations on waste disposal and wastewater treatment. Technological advancements in separation technologies, such as gravity, coalescing, and centrifugal separators, are enhancing the efficiency and effectiveness of these systems, making them more attractive to industries. Additionally, the increasing need for sustainable practices in industries like oil and gas, chemical, food and beverage, and water and wastewater management is boosting the demand for separators. The growing awareness of environmental sustainability and adopting circular economy principles further propel the market as industries seek to minimize waste and maximize resource recovery.

Application Insights

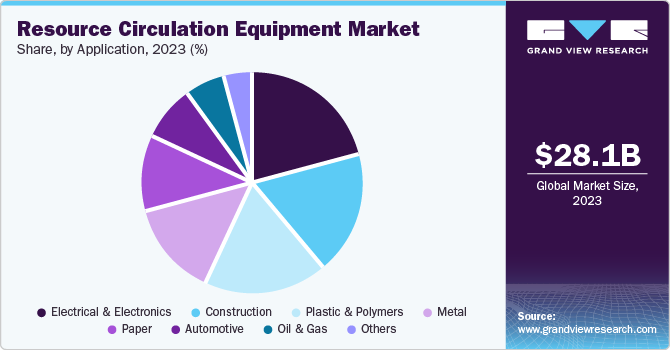

Electrical & electronics dominated the market with the largest revenue share in 2023. Rapid technological advancements and the frequent upgrading of electronic devices drive the increasing volume of electronic waste (e-waste) generated globally. The need for efficient recycling and disposal solutions for e-waste, which contains valuable materials like gold, silver, and copper, as well as hazardous substances, has spurred the demand for specialized resource circulation equipment in this sector. Additionally, stringent regulations and policies regarding e-waste management and recycling in various countries have further propelled the growth of this segment. The rising consumer awareness about the environmental impact of improper e-waste disposal and the adoption of circular economy practices by electronics manufacturers are also significant contributors to the segment's leading position in the market.

Metal is projected to witness significant growth over the forecast period. The increasing demand for recycled metals in various industries such as automotive, construction, and electronics. The rising awareness about the environmental benefits of recycling metals, such as reducing greenhouse gas emissions and conserving natural resources, also contributes to this trend. Additionally, advancements in recycling technologies, which enhance the efficiency and effectiveness of metal recovery processes, are further propelling the market. Implementing stringent regulations and policies to promote sustainable practices and reduce waste encourages industries to adopt resource circulation equipment for metal recycling. Moreover, the growing adoption of circular economy principles, which emphasize the reuse and recycling of materials, is expected to boost the demand for metal recycling equipment.

Regional Insights

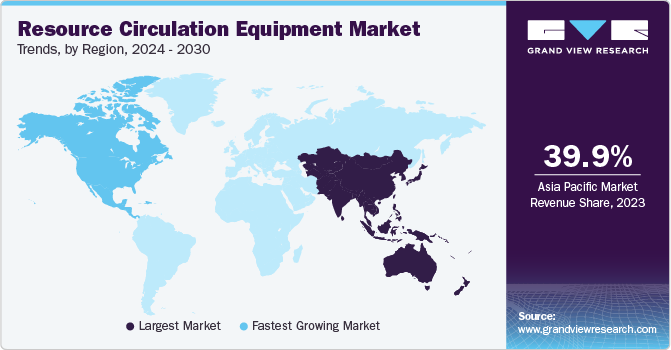

Asia Pacific resource circulation equipment market dominated the global market with a revenue share of 39.9% in 2023. Rapid industrialization and urbanization in countries like China, India, and Japan generate significant amounts of waste and necessitate advanced waste management solutions. The region’s strong manufacturing base, particularly in the electronics and automotive industries, further drives the demand for resource circulation equipment. Additionally, increasing government initiatives and regulations aimed at promoting sustainable practices and efficient waste management are propelling market growth.

China’s resource circulation equipment market is expected to grow at the fastest CAGR over the forecast period. The rising awareness among consumers and industries about the environmental benefits of recycling and resource recovery is also contributing to the market’s expansion in China.

Europe Resource Circulation Equipment Market Trends

Europe's resource circulation equipment market was identified as a lucrative region in 2023. This is largely due to the region’s stringent environmental regulations and policies that promote sustainable waste management and recycling practices. European countries have been at the forefront of adopting circular economy principles, which emphasize the reuse, recycling, and repurposing of materials. Additionally, the high level of consumer awareness and demand for sustainable products in Europe drives the need for advanced resource circulation equipment.

Germany’s resource circulation equipment market is expected to grow rapidly in the coming years. The presence of well-established industries, particularly in the automotive, electronics, and construction sectors, further boosts the market. Moreover, government initiatives and funding to enhance recycling infrastructure and technologies contribute to the market’s growth. Continuing prioritizing sustainability and resource efficiency, the demand for resource circulation equipment is expected to drive market growth.

North America Resource Circulation Equipment Market Trends

North America's resource circulation equipment market is expected to grow significantly over the forecast period. The increasing emphasis on sustainable waste management practices and the adoption of circular economy principles. The region’s strong regulatory framework, which includes stringent environmental regulations and policies, is encouraging industries to invest in advanced recycling and waste management solutions. Additionally, technological advancements in resource circulation equipment, such as automated sorting systems and advanced material recovery techniques, are enhancing the efficiency and effectiveness of recycling processes.

The U.S. resource circulation equipment market is expected to grow in the coming years. There is a growing emphasis on sustainability and reducing environmental impact in the country is expected to drive market growth. Furthermore, the rapid adoption of advanced waste management is expected to boost market progress.

Key Resource Circulation Equipment Company Insights

Some key companies in the resource circulation equipment market includeRecycling Equipment Manufacturing; The CP Group; American Baler; Kiverco; General Kinematics; and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

American Baler Company is a prominent manufacturer in the resource circulation equipment market. They specialize in producing a wide range of balers, including manual-tie and auto-tie single ram horizontal balers, as well as two ram auto-tie balers.

-

Sunny Group is a leading enterprise specializing in the design, R&D, production, and sales of environmental recycling equipment. It offers e-waste recycling machinery, cable wire recycling machines, PCB recycling machines, and others.

Key Resource Circulation Equipment Companies:

The following are the leading companies in the resource circulation equipment market. These companies collectively hold the largest market share and dictate industry trends.

- The CP Group

- American Baler

- Kiverco

- General Kinematics

- MHM Recycling Equipment

- Marathon Equipment

- Ceco Equipment Ltd.

- Danieli Centro Recycling

- ELDAN Recycling

- Metso

- Suny Group

- Forrec Srl Recycling

- BHS Sonthofen

- LEFORT GROUP

Recent Developments

-

In April 2024, American Baler Company based in Bellevue, Ohio, unveiled plans for a significant expansion project at its existing facility and targeted completion in the fall of 2025. It aims to enhance the manufacturing space by 20% by adding a new strategic wing.

Resource Circulation Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 29.60 billion |

|

Revenue forecast in 2030 |

USD 40.69 billion |

|

Growth rate |

CAGR of 5.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Brazil; Argentina; UAE; Saudi Arabia |

|

Key companies profiled |

The CP Group; American Baler; Kiverco; General Kinematics; MHM; Recycling Equipment; Marathon Equipment; Ceco Equipment Ltd.; Danieli Centro Recycling; ELDAN Recycling; Metso; Suny Group; Forrec Srl Recycling; BHS Sonthofen; LEFORT GROUP |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Resource Circulation Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global resource circulation equipment market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Baler Press

-

Shredders

-

Granulators

-

Agglomerators

-

Shears

-

Separators

-

Extruders

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Construction

-

Electrical & Electronics

-

Paper

-

Plastic & Polymers

-

Metal

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."