- Home

- »

- Organic Chemicals

- »

-

Research Department Explosive Market Size Report, 2030GVR Report cover

![Research Department Explosive Market Size, Share & Trends Report]()

Research Department Explosive Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Military, Civilian), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-2-68038-810-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Research Department Explosive Market Summary

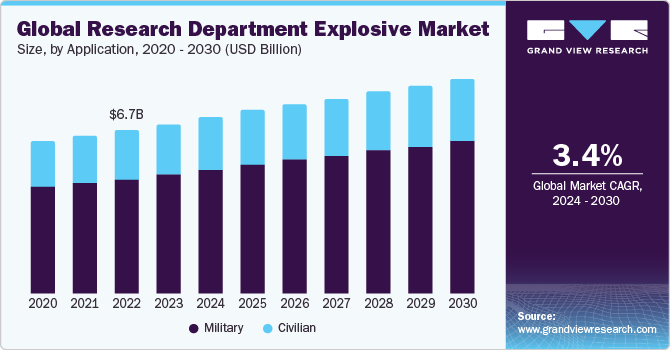

The global research department explosive market size was estimated at USD 6.94 billion in 2023 and is projected to reach USD 8.82 billion by 2030, growing at a CAGR of 3.4% from 2024 to 2030. Research Department Explosive (RDX) are utilized in numerous military and civil applications, such as pyrotechnics and cast polymer bonded explosive (PBX) charges.

Key Market Trends & Insights

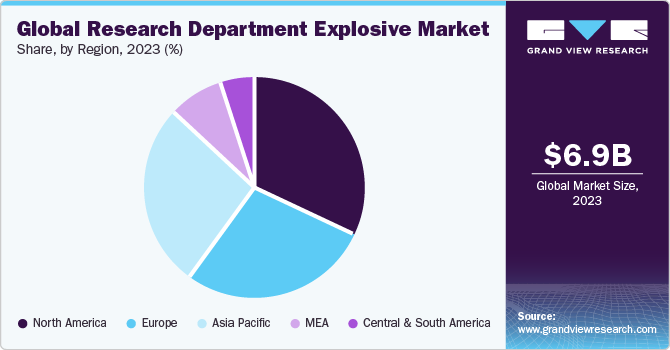

- The North America dominated the market with the largest revenue share of 31.84% in 2023.

- The research department explosive (RDX) market in Asia Pacific is expected to grow at the fastest CAGR of 3.8% over the forecast period.

- Based on application, the civilian of hexogen is expected to grow at the fastest CAGR of 3.1% during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 6.94 Billion

- 2030 Projected Market USD 8.82 Billion

- CAGR (2024-2030): 3.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The significant prevalence of mineral extraction activities in developed regions is estimated to create scope for business growth during the forecast period. RDX can be used alone as a base charge for a wide range of detonators and can also be mixed with oils or waxes to make military munitions and other products.

RDXs are increasingly utilized in the mining and construction industries. Mining industry requires high-performance products for exploration and rock excavation activities. The market is driven by increasing defense expenditures and rising mining activities across regions. In addition, the market penetration of RDX in the construction sector is also expected to grow significantly over the forecast period, owing to rising infrastructure and rock excavation activities, especially in developing countries.

Hexamine, ammonium nitrate, nitric acid, acetic acid, acetic anhydride, and paraformaldehyde are the primary raw materials used to manufacture RDX. The raw materials are provided by key suppliers such as Rock Hard Petrochemical Industries Ltd., Newton Engineering and Chemicals, Seidler Chemical Company, Simagchem Corporation, RCU Chemical, IOL Chemicals, Shanghai Youyuan Biochem Co. Ltd., and Celanese Corporation.

Research department explosives, also known as hexogen, can be used with waxes or oils to make military munitions. The production process of RDX involves multiple stages, ranging from raw materials storage and feeding to nitration, decomposition, filtration, and transport. Manufacturers spend extensively on R&D activities to develop innovative products to aid defense forces and cater to ever-increasing product demand.

In military applications, RDX can either be used with explosives such as trinitrotoluene (TNT) to make cyclotrons that produce bursting charges for aerial bombs, mines, and torpedoes or as a base charge for detonators. In addition, in civilian applications, RDX is used as a heating fuel, in fireworks, occasional rodenticide, and block demolition.

RDX industry has witnessed rapid expansion owing to the rising demand for modern rockets and missiles. This is expected to augment the demand for propellants in the market. The cost reduction, improved reliability & performance, and environmentally friendly impact have led to developing new-generation propellants. Moreover, propellants used in driving turbines, operating rocket valves, pump fluids, and ammunition for military purposes are expected to augment their demand in the market.

Market Concentration & Characteristics

Market growth stage is low, and pace of the market growth is accelerating. The industry is fragmented on account of the involvement of many large and small-scale players with significant production capacities and distribution networks. Moreover, the market is characterized by technological advancements in RDX manufacturing methods, making the market players actively participate in various strategies like innovations, mergers and acquisitions, and geographic expansion.

Regulatory policies framed by the EPA, FDA, and other related agencies are likely to act as a restraining force for growth. Still, the impact of this factor is expected to be mitigated by alternative production processes and sustainability through the product’s life cycle.

The market exhibits a high threat of substitutes owing to the presence of numerous options, including ammonium nitrate and fuel oil (ANFO), TNT, propellants, and gunpowder. The industry is expected to be impacted by innovative, environmentally friendly explosives development over the forecast period. Furthermore, buyers' power is expected to increase owing to the increasing consumption of explosives in military and civil applications. This high bargaining power for buyers is owing to the large number of buyers present in the market.

Application Insights

The civilian application of hexogen is expected to grow at the fastest CAGR of 3.1% during the forecast period, owing to growing demand for demolition blocks, fireworks, and civil pyrotechnics applications. Rising supply and demand for various fireworks, such as powder-actuated nail guns, recreational fireworks, and others, have significantly triggered demand in civil applications.

Military dominated the market and held the highest revenue share of 70.47% in 2023. Rapidly increasing defense expenditures across the U.S. have significantly boosted industry growth. RDX cyclonite is widely utilized in numerous military applications, such as bombs, munitions of all calibers, and missile warheads. Cast PBX dominated the military applications segment in 2023. This new generation of explosives possesses exceptional inherent characteristics, such as excellent mechanical properties, long service life, no risk of cracks or exudation, and safe storage, transport, and handling. In addition, it is classified as brisant, aluminized compositions, and explosives of spatial effects based on energy potential and its impacts. These factors are expected to prove conducive to market growth over the forecast period.

Regional Insights

North America dominated the market with the largest revenue share of 31.84% in 2023. Favorable demographic trends in North America, such as the growing population, are expected to lead to the construction of more roads and bridges, which in turn will fuel the demand for high-performance explosives, such as RDX and TNT, in the construction sector. Moreover, capacity addition by airports and railways is expected to drive the demand for RDX over the forecast period.

U.S. Research Department Explosive (RDX) Market Trends

The research department explosive (RDX) market in the U.S. is expected to grow over the forecast period. The U.S. is a major consumer of RDX in North America, owing to high demand in the military, mining, and construction sectors. The revival of construction industry, coupled with activities in non-residential construction sector, is expected to increase in the forecast period as a result of significant investment in retail outlets and logistic warehouse constructions. These further are a significant driving factor of the market in the U.S.

Asia Pacific Research Department Explosive (RDX) Market Trends

The research department explosive (RDX) market in Asia Pacific is expected to grow at the fastest CAGR of 3.8% over the forecast period, owing to an increase in several industrial and commercial metals and minerals mining activities across the region.

The China research department explosive (RDX) market accounted for the largest revenue share in Asia Pacific in 2023. The country has emerged as one of the promising markets in the Asia Pacific region due to growing defense expenditure over the years.

The research department explosive (RDX) market in India is investing in modernizing its defense sector, which is increasing demand for high-performance explosives such as RDX. In addition, mining sector in the country is highly dependent on explosives for mineral extraction and demolition. This is further expected to fuel market growth.

Europe Research Department Explosive (RDX) Market Trends

Research department explosive (RDX) in Europe is anticipated to grow at a CAGR of 3.1% over the forecast period. The region comprises many developed economies, such as Germany, the UK, Russia, Italy, and France. The rising geopolitical tensions between the countries have led to the need to invest in explosives such as RDX to strengthen their armies.

The Germany research department explosive (RDX) market relies on quarrying, mining, and demolition. This is fueling the growth of RDX market in the country. Furthermore, Germany invests in research and development activities related to explosive technology, which has led to advanced production techniques, thereby providing new opportunities for players.

Middle East & Africa Research Department Explosive (RDX) Market Trends

Research department explosive (RDX) market in Middle East & Africa is expected to grow at a significant rate over the years owing to the infrastructure activities on account of growing urbanization and increased government investments.

The Saudi Arabia research department explosive (RDX) market has witnessed growth over the years due to a well-established oil & gas sector. The oil & gas sector in this region relies on RDX for perforating and seismic exploration.

Central & South America Research Department Explosive (RDX) Market Trends

The research department explosive (RDX) market in Central & South America is propelled by emerging economies, such as Argentina, Brazil, and Peru, which are witnessing population growth and rapid urbanization. This is fueling the construction of transportation networks in the region, thereby propelling the product demand.

The Brazil research department explosive (RDX) market consists of various regulations and standards governing the use, production, and storage of RDX in the country. Furthermore, oil & gas and mining sector of the country keeps up the demand for explosives such as RDX in the market.

Key Research Department Explosive Company Insights

Some of the key players operating in the market include Dyno Nobel, BAE Systems, and Nitro Chem.

-

BAE Systems is headquartered in London, UK, and is a multinational defense, security, and aerospace company. BAE Systems develops, engineers, manufactures, and supports products and systems to deliver military capability, protect national security and people, and keep critical information and infrastructure secure.

-

Dyno Nobel is a wholly owned subsidiary of Incitec Pivot. The company is engaged in manufacturing explosives for coal & metal mining, quarrying, oil & gas, and construction sectors. It has an operational presence in America and Asia through its SBUs, namely Dyno Nobel Americas and Dyno Nobel Asia Pacific.

Eurenco, Chemring Nobel, and LSB Industries Inc. are some of the emerging market participants.

-

Eurenco is engaged in manufacturing and developing energetic materials for commercial and defense markets. Eurenco is a merger between SNPE Matériaux Energétiques (SME) of France, SAAB of Sweden, and Patria of Finland. Eurenco was created with a vision to be a leading propellant and explosives company in Europe, drawing on advanced technology and in-depth knowledge of business.

-

LSB Industries is engaged in manufacturing chemical products for agricultural, mining, and industrial sectors. The company’s businesses are segmented into chemicals and engineered products, wherein chemicals segment produces ingredients, such as ammonium nitrate, that are used in explosives for mining.

Key Research Department Explosive Companies:

The following are the leading companies in the research department explosive (RDX) market. These companies collectively hold the largest market share and dictate industry trends.

- Eurenco

- Chemring Nobel

- Prva Iskra- Namenska a.d.

- BAE Systems

- Nitro Chem S.A.

- Austin Powder Company

- EPC Groupe

- LSB Industries Inc.

- Ensign Bickford Company

- Dyno Nobel

Recent Developments

-

In June 2018, the company entered a strategic partnership with Solar Industries, India. Eurenco supplies propellants, bombs, ammunition filling, and modular charges technologies to Solar Industries. The partnership has helped the company to establish a stronger position in the Indian market.

Research Department Explosive (RDX) Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.21 billion

Revenue forecast in 2030

USD 8.82 billion

Growth rate

CAGR of 3.4% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Saudi Arabia

Key companies profiled

Eurenco; Chemring Nobel; Prva Iskra- Namenska a.d.; BAE Systems; Nitro Chem S.A.; Austin Powder Company; EPC Groupe; LSB Industries Inc.; Ensign Bickford Company; Dyno Nobel

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Research Department Explosive (RDX) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global research department explosive (RDX) market report based on application and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Military

-

Melt Cast & Pressed Explosives

-

Cast PBX

-

Pyrotechnics

-

Others

-

-

Civilian

-

Fireworks

-

Demolition Blocks

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global research department explosive market size was estimated at USD 6.94 billion in 2023 and is expected to reach USD 7.21 billion in 2024.

b. The global research department explosive (RDX) market is expected to grow at a compound annual growth rate of 3.4% from 2024 to 2030 to reach USD 8.82 billion by 2030.

b. The military segment dominated the research department explosive (RDX) market with a share of 70.47% in terms of revenue for 2023 owing to continuously increasing military expenditure across the globe.

b. Some of the key players operating in the research department explosive market include Eurenco, Chemring Nobel, Prva Iskra- Namenska a.d., BAE Systems, and Nitro Chem S.A.

b. The key factor which is driving the research department explosive (RDX) market is utilization of the product in numerous military and civil applications such as pyrotechnics and cast PBX charges among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.