- Home

- »

- Advanced Interior Materials

- »

-

Residential Remodeling Market Size And Share Report, 2030GVR Report cover

![Residential Remodeling Market Size, Share & Trends Report]()

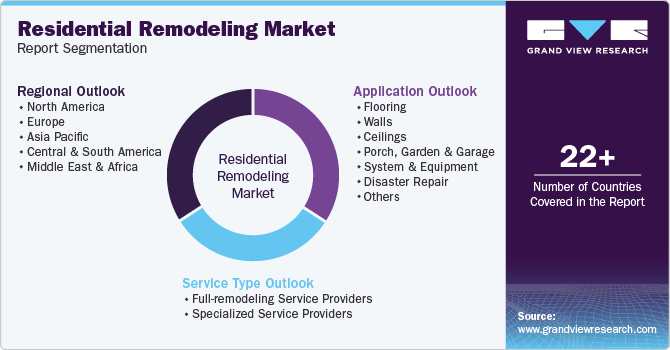

Residential Remodeling Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Flooring, Walls, Ceilings, Porch), By Service Type (Full-remodeling Service Providers Specialized Service Providers), By Region, And By Segment Forecasts

- Report ID: GVR-4-68040-453-0

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Residential Remodeling Market Summary

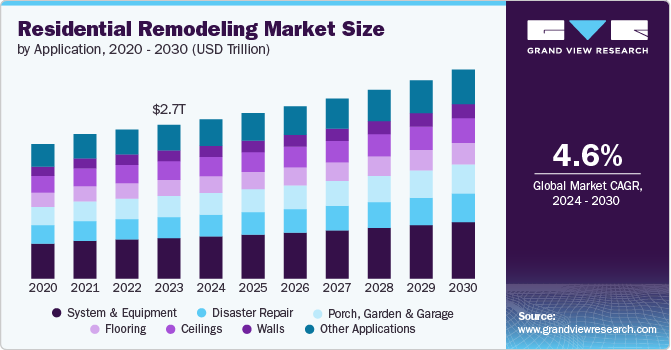

The global residential remodeling market size was estimated at USD 2.70 trillion in 2023 and is projected to reach USD 3.67 trillion by 2030, growing at a CAGR of 4.6% from 2024 to 2030. The market is driven by several key factors, including the aging housing stock and the growing trend of homeownership.

Key Market Trends & Insights

- Asia Pacific led the residential remodeling market with the largest revenue share of 36.9% in 2023 and is expected to grow at the fastest CAGR over the forecast period.

- The residential remodeling market in the U.S. is growing at a CAGR of 4.6% over the forecast period.

- Based on application, system & equipment segment dominated the market with a revenue share of 26.3% in 2023 and is further expected to grow at the fastest rate over forecast period.

- In terms of application, demand for disaster repairs is expected to grow at 4.6% from 2024 to 2030 as climate change leads to an increase in the frequency and severity of natural disasters, such as hurricanes, floods, and wildfires.

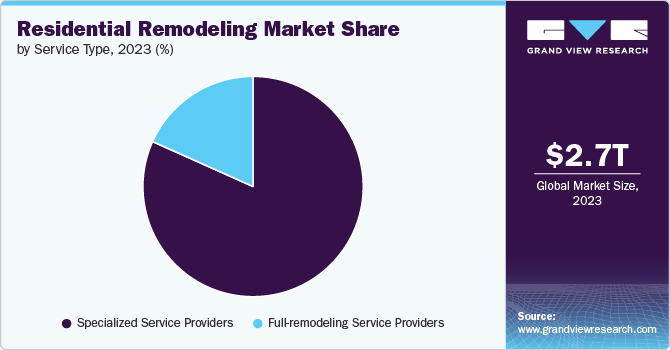

- On the basis of service type, specialized service providers accounted for the largest revenue share of 81.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.70 trillion

- 2030 Projected Market Size: USD 3.67 trillion

- CAGR (2024-2030): 4.6%

- Asia Pacific: Largest market in 2023

Many homes in the U.S. are over 30 years old, necessitating updates and repairs to maintain their functionality and aesthetic appeal. This aging housing stock prompts homeowners to invest in remodeling projects that improve energy efficiency, increase home value, and enhance living conditions, thus propelling the industry demand.

Additionally, the rise in homeownership rates, especially among millennials, has led to a surge in demand for renovations and remodeling, as new homeowners are eager to personalize their spaces and adapt them to modern living standards. The rising trend toward remote work has also significantly boosted the demand for home office setups and other home modifications to accommodate new lifestyle needs. As people spend more time at home, they are more inclined to invest in projects that improve comfort, functionality, and the overall quality of their living spaces, thus propelling the growth of the residential remodeling market.

The residential remodeling market presents numerous opportunities, particularly in the areas of sustainable and smart home renovations. Consumer interest is growing in eco-friendly remodeling solutions, such as energy-efficient windows, solar panels, and sustainable building materials. This trend is driven by increasing environmental awareness and government incentives aimed at reducing carbon footprints. Hence homeowners are increasingly looking to reduce their energy bills and improve their homes' environmental performance, creating significant opportunities for companies offering green remodeling products and services.

However, rising material costs and labor shortages are expected to restrain the market growth. The cost of construction materials, including lumber, steel, and concrete, has seen substantially increases in recent years due to supply chain disruptions, tariffs, and high demand. These rising costs can significantly impact project budgets, leading some homeowners to delay or scale back their remodeling plans. Additionally, labor shortages in the construction and remodeling sectors pose a major challenge, as the demand for skilled workers often exceeds supply. This can result in longer project timelines and increased labor costs, further straining homeowner budgets.

The competitive landscape of the residential remodeling market is highly fragmented, with a mix of large national players and numerous small, specialized contractors. Major companies in the market, such as Dow Inc., Pella Corporation, JELD-WEN, IndustrieCottoPossagno S.p.A, Andersen Corporation, Seven Group Holdings Limited, and Kohler Co., leverage their extensive distribution networks, strong brand recognition, and wide range of products and services to capture a significant share of the market. Furthermore, these companies often offer bundled services, such as design consultations and installation, which provide added convenience to homeowners and give them a competitive edge.

Application Insights

System & equipment segment dominated the market with a revenue share of 26.3% in 2023 and is further expected to grow at the fastest rate over forecast period. This growth is attributed to increasing adoption of energy-efficient technologies and smart home systems around the globe. Homeowners are investing in upgrades like modern HVAC systems, solar panels, and advanced home security systems to improve energy efficiency, reduce utility costs, and enhance home automation.

The flooring segment is experiencing robust growth due to the rising demand for durable, aesthetically pleasing, and low-maintenance flooring options. The popularity of materials like luxury vinyl tile (LVT), hardwood, and engineered wood is driving the market as homeowners seek to upgrade their interiors with flooring that offers both style and functionality. The trend toward open floor plans and the desire for cohesive design elements across living spaces also contribute to increased flooring renovations, particularly in kitchens and living rooms, which are focal points in home remodeling projects.

Demand for disaster repairs is expected to grow at 4.6% from 2024 to 2030 as climate change leads to an increase in the frequency and severity of natural disasters, such as hurricanes, floods, and wildfires. Homeowners affected by these events are often compelled to undertake extensive repairs or rebuilds, driving demand for remodeling services focused on disaster recovery. Moreover, there is a growing awareness and demand for resilient building practices and materials that can withstand future disasters, encouraging homeowners to not only repair but also reinforce their homes against potential future damage.

The walls segment is growing as homeowners increasingly seek to update the aesthetic and functionality of their living spaces through renovations like painting, drywall installation, and the removal or addition of walls. Open floor plans and the integration of multifunctional spaces are driving demand for wall modifications. In contrast, the trend toward accent walls and textured finishes adds to the popularity of wall-related remodeling projects. Furthermore, the need for improved insulation and soundproofing in home offices or entertainment spaces is projected to propel the market to reach USD 248.52 billion by 2030.

Service Type Insights

Specialized service providers accounted for the largest revenue share of 81.7% in 2023. Specialized service providers are experiencing growth as homeowners seek out experts for specific remodeling needs, such as kitchen and bathroom renovations, flooring installations, or exterior upgrades. The desire for high-quality craftsmanship, coupled with the increasing complexity of certain projects, drives demand for specialists who offer deep expertise in particular areas of remodeling.

Additionally, niche markets like sustainable building practices, smart home installations, and aging-in-place modifications are further boosting the growth of specialized service providers who can cater to these specific homeowner preferences and requirements.

Full-remodeling service providers’ revenue is anticipated to grow at fastest rate of 5.1% over the forecast period. Full remodeling service providers are witnessing growth due to the increasing demand for comprehensive, end-to-end renovation solutions that offer convenience and consistency.

Homeowners are drawn to these providers as they offer one-stop-shop experience, handling everything from design to construction, which simplifies the remodeling process. The trend toward larger-scale, more complex home renovations, such as complete kitchen or bathroom overhauls, also contributes to the expansion of this segment, as these projects often require the broad expertise and resources that full-service remodelers can offer.

Regional Insights

The residential remodeling market in North America is driven by a combination of aging housing stock, increasing homeownership rates, and a strong preference for home improvements over new home purchases. Homeowners across the region are investing in renovations that enhance energy efficiency, improve aesthetics, and accommodate changing lifestyle needs, such as remote work and multigenerational living. Furthermore, government incentives and favorable financing options for energy-efficient upgrades, along with a robust housing market, continue to fuel demand for remodeling services. Hence, the industry demand in North America is expected to grow at a CAGR of 4.8% over the forecast period.

U.S. Residential Remodeling Market Trends

The residential remodeling market in the U.S. is growing at a CAGR of 4.6% over the forecast period. In the U.S., shift toward work-from-home arrangements has spurred demand for home office setups, along with other functional upgrades like expanded living areas and enhanced outdoor spaces. In addition, the U.S. market is characterized by significant regional variations, with strong growth in metropolitan areas where older homes are prevalent and where homeowners have the financial capacity to invest in extensive renovations. Increased interest in smart home technology and sustainable remodeling practices further propels the U.S. market as consumers seek to enhance their homes’ functionality and energy efficiency.

Asia Pacific Residential Remodeling Market Trends

Asia Pacific led the residential remodeling market with the largest revenue share of 36.9% in 2023 and is expected to grow at the fastest CAGR over the forecast period. The rising disposable incomes, urbanization, and the growing middle class in countries such as China, India, and other Southeast Asian economies support this growth. Homeowners in the region are increasingly investing in home renovations to improve their living standards, focusing on modern design, functionality, and comfort. The market is also benefiting from a boom in the construction of new residential units, where buyers often undertake immediate remodeling to personalize their spaces.

Europe Residential Remodeling Market Trends

Europe residential remodeling market accounted for USD 792.53 billion in 2023 due to region's focus on energy efficiency and sustainability, as well as government regulations that encourage green building practices. European homeowners are increasingly investing in retrofitting to comply with stringent energy performance standards, including the installation of energy-efficient windows, insulation, and renewable energy systems. Moreover, as European consumers prioritize quality and sustainability, there is a rising demand for high-end materials and professional remodeling services that align with these values.

Key Residential Remodeling Company Insights

Some of the key players operating in the market include Andersen Corporation, Dow, Inc., Kohler Co., Pella Corporation, Trex Company, and JELD-WEN:

-

Andersen Corporation is a leader in the window and door manufacturing industry. It is known for its innovative products that combine energy efficiency with premium design. The company's strong market presence and extensive distribution network have led it to gain a high market share.

-

JELD-WEN, Inc. is a prominent player in the production of energy-efficient windows and doors, with operations across North America, Europe, and Australia. A prominent player in the window and door industry. The company’s commitment to innovation and customer service solidifies its leadership status in the remodeling sector.

Boise Cascade Company, Lutron Electronics Co. Inc., Seven Group Holdings Limited, and IndustrieCottoPossagno S.p.A are some of the emerging participants in the market.

-

Lutron Electronics Co. Inc.is known for its advanced lighting control systems and smart home solutions, The company is making significant inroads as an emerging player in the remodeling industry. Its focus on smart home technology aligns with the growing demand for home automation in remodeling projects, thus leading to gaining a competitive edge.

-

Seven Group Holdings Limited is a diversified company with interests in building materials, Seven Group Holdings Limited is expanding its footprint in the residential remodeling market as it leverages its strong financial position and strategic acquisitions to enhance its market presence and capitalize on growth opportunities.

Key Residential Remodeling Companies:

The following are the leading companies in the residential remodeling market. These companies collectively hold the largest market share and dictate industry trends.

- Dow Inc.

- Pella Corporation

- JELD-WEN

- IndustrieCottoPossagno S.p.A

- Andersen Corporation

- Seven Group Holdings Limited

- Kohler Co.

- Trex Company

- Lutron Electronics Co. Inc.

- Boise Cascade company

Recent Developments

-

In November 2023, a Groundworks Company acquired Texas-based Eco-Soil Stabilizers, which offers residential customers and homebuilders proprietary soil stabilization injection technology. Thus, A Groundworks Company aims to leverage this technology to enhance foundation repairs of residential buildings across the U.S.

-

In July 2022, Renovo Home Partners acquired Reborn Cabinets. As a result of the acquisition, network, technology, and infrastructure support was shared among the acquirer and acquired company, allowing Renovo Home Partners to continue growing in the market.

Residential Remodeling Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.80 trillion

Revenue forecast in 2030

USD 3.67 trillion

Growth rate

CAGR of 4.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, service type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia

Key companies profiled

Dow Inc.; Pella Corporation; JELD-WEN; IndustrieCottoPossagno S.p.A; Andersen Corporation; Seven Group Holdings Limited; Kohler Co.; Trex Company; Lutron Electronics Co. Inc.; Boise Cascade Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Residential Remodeling Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the residential remodeling market based on application, service type, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Flooring

-

Walls

-

Ceilings

-

Porch, Garden And Garage

-

System & Equipment

-

Disaster Repair

-

Other Applications

-

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Full-remodeling Service Providers

-

Specialized Service Providers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global residential remodeling market size was estimated at USD 2.70 billion in 2023 and is expected to reach USD 2.80 billion in 2024.

b. The global residential remodeling market is expected to grow at a compound annual growth rate (CAGR) of 4.6% from 2024 to 2030, reaching USD 3.67 billion by 2030.

b. Systems and equipment accounted for the largest revenue share of over 26.3% in 2023, owing to its increasing adoption of energy-efficient technologies and smart home systems.

b. Some key players operating in the residential remodeling market include Dow Inc., Pella Corporation, JELD-WEN, IndustrieCottoPossagno S.p.A, Andersen Corporation, Seven Group Holdings Limited, Kohler Co., Trex Company, Lutron Electronics Co. Inc., and Boise Cascade company.

b. The key factors driving the residential remodeling market growth include the aging housing stock, the growing trend of homeownership, and the increased availability of home improvement financing options, including home equity loans and lines of credit.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.