- Home

- »

- Electronic & Electrical

- »

-

Residential Washing Machine Market Size Report, 2030GVR Report cover

![Residential Washing Machine Market Size, Share & Trends Report]()

Residential Washing Machine Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fully Automatic, Semi-Automatic), By Capacity (Below 6 kg, 6kg to 8 kg), By Technology, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-166-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Residential Washing Machine Market Summary

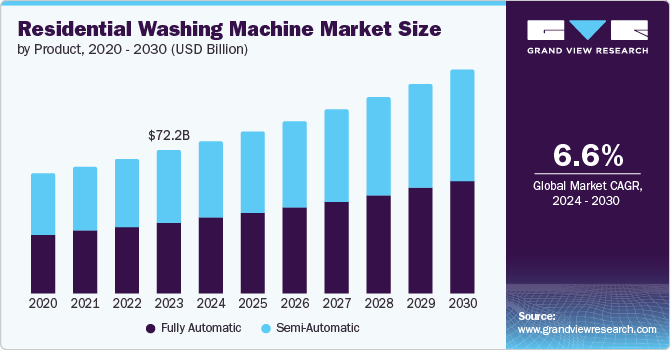

The global residential washing machine market size was valued at USD 72.24 billion in 2023 and is projected to reach USD 113.0 billion by 2030, growing at a CAGR of 6.6% from 2024 to 2030. Rising disposable income, rapid urbanization worldwide and growing trend toward water-saving machines are the key drivers propelling market growth.

Key Market Trends & Insights

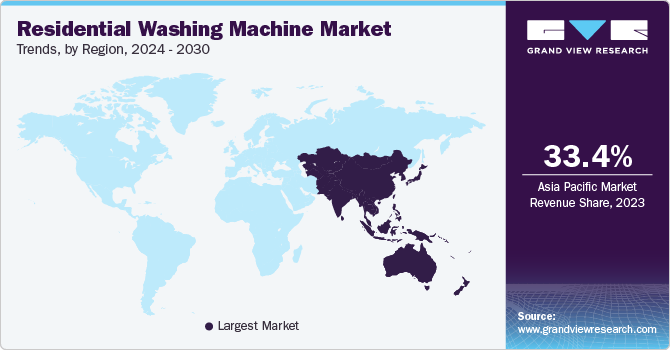

- Asia Pacific dominated the market with a revenue share of 33.4% in 2023.

- China held a substantial market share in 2023.

- By product, semi-automatic dominated the market and accounted for a share of 50.3% in 2023.

- By capacity, 6 to 8 kg accounted for the largest market revenue share of 47.0% in 2023.

- By technology, top load accounted for the largest market revenue share of 68.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 72.24 Billion

- 2030 Projected Market Size: USD 113.0 Billion

- CAGR (2024-2030): 6.6%

- Asia Pacific: Largest market in 2023

Furthermore, integration of smart technologies into washing machines such as Internet of things (IoT) and growing use of Artificial Intelligence (AI) in machines and software is likely to propel the residential washing machine market.

With the changing lifestyle trends and busier schedules of the working population, consumers are now choosing convenient and effortless laundry systems. This has led to a rising preference for automatic and semi-automatic washing machines, as consumers seek to save time. The increasing disposable income and growing affordability of washing machines is increasing the adoption of washing machines in the residential sector. The demand for washing machines is rising even in rural areas as standard of living is improving as improvements in electric supply drives the demand for electronic products such as washing machines.

The growing environmental awareness has led to the increased demand for energy efficient and water saving washing machines. The consumers are focusing more on sustainability and energy saving which is significantly impacting the residential washing machine market. In addition, various governments around the world are implementing energy and water saving regulations and standards for home appliances such as washing machines. According to United Nations International Children Emergency Fund (UNICEF), half of the global population could be residing in areas facing water scarcity by 2025.

Product Insights

Semi-automatic dominated the market and accounted for a share of 50.3% in 2023, attributed to low cost for machines, energy and water efficiency that this segment offers. Semi-automated washing machines offer manual adjust settings to monitor the washing process and it has low maintenance cost.

The fully automatic segment is expected to witness the fastest CAGR during the forecast period, owing to increasing disposable income, time efficiency and ease of use. Fully automatic washing machines eliminates the need for manual intervention and offer greater convenience. Moreover, these machines are programmed with optimal water and energy use based on machine load size. Furthermore, integration of smart technology in fully automatic machines such as IoT & AI allow users to monitor cycles and saves time.

Capacity Insights

6 to 8 kg accounted for the largest market revenue share of 47.0% in 2023. Washing machines with capacity of 6 to 8 kg is ideal for majority of households and offers strength, power, capacity and are more budget friendly. 6 to 8 kg washing machines are more water and energy efficient, translating to them being environment friendly. Moreover, the washing machines of this capacity attracts customers with top load and front load options.

Below 6 kg segment is expected to hold substantial share during the forecast period. Washing machines below 6 kg are well suited for smaller living spaces and come with an affordable range. The demand for washing machines below 6 kg is fueled by individuals or working couples that may not generate enough laundry. Furthermore, these machines require less water and energy to operate and are easier to move around.

Technology Insights

Top load accounted for the largest market revenue share of 68.4% in 2023, owing to affordable cost of washing machines and convenient loading. Top load machines offers more convenience compared to front load machines. Moreover, top load machines have shorter cycle times and can accommodate large load capacity. The top load washing machines are more budget friendly which creates demand among consumers.

Front load segment is expected to register the fastest CAGR of during the forecast period. The growth can be attributed to technology’s superior performance and better cleaning performance. Front load washing machines uses less water and energy which makes them environmentally friendly.

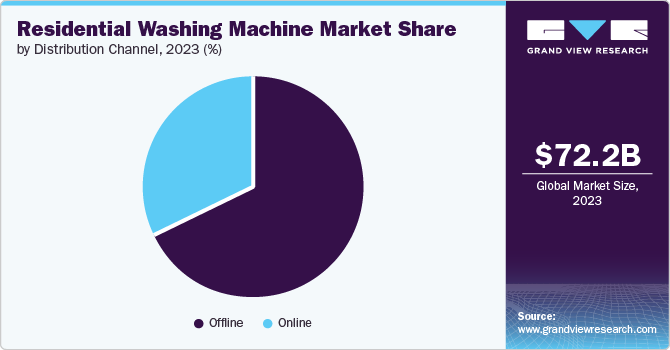

Distribution Channel Insights

The offline segment dominated the market in 2023. The growth can be attributed to rise in specialty store shopping as these stores focus solely on particular types of products like electronic appliances and homes goods. This specialization allows them to provide a wide range of washing machines that caters to different consumer needs based on budget, specifications and preference. Moreover, the presence of skilled and knowledgeable staff in stores is a greater advantage as consumers seeking for washing machines can benefit from their expertise. Furthermore, offline stores allow customers to interact with products before making purchase decision. This instills a sense of confidence and trust in the product enhancing overall experience.

The online segment is projected to grow at the fastest CAGR of 7.1% during the forecast period, owing to growing trend of online shopping and availability of wide variety of items. Online sales offer several benefits such as home delivery, convenience and product reviews which helps consumer to make purchase decision. For instance, there are 2.71 billion buyers buying from online platform in 2024, an increase of 2.7% from previous years. Moreover, the fair and affordable prices offered by e-commerce platforms encourages people to shop online. The rise in e-commerce sales is expected to boost the sale of consumer electronics including washing machines.

Regional Insights

North America residential washing machine market was identified as a lucrative region in 2023 owing to rising technological advancements and innovation in washing machines. The growing trend of smart home system in countries such as the U.S. Canada and Mexico is contributing to the growth for washing machines in the region. Moreover, the growing concern for water crisis in the region is pushing advanced washing machines which consumes less water and provides cleaning efficient.

U.S. Residential Washing Machine Market Trends

The U.S. residential washing machine market dominated the North America market in 2023 owing to the consumer demand for energy efficient products. The rising awareness among people about water shortage in the country is accelerating the market growth.

Europe Residential Washing Machine Market Trends

The Europe residential washing machine market is anticipated to witness significant market revenue share during the forecast period. The growth can be attributed to technological advancements and the rising penetration of smart homes. The growing awareness among consumers about the energy efficiency of washing machines in propelling the market. For instance, International Energy Agency (IEA), forecasts European Union (EU) electricity demand growth to rise by an average 2.3% in 2024-2026.

The UK residential washing machine market accounted for the largest revenue share in 2023. The growth can be attributed to increase in adoption of cost-efficient and environment friendly washing machines. Furthermore, the changing lifestyle and increasing work culture is rising the demand for electrical appliances that save their time and offer convenience. The working women employment rate in UK accounted for 72.1% in 2023, which is expected to further propel the market growth.

The Germany residential washing machine market is expected to grow rapidly during the forecast period owing to advancements in technology and rise in online shopping. The rise in adoption of smart technology that saves energy and consumes less water is accelerating the market growth.

Asia Pacific Residential Washing Machine Market Trends

Asia Pacific residential washing machine dominated the market with a revenue share of 33.4% in 2023 and is anticipated to witness the fastest CAGR during the forecast period, owing to rising urbanization, increasing per capita income and hub to strong manufacturing sector. The rising popularity of smart homes in emerging countries like India, China and japan is likely to propel the market growth. Furthermore, the adoption of technological advancements and rising alarm for environment concern is driving the demand for innovative electrical appliances.

The China residential washing machine market held a substantial market share in 2023. China is hub to some of largest manufactures across the globe and leads the production and sales of washing machine market globally.

The residential washing machine market in India is expected to witness significant growth during the forecast period, owing to the growing per capita income and rapid urbanization. Furthermore, India accounts for the largest young population across the globe and the changing lifestyle among these youths such as current trend of young couple shift towards nuclear families that translates to increasing demand for washing machines. Moreover, the rising consumer awareness about the benefits of washing machines including saving water and energy, convenience and better hygiene is driving demand foe washing machines in the country.

Key Residential Washing Machine Company Insights

Some of the key companies in the residential washing machine marketinclude Samsung Electronics Co. Ltd.; Hitachi, Ltd.; Panasonic Corporation; Whirlpool Corporation; Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Samsung Electronics Co. Ltd is the world’s largest manufacturer of smartphones and semiconductor memory. The product line of the company includes Home Electronics, personal computing, mobile devices and home appliances.

-

Whirlpool Corporation is an American manufacturer of kitchen and laundry appliance and manufactures product such as refrigerator, washing machines, air conditioners, dish washers and more.

Key Residential Washing Machine Companies:

The following are the leading companies in the residential washing machine market. These companies collectively hold the largest market share and dictate industry trends.

- Hitachi, Ltd.

- Midea Group Co. Ltd.

- Panasonic Corporation

- IFB Industries Ltd.

- BSH Hausgeräte GmbH

- GE Appliances

- AB Electrolux

- LG Electronics Inc.

- Samsung Electronics Co. Ltd.

- Whirlpool Corporation

Recent Developments

-

In April 2024, Samsung Electronics launched new washing machine lineup in UK offering high energy efficiency and loaded with advanced AI features. The new washing machines saves 40% more energy previous model. Moreover, with integration of AI, users can now monitor daily, weekly and monthly power consumption and energy bills.

-

In April 2024, Whirlpool Corporation announced the completion of a transaction with Arçelik A.Ş. to establish Beko Europe, a new European appliance company. The completion of this transaction emphasize significant advancement toward becoming a more profitable business focused on growth.

-

In March 2024, Samsung electronics launched new range of AI Ecobubble, 11 kg fully automatic front load washing machine. The newly launched machine saves up to 70% energy, 50% lower wash time and 45.5% better fabric care and is equipped with advanced AI features.

-

In November 2023, LG WashTower was launched in India. LG offers 10 years of warranty for its WashTower motor and the machine has a compact design and is available in front-load.

Residential Washing Machine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 76.8 billion

Revenue forecast in 2030

USD 113.0 billion

Growth Rate

CAGR of 6.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, capacity, technology, distribution channel and region.

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, South Africa.

Key companies profiled

Hitachi, Ltd.; Midea Group Co. Ltd.; Panasonic Corporation; IFB Industries Ltd.; BSH Hausgeräte GmbH; GE Appliances; AB Electrolux; LG Electronics Inc.; Samsung Electronics Co. Ltd.; Whirlpool Corporation;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Residential Washing Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global residential washing machine market report based on product, capacity, technology, distribution channel and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fully Automatic

-

Semi-Automatic

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 6 kg

-

6 to 8 kg

-

Above 8 kg

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Top Load

-

Front Load

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.