Resistance Bands Market Size, Share & Trends Analysis Report By Product (Therapy, Pull up, Exercise), By Application (Individual, Health & Sports Clubs), By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-163-4

- Number of Report Pages: 79

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Resistance Bands Market Size & Trends

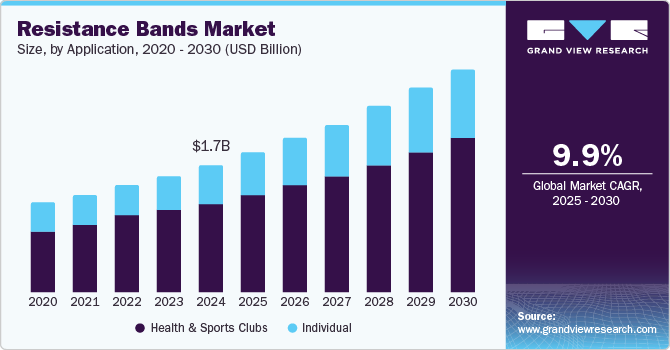

The global resistance bands market size was valued at USD 1.66 billion in 2024 and is expected to expand at a CAGR of 9.9% from 2025 to 2030. The increasing demand for home fitness equipment, especially after the COVID-19 pandemic, has led more people to invest in portable and space-efficient workout tools like resistance bands. The rise of online fitness programs and influencers promoting strength training and home workouts has further fueled this trend. Resistance bands are used in physical therapy to build muscular strength and in the rehabilitation of patients. These bands are available in four main categories of resistance: light, medium, heavy, and extra-heavy. In addition, there are color codes to define tension levels such as green, yellow, and red. Consumers can choose their equipment according to their fitness and muscle endurance.

The growing awareness of the health benefits of regular physical activity, including improved muscle strength, flexibility, and overall well-being, encourages more individuals to incorporate resistance bands into their fitness routines. Resistance bands' affordability and accessibility and versatility in various exercises also contribute to their market growth.

The advent of smart resistance bands equipped with motion sensors and Bluetooth transmitters will drive the market over the forecast period. Such bands can be used to target arms, shoulders, legs, and back. In addition, they can offer 25 different movements to support a full-body workout. Moreover, the availability of multiple functionalities without supervision and the product's overall cost-effectiveness will drive the market in the coming years.

Application Insights

Health & sports clubs dominated the market with the largest revenue share of 70.6% in 2024. Health & sports clubs are prime venues for strength and resistance training, where resistance bands are extensively used for a variety of exercises, from warm-ups to full workout routines. Integrating resistance bands into group fitness classes and personal training sessions also contributes significantly to their popularity in these settings. Additionally, the continuous expansion of health clubs and the growing trend of fitness memberships further support the market.

The individual segment is expected to grow at the fastest CAGR of 10.9% over the forecast period. The increasing awareness of health and fitness among individuals, coupled with the convenience and flexibility of home workouts, is a major contributor. Resistance bands are highly portable, affordable, and versatile, making them attractive for personal use. The rise of digital fitness platforms and online workout classes has also encouraged more individuals to invest in their own fitness equipment. Additionally, the growing trend of personalized fitness routines and the desire for flexible workout options further support the robust growth of the individual segment in the resistance bands market.

Product Insights

Exercise bands dominated the market with the largest revenue share in 2024. They are highly versatile and suitable for a wide range of fitness activities, including strength training, rehabilitation, and flexibility exercises. Their affordability and ease of use make them accessible to a broad audience, from beginners to professional athletes. The growing popularity of home workouts and the integration of exercise bands into various fitness programs and routines further boost their demand.

Therapy bands are expected to grow significantly over the forecast period owing to the increasing awareness of the benefits of physical therapy and rehabilitation exercises, particularly for injury recovery and chronic pain management. Physiotherapists and healthcare professionals widely use therapy bands for their effectiveness in improving strength, flexibility, and range of motion. The growing elderly population, which often requires therapeutic exercises, further boosts demand. Additionally, the rising trend of home-based rehabilitation and the availability of online resources and guidance for using therapy bands support their market expansion.

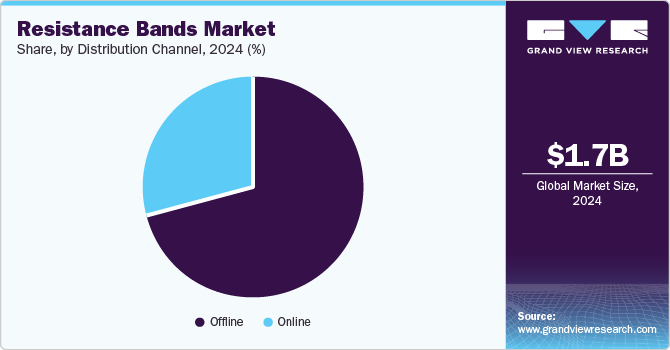

Distribution Channel Insights

The offline segment dominated the market with the largest revenue share in 2024, owing to the availability of a wide range of resistance bands in physical retail stores, including specialty fitness shops, sporting goods stores, and general retail outlets. Consumers often prefer buying fitness equipment offline to physically inspect the products, assess their quality, and receive immediate assistance from sales staff. Additionally, the presence of offline promotional activities, discounts, and the ability to try products before purchasing further enhance the shopping experience.

The online segment is expected to grow at the fastest CAGR over the forecast period owing to the increasing convenience and accessibility of online shopping, allowing consumers to purchase resistance bands from the comfort of their homes. The rise of e-commerce platforms and the growing number of fitness brands offering their products online further support this trend. Additionally, online shopping provides access to various products, competitive pricing, customer reviews, and detailed product information, enhancing the overall shopping experience. The influence of social media and fitness influencers promoting resistance bands also plays a significant role in driving online sales.

Regional Insights

North America dominated the global resistance bands market, with a revenue share of 40.0% in 2024. The region's high health consciousness and the growing home fitness trend have significantly boosted the demand for resistance bands. The presence of major fitness equipment manufacturers and a well-established distribution network also contribute to market growth. Additionally, the increasing popularity of fitness programs and online workout classes incorporating resistance bands further fuels their demand.

U.S. Resistance Bands Market Trends

The U.S. resistance bands market is expected to grow significantly over the forecast period. Americans' increasing focus on health and fitness has increased demand for home workout equipment, including resistance bands. For instance, there are approximately 50,516 physical therapy centers in the U.S., highlighting the importance of resistance bands in rehabilitation and physical therapy. As of 2022, there were around 31,000 health clubs in the U.S., indicating a strong fitness and resistance band usage infrastructure. Furthermore, resistance bands' convenience, affordability, and versatility make them an attractive option for many consumers, from fitness enthusiasts to those undergoing physical therapy. Additionally, the growing popularity of online fitness programs and the influence of social media fitness influencers promoting resistance band exercises contribute to the market's expansion.

Europe Resistance Bands Market Trends

Europe's resistance bands market was identified as a lucrative region in 2024. This growth is driven by increasing health consciousness and the popularity of home-based workouts among Europeans. The growing trend of fitness and wellness, coupled with the rising adoption of resistance bands in physical therapy and rehabilitation, supports market expansion. Additionally, the presence of well-established fitness infrastructure and the influence of fitness trends and programs further boost demand.

Asia Pacific Resistance Bands Market Trends

Asia Pacific resistance bands market is expected to grow at the fastest CAGR of 10.4% over the forecast period owing to increasing health awareness and the rising trend of home fitness. The region's expanding middle-class population, with higher disposable incomes, supports purchasing fitness equipment like resistance bands. Additionally, the proliferation of online fitness programs and influencers promoting at-home workouts has significantly boosted demand. The versatility and affordability of resistance bands make them particularly appealing to a broad range of consumers, from fitness enthusiasts to those seeking rehabilitation solutions.

Key Resistance Bands Company Insights

Some key companies in the resistance bands market include Performance Health, Black Mountain Products, Inc., Prosource Wholesale, Xtreme Bands, Wacces, Bodylastics USA Inc., The 4D Badge, and others.

-

Performance Health is a leading professional-grade resistance band and fitness equipment provider. Its THERABAND line is particularly well-known, offering a range of resistance bands designed for rehabilitation, physical therapy, and general fitness.

-

Black Mountain Products, Inc. is a family-owned business based in Illinois that specializes in high-quality resistance bands and home gym equipment. Their product line includes a variety of resistance bands, ranging from beginner to advanced levels, with options for physical therapy, strength training, and rehabilitation. Black Mountain

Key Resistance Bands Companies:

The following are the leading companies in the resistance bands market. These companies collectively hold the largest market share and dictate industry trends.

- Performance Health

- Black Mountain Products, Inc.

- Prosource Wholesale

- Xtreme Bands

- Fitness Anywhere LLC

- Bodylastics USA Inc.

- The 4D Badge

- Wacces

- Reehut

View a comprehensive list of companies in the Resistance Bands Market

Resistance Bands Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.82 billion |

|

Revenue forecast in 2030 |

USD 2.92 billion |

|

Growth rate |

CAGR of 9.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Denmark, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa, |

|

Key companies profiled |

Performance Health; Black Mountain Products, Inc.; Prosource Wholesale; Xtreme Bands; Fitness Anywhere LLC; Bodylastics USA Inc.; The 4D Badge; Wacces; Reehut |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Resistance Bands Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global resistance bands market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapy

-

Pull up

-

Exercise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual

-

Health & Sports Clubs

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global resistance bands market size was estimated at USD 799.1 million in 2019 and is expected to reach USD 896.6 million in 2020.

b. The global resistance bands market is expected to grow at a compound annual growth rate of 12.4% from 2019 to 2025 to reach USD 1,615.7 million by 2025.

b. North America dominated the resistance bands market with a share of 38.3% in 2019. This is attributable to rising consumer awareness regarding the need for physical fitness.

b. Some key players operating in the resistance bands market include Performance Health, LLC (TheraBand); Wacces; Black Mountain Products Inc.; Prosource; ZAJ FIT; Xtreme Bands; Bodylastics International Inc.; and Fitness Anywhere LLC.

b. Key factors that are driving the market growth include the rising popularity of rehabilitation therapies worldwide and the increasing consumer participation in fitness programs.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."