- Home

- »

- Homecare & Decor

- »

-

Religious Tourism Market Size, Share & Trends Report, 2030GVR Report cover

![Religious Tourism Market Size, Share & Trends Report]()

Religious Tourism Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Hinduism, Islam, Christianity), By Age Group (Below 20 Years, 20 - 40 Years, 40 - 60 Years, 60 Years & Above), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-454-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Religious Tourism Market Summary

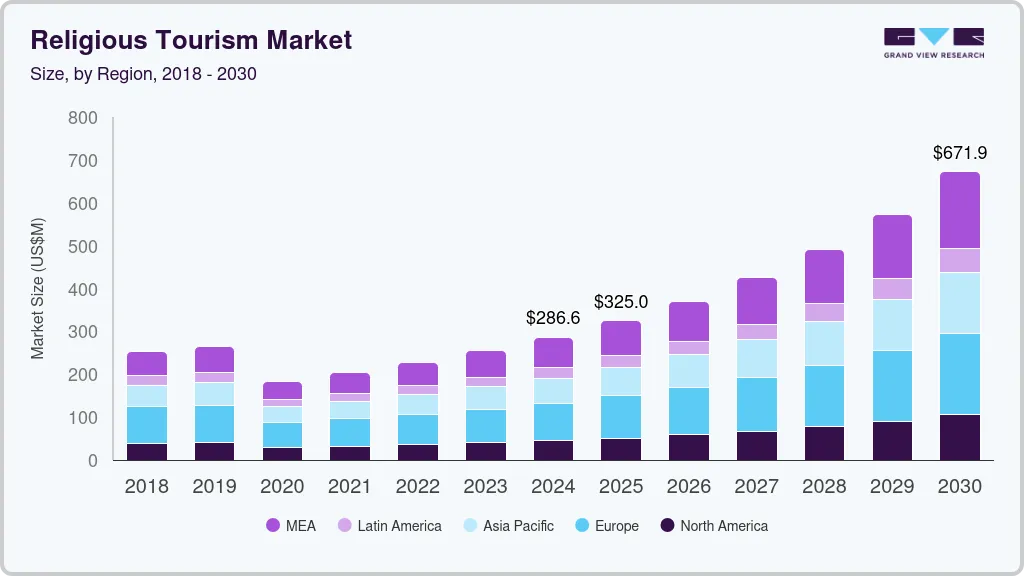

The global religious tourism market size was valued at USD 286.6 billion in 2024 and is expected to reach USD 671.9 billion by 2030, growing at a CAGR of 15.6% from 2025 to 2030. Cultural and spiritual interests drive the demand for religious tourism by attracting travelers who seek deeper connections with their faith, heritage, and history.

Key Market Trends & Insights

- North America religious tourism market accounted for a revenue share of around 15% in 2023.

- The religious tourism market in the U.S. accounted for a revenue share of around 65% in 2023.

- By type, christianity religious tourism segment accounted for the largest market share of around 31% in 2023.

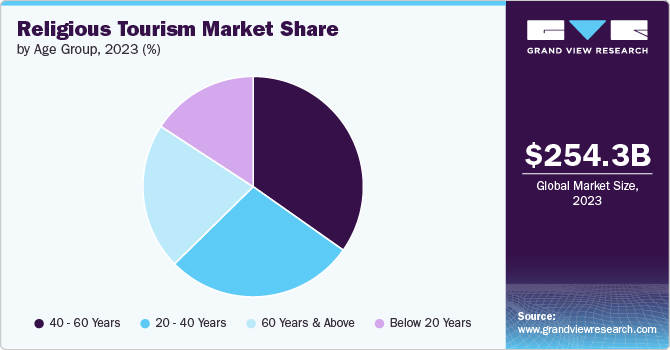

- By age group, the religious tourism among the 40 - 60 years age group accounted for the largest market share of around 35% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 286.6 Billion

- 2030 Projected Market Size: USD 671.9 Billion

- CAGR (2025-2030): 15.6%

- North America: Largest market in 2023

Many religious sites are rich in cultural significance, offering unique experiences that blend religious practices with historical and architectural importance. People visit these locations for spiritual growth and also to learn about the local traditions and customs associated with their faith. This blend of cultural exploration and spiritual fulfillment makes religious tourism appealing to a broad audience, increasing demand for travel to sacred sites globally.Traditional pilgrimages to sacred locations, such as Mecca for Hajj or Vatican City for Catholic pilgrimages, significantly drive the market by creating consistent and large-scale travel patterns. These pilgrimages are often mandatory or deeply encouraged within various religions, leading millions of adherents to participate annually. As these journeys are essential spiritual practices, they create sustained demand for transportation, accommodation, and related services. Additionally, the significance of these sacred locations ensures repeated visitors and continued market growth, with travel agencies and governments investing in infrastructure to cater to this steady influx of pilgrims.

Moreover, government initiatives and infrastructure development drive the demand for religious tourism by improving accessibility, comfort, and safety for visitors to religious sites. Many governments recognize the economic and cultural value of religious tourism and invest in building better transportation networks, lodging facilities, and visitor amenities around key pilgrimage destinations. They also promote these sites through marketing campaigns, offering visa incentives or organizing events to attract more tourists. By making religious sites more accessible and enhancing the overall travel experience, these initiatives encourage both domestic and international visitors, boosting demand for religious tourism.

Additionally, seasonal pilgrimages and festivals like Easter, Ramadan, and Kumbh Mela drive the demand for religious tourism by creating concentrated periods of high travel activity. These events attract millions of devotees who travel to participate in communal worship, rituals, or religious ceremonies. The unique spiritual and cultural significance of these festivals compels many to travel from across the world to sacred locations, often boosting local economies through spending on accommodations, food, and transportation. Additionally, the cyclical nature of these events ensures repeat travel, with many planning trips annually or seasonally, further contributing to the steady demand for religious tourism.

Type Insights

Christianity religious tourism accounted for the largest market share of around 31% in 2023. Destinations such as the Vatican, Jerusalem, and Lourdes attract millions of Christian tourists annually, seeking to experience their faith’s historical and spiritual landmarks. Key religious events like Easter and Christmas further increase travel surges, with devotees attending services, festivals, and religious ceremonies. Additionally, Christian educational tours and retreats aimed at deepening faith and religious understanding contribute to sustained demand, supported by organized travel packages and church-led initiatives promoting faith-based travel experiences.

The demand for Islamic religious tourism is expected to grow at the highest CAGR of 16.8% from 2024 to 2030. The demand for religious tourism within Islam is primarily driven by the pilgrimage of Hajj to Mecca, a key pillar of Islam, which every Muslim is required to undertake at least once in their lifetime if financially and physically able. Additionally, the Umrah pilgrimage, which can be performed at any time of the year, contributes to sustained travel flows. The spiritual significance of these pilgrimages, coupled with growing populations and increasing disposable income in many Islamic countries, further fuels the market.

Age Group Insights

Religious tourism among the 40 - 60 years age group accounted for the largest market share of around 35% in 2023. The demand for religious tourism among this age group is driven by a combination of spiritual fulfillment, personal reflection, and cultural exploration. Individuals in this age range often seek deeper connections with their faith as they approach midlife, valuing meaningful travel experiences that offer both spiritual enrichment and a sense of purpose. Additionally, this demographic typically has more financial stability and disposable income, allowing for more frequent and extended trips to sacred sites. Enhanced by a desire to participate in significant religious events or rituals, this group contributes to a steady demand for religious tourism services tailored to their needs and interests.

Religious tourism among the 20 - 40 years age group is expected to grow at a CAGR of 16.5% from 2024 to 2030. This age group is increasingly interested in immersive travel experiences that offer both personal growth and connection to cultural heritage. Social media and digital platforms play a significant role, as young adults share their travel experiences, inspire peers, and create trends around religious destinations. Additionally, this demographic often seeks meaningful travel experiences that align with their values and offer a sense of community, further fueling interest in religious tourism. The accessibility of affordable travel options and the desire for experiential learning also contribute to the rise in this market segment.

Regional Insights

North America religious tourism market accounted for a revenue share of around 15% in 2023. North America hosts a range of religious sites and events that attract both domestic and international visitors, including significant Christian pilgrimage destinations and historical places of worship. The region’s diverse religious landscape creates opportunities for varied religious tourism experiences, from exploring historical churches and temples to participating in large-scale religious festivals. Additionally, increasing interest in spiritual and wellness travel, coupled with strong infrastructure and accessibility, further enhances the appeal of religious tourism in North America.

U.S. Religious Tourism Market Trends

The religious tourism market in the U.S. accounted for a revenue share of around 65% in 2023. Major factors include the prominence of pilgrimage destinations such as the National Shrine of the Immaculate Conception, Martin Luther King Jr. National Historic Site, and various historic churches and temples across the country. The diverse religious landscape in the U.S. attracts visitors from various faith backgrounds seeking to explore significant sites and participate in religious events. Additionally, the growing trend of experiential travel and the increasing interest in spiritual and cultural enrichment contribute to the demand for religious tourism. Government and local initiatives to promote these sites further enhance their appeal, driving continued growth in the market.

Asia Pacific Religious Tourism Market Trends

The religious tourism market in Asia Pacific accounted for a revenue share of around 20% of global revenue in 2023. The regional market is driven by the rich cultural and spiritual diversity inherent to the area, with numerous significant religious sites and festivals attracting both domestic and international visitors. Major pilgrimage destinations, such as India’s Kumbh Mela, Thailand’s Buddhist temples, and Japan’s Shinto shrines, draw large crowds annually. Additionally, the region’s growing middle class, increased disposable income, and improved infrastructure support ease of travel, further boosting religious tourism. Government initiatives and local community efforts to promote and preserve these sacred sites also play a crucial role in enhancing the appeal and accessibility of religious tourism throughout the region.

Europe Religious Tourism Market Trends

The religious tourism market in Europe is expected to grow at a CAGR of 13.7% from 2024 to 2030. The market in Europe is fueled by the continent's rich historical and spiritual heritage, with numerous iconic pilgrimage sites and religious landmarks drawing millions of visitors annually. Key destinations include the Vatican City, which attracts Catholic pilgrims from around the world, and other significant sites such as Santiago de Compostela in Spain and Lourdes in France. Europe's well-developed transportation infrastructure, diverse accommodation options, and cultural attractions complement these spiritual journeys, making it a highly accessible region for religious tourism. Additionally, European governments and religious organizations actively promote these sites, enhancing their visibility and appeal to both traditional pilgrims and those seeking cultural and historical experiences.

Key Religious Tourism Company Insights

The religious tourism market is characterized by a diverse array of players, including government tourism boards, religious organizations, and private travel agencies, all vying to attract pilgrims and spiritual travelers. Key competitors often differentiate themselves through specialized travel packages, tailored experiences, and partnerships with local religious institutions to offer unique access to sacred sites and events. Major players invest in marketing campaigns, enhance infrastructure, and leverage digital platforms to reach a global audience. Additionally, the market is influenced by local and regional competitors who offer distinct cultural and spiritual experiences, contributing to a dynamic and competitive environment as each entity seeks to capture a share of this niche but growing segment.

Key Religious Tourism Companies:

The following are the leading companies in the religious tourism market. These companies collectively hold the largest market share and dictate industry trends.

- Trafalgar Tours

- Catholic Travel Centre

- Expedia, Inc.

- G Adventures

- Globus

- TourRadar

- Kesari

- Insight Vacations

- Rick Steves' Europe, Inc.

- ACE CULTURAL TOURS

Recent Developments

-

In August 2024,Trafalgar committed to responsible tourism through its initiative "Greening the World One Trip at a Time." Trafalgar made significant strides in integrating sustainable practices across its travel operations, including reducing carbon emissions and supporting environmental conservation projects. The company has implemented eco-friendly measures such as energy-efficient accommodations and waste reduction strategies, aiming to minimize its environmental footprint while promoting responsible travel. This initiative reflects Trafalgar's broader strategy to address environmental challenges and encourage more sustainable travel practices within the industry

Religious Tourism Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 0.32 billion

Revenue forecast in 2030

USD 671.9 billion

Growth Rate (Revenue)

CAGR of 15.6% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, age group, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, & Middle East & Africa

Country scope

U.S, Canada, Mexico, U.K., Germany, France, Italy, Spain, Japan, China, India, Brazil, Argentina, Saudi Arabia, and South Africa

Key companies profiled

Trafalgar Tours; Catholic Travel Centre; Expedia, Inc.; G Adventures; Globus; TourRadar; Kesari; Insight Vacations; Rick Steves' Europe, Inc.; ACE CULTURAL TOURS

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Religious Tourism Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global religious tourism market report on the basis of type, age group, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Buddhism

-

Hinduism

-

Islam

-

Christianity

-

Jewish

-

Others

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Below 20 Years

-

20 - 40 Years

-

40 - 60 Years

-

60 Years & Above

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The religious tourism market was estimated at USD 254.30 billion in 2023 and is expected to reach USD 289.60 billion in 2024.

b. The religious tourism market is expected to grow at a compound annual growth rate of 15.3% from 2023 to 2030 to reach USD 671.93 billion by 2030.

b. Europe dominated the religious tourism market with a share of around 30% in 2023. The religious tourism market in Europe is driven by the region's rich religious heritage, including iconic pilgrimage sites, historic churches, and sacred destinations, attracting both spiritual and cultural travelers.

b. Key players in the religious tourism market are Trafalgar Tours; Catholic Travel Centre; Expedia, Inc.; G Adventures; Globus; TourRadar; Kesari; Insight Vacations; Rick Steves' Europe, Inc.; and ACE CULTURAL TOURS.

b. Key factors that are driving the religious tourism market growth include increasing interest in spiritual experiences, the preservation of religious heritage sites, improved accessibility and infrastructure, and the desire for cultural exploration and personal reflection.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.