- Home

- »

- Homecare & Decor

- »

-

Resort Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Resort Market Size, Share & Trends Report]()

Resort Market (2025 - 2030) Size, Share & Trends Analysis Report By Resort Type (Golf Resorts, Beach Resorts, Island Resorts), By Price Range (Budget, Midrange), By Booking Mode, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-423-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Resort Market Summary

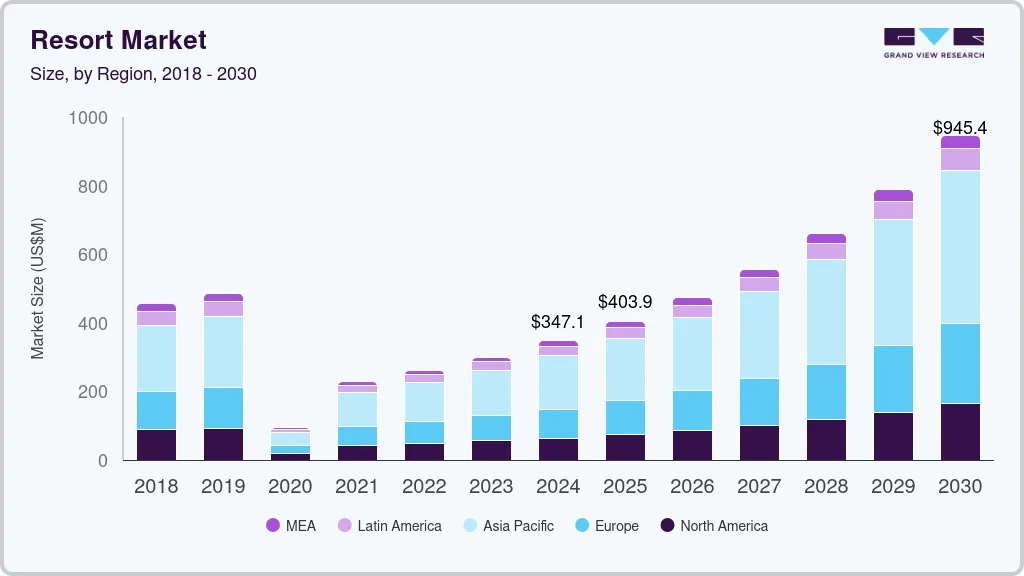

The global resort market size was estimated at USD 347.1 billion in 2024 and is anticipated to reach USD 945.4 billion by 2030, growing at a CAGR of 18.5% from 2025 to 2030. The market has experienced substantial growth over the past decade, driven by rising disposable incomes, increased international travel, and the expanding middle class in emerging markets.

Key Market Trends & Insights

- Asia Pacific dominated the resort market with the largest revenue share of 44.25% in 2023.

- The resort market in the U.S. is expected to grow at a significant CAGR of 18.5% from 2024 to 2030.

- Based on resort type, the beach resorts segment led the market with the largest revenue share of 28.67% in 2023.

- Based on price range, the midrange resorts segment led the market with the largest revenue share of 53.25% in 2023.

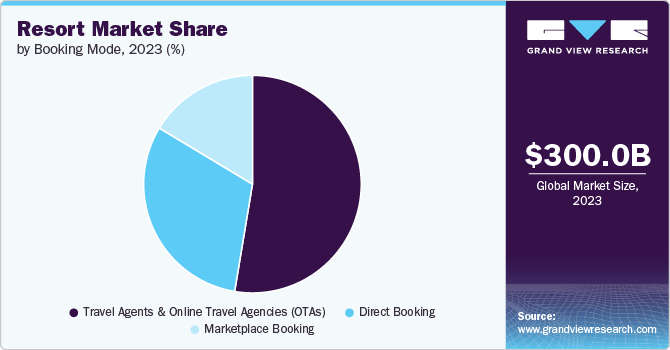

- Based on booking mode, the travel agents and online travel agencies (OTAs) segment led the market with the largest revenue share of 52.62% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 347.1 Billion

- 2030 Projected Market Size: USD 945.4 Billion

- CAGR (2025-2030): 18.5%

- Asia Pacific: Largest market in 2023

- Europe: Fastest growing market

As consumers seek more immersive and luxurious travel experiences, resorts have become a preferred choice for vacationers looking to combine relaxation with a variety of amenities. This trend has been particularly pronounced in regions like Asia-Pacific and the Middle East, where investments in high-end resort properties have surged to cater to both domestic and international tourists. The demand for unique and tailored resort experiences has led to the development of niche segments, such as eco-resorts and wellness resorts, further fueling market growth.Technological advancements have also played a crucial role in the expansion of the resort industry. The integration of digital technologies, including online booking platforms, mobile apps, and personalized marketing strategies, has made it easier for consumers to access resort offerings and plan their vacations. Moreover, the adoption of data analytics has allowed resorts to better understand customer preferences and enhance service delivery, leading to improved guest satisfaction and repeat business. As resorts continue to leverage technology to optimize operations and enhance the guest experience, the industry is expected to see sustained growth in the coming years.

The rise of experiential travel has significantly contributed to the market growth. Travelers are increasingly seeking experiences that go beyond traditional leisure, looking for opportunities to engage with local cultures, participate in outdoor activities, and enjoy unique culinary offerings. Resorts have responded by curating experiences that cater to these evolving consumer preferences, such as cultural tours, adventure sports, and farm-to-table dining. This shift towards experience-driven travel has not only attracted a broader customer base but has also encouraged resorts to innovate and diversify their offerings, leading to an expansion in both market size and revenue.

Data from the United Nations World Tourism Organization (UNWTO) indicates that an estimated 285 million tourists traveled internationally during the first quarter of 2024, reflecting a notable 20% growth compared to the same period in 2023. This surge in international travel has led to a notable uptick in the number of travelers opting for resort accommodations, which has, in turn, contributed to the robust expansion of the global industry. This trend underscores the vital role of resorts in catering to the evolving preferences of international travelers, further solidifying their position as a key segment within the global hospitality industry.

Sustainability has become a key driver of market growth, as environmentally conscious travelers seek accommodations that align with their values. Resorts that prioritize sustainability through eco-friendly practices, such as energy-efficient designs, waste reduction initiatives, and the use of locally sourced materials, have gained a competitive edge in the market. The trend towards sustainable tourism has led to the proliferation of eco-resorts, which cater to a growing segment of travelers who prioritize environmental responsibility in their travel decisions. This focus on sustainability is expected to continue shaping the industry, with more resorts adopting green practices to attract environmentally aware customers.

Integrating spa and wellness services into the resorts is significantly enhancing revenue streams, as these offerings cater to the growing consumer demand for health-conscious and holistic travel experiences. Resorts that invest in comprehensive wellness programs, including spa treatments, fitness classes, and personalized health consultations, can attract a broader clientele, ranging from leisure travelers seeking relaxation to those prioritizing physical and mental well-being. In 2019, the number of hotels and resorts offering spa and wellness services totaled 64,181, rising to 80,423 by 2022. This significant growth highlights the increasing importance of wellness amenities within the industry. The integration of these services across more resorts not only broadens their appeal to diverse customer segments but also boosts occupancy rates and increases per-guest spending. By incorporating spa and wellness facilities, resorts are strategically positioned to drive substantial market growth. This approach attracts a wellness-focused clientele, supports premium pricing strategies, and promotes customer loyalty, ultimately enhancing revenue streams and ensuring sustained profitability.

The global resort industry has benefited from increased investment in infrastructure and tourism development by governments and private entities. In many regions, such as Southeast Asia and the Caribbean, governments have recognized the economic potential of tourism and have invested heavily in improving accessibility, building new airports, and developing tourism-friendly policies. These efforts have facilitated the growth of the resort industry by making it easier for international tourists to reach resort destinations and by encouraging the development of new properties. As governments and private investors continue to prioritize tourism infrastructure, the resort industry is poised for further expansion on a global scale.

Resort Type Insights

Based on resort type, the beach resorts segment led the market with the largest revenue share of 28.67% in 2023. Beach resorts, with their inherent appeal of relaxation, scenic beauty, and recreational activities, are becoming increasingly popular destinations for vacations. Beach resorts are often perceived as ideal locations for health and wellness activities, including spa treatments, yoga retreats, and fitness programs. The tranquil environment, combined with access to natural elements like the sea and sun, enhances their attractiveness for wellness-focused travelers. Modern travelers are increasingly seeking unique and memorable experiences. Beach resorts, offering a blend of luxury, adventure, and local culture, align well with this trend. Experiences such as water sports, beachfront dining, and cultural excursions make beach resorts a preferred choice for those seeking more than just accommodation.

The eco-resorts segment is anticipated to grow at the fastest CAGR of 22.5% from 2024 to 2030. As environmental concerns become more prominent, consumers are increasingly conscious of their ecological footprint. This heightened awareness has led to a growing preference for eco-friendly travel options. Eco-resorts, which prioritize sustainability, conservation, and minimal environmental impact, resonate with these environmentally conscious travelers. The growth of health and wellness tourism is also contributing to the demand for eco-resorts. These resorts often emphasize natural and holistic well-being, offering activities such as yoga, meditation, and spa treatments in pristine natural settings. The serene environment of eco-resorts, combined with their focus on sustainability, attracts wellness-focused travelers seeking relaxation and rejuvenation.

Price Range Insights

Based on price range, the midrange resorts segment led the market with the largest revenue share of 53.25% in 2023. The rising middle-class population, particularly in emerging markets such as Asia Pacific and Latin America, is driving demand for affordable yet comfortable vacation options. These consumers are increasingly seeking high-quality experiences without the premium price tag associated with luxury resorts. Midrange resorts perfectly cater to this demographic, offering a balanced blend of comfort, amenities, and value. In addition, the post-pandemic travel rebound has seen a shift in consumer behavior, with many travelers prioritizing more frequent getaways that fit within their budget. Midrange resorts provide an ideal solution, allowing guests to enjoy resort-style amenities such as pools, dining options, and recreational activities while remaining within a more accessible price range. This has made them particularly attractive to families and groups who are looking to maximize value without compromising on the quality of their stay.

The luxury and ultra-luxury resorts segment is anticipated to grow at the fastest CAGR of 19.4% from 2024 to 2030. The luxury and ultra-luxury resort segments are witnessing robust growth, driven by several converging factors that cater to the evolving expectations of affluent travelers and high-net-worth individuals (HNWIs). The rise in global wealth, particularly among the upper echelons of society in regions like Asia Pacific, North America, and the Middle East, has significantly increased the demand for exclusive and high-end travel experiences. These travelers prioritize privacy, personalized service, and unique experiences, which luxury and ultra-luxury resorts are uniquely positioned to deliver. In addition, there is a growing trend among affluent consumers toward experiential travel, where the focus is not just on the destination but on the quality and distinctiveness of the experience itself. Luxury and ultra-luxury resorts cater to this demand by offering bespoke services such as private villas, personalized itineraries, gourmet dining experiences, and wellness programs that go beyond the standard offerings of traditional resorts. This level of customization and exclusivity is increasingly sought after, particularly as consumers look to spend on travel that provides lasting memories and a sense of fulfillment.

Hotels and resort companies are actively expanding their luxury portfolios to meet the growing demand from affluent travelers. For instance, In August 2024, Marriott International, Inc. recently celebrated the milestone of opening its 9,000th property with The St. Regis Longboat Key Resort. Located on 18 acres of pristine beachfront in Longboat Key, Florida, this luxury resort features 168 elegantly designed guestrooms, including 26 suites, all offering stunning ocean views. The property is distinguished by its exceptional culinary offerings and world-class amenities, embodying the St. Regis brand's commitment to distinctive design and unparalleled service. In addition, the resort includes 69 private branded residences and provides an extraordinary luxury living experience. Such strategic developments are expected to diversify the range of resort options available to consumers and contribute significantly to market growth.

Booking Mode Insights

Based on booking mode, the travel agents and online travel agencies (OTAs) segment led the market with the largest revenue share of 52.62% in 2023. The increasing reliance on digital platforms for travel planning has transformed the way travelers research and book accommodations. OTAs provide a convenient, user-friendly experience that allows travelers to compare a wide range of resort options, amenities, and pricing in a single interface. This aggregation of information empowers consumers to make informed decisions, driving higher booking volumes through these platforms. The ongoing trend of experiential travel has amplified the demand for unique and personalized resort experiences. Travel agents, leveraging their expertise, play a critical role in curating tailored itineraries and recommendations for their clients. This personalized service, combined with the broad inventory available through OTAs, enhances the appeal of booking through these channels, particularly among affluent travelers seeking bespoke vacation experiences.

The marketplace booking segment is projected to grow at the fastest CAGR of 20.5% over the forecast period. Online marketplaces provide travelers with comprehensive information about various resorts, including detailed descriptions, user reviews, high-quality images, and pricing comparisons. This transparency allows consumers to make informed decisions, fostering trust and increasing the likelihood of booking through these platforms. Marketplaces aggregate a wide range of resorts, catering to various preferences, budgets, and experiences. This diversity enables consumers to easily find accommodations that meet their specific needs, from luxury resorts to budget-friendly options, driving higher conversion rates.

Regional Insights

The resort market in North America accounted for the revenue share of 18.51% in 2023. The regional market is experiencing robust growth, largely attributed to a strong recovery in international tourism and a renewed focus on regional travel. Canada and Mexico, alongside the U.S., have become increasingly popular as resort destinations due to their proximity, varied landscapes, and the expansion of all-inclusive and luxury resort offerings. The rise of multi-generational travel, where families seek destinations that cater to all age groups, has further driven demand for resorts that provide a comprehensive range of activities and amenities. Moreover, the emphasis on sustainability and eco-tourism in resort development is resonating with environmentally conscious travelers, making North America a key market for innovative and sustainable resort projects.

U.S. Resort Market Trends

The resort market in the U.S. is expected to grow at a significant CAGR of 18.5% from 2024 to 2030. The growth is driven by a resurgence in domestic tourism, supported by strong consumer spending and an increasing preference for luxury and experiential travel. The U.S. economy's relative stability, coupled with a rising disposable income among American travelers, has fueled demand for high-end resort accommodations. In addition, the country's diverse range of natural attractions-from coastal beaches to mountainous regions-has encouraged the development of specialized resorts catering to niche markets, such as wellness retreats, adventure resorts, and family-oriented properties. This diversification has positioned the U.S. as a leading market for resort growth, attracting both domestic and international visitors seeking unique and tailored vacation experiences.

Asia Pacific Resort Market Trends

Asia Pacific dominated the resort market with the largest revenue share of 44.25% in 2023. The region is witnessing a significant expansion in its market, driven by the rapid growth of the middle class, increased urbanization, and a burgeoning interest in luxury travel experiences. Key markets such as China, Thailand, Indonesia, and the Maldives are seeing a surge in resort development, catering to both domestic and international tourists. The region's appeal lies in its diverse offerings, from tropical beach resorts to culturally immersive experiences and adventure tourism. Furthermore, strategic investments in infrastructure, such as new airports and improved transportation networks, are enhancing accessibility to remote and exotic destinations, fueling the growth of the resort sector. The rise of digital nomadism and long-stay tourism, particularly in Southeast Asia, is also contributing to the sustained demand for resort accommodations.

Europe Resort Market Trends

The resort market in Europe is projected to grow at the fastest CAGR of 18.3% from 2024 to 2030. The regional market is benefiting from a combination of strong intra-regional travel, increasing demand for luxury experiences, and the continent's rich cultural heritage. Countries like Spain, Italy, and Greece continue to be top choices for resort vacations, particularly among European travelers seeking both relaxation and cultural enrichment. The rise of wellness tourism in Europe has also contributed to the growth of spa and health-focused resorts, which cater to an aging population as well as younger demographics looking for holistic well-being. In April 2024, Hilton announced a strategic expansion of its resort portfolio in Europe, with plans to rapidly increase its presence across the continent. The company is set to open 10 new properties, adding over 1,500 guest rooms to its offerings in time for the summer season. This expansion will be across Hilton's Curio Collection by Hilton, Tapestry Collection by Hilton, and DoubleTree by Hilton brands, reinforcing Hilton's commitment to growth in key European markets and enhancing its ability to cater to the rising demand for upscale resort experiences. Additionally, the expansion of budget airlines and improved connectivity across Europe have made resort destinations more accessible, boosting short-term and long-term stays in resort properties across the region.

Key Resort Company Insights

The global resort industry is characterized by intense competition, with key players vying for market share across various resort segments. Major hotel chains such as Marriott International, Hilton Worldwide, and Accor operate expansive portfolios that include luxury and mid-range resorts in prime locations globally. These players leverage brand recognition, extensive loyalty programs, and diversified service offerings to attract a broad customer base. In addition, independent boutique resorts and regional operators focus on niche markets, offering unique experiences that cater to specific traveler segments, such as eco-tourism, wellness retreats, or cultural immersion, thus creating competitive differentiation.

Strategic partnerships, mergers, and acquisitions are also prevalent as companies seek to expand their market presence and tap into emerging trends, such as the growing demand for eco-friendly and wellness-oriented resorts. This dynamic environment necessitates continuous adaptation and innovation for players to maintain and grow their market share.

Key Resort Companies:

The following are the leading companies in the resort market. These companies collectively hold the largest market share and dictate industry trends.

- Marriott International, Inc.

- Hilton Worldwide Holdings Inc.

- Wyndham Hotels & Resorts

- Accor S.A.

- InterContinental Hotels Group (IHG)

- Four Seasons Hotels and Resorts

- Banyan Tree Holdings Limited

- Hyatt Hotels Corporation

- MGM Resorts International

- Las Vegas Sands Corp.

Recent Developments

-

In September 2023, Banyan Tree Hotels & Resorts completed a significant transaction, paving the way for its debut on Bluewaters Island, a dynamic lifestyle destination that highlights Dubai’s innovation and world-class hospitality. The Banyan Tree Dubai was announced as the successor to the existing Dubai's Caesars Palace. The rebranded resort was set to undergo phased upscale enhancements, ultimately offering 179 rooms, including 30 suites, along with a newly designed four-bedroom villa featuring a private entrance, pool, and direct beach access. The estate was slated to reopen as Banyan Tree Dubai by late 2023, marking the introduction of the brand’s acclaimed Asian-inspired luxury hospitality to the Emirate

-

In April 2024, Wyndham Alltra unveiled its newest resort on the coast of the Samaná Peninsula in the Dominican Republic. Located in the town of Las Galeras, the Wyndham Alltra Samaná provides a family-friendly, all-inclusive experience characterized by ocean views, pristine white sands, and a variety of entertainment options throughout the day. This property, managed by Playa Hotels & Resorts-a leading global operator of all-inclusive resorts-marks Wyndham Alltra's inaugural venture in the Dominican Republic. Later this year, the brand will also introduce Wyndham Alltra Punta Cana, which will be managed by Playa as well. These new developments enhance Wyndham's rapidly growing all-inclusive portfolio, which now consists of approximately 40 resorts worldwide

Resort Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 403.9 billion

Revenue forecast in 2030

USD 945.4 billion

Growth rate

CAGR of 18.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resort type, price range, booking mode, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Marriott International, Inc.; Hilton Worldwide Holdings Inc.; Wyndham Hotels & Resorts; Accor S.A.; InterContinental Hotels Group (IHG); Four Seasons Hotels and Resorts; Banyan Tree Holdings Limited; Hyatt Hotels Corporation; MGM Resorts International; Las Vegas Sands Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Resort Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global resort market report based on resort type, price range, booking mode, and region.

-

Resort Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Golf Resorts

-

Beach Resorts

-

Island Resorts

-

Lake Resorts

-

Mountain Resorts

-

Ski Resorts

-

Eco-Resorts

-

Others (Heritage Resorts, Casino Resorts, etc.)

-

-

Price Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Budget

-

Midrange

-

Luxury and Ultra-Luxury

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Travel Agents & Online Travel Agencies (OTAs)

-

Marketplace Booking

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global resort market was estimated at USD 300.03 billion in 2023 and is expected to reach USD 347.14 billion in 2024.

b. The global resort market is expected to grow at a compound annual growth rate of 18.2% from 2024 to 2030 to reach USD 945.38 billion by 2030.

b. Asia Pacific dominated the resort market with a share of over 44.25% in 2023. The region is witnessing a significant expansion in its resort market, driven by the rapid growth of the middle class, increased urbanization, and a burgeoning interest in luxury travel experiences.

b. Some of the key players operating in the resort market include Marriott International, Inc., Hilton Worldwide Holdings Inc., Wyndham Hotels & Resorts, Accor S.A., InterContinental Hotels Group (IHG), Four Seasons Hotels and Resorts, Banyan Tree Holdings Limited, Hyatt Hotels Corporation, MGM Resorts International, and Las Vegas Sands Corp.

b. Key factors driving the resort market growth include increasing consumer spending on travel, the rising appeal of experiential and luxury tourism, and the strategic expansion of resort offerings across emerging and established destinations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.