- Home

- »

- Medical Devices

- »

-

Resectoscope Devices Market Size, Industry Report, 2030GVR Report cover

![Resectoscope Devices Market Size, Share & Trends Report]()

Resectoscope Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Device Type (Monopolar Resectoscopes, Bipolar Resectoscopes), By Application (Urology, Gynecology, General Surgery), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-489-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Resectoscope Devices Market Size & Trends

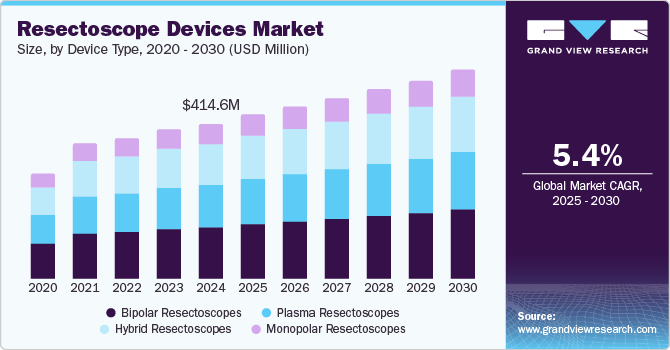

The global resectoscope devices market size was estimated at USD 414.62 million in 2024 and is projected to grow at a CAGR of 5.36% from 2025 to 2030. Market growth is driven by the rising prevalence of urogenital diseases, developing healthcare infrastructure, technological advancements and growing geriatric population base. The aging population globally is leading to a higher incidence of conditions that require surgical intervention. For instance, according to the United Nations, the global elderly population aged 65 years and above is expected to more than double from around 761 million in 2021 to 1.6 billion in 2050. As the elderly population grows, it increases the demand for effective treatments for urogenital diseases, which in turn drives the resectoscope market.

Resectoscopes, primarily used for transurethral resection procedures, are highly effective in treating conditions such as benign prostatic hyperplasia (BPH), bladder tumors, and uterine fibroids. The shift toward minimally invasive procedures, which offer reduced recovery time, lower complication rates, and improved patient outcomes, has driven the adoption of resectoscopes.

Another key driver of the resectoscope market is the rising geriatric population, which is more prone to conditions such as BPH and bladder cancer, requiring frequent surgical interventions. In addition, the increasing efforts by various organizations to increase awareness about urological and gynecological disorders and improve access to treatment is further expected to fuel the market growth over the forecast period. For instance, in October 2024, Strand Life Sciences partnered with FOGSI to enhance gynecological care through genomic testing. This collaboration aims to promote awareness and accessibility of genomic diagnostics, which can significantly improve patient outcomes by enabling personalized treatment strategies for various gynecological conditions, including cancers and reproductive health issues. Such awareness initiatives are expected to increase the demand for advanced solutions and drive the resectoscope devices industry growth.

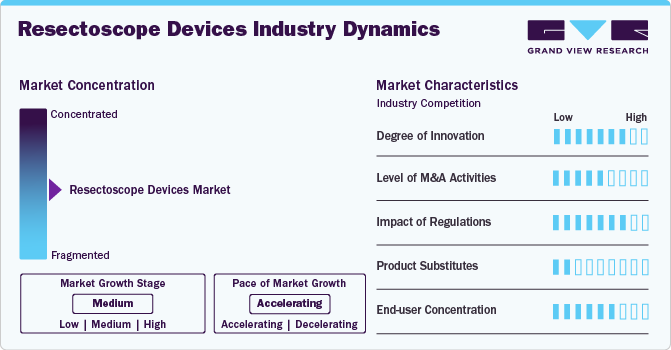

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The market is characterized by the growing geriatric population, developing healthcare infrastructure, increasing awareness about urological and gynecological health, and the rising prevalence of urogenital diseases.

The degree of innovation in the resectoscope devices industry is considered moderate as the manufacturers are focused on enhancing features such as better optics, user-friendliness, and performance rather than introducing entirely new technologies. Thus, the advancements aim to improve precision and safety of these devices during procedures, by heavily on existing frameworks.

Mergers and acquisitions (M&A) are a significant factor in the respectively developing devices market as they allow consolidation among key players, enhancing competitive rivalry. Through M&A activities, companies can acquire advanced technologies, expand their product portfolios, and enter new geographical markets more effectively. Furthermore, M&A can provide access to established distribution networks and customer bases, which are crucial for market penetration.

Regulations significantly influence the resectoscope devices industry in various areas such as product development, approval timelines, and commercialization strategies. Strict regulatory frameworks, such as FDA and CE Mark requirements, ensure device safety and efficacy but also increase compliance costs and time-to-market. Moreover, frequent updates to medical device standards require continuous adaptation. However, adherence to these regulations enhances product credibility, enabling better acceptance among healthcare professionals and other end-users.

The threat of product substitutes in the resectoscope devices industry is moderate, primarily due to their specific application in urological and gynecological procedures. While alternative methods such as laser surgeries or robotic-assisted technologies offer less invasive options, they may require higher costs. Thus, resectoscopes remain the preferred choice for certain procedures requiring direct visualization and tissue resection.

End user concentration in the resectoscope devices industry is significantly high, with hospitals, specialized clinics, and ambulatory surgical centers (ASCs) being primary end users. Thus, the resectoscope device manufacturers and suppliers need to customize their marketing strategies to meet the specific needs of these end user segments effectively.

Device Type Insights

The bipolar resectoscope segment dominated the market in 2024 owing to their advanced technology, superior safety profile, and clinical effectiveness. Bipolar systems utilize saline irrigation, which significantly reduces the risk of transurethral resection syndrome (TUR syndrome), which is a potentially life-threatening complication associated with the absorption of non-isotonic irrigation fluids. This feature makes bipolar resectoscopes suitable for patients with pre-existing cardiovascular or renal conditions. In addition, bipolar resectoscopes offer improved precision in tissue resection and coagulation, minimizing thermal damage to surrounding tissues, further contributing to their high demand in the market.

The hybrid resectoscopes segment is expected to register the fastest CAGR during the forecast period. This can be attributed to their unique design that combines the benefits of monopolar and bipolar technologies. These devices offer enhanced versatility, enabling surgeons to switch seamlessly between energy modalities during procedures without the need for device replacement. This adaptability reduces operative time and minimizes disruption during complex resections, which is particularly valuable in urological and gynecological procedures. Moreover, the increasing adoption of minimally invasive techniques has further fueled the demand for hybrid resectoscopes, as these devices are well-suited to advanced endoscopic procedures requiring precision and reduced tissue trauma.

Application Insights

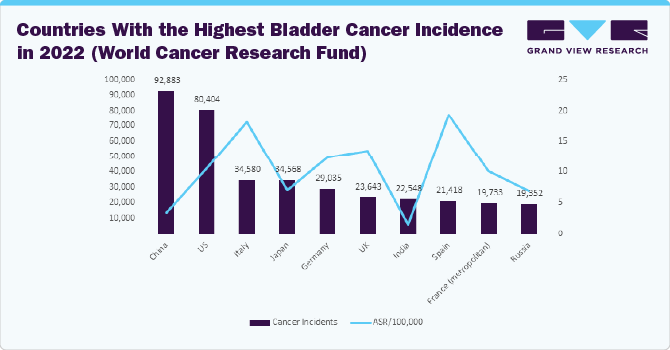

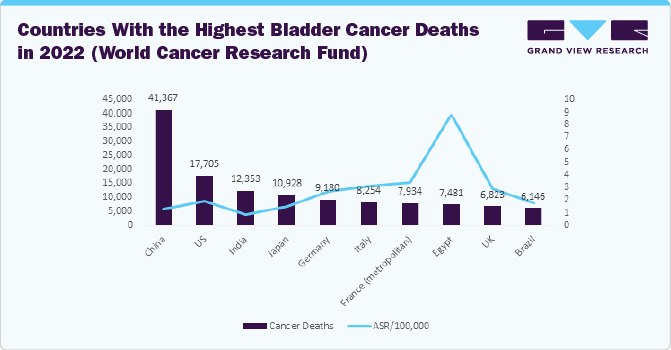

The urology segment dominated the market in 2024. Resectoscope devices have applications in procedures such as transurethral resection of the prostate (TURP) and transurethral resection of bladder tumors (TURBT), which are cornerstone treatments for benign prostatic hyperplasia (BPH) and bladder cancer, respectively. According to the Urologic Diseases in America annual data report 2024, the average incidence of BPH/LUTS in men aged 65 years and above was around 600 per 10,000 men per year from 2015 through 2021, which is approximately 600,000 men aged 65 and older who were newly identified with BPH annually. Such high incidents of urologic diseases further contribute to the growth of the segment.

The gynecology segment is expected to register the fastest CAGR during the forecast period. This can be attributed to the rising prevalence of various gynecological conditions globally. For instance, according to the World Cancer Research Fund, 420,368 cases of endometrial cancer were diagnosed in 2022 globally, with China and the U.S. accounting for the highest number of cases. Such a high prevalence of gynecological conditions is expected to increase the demand for resectoscopes and drive the segment growth over the forecast period.

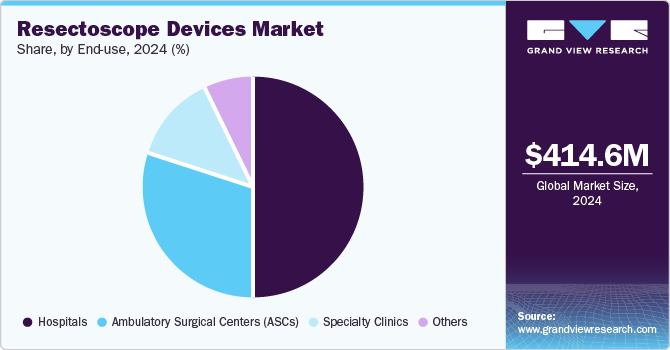

End-use Insights

The hospitals segment dominated the market in 2024 due to their advanced infrastructure, high patient volumes, and access to specialized surgical expertise. Moreover, several hospitals are focused on improving their urological and gynecological services, which is further expected to increase the demand for resectoscope devices in these facilities. For instance, in July 2024, the Staten Island University Hospital announced the expansion of the Smith Institute for Urology, enhancing advanced urological care with state-of-the-art technology. The facility offers specialized treatments for various urological conditions, emphasizing minimally invasive procedures. This expansion strengthens community healthcare access and positions the hospital as a key resource for local residents. Such developments in hospital infrastructure are also expected to fuel the segment's growth over the forecast period.

The Ambulatory Surgical Centers (ASC) segment is expected to witness the fastest growth over the forecast period owing to their ability to provide specialized, cost-effective, and efficient care for minimally invasive procedures. These centers specialize in providing outpatient surgeries, making them an ideal setting for resectoscope-assisted interventions such as transurethral resection of the prostate (TURP) or bladder tumor resections. In addition, the cost advantages ASCs offer to patients, along with lower infection rates due to their controlled outpatient environments, have further increased their preference for resectoscope-related procedures.

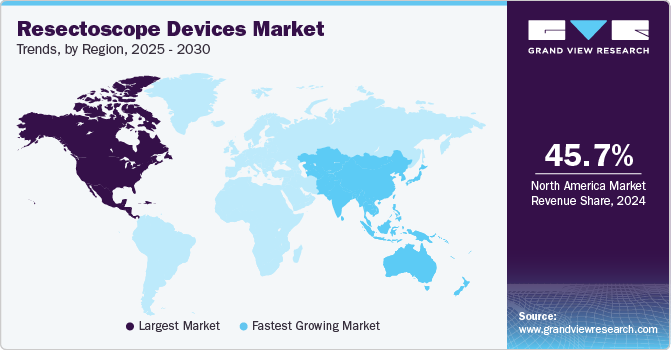

Regional Insights

North America dominated the resectoscope devices market with a share of 45.70% in 2024. This can be attributed to the increasing awareness and adoption of minimally invasive surgical techniques for treating urological and gynecological conditions. Moreover, the rising prevalence of urological and gynecological conditions is further expected to fuel market growth. For instance, according to the American Cancer Society, around 83,190 new cases of bladder cancer were estimated to be diagnosed in 2024. The region’s advanced healthcare infrastructure supports the widespread availability of resectoscope devices. North America also benefits from continuous technological advancements and developed a regulatory framework that encourages innovation.

U.S. Resectoscope Devices Market Trends

The resectoscope device market in U.S. held a significant share of market in 2024 owing to the increasing adoption of minimally invasive procedures for treating urological and gynecological conditions, such as benign prostatic hyperplasia (BPH) and endometrial abnormalities. A growing geriatric population with a higher prevalence of urological disorders has amplified demand for these devices. The U.S. healthcare system's focus on reducing hospital stays and improving patient outcomes has further fueled the use of resectoscopes in outpatient and ambulatory surgical centers.

The Canada resectoscope device market is experiencing steady growth, driven by advancements in minimally invasive surgical techniques and the rising prevalence of urological and gynecological conditions in the country. Moreover, the growing awareness of urological and gynecological conditions is further expected to fuel the market growth in the country.

Europe Resectoscope Devices Market Trends

The Europe resectoscope device market is experiencing significant growth, driven by advancements in minimally invasive surgical techniques and a rising prevalence of urological and gynecological disorders. For instance, according to the European Association of Urology, in September 2023, around 55 to 60 million population in Europe suffered from continence health problems. Increasing adoption of resectoscopes in procedures such as transurethral resection of the prostate (TURP) and endometrial ablation reflects a growing preference for technologies offering improved precision and reduced recovery times. Countries such as Germany, France, and Italy are leading in demand due to well-established healthcare systems and high procedural volumes.

The resectoscope device market in the UK is expected to grow over the forecast period due to the growing focus on improving patient outcomes and growing awareness about urological and gynecological conditions in the country. For instance, in January 2024, the UK government outlined its women's health priorities for 2024, focusing on gynecological health. Key initiatives include improving care for menstrual and gynecological conditions, such as endometriosis and fibroids, through the establishment of women’s health hubs. Such initiatives are further expected to drive the market growth in the country.

The Germany resectoscope device market is witnessing significant growth due to an increasing prevalence of urological disorders and a rising demand for minimally invasive surgical procedures. Moreover, the aging population and advancements in healthcare technology are further contributing to this growth, as hospitals and surgical centers adopt innovative resectoscope designs that enhance procedural efficiency and patient outcomes.

Asia Pacific Resectoscope Devices Market Trends

Asia Pacific resectoscope device market is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to the increasing prevalence of urogenital diseases and a rising aging population. The healthcare infrastructure improvements and greater access to medical technology are enhancing surgical capabilities in the region. The demand for minimally invasive procedures, such as transurethral resection of the prostate (TURP), is further contributing to this growth as patients prefer quicker recovery times and reduced complications.

The resectoscope device market in China is expected to witness significant growth over the forecast period. The country’s developing healthcare infrastructure, coupled with rising rates of urological and gynecological disorders, has increased the use of resectoscopes for diagnostic and therapeutic procedures. Technological innovations, such as high-definition imaging and improved user-friendly designs, have made these devices more efficient and safer, increasing their adoption in both public and private hospitals.

Latin America Resectoscope Devices Market Trends

The Latin America resectoscope device market is experiencing significant growth, driven by an aging population, increasing prevalence of urological and gynecological disorders, coupled with a rising demand for minimally invasive surgical solutions. Countries such as Brazil and Argentina are key contributors due to their improving healthcare infrastructure and government efforts to enhance surgical care.

Middle East and Africa Resectoscope Devices Market Trends

The resectoscope device market in MEA is experiencing growth driven by increasing prevalence of urological disorders, including benign prostatic hyperplasia and bladder tumors, driven by aging populations and lifestyle changes. Rising awareness of minimally invasive surgical procedures among healthcare providers and patients in countries such as Saudi Arabia, the UAE, and South Africa is further increasing the demand for resectoscope devices.

The resectoscope device market in Saudi Arabia is expanding due developing healthcare infrastructure, increasing awareness, and increasing prevalence of urological and gynecological disorders, such as benign prostatic hyperplasia (BPH) and uterine fibroids. Advancements in healthcare infrastructure, supported by government initiatives under Saudi Vision 2030, have enhanced the accessibility of advanced medical technologies, including resectoscope devices.

Key Resectoscope Devices Company Insights

Key market players are focusing on offering advanced products, growth strategies, and technological advancements. These advancements in the resectoscope devices market are anticipated to boost market growth over the forecast period.

Key Resectoscope Devices Companies:

The following are the leading companies in the resectoscope devices market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus

- Stryker

- KARL STORZ SE & Co. KG

- Advin Health Care

- Richard Wolf GmbH.

- Orion Medical

- Bissinger Medizintechnik

- Ayush Surgical Co.

- Golden Nimbus International

- JDmeditech

Recent Developments

-

In December 2023, Erbe Medicine introduced an advanced resectoscope portfolio for resectoscopy, featuring highCUT bipolar cutting via the VIO 3 unit for precise incisions and optimal hemostasis. Paired with full HD imaging and ergonomic design, these innovations enhance visibility, handling, and procedural efficiency, ensuring superior outcomes and a comprehensive solution for surgical needs.

Resectoscope Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 435.73 million

Revenue forecast in 2030

USD 565.65 million

Growth rate

CAGR of 5.36% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Segments covered

Device type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Report coverage

Revenue, competitive landscape, growth factors, and trends

Key companies profiled

Olympus; Stryker; KARL STORZ SE & Co. KG; Advin Health Care; Richard Wolf GmbH.; Orion Medical; Bissinger Medizintechnik; Ayush Surgical Co.; Golden Nimbus International; JDmeditech

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Resectoscope Devices Market Report Segmentation

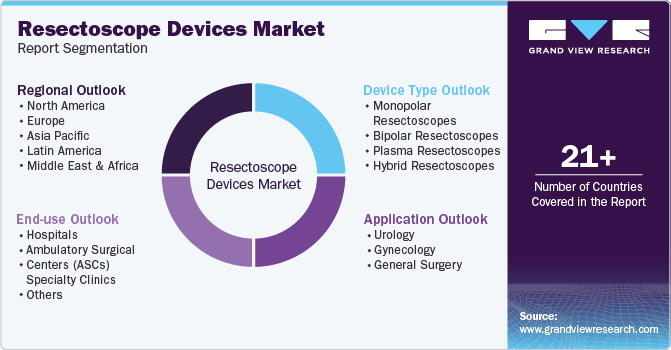

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global resectoscope devices market report on the basis of device type, application, end-use, and region:

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Monopolar Resectoscopes

-

Bipolar Resectoscopes

-

Plasma Resectoscopes

-

Hybrid Resectoscopes

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Urology

-

Gynecology

-

General Surgery

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global resectoscope device market size was estimated at USD 414.62 million in 2024 and is expected to reach USD 435.73 million in 2025.

b. The global resectoscope device market is expected to grow at a compound annual growth rate of 5.36% from 2025 to 2030 to reach USD 565.65 million in 2030.

b. North America dominated the resectoscope device market with a share of 45.70% in 2024.

b. Some key players operating in the resectoscope device market include Olympus; Stryker; KARL STORZ SE & Co. KG; Advin Health Care; Richard Wolf GmbH.; Orion Medical; Bissinger Medizintechnik; Ayush Surgical Co.; Golden Nimbus International; JDmeditech.

b. Key factors that are driving the market growth include the rising number of cases of conditions such as urinary tract infections, uterine fibroids, polyps, menorrhagia, and benign prostatic hyperplasia is driving the demand for resectoscopes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.