- Home

- »

- Next Generation Technologies

- »

-

Global Remittance Market Size, Share & Growth Report, 2030GVR Report cover

![Remittance Market Size, Share & Trends Report]()

Remittance Market (2022 - 2030) Size, Share & Trends Analysis Report By Mode Of Transfer (Digital, Traditional), By Type (Inward, Outward), By Channel, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-020-0

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Remittance Market Summary

The global remittance market size was estimated at USD 48.99 billion in 2021 and is projected to reach USD 107.80 billion by 2030, growing at a CAGR of 10.1% from 2022 to 2030. Cross-border remittances provide numerous economic benefits, including increased financial inclusion and economic development. Remittances are extremely important in the lives of migrants and their families.

Key Market Trends & Insights

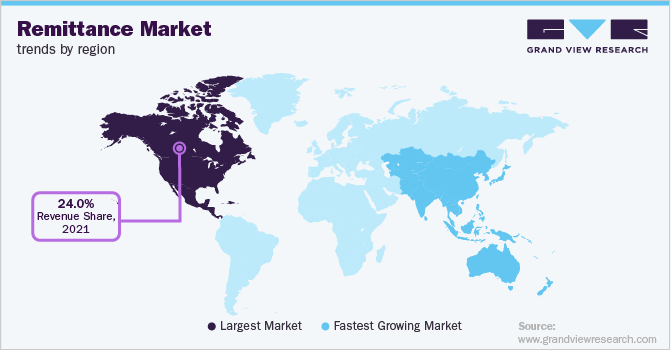

- North America dominated the remittance market in 2021 and accounted for a revenue share of more than 24.0%.

- Asia Pacific is expected to emerge as the fastest-growing region over the forecast period.

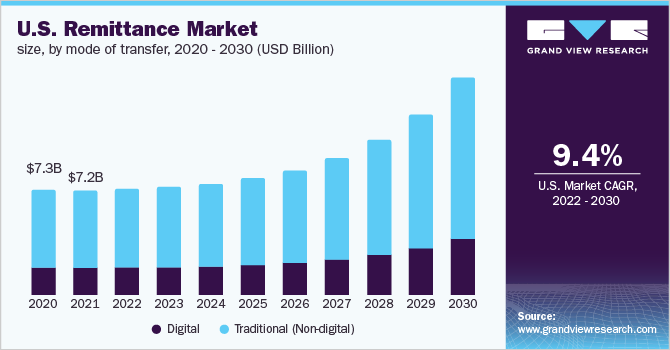

- Based on mode of transfer, the traditional (non-digital) segment accounted for the largest revenue share of more than 75.0% in 2021.

- Based on type, the outward remittance segment dominated the market in 2021 and accounted for a revenue share of more than 54.0%.

- Based on channel, the money transfer operators segment accounted for the largest revenue share of more than 50.0% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 48.99 Billion

- 2030 Projected Market Size: USD 107.80 Billion

- CAGR (2022-2030): 10.1%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

Money received in migrant households in their countries of origin accounts for most of the household income, typically spent on necessities such as medicines, education, food, and housing. Sending money abroad has traditionally been time-consuming and costly, as evidenced by the never-ending chains of intermediaries, hidden fees, and manual paperwork. Fortunately, advancements in the industry over the last few years mean that individuals and even small-to-medium-sized businesses can now benefit from cheaper, faster, and value-added foreign fund transfer services.

Large corporations, banks, and governments have traditionally enjoyed these advantages through direct access to the institutional foreign exchange market, fueling remittance market growth. Moreover, new players penetrating the remittance market are expanding the levels of competition, using fees as a tangible differentiator to position themselves against peers, bringing more convenience and affordability to the customers, and propelling the market growth.

Incumbents leverage digital platforms' capabilities and enjoy lower fixed costs, and their modern, cleaner technological and operational platforms provide consumers with faster turnaround times. As a result, they can offer lower fees, making remittances affordable for every class of individuals. Moreover, market players are actively partnering with new-age fintech companies to expand their regional foothold.

For instance, in December 2021, Mastercard formed a strategic alliance with ProgressSoft, a provider of real-time payment solutions, to facilitate the integration of Mastercard Cross-Border Services and accelerate international remittances throughout the MEA region.

In another instance, in August 2022, Trustly, an open banking payments company, partnered with Conotoxia, a Poland-based multi-currency company, to provide users with a secure, fast, and safe method to transfer money internationally via their bank accounts. The partnership aimed at allowing future and current customers to benefit from improved flexibility when remitting money into North America.

Moreover, Conotoxia is also planning to offer fund transfers at 0% fees from the U.S. to Europe for new Trustly customers for up to USD 14 per transaction for a limited time. Such initiatives are expected to boost the industry’s growth.

A significant disadvantage of remittance is that it may encourage more labor migration because family members who receive remittances believe that they would be better off moving to developed countries and earning more money than remaining in their home country. In the long run, this can have a negative impact, commonly referred to as brain drain. As a result, the population composition has most people outside the labor market range or uneducated individuals.

However, compared to other forms of international financial transfers, remittances have a positive direct impact on recipients and should be encouraged by appropriate policies from the relevant governments.

COVID-19 Impact Analysis

Many developing countries rely heavily on remittances for financial support. As COVID-19 devastated lives and livelihoods worldwide, remittances served as a vital lifeline for the poor and vulnerable, assisting in meeting their increased need for livelihood support during the pandemic. According to the Migration and Development Brief, remittance flows to low- and middle-income countries reached USD 540 billion in 2020, up 1.6% from 2019. Moreover, the rising awareness about digital remittances post-pandemic is driving the market's growth.

Mode of Transfer Insights

The traditional (non-digital) segment accounted for the largest revenue share of more than 75.0% in 2021. The traditional method of remitting funds includes cheques and ATMs, among other methods. The major factor contributing to the segment's growth is the sense of security and safety the consumer experiences while remitting funds through an offline channel. Moreover, before the recent emergence of digital channels, traditional methods are the only possible ways to remit funds internationally, justifying the largest share of the segment.

The digital segment is anticipated to register significant growth over the forecast period. The growing developments in the digital space are rapidly altering the dynamics of the digital remittance industry. Digitization helps in improving efficiency, convenience, transparency, and access and reducing transfer prices. Furthermore, evolving customer demands for cross-border remittances are expected to fuel the segment’s growth over the forecast period. Customers in low- and middle-income countries are increasingly accepting digital money transfer services. In addition, rising income levels and rapid urbanization are driving demand for digital remittance services.

Type Insights

The outward remittance segment dominated the market in 2021 and accounted for a revenue share of more than 54.0%. Most businesses are a part of the global economy, and a company must deal with competition everywhere to compete on this grand scale. An outward remittance enables transactions worldwide and capitalizes on business opportunities that might not have existed otherwise.

Funds can be securely remitted to partners located anywhere in the world, making purchasing goods and services from a foreign entity much easier for an organization. Furthermore, an outward remittance is an excellent way to send money in an emergency. For example, funds can be transferred almost immediately if someone runs out of money while studying abroad or is in an accident while traveling.

The inward remittance segment is anticipated to register significant growth over the forecast period. Inward remittances shield developing countries from financial setbacks. This is accomplished through increased consumption and purchasing power of a business or a family, as well as increased access to better health care, education, housing, food, lifestyle, and stock.

Furthermore, because no intermediaries are involved in the process, inward remittance directly benefits the recipients, reducing the possibility of corruption. Incentives such as tax-free accounts have also been introduced to encourage legal foreign remittances.

Channel Insights

The money transfer operators segment accounted for the largest revenue share of more than 50.0% in 2021. Bank fees vary depending on where the users are sending money and the specific policies of a particular bank. On the other hand, some money transfer operators charge a flat rate regardless of where the transfer goes. Meanwhile, some money transfer services, such as Western Union, offer options that make international transfers more affordable. For example, Western Union allows customers to send money online to bank accounts all over the world with no transfer fee for international bank transfers over USD 5,000, aggravating the segment's growth.

The online platforms (wallets) segment is anticipated to register significant growth over the forecast period. The segment's growth is attributable to the fact that online platforms save a lot of time. People no longer have to stand in lines, write cheques, or wait for paper bills, and they are not required to wait for banks to clear their cheques before accessing the funds. Moreover, another advantage of using an online platform is that it helps businesses to eliminate geographical limitations and operate globally.

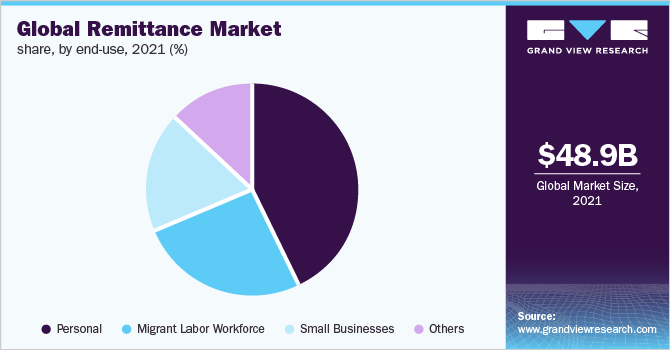

End-use Insights

The personal segment accounted for the largest global revenue share of more than 42.0% in 2021. Personal remittances refer to all financial transactions between resident and non-resident parties, and the residents can be non-migrants or migrants. According to Eurostat, Directorate-General of the European Commission, Romania, Latvia, and Croatia were most dependent on inflows of personal remittances in the EU in 2020, representing the significance of personal remittances. Moreover, there are internal remittances transfers within the borders of a country as well, contributing to the segment's dominance.

The migrant labor workforce segment is anticipated to register the fastest growth over the forecast period. After migration, a person's income generally multiplies rapidly, and the income gains are shared with friends and family members back home through remittances. Moreover, migrants contribute to expanding labor markets in host countries while supporting their families through remittances. Workers have benefited from inclusive social protection policies that have helped them weather the income and employment uncertainties caused by the COVID-19 pandemic.

Regional Insights

North America dominated the remittance market in 2021 and accounted for a revenue share of more than 24.0%. The dominance can be attributed to the presence of some prominent players in the market, such as Bank of America Corporation, and Citigroup, Inc. Moreover, fintech companies in North American countries are aggressively partnering with prominent players to leverage their capabilities.

For instance, in October 2021, Payfare, a fintech company based in Canada, partnered with Wise, Inc. to bring international fund transfer capabilities to Payfare’s digital banking application. With Wise embedded into Payfare’s platform, North American gig and contract workers supported by Payfare can quickly transfer funds to over 80 countries.

Asia Pacific is expected to emerge as the fastest-growing region over the forecast period. The growth can be attributed to the fact that the major remittance recipient countries, such as India, the Philippines, and China, are located in the Asia Pacific region. Moreover, several key players from around the world are making efforts to capture the booming regional industry.

For instance, in November 2021, UniTeller, a U.S.-based cross-border remittance payments processor, partnered with Thunes, a global payments network based in Singapore, to expand its services in over 20 markets worldwide, including Asia Pacific.

Key Companies & Market Share Insights

Prominent players are pursuing various strategies, such as research & development initiatives, product innovations, joint ventures & strategic partnerships, expansion, and mergers & acquisitions to gain a competitive edge in the market. Market players are focusing on leveraging the capabilities of newly emerged fintech companies to offer their consumers the utmost convince of remitting funds. For instance, in August 2022, Payments enabler Currencycloud collaborated with Future FinTech (FTFT) Labs to launch the remittance application, Tempo for U.S. immigrants. FTFT Labs offers its customers a multi-currency wallet with advantageous fees over the competition through this partnership.

Vendors are focusing on the expansion of their foothold in the remittance market. For instance, In December 2022, Mastercard collaborated with Credit Libanais, a Lebanese bank, to enable inward cross-border payments via direct bank deposits. The use of Mastercard's cross-border services aims to improve international payment processes for the bank's customers. Such initiatives and collaborations by key market players are driving the market's growth. Some prominent players in the global remittance market include:

-

Bank of America Corporation

-

ZEPZ

-

Citigroup, Inc.

-

Ria Financial Services, Inc.

-

OFX

-

Wells Fargo

-

Western Union Holdings, Inc.

-

PayPal

-

MoneyGram International, Inc.

-

Wise US, Inc.

Remittance Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 49.86 billion

Revenue forecast in 2030

USD 107.80 billion

Growth rate

CAGR of 10.1% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Mode of transfer, type, channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; India; Philippines; China; Japan; Vietnam; Brazil

Key companies profiled

Bank of America Corporation; ZEPZ; Citigroup, Inc.; Ria Financial Services, Inc.; OFX; Wells Fargo; Western Union Holdings, Inc.; PayPal; MoneyGram International, Inc.; Wise US, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Remittance Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global remittance market report based on the mode of transfer, type, channel, end-use, and region:

-

Mode of Transfer Outlook (Revenue, USD Billion, 2017 - 2030)

-

Digital

-

Traditional (Non-digital)

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Inward Remittance

-

Outward Remittance

-

-

Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Banks

-

Money Transfer Operators

-

Online Platforms (Wallets)

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Migrant Labor Workforce

-

Personal

-

Small Businesses

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

Philippines

-

China

-

Japan

-

Vietnam

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global remittance market size was estimated at USD 48.99 billion in 2021 and is expected to reach USD 49.86 billion in 2022.

b. The global remittance market is expected to grow at a compound annual growth rate of 10.1% from 2022 to 2030 to reach USD 107.80 billion by 2030.

b. North America dominated the remittance market with a share of 24.46% in 2021. This is attributable to the dominance of the market players, including Bank of America Corporation, among others in the region.

b. Some key players operating in the remittance market include Bank of America Corporation, ZEPZ, Citigroup, Inc.; Ria Financial Services, Inc.; OFX; Wells Fargo; Western Union Holdings, Inc., PayPal; MoneyGram International, Inc., Wise US, Inc.

b. Key factors that are driving the market growth include increasing migrant population and proliferation of smartphones and digitization of money

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.