- Home

- »

- Biotechnology

- »

-

Research-grade Proteins Market Size, Industry Report, 2030GVR Report cover

![Research-grade Proteins Market Size, Share & Trends Report]()

Research-grade Proteins Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Cytokines & Growth Factors, Antibodies, Immune Checkpoint Proteins), By Host Cell (Mammalian Cells, Bacterial Cells), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-130-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Research-grade Proteins Market Summary

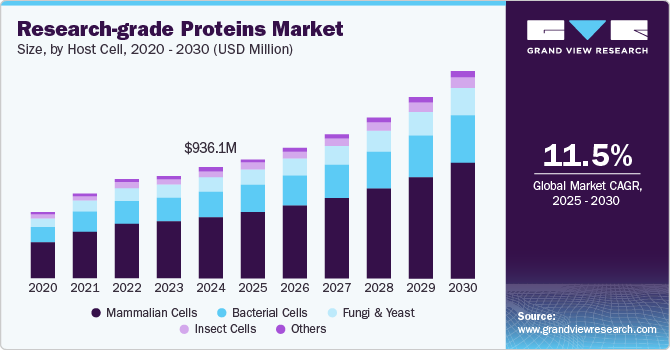

The global research-grade proteins market size was estimated at USD 936.2 million in 2024 and is projected to reach USD 1,748.5 million by 2030, growing at a CAGR of 11.49% from 2025 to 2030. Advancements in proteomics research, an increase in R&D activities in pharmaceutical and biotechnology industries, and the rising demand for personalized medicine are some of the factors anticipated to fuel the market's growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, cytokines & growth factors accounted for a revenue of USD 242.4 million in 2024.

- Cytokines & Growth Factors is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 936.2 Million

- 2030 Projected Market Size: USD 1,748.5 Million

- CAGR (2025-2030): 11.49%

- North America: Largest market in 2024

Moreover, rising investments from the government and various academic institutes are further expected to drive the market's growth from 2025 to 2030.

The shift of the healthcare industry toward biologics can be attributed to the progress in synthetic biology over the years. Recombinant DNA technology has created the way for the production of recombinant proteins, which can be further used for drug discovery, therapeutics, diagnostics, vaccines, and even advanced therapies such as cell & gene therapy, which have lesser side effects and more accuracy. Moreover, the wide applications of recombinant proteins at both research and industrial scale have led to the development of innovative bioprocessing technologies. The inclination toward biology can also be seen in the number of licensed products.

For example, there are currently 64 biosimilars approved by the U.S. Food and Drug Administration (FDA). In December 2024, the FDA officially approved Steqeyma (ustekinumab-stba), a biosimilar to Stelara (ustekinumab), developed by Celltrion, for the treatment of various psoriatic conditions and inflammatory bowel disease. This approval marks Steqeyma as the seventh biosimilar referencing Stelara, which is a well-established treatment for chronic inflammatory diseases. Thus, the rising adoption of biologics & biosimilars is anticipated to impel the growth of the research-grade proteins market.

The increasing preference for recombinant proteins over natural proteins for research is driven by the advantages offered by these proteins. For instance, recombinant proteins can be synthesized with a high protein yield, no animal contaminants, and controlled batch-to-batch variation. The amino acid sequences of these proteins can be easily altered, and unnatural amino acids can be incorporated as required. Commonly used recombinant proteins for research applications include growth factors family proteins, such as fibroblast growth factors, vascular endothelial growth factors, and neurotrophins.

Similarly, cytokines, such as interferons, chemokines, interleukins, and pro-inflammatory cytokines, and enzymes, such as recombinant proteases, kinases, and nucleases, are used for life sciences research that requires biologically active proteins. Therefore, increasing the use of recombinant proteins in research activities is projected to accelerate the market growth.

Moreover, the pandemic fueled the R&D race to find treatments and diagnostic tools for the SARS-CoV-2 virus. Recombinant technology was at the forefront during this phase, and many recombinant COVID-19 vaccines entered the market with emergency use approval. For instance, in December 2021, the World Health Organization (WHO) issued a 9th COVID-19 vaccine for Emergency Use Listing (EUL). This EUL allowed vaccination access in low- and middle-income countries.

In addition to the actions taken to develop recombinant vaccines, intense efforts are being made by multiple players for therapeutics via accelerated cycles of innovation to bring breakthroughs to patients faster. Furthermore, the search for safe, efficacious, and efficient drugs increased the popularity of biopharmaceuticals. The rapid R&D of the COVID-19 vaccine and its continuous commercial manufacturing activities had a positive impact and encouraged biologics-based research activities, eventually boosting research-grade protein industry growth.

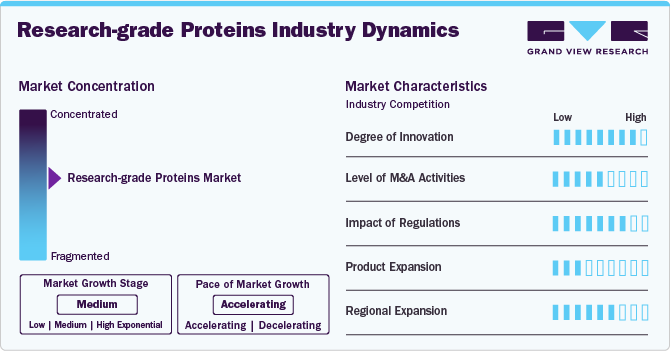

Market Concentration & Characteristics

Advancements in recombinant DNA technology enable the production of highly pure, consistent, and scalable proteins. Expression systems such as E. coli, yeast, insect, and mammalian cells have been optimized for better yields and post-translational modifications. Moreover, innovative cell-free systems allow rapid, high-throughput protein production without relying on living cells. These systems are gaining traction for producing proteins with complex structures or toxic properties.

The research-grade proteins industry is characterized by a high level of collaboration and partnership activities, driven by the need for innovation, resource sharing, and speed to market. Companies, academic institutions, and government organizations are working together to advance protein science for various applications, including drug discovery, diagnostics, and regenerative medicine. For instance, in November 2022, NanoString Technologies, Inc. and Abcam Plc announced a new partnership to compare Abcam’s antibodies for NanoString's high-plex spatial multiomic solutions, expanding their long-standing cooperation. According to the partnership's conditions, Abcam’s RabMAb recombinant antibodies would be offered as part of the initial 64-plex protein panel for NanoString's CosMx Spatial Molecular Imager.

Researchers increasingly demand consistent, high-quality proteins, especially for reproducibility in critical experiments. While not mandatory for research-grade proteins, many manufacturers voluntarily comply with Good Manufacturing Practices (GMP) or ISO standards to meet customer expectations. Growth factors, cytokines, and other proteins used for cell therapy manufacturing often require compliance with GMP, even during early-stage research.

Product expansion is a key strategy companies adopt in the research-grade proteins industry. It involves a company strategically introducing a new protein product or expanding its existing product line to cater to evolving scientific research demands. For instance, several companies operating in this market have expanded their product portfolio to include proteins critical for the development of therapeutics, vaccines, and targeted therapies.

The research-grade proteins industry is experiencing significant regional expansion, indicating rapid growth and increasing market presence across different geographic regions. For instance, In November 2022, Sino Biological, Inc. announced signing a leasing agreement with Hines and starting work on its new Center for Bioprocessing (C4B) at its Levit Green site in Houston, Texas, U.S.

Product Insights

The cytokines & growth factors segment held the largest market share of 23.61% in 2024. Proteins are primarily used in biomedical research and drug development, particularly in understanding diseases, identifying potential therapeutic targets, and developing drugs or therapies to modulate specific biological processes. Moreover, they are widely used for various research applications, such as cell culture, immunology, oncology, and regenerative medicine. In August 2023, PeptiGrowth, Inc., a Japanese biotech firm specializing in the advancement of synthetic peptide-based growth factors, collaborated with Orizuru Therapeutics, Inc. (OZTx), a Japanese biopharmaceutical company dedicated to researching and developing regenerative medicine derived from induced Pluripotent Stem Cells (iPSCs). Thus, the rapid launch of novel cytokines & growth factors due to the rising demand for research-grade proteins is propelling the segment growth.

The antibodies segment is expected to grow at a CAGR of 11.49% from 2025 to 2030. Antibodies play an essential role in the immune system and are widely used in various research areas. Due to the versatile molecules of antibodies, they are employed to detect and quantify specific proteins in biological samples. They are most commonly used in techniques such as Western blotting, Enzyme-Linked Immunosorbent Assays (ELISA), immunoprecipitation, and immunohistochemistry. Researchers use antibodies for the understanding of protein expression and their functions, making them a fundamental component of many experimental workflows. In March 2022, Sanofi announced its collaboration with IGM to discover, create, manufacture, and launch immunoglobulin M antibodies, which would target oncology. This collaboration would combine the antibody engineering skills and disease biology expertise of both companies to expedite the discovery and development of new antibody-based treatments.

Host Cell Insights

The mammalian cells segment held the largest market share of 56.20% in 2024. Due to the similar biological makeup to human cells, mammalian cells are widely used in the production of biopharmaceuticals, including monoclonal antibodies, vaccines, therapeutic proteins, and growth factors, among others. In a clinical study conducted by researchers of Karolinska Institute and Karolinska University Hospital and published in March 2023, a possible basic mechanism for the enhancement of cardiac pump function through the use of ghrelin was identified by scientists by studying isolated mouse heart cells in the laboratory. Thus, growing research, especially in the field of oncology and immunology, is anticipated to drive the demand for mammalian cells over the period.

The bacterial cells segment is expected to grow at the fastest CAGR of 12.04% from 2025 to 2030. The use of bacterial cells as host cells in biotechnology and research has significantly increased, driving the expansion of the market for research-grade proteins. Bacterial cells, mainly Escherichia coli (E. coli), are favorable choices for protein expression due to their rapid growth, well-characterized genetics, and ease of handling. The growing demand for a wide range of applications, such as drug development and antibodies, is anticipated to propel the growth of bacterial cells over the forecast period.

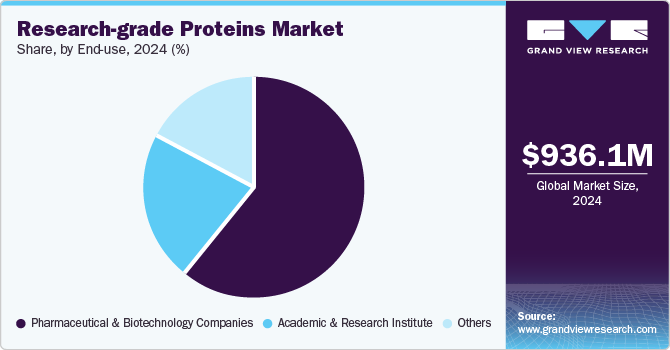

End-use Insights

The pharmaceutical and biotechnology companies segment held the largest market share of 61.48% in 2024. The growing drug discoveries and development, rising demand for personalized medicines, and increasing number of clinical trials are anticipated to impel the growth of the segment over the forecast period. Moreover, continuous investments by governments to support rising R&D activities are further expected to accelerate the growth of the segment.

The others segment is expected to grow at the fastest CAGR of 12.29% during the forecast period. The others segment includes contract research organizations and manufacturing organizations. These end users employ these proteins in medical research activities, enabling the advancement of novel therapies, precision medicine, and the validation of diagnostic tests, ultimately translating scientific discoveries into improved patient outcomes. In February 2023, Lunaphore, a Swiss-based life sciences firm developing innovative technology for facilitating spatial biology in laboratories, collaborated with Sirona Dx, a prominent player in multi-omics and single-cell analytical services. Thus, this is anticipated to speed up drug research, and development, as well as bring significant advancements to the field.

Regional Insights

North America held the largest share of 44.47% of the global market in 2024. The rising research funding, presence of key players, and availability of healthcare infrastructure contribute to the high market share of North America. For instance, in September 2022, the Department of Health and Human Services announced an investment of USD 40 million to enhance the significance of biomanufacturing in the creation of Active Pharmaceutical Ingredients (APIs), and antibiotics. for manufacturing vital medications & addressing pandemic situations. Thus, continuous advancements and increasing investments are anticipated to boost the market growth.

U.S. Research-grade Proteins Market Trends

The U.S. research-grade proteins industryhas emerged as a growing and dynamic sector within the life sciences industry. This growth can be attributed to the expansion of biotechnology, which creates the demand for highly purified and well-characterized proteins for research purposes. Thus, the rising demand for research-grade proteins is expected to propel during the forecast period.

Europe Research-grade Proteins Market Trends

The Europe research-grade proteins industry is a dynamic and rapidly evolving sector within the life sciences industry. It involves producing and supplying proteins with a high degree of purity and quality extracted from various biological sources. These proteins are critical tools for researchers and scientists to conduct experiments, validate hypotheses, and develop new therapeutic approaches.

The UK's research-grade proteins market held a significant share in 2024. The funding in the U.K. is a combination of government support & private investment aimed at enhancing the manufacturing & innovation capabilities of the UK life sciences sector. These developments are expected to drive market growth within the UK.

Growth of the research-grade proteins market in France is driven by theincreasing focus of biotechnology investors in France. The focus has shifted towards researching the potential applications of research-grade proteins over the years. For instance, in March 2023, Iktos, a French startup focusing on AI for innovative drug discovery, secured €15.5 million (USD 16.54 million) in Series A funding.

Asia Pacific Research-grade Proteins Market Trends

The Asia Pacific industry for research-grade proteins is anticipated to grow at a significant CAGR of 14.92% from 2025 to 2030. Due to the increasing awareness of novel technologies, developing healthcare infrastructure, and surging demand for advanced diagnostics & efficient therapeutic solutions, the market is expected to have a lucrative growth rate. Furthermore, regional emerging economies are establishing research facilities and infrastructure for the biotechnology sector. With the rising number of clinical studies on cancer research and drug development, the Asia Pacific market for research-grade proteins is anticipated to boost over the years.

China's research-grade proteins market is expected to grow over the forecast period. This can be attributed to the rising investments in stem cell and cancer research from government and private organizations. These investments help develop infrastructure for academic and research institutes using the latest technologies.

Research-grade proteins market in Japan is witnessing rapid growth over the forecast period. In Japan, companies are collaborating to develop novel tests and instruments. The government is encouraging advancements to enable efficient capture and quantitative analysis of genomic data.

MEA Research-grade Proteins Market Trends

The Middle East and Africa research-grade proteins industry has a very low global market share due to a lack of awareness, infrastructure, and skilled personnel in these regions. Revenue generation is restricted due to the challenges faced by scientists because of lower purchasing power.

The growth of Saudi Arabia's research-grade proteins market can primarily be attributed to various initiatives undertaken by the government to expand the biotechnology sector in the country.

The South African research-grade Proteins Market is anticipated to grow moderately over the forecast period. Government initiatives to attract foreign investors and support from international organizations to enhance the quality of life in the country are expected to boost the South African market in the coming years.

Key Research-grade Proteins Company Insights

Market leaders are involved in extensive R&D to manufacture cost-efficient and technologically advanced products. Several strategies, such as mergers and acquisitions, undertaken by these organizations to expand their market presence are anticipated to create significant growth opportunities over the forecast period.

Key Research-grade Proteins Companies:

The following are the leading companies in the research-grade proteins market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Danaher (Abcam Plc)

- Miltenyi Biotec

- GenScript

- Bio-Techne

- Proteintech Group, Inc.

- ACROBiosystems

- Sino Biological, Inc.

- ProSpec-Tany TechnoGene Ltd.

- New England Biolabs

Recent Developments

-

In September 2024, ScaleReady and Bio-Techne Corporation announced the launch of the G-Rex optimized ProPakTM GMP Cytokines, ideally tailored to high-efficiency closed system cell and gene-modified cell therapy manufacturing.

-

In August 2023, Proteintech expanded its U.S. headquarters in Rosemont, IL, established a new office in Shanghai, and added additional buildings in Wuhan, China, more than doubling the company's presence to accommodate rapid growth & better serve scientific professionals.

-

In August 2023, Danaher Corporation announced that it had signed a definitive contract to acquire Abcam Plc. Under the terms of the agreement, Danaher will acquire all of Abcam's outstanding shares for USD 24.00 per share in cash, for a total company value of approximately USD 5.7 billion, including assumed indebtedness along with net of acquired cash.

-

In May 2023, GenScript extended its principal oligonucleotide and peptide manufacturing plant in Zhenjiang, Jiangsu, China. For the past 20 years, GenScript has supported scientists worldwide by providing high-quality oligo and peptides.

Research-grade Proteins Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.02 billion

Revenue forecast in 2030

USD 1.75 billion

Growth rate

CAGR of 11.49% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, host cell, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Danaher; Miltenyi Biotec; GenScript; Bio-Techne; Proteintech Group, Inc.; ACROBiosystems; Sino Biological, Inc.; ProSpec-Tany TechnoGene Ltd.; New England Biolabs

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Global Research-grade Proteins Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global research-grade proteins market report based on product, host cell, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cytokines & Growth Factors

-

Interferons (IFNs)

-

Interleukins (ILs)

-

Others

-

-

Antibodies

-

Immune Checkpoint Proteins

-

Virus Antigens

-

Enzymes

-

Kinases

-

Metabolic Enzymes

-

Others

-

-

Recombinant Regulatory Proteins

-

Hormones

-

Others

-

-

Host Cell Outlook (Revenue, USD Million, 2018 - 2030)

-

Mammalian Cells

-

Bacterial Cells

-

Fungi & Yeast

-

Insect Cells

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institute

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global research-grade proteins market is expected to grow at a compound annual growth rate of 11.49% from 2025 to 2030 to reach USD 1.75 billion by 2030.

b. The cytokines and growth factors segment held the largest market share of 23.61%, in 2024. These proteins are primarily used in biomedical research and drug development, particularly in understanding diseases, identifying potential therapeutic targets, and developing drugs or therapies to modulate specific biological processes.

b. Some of the key players operating in the market are Thermo Fisher Scientific, Inc., Danaher, Miltenyi Biotec, GenScript, Bio-Techne, Proteintech Group, Inc., ACROBiosystems, Sino Biological, Inc., Prospec-Tany Technogene Ltd., and New England Biolabs.

b. The Research-grade protein market size was estimated at USD 936.1 million in 2024 and is expected to reach USD 1.03 billion in 2025.

b. Advancements in proteomics research, an increase in R&D activities in pharmaceutical and biotechnology industries, and the rising demand for personalized medicine are some of the factors anticipated to fuel the market's growth over the forecast period. Moreover, rising investments from the government and various academic institutes are further expected to drive the market's growth from 2025 to 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.