- Home

- »

- Medical Devices

- »

-

Renal Failure Treatment Market Size & Share Report, 2030GVR Report cover

![Renal Failure Treatment Market Size, Share & Trends Report]()

Renal Failure Treatment Market (2024 - 2030) Size, Share & Trends Analysis Report By Treatment (Dialysis, Kidney Transplantation, Drug Therapy), By End-use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-441-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 24 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Renal Failure Treatment Market Summary

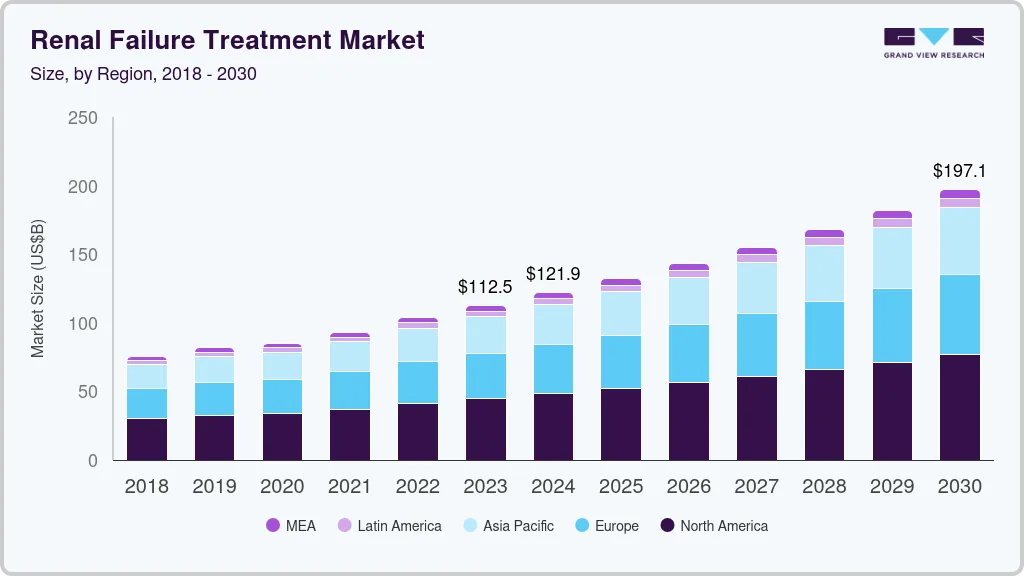

The global renal failure treatment market size was estimated at USD 112.5 billion in 2023 and is projected to reach USD 197.1 billion by 2030, growing at a CAGR of 8.3% from 2024 to 2030. The growth is driven by several critical factors, including the rising prevalence of chronic kidney disease (CKD) and advancements in technology and treatment options.

Key Market Trends & Insights

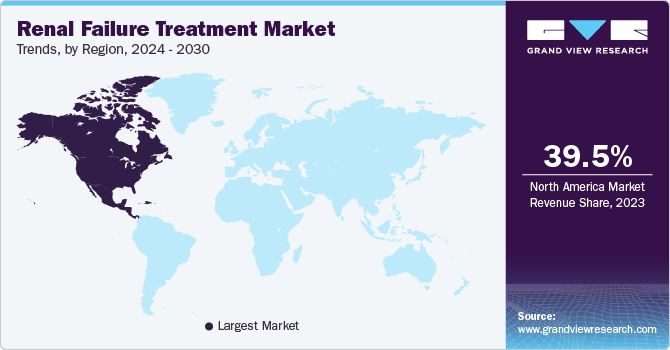

- North America dominated the renal failure treatment market with a revenue share of 39.54% in 2023.

- By treatment, the dialysis segment held the largest revenue share of 72.34% in 2023.

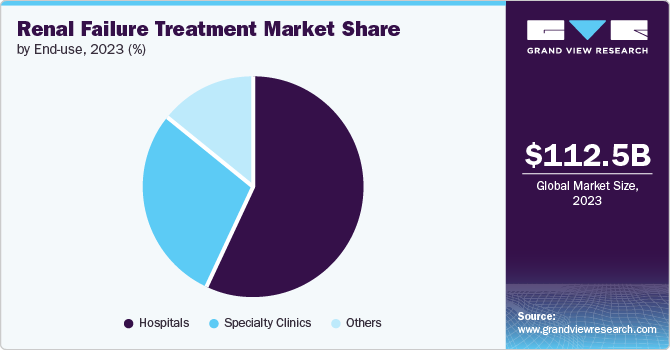

- By end use, the hospital segment held the largest revenue share of 57.64% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 112.5 Billion

- 2030 Projected Market Size: USD 197.1 Billion

- CAGR (2024-2030): 8.3%

- North America: Largest market in 2023

The increasing awareness and education regarding kidney health and supportive government initiatives and regulatory frameworks are expected to further fuel the growth. These drivers collectively contribute to the growth and evolution of the market, enabling better patient outcomes and access to care. For instance, in July 2023, as Boehringer Ingelheim and Eli Lilly and Company announced, Empagliflozin received approval from the European Medicines Agency (EMA) as the first SGLT2 inhibitor for treating CKD in adult patients.

The increase in the elderly population is a significant factor contributing to the growth of the chronic kidney disease treatment market. Older adults are particularly vulnerable to the onset and progression of chronic kidney disease, leading to greater demand for advanced treatment options. For instance, the Centers for Disease Control and Prevention (CDC) reports that CKD predominantly affects individuals aged 65 and older (38.0%), followed by those aged 45 to 64 years (12.0%) and those aged 18 to 44 years (6.0%). This demographic shift is expected to drive market expansion further.

Advancements in treatment technologies are also a crucial driver. Innovations such as high-efficiency dialysis machines, wearable artificial kidneys, and improved dialyzer membranes are transforming renal care. Recent advancements include the development of portable dialysis machines that enhance patient mobility and convenience. For instance, in February 2024, Fresenius Medical Care (FME) received 510(k) approval from the U.S. Food and Drug Administration (FDA) for its 5008X Hemodialysis System.

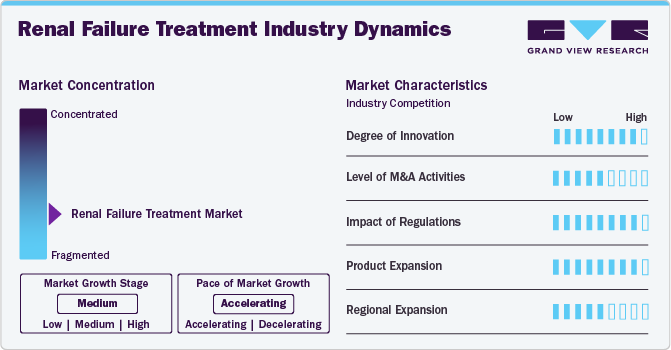

Market Concentration & Characteristics

The market is highly innovative, driven by advancements in dialysis technologies and the development of novel therapies. For instance, in August 2022, KidneyX introduced a new prize for artificial kidney innovation, supported by $10.5 million in funding. In addition, integrating AI and machine learning in patient monitoring and treatment customization further exemplifies this field's high level of innovation.

The market's merger and acquisition (M&A) level is moderate, reflecting strategic consolidation and selective growth opportunities. For instance, in August 2022, Fresenius Medical Care finalized a three-way merger involving Fresenius Health Partners, its North American value-based care division, to improve services for patients with kidney disease. The market is witnessing a different level of aggressive M&A activity than other sectors, suggesting a balanced approach where companies focus on targeted acquisitions rather than large-scale consolidations.

Regulations greatly impact the market, as regulatory bodies such as the FDA and EMA play a crucial role in approving new therapies and devices. The regulatory landscape is complex, with specific drug and device approval requirements. For instance, in September 2023, the FDA approved Jardiance for treating adults with chronic kidney disease, expanding its use beyond diabetes management to benefit individuals with impaired kidney function.

Product expansion in the market is high, with continuous introduction of new and improved treatment options. Companies are expanding their portfolios beyond traditional dialysis machines to include novel therapies such as gene editing and regenerative medicine. The launch of new drugs and technologies, such as in April 2023, Medtronic and DaVita launched Mozarc Medical, a new company dedicated to developing innovative kidney health solutions to improve patient care for kidney failure patients.

The market's region expansion is medium, with companies increasingly focusing on emerging markets where renal disease prevalence is rising due to lifestyle changes. Multinational companies are expanding their presence in Asia-Pacific regions, such as India and China, to cater to growing patient populations. However, challenges such as regulatory differences and market entry barriers temper the overall pace of regional expansion compared to more mature markets, including North America and Europe.

Treatment Insights

The dialysis segment represented the largest share of 72.34% in 2023. It is expected to retain dominance during the forecasted period due to its essential role in managing end-stage renal disease (ESRD) and chronic kidney disease (CKD). This segment's substantial revenue is attributed to the increasing prevalence of kidney disorders, which drives demand for hemodialysis and peritoneal dialysis. Technological advancements are a significant driver, with innovations such as high-efficiency dialysis machines, automated peritoneal dialysis systems, and wearable dialysis units enhancing treatment efficacy and patient convenience. Moreover, the development of portable hemodialysis machines has transformed patient mobility and lifestyle, while improvements in dialyzer technology have led to more efficient and less invasive treatments.

Moreover, supportive healthcare policies and increasing adoption of home dialysis solutions fueled the segment's rapid growth. Government initiatives and healthcare programs are expanding access to advanced dialysis treatments, particularly in underserved regions. In the U.S., initiatives such as the ESRD Quality Incentive Program and the Kidney Care Choices model aim to improve patient care and expand access to innovative therapies. Similarly, Japan and Germany are investing in renal care infrastructure and integrating new dialysis technologies into their healthcare systems. This global push towards improving renal care and increasing patient access to adequate dialysis options contributes to the segment's robust growth and expanding market share.

End-use Insights

The hospital segment represented the largest share of 57.64% in 2023 due to its comprehensive care capabilities, including advanced dialysis and kidney transplants. Hospitals are essential for complex procedures and specialized care, supported by advanced technologies and specialized staff. Key drivers include the increasing prevalence of chronic kidney disease, the need for sophisticated treatment options, and the integration of new dialysis technologies. Hospitals are primary sites for using advanced hemodialysis machines and robotic-assisted kidney transplants, reflecting their central role in critical renal care.

The others segment experienced the fastest-growing CAGR in 2023 due to increasing patient preference for convenience, improved quality of life, and advancements in home dialysis technologies. The growth is driven by innovations such as automated peritoneal dialysis (APD) machines and portable hemodialysis units, which make home-based treatment more feasible and practical. Instances of this trend include expanding home dialysis programs and government initiatives supporting home care, such as the U.S. Centers for Medicare & Medicaid Services' increased reimbursement for home dialysis. These factors collectively enhance accessibility and patient autonomy, driving the segment's rapid expansion.

Regional Insights

North America dominated the market with a revenue share of 39.54% in 2023. A high prevalence of chronic kidney disease (CKD) characterizes the renal failure treatment market in North America. According to Canadian Organ Replacement Repair (CORR), approximately 4.0 million Canadians, equivalent to 1 in 10 individuals, are affected by kidney disease, highlighting the significant burden of this health condition in the country. The region benefits from a well-established healthcare infrastructure and significant technological advancements in treatment modalities, including the adoption of home dialysis and telemedicine.

U.S. Renal Failure Treatment Market Trends

The renal failure treatment market in the U.S. is heavily influenced by a growing geriatric population and increasing kidney health awareness. The FDA is actively approving new treatments, which supports the introduction of advanced therapies and devices, enhancing patient outcomes. According to the data published by the American Kidney Fund in July 2024, approximately 35.5 million people in the U.S. are affected by kidney disease, with around 808,000 individuals currently living with kidney failure.

Europe Renal Failure Treatment Market Trends

The renal failure treatment market in Europe is marked by a rising incidence of chronic kidney disease (CKD) and a focus on improving treatment accessibility. The UK and France are implementing government initiatives to enhance healthcare services, including promoting e-health solutions and integrated care models. The European market is also witnessing a surge in innovation, with several new treatment launches, such as novel medications and advanced dialysis technologies.

UK renal failure treatment market is driven by a high prevalence of kidney diseases and a strong emphasis on early diagnosis and prevention. The National Health Service (NHS) was actively promoting initiatives to enhance kidney health awareness and improve access to treatment. In addition, the UK is seeing increased investment in research and development for kidney therapies, with several clinical trials underway for new drugs and treatment modalities, reflecting a commitment to innovation in renal care.

The renal failure treatment market in France is characterized by a robust healthcare system and a growing focus on personalized medicine. The French government is investing in healthcare infrastructure and promoting initiatives to enhance the quality of care for patients with CKD. Regulatory bodies, such as the French National Agency for the Safety of Medicines and Health Products (ANSM), facilitate the approval of new therapies. Recent government initiatives aim to enhance the quality of renal care and expand access to advanced treatments.

Asia Pacific Renal Failure Treatment Market Trends

The renal failure treatment market in Asia Pacific is witnessing significant growth, driven by the increasing prevalence of diabetes and hypertension, which are major risk factors for chronic kidney disease (CKD). Innovation in home dialysis technologies, such as the introduction of portable dialysis machines, further supports market expansion. Government initiatives in India and Australia, including subsidized dialysis treatments and enhanced healthcare infrastructure, further support market expansion. Furthermore, regulatory bodies are increasingly focusing on improving treatment standards and introducing new guidelines to ensure better patient outcomes.

Japan renal failure treatment market is characterized by the high adoption of advanced dialysis technologies and a strong emphasis on precision medicine. Japan's regulatory environment is supportive, with the Ministry of Health, Labor, and Welfare (MHLW) expediting approvals for new therapies and technologies. In addition, Japan's aging population and high incidence of chronic kidney disease drive demand for improved and more personalized renal care solutions. According to an article published in March 2024, CKD significantly affects patients' life expectancy and quality of life. Globally, 700 million people (9.1% of the population) have CKD, with 13 million (13.0% of adults) affected in Japan, a number that continues to rise.

The renal failure treatment market in China is expanding due to increasing rates of diabetes and hypertension, which are major risk factors for kidney disease. According to the National Centre for Biotechnology Information (NCBI), China experiences a high prevalence of CKD, particularly among older adults and individuals with chronic risk factors, significantly burdening both the population and the healthcare system. Furthermore, introducing advanced dialysis machines and developing healthcare facilities in urban and rural areas contribute to market growth.

Latin America Renal Failure Treatment Market Trends

The renal failure treatment market in Latin America is characterized by a growing emphasis on improving healthcare access and quality. Innovations in treatment options, such as new dialysis technologies and home-based care solutions, are becoming more prevalent. Moreover, there is an increase in clinical trials and research activities aimed at developing more effective treatments. However, challenges such as varying regulatory environments and disparities in healthcare access across the region remain significant.

Brazil renal failure treatment market is fueled by a high incidence of CKD and a strong focus on enhancing treatment accessibility and quality. The country is experiencing a rise in new treatment options, including advanced dialysis techniques and novel pharmaceuticals. Brazilian regulatory bodies are working to streamline the approval process for new treatments, while government initiatives aim to increase funding for renal care programs and improve patient outcomes.

Middle East & Africa Renal Failure Treatment Market Trends

The renal failure treatment market in the Middle East & Africa is experiencing growth driven by rising incidences of diabetes and hypertension, which are major contributors to chronic kidney disease. Innovations in treatment, such as advanced dialysis technologies and new pharmaceuticals, are becoming increasingly available in the region. Government initiatives focus on improving healthcare infrastructure and access to renal treatments, with several countries implementing national programs to address kidney disease.

Saudi Arabia renal failure treatment market is witnessing notable advancements due to increased healthcare spending and government initiatives to improve renal care. Introducing advanced dialysis technology and new treatment options enhances patient outcomes. The Saudi government is investing in healthcare infrastructure and research, with initiatives including expanding dialysis centers and funding renal health programs. For instance, the Saudi government aims to invest over $65 billion under Vision 2030 to improve healthcare infrastructure, privatize services, create 21 health clusters, and enhance e-health services.

Key Renal Failure Treatment Company Insights

Key players are at the forefront of introducing advanced treatments such as high-efficiency dialysis machines, home-based dialysis options, and novel anemia management drugs. Their strong market presence is bolstered by strategic initiatives, including mergers and acquisitions, which are most likely to enhance their product offerings and expand their global reach. In addition, these companies invest heavily in R&D to drive innovation and maintain competitive advantage in a rapidly evolving market.

Key Renal Failure Treatment Companies:

The following are the leading companies in the renal failure treatment market. These companies collectively hold the largest market share and dictate industry trends.

- NIPRO

- Fresenius Medical Care AG,

- Baxter

- Medtronic

- B. Braun SE

- Asahi Kasei Medical Co., Ltd.

- AbbVie Inc.

- Nikkiso Co., Ltd.

- JMS Co., Ltd.

- AstraZeneca

Recent Developments

-

In April 2024, Outset Medical, Inc. partnered with U.S. Renal Care to enhance the adoption of home hemodialysis in the U.S., aiming to simplify and reduce dialysis costs through their medical technology innovations.

-

In October 2023, Novartis reported positive preliminary results from the Phase III ALIGN study of atrasentan, an oral endothelin receptor antagonist, for IgAN patients. The safety profile of atrasentan matched that observed in the Phase II AFFINITY trial.

Renal Failure Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 121.9 billion

Revenue forecast in 2030

USD 197.1 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

NIPRO; Fresenius Medical Care AG; Baxter; Medtronic; B. Braun SE; Asahi Kasei Medical Co., Ltd.; AbbVie Inc.; Nikkiso Co., Ltd.; JMS Co., Ltd.; AstraZeneca

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Renal Failure Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global renal failure treatment market report based on treatment, end-use, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Dialysis

-

Hemodialysis

-

Peritoneal Dialysis

-

-

Kidney Transplantation

-

Drug Therapy

-

Antihypertensive Drugs

-

Antianemia Therapeutics (Erythropoiesis-Stimulating Agents)

-

Potassium Binders

-

Phosphate Binders

-

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global renal failure treatment market size was valued at USD 112.5 billion in 2023 and is projected to reach USD 121.9 billion in 2024.

b. The global renal failure treatment market is projected to grow at a compound annual growth rate (CAGR) of 8.3% from 2024 to 2030 to reach USD 197.1 billion by 2030.

b. The dialysis segment represented the largest share of 72.3% in 2023. It is expected to retain dominance during the forecasted period due to its essential role in managing end-stage renal disease (ESRD) and CKD.

b. Some of the key players operating in this market include NIPRO, Fresenius Medical Care AG, Baxter, Medtronic, B. Braun SE, Asahi Kasei Medical Co., Ltd., AbbVie Inc., Nikkiso Co., Ltd., JMS Co., Ltd., AstraZeneca.

b. The market is driven by several critical factors, including the rising prevalence of chronic kidney disease (CKD), advancements in technology and treatment options, increasing awareness and education regarding kidney health, and supportive government initiatives and regulatory frameworks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.