- Home

- »

- Medical Devices

- »

-

Rehabilitation Equipment Market Size, Industry Report, 2030GVR Report cover

![Rehabilitation Equipment Market Size, Share & Trend Report]()

Rehabilitation Equipment Market (2025 - 2030) Size, Share & Trend Analysis Report By Type (Therapy Equipment, Daily Living Aids, Mobility Equipment) By Application (Physical Rehabilitation & Training), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-679-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rehabilitation Equipment Market Summary

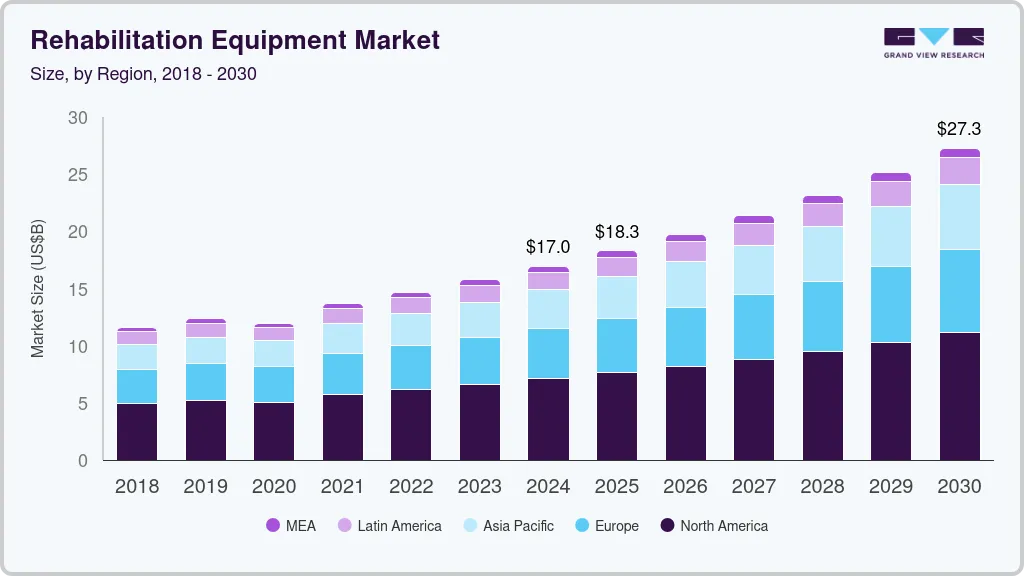

The global rehabilitation equipment market size was estimated at USD 16.96 billion in 2024 and is anticipated to reach USD 27.29 billion by 2030, growing at a CAGR of 8.3% from 2025 to 2030. The rising prevalence of chronic diseases and disabilities is a significant driver of the rehabilitation equipment market.

Key Market Trends & Insights

- North America rehabilitation equipment market dominated the overall global market and accounted for the 41.9% revenue share in 2024.

- The U.S. rehabilitation equipment market held a significant share of North America market in 2024.

- By type, the therapy equipment segment held the largest revenue share of 34.3% in 2024.

- By application, the occupational rehabilitation & training segment held the largest revenue share of 54.9% in 2024.

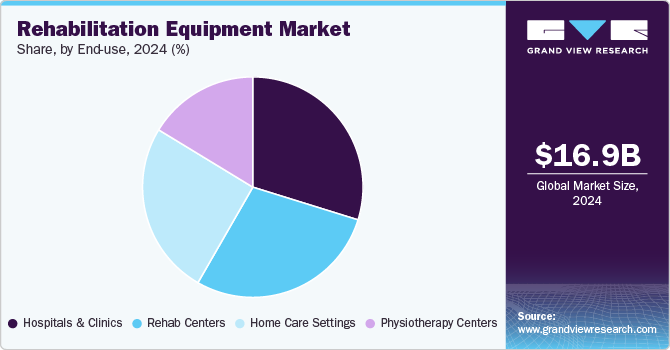

- By end use, the hospitals & clinics segment held the largest share of 30.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.96 Billion

- 2030 Projected Market Size: USD 27.29 Billion

- CAGR (2025-2030): 8.3%

- North America: Largest market in 2024

Conditions such as arthritis, stroke, and cardiovascular diseases necessitate long-term rehabilitation therapies to restore patients' mobility and functionality. For instance, according to a CDC report from February 2024, a growing number of Americans are managing multiple chronic conditions, with 42% having at least two and 12% living with five or more. Additionally, the aging global population, which is more prone to such conditions, further fuels the demand for rehabilitation equipment. These devices, including mobility aids, exercise equipment, and therapy devices, play a crucial role in patient recovery and improving their quality of life. The growing need for effective rehabilitation solutions to manage chronic conditions and disabilities is a primary factor propelling the market's growth.

Technological advancements in rehabilitation equipment are significantly contributing to market expansion. Innovations such as robotic-assisted therapy devices, wearable technology, and tele-rehabilitation platforms are enhancing the efficiency and effectiveness of rehabilitation therapies. For instance, in April 2023, Harmonic Bionics, a rehabilitation robotics company, announced, Harmony SHR, has been registered as a Class II 510(k)-exempt device. Designed as an upper extremity exercise device, Harmony can aid in treating upper body movement impairments, including those caused by neurological injuries (such as strokes), neuromuscular diseases/disorders, musculoskeletal diseases, post-procedure musculoskeletal rehabilitation, and transplant rehabilitation. These advanced devices provide personalized treatment plans, real-time progress monitoring, and improved patient engagement. For example, robotic exoskeletons aid in physical therapy by providing support and facilitating movement, while wearable sensors track patient activity and offer feedback to therapists. The continuous development and integration of cutting-edge technologies in rehabilitation equipment are driving their adoption across healthcare settings, thus boosting market growth.

Moreover, about 21% of all traumatic brain injuries are incurred from sports and recreational activities, which are also the leading cause of death from sports-related injuries. Additionally, nearly 775,000 children receive treatment for sports-related injuries annually in the U.S. Thus, the high rate of injury treatment in both emerging and developed countries and the growing participation in sports is expected to drive significant growth in rehabilitation equipment market in the coming years.

The global demand for daily assistive devices for the handicapped population is rising rapidly. Awareness of new products is increasing due to manufacturers adopting innovative communication channels, keeping patients informed about the latest market offerings. Additionally, local governments in various countries are facilitating this growth by providing easy financing, subsidies, and alternative funding options for rehabilitation equipment. These measures are expected to boost the demand for assistive products, driving market growth.

Furthermore, favorable reimbursement policies in major markets such as the U.S. are anticipated to create significant sales opportunities for manufacturers. Medicare reimbursements allow individuals to depend on assistive devices for rehabilitation. Medicare covers durable medical equipment for rehabilitation, including wheelchairs, hospital beds, patient lifts, canes, walkers, crutches, and commode chairs. Additionally, to support the Global Cooperation on Assistive Technology (GATE), the WHO has introduced the Priority Assistive Products List (APL) to enhance access to high-quality and affordable assistive products. These initiatives are expected to expand growth opportunities for manufacturers.

Market Concentration & Characteristics

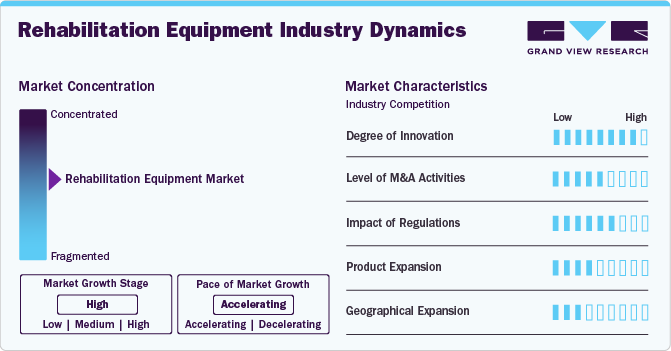

The degree of innovation in the rehabilitation equipment market can be described as moderate. While there is ongoing progress in technological advancements such as robotic-assisted therapies, wearable devices, and tele-rehabilitation platforms, the pace of innovation is restrained by regulatory challenges and the need for extensive clinical validation. Innovations primarily focus on enhancing therapy effectiveness, patient engagement, and usability. Despite these advancements, the market generally evolves incrementally rather than disruptive innovations, maintaining a balanced approach between innovation and regulatory compliance.

The impact of regulations in the rehabilitation equipment market is high. Regulatory standards ensure the safety, efficacy, and quality of rehabilitation devices, which are crucial for patient outcomes. Compliance with stringent regulations often involves significant time and investment, influencing market entry and product development. Consequently, these regulations play a pivotal role in shaping the market dynamics and growth trajectories.

The level of mergers and acquisitions in the rehabilitation equipment market is moderate. Companies seek to expand their product portfolios, enhance technological capabilities, and increase market share through strategic acquisitions. While there is steady activity driven by the need for innovation and market consolidation, it is balanced by regulatory scrutiny and the high costs associated with such transactions. For instance, in April 2024, GF Health Products purchased all the assets of Transfer Master Products. This acquisition enables Graham-Field to broaden its range of bed and sleep support systems.

Product expansion in the rehabilitation equipment market is high. Companies continuously innovate and diversify their offerings to meet the growing demand for advanced rehabilitation solutions. This includes the development of new technologies such as robotic exoskeletons, tele-rehabilitation tools, and wearable devices, enhancing the range and effectiveness of rehabilitation options available to patients and healthcare providers. For instance, in November 2023, Syrebo introduced new groundbreaking rehabilitation robots at MEDICA 2023, unveiling two innovative products: the Hand Rehabilitation Robot (BCI) and the Upper Limb Rehabilitation Robot.

Global expansion in the rehabilitation equipment market is high. Companies are actively pursuing international markets to capitalize on the increasing demand for advanced rehabilitation solutions. This expansion is driven by rising healthcare investments, aging populations, and greater awareness of rehabilitation benefits worldwide, leading to broader market penetration and growth opportunities across various regions. For instance, in April 2021, Ekso Bionics partnered with Royal Rehab in Australia, expanding the use of its robotic exoskeleton across the Asia Pacific region.

Type Insights

By type, the therapy equipment segment held the largest revenue share of 34.3% in 2024 The segment is driven by increasing awareness of the importance of rehabilitation equipment in managing musculoskeletal and neurological conditions and post-surgical recovery. Technological advancements in rehabilitation equipment, such as advanced therapeutic modalities and robotic-assisted devices, enhance treatment outcomes and drive segment growth. For instance, in November 2023, Syrebo, a rehabilitation equipment company, introduced two brand-new products, an Upper Limb Rehabilitation Robot and a Hand Rehabilitation Robot (BCI), at the International Medical Trade Fair in Düsseldorf, Germany.

The daily living aids segment is projected to record the fastest growth over the forecast period. Developing advanced sensors, materials, and smart technology has created more effective and sophisticated daily living aids. For instance, smart walkers that monitor the user's stability or self-adjusting beds that help individuals with limited mobility have improved user experience and outcomes. Such advancements in rehab equipment boost the segment's growth.

Application Insights

By application, the occupational rehabilitation & training segment held the largest revenue share of 54.9% in 2024, driven by several factors. Increasing awareness of the benefits of occupational therapy in enhancing functional independence and quality of life for individuals with disabilities or injuries is expanding its adoption. According to the WHO, in 2023, approximately 2.4 billion people have certain medical conditions that could benefit from rehabilitation. Technological advancements in rehabilitation equipment, such as adaptive devices and assistive technologies, are further fueling market growth. Moreover, supportive government policies and rising healthcare expenditure worldwide are boosting demand. The growing prevalence of chronic diseases and aging populations are also significant contributors, necessitating expanded rehabilitation services and driving the market for occupational therapy and associated equipment.

The physical rehabilitation & training segment is projected to record the fastest growth over the forecast period, supported by a rising number of physiotherapy centers globally. This expansion is driven by increasing awareness of the importance of physical rehabilitation in managing musculoskeletal and neurological conditions, as well as post-surgical recovery. Technological advancements in rehabilitation equipment, such as advanced therapeutic modalities and robotic-assisted devices, are enhancing treatment outcomes and driving market demand. For instance, in November 2022, Penumbra, Inc. announced the launch of REAL y-Series, the first full-body virtual reality-based offering for rehabilitation. It is part of a comprehensive, immersive platform that is expected to facilitate the rehabilitation of approximately 50 million people. Additionally, favorable reimbursement policies in key markets and growing healthcare investments are facilitating the establishment and growth of physiotherapy facilities. The aging population and the prevalence of chronic diseases further boost the need for expanded physiotherapy services, ensuring sustained market growth.

End Use Insights

By end use, the hospitals & clinics segment held the largest share of 30.3% in 2024, bolstered by an increasing number of healthcare facilities globally. The rise in hospital infrastructure, especially in emerging economies, coupled with investments in healthcare modernization, is driving demand for rehabilitation equipment. For instance, in April 2024, Lee Health and Encompass Health initiated construction on a collaborative project: a new 60-bed inpatient rehabilitation hospital in Fort Myers, Florida. Hospitals are expanding their rehabilitation departments to cater to growing patient populations with chronic conditions and post-surgical rehabilitation needs. Moreover, advancements in medical technology and the integration of robotic-assisted therapies are enhancing treatment efficacy, further boosting market growth. Additionally, supportive government policies and initiatives to improve healthcare access are fostering the expansion of rehabilitation services within hospitals and clinics.

The rehabilitation centers segment is expected to grow at a significant rate over the forecast period, driven by advancements that enhance usability and accessibility. Rehabilitation centers, dedicated to providing focused therapeutic care, utilize specialized equipment tailored to address a range of conditions from musculoskeletal injuries to neurological disorders. Hydrotherapy pools and underwater treadmills are examples of such specialized equipment, offering low-impact exercise options that are gentle on the joints, making them ideal for patients recovering from surgeries or dealing with chronic conditions such as arthritis.

Regional Insights

North America rehabilitation equipment market dominated the overall global market and accounted for the 41.9% revenue share in 2024. The region benefits from a sizable elderly population and rising incidences of chronic diseases such as cancer, cardiovascular ailments, diabetes, arthritis, and Parkinson’s disease. Programs such as Medicare are enhancing accessibility to rehabilitation products. Key players in North America include Invacare Corporation, Medline Industries, Inc., Dynatronics Corporation, Ekso Bionics, and GF Health Products, Inc., renowned for manufacturing walking aids, daily living aids, wheelchairs, power scooters, and patient lifts & slings.

U.S. Rehabilitation Equipment Market Trends

The U.S. rehabilitation equipment market held a significant share of North America market in 2024, due to the increasing prevalence of chronic disorders such as cardiovascular diseases, diabetes, arthritis, and neurological conditions. In 2022, around 43% of the U.S. population, totaling approximately 133 million people, live with one or more chronic illnesses. These conditions drive demand for advanced rehabilitation equipment aimed at improving mobility, managing pain, and enhancing overall quality of life. This trend is supported by technological advancements and favorable reimbursement policies, contributing to sustained market growth in the U.S.

Europe Rehabilitation Equipment Market Trends

The Europe rehabilitation equipment market is advancing with rapid technological innovations and increased funding for healthcare. These advancements are driving the development of sophisticated rehabilitation devices and therapies aimed at improving patient outcomes and enhancing healthcare delivery across the continent. For instance, in December 2023, the UK Government allocated approximately USD 28 million to the National Robotarium, aiming to promote cutting-edge research, create high-quality jobs, and stimulate economic growth. This investment is part of a broader commitment of over USD 3.6 billion to enhance development across Scotland and strengthen its innovation ecosystem.

The UK rehabilitation equipment market is experiencing growth driven by increasing investment in startup research initiatives. Innovations in rehabilitation technology are expanding, focusing on improving patient outcomes and enhancing healthcare efficiency. For instance, in April 2023, a student startup secured approximately USD 2.9 million in funding to advance its soft robotic glove designed to help stroke patients regain upper limb mobility. This investment aims to support the development of innovative healthcare solutions that enhance the quality of life for individuals recovering from a stroke. This trend is supported by government funding and collaborations between research institutions and startups, fostering advancements in devices and therapies aimed at addressing the needs of a diverse patient population.

The Germany rehabilitation equipment market is witnessing notable growth due to significant technological innovations. These advancements include the development of advanced robotic-assisted therapies, wearable devices, and tele-rehabilitation solutions. Such innovations are enhancing treatment outcomes, improving patient care, and driving growth in the rehabilitation equipment sector across Germany.

Asia Pacific Rehabilitation Equipment Market Trends

The Asia Pacific rehabilitation equipment market is expanding through collaborative efforts with hospitals and the integration of advanced technologies. Increased partnerships between healthcare institutions and equipment manufacturers are driving innovation in rehabilitation devices and therapies. For instance, in April 2023, Hyundai partnered with medical centers in Korea to implement its wearable robot, 'X-ble MEX', inpatient rehabilitation programs. This two-year collaboration aims to enhance mobility for paraplegic patients, offering them advanced levels of mobility assistance and support. This collaboration aims to enhance patient outcomes and expand access to high-quality rehabilitation services across the region. Technological advancements such as robotic-assisted therapies and smart rehabilitation tools further contribute to the market's growth by improving treatment efficacy and patient care.

The China rehabilitation equipment market is advancing with significant technological innovations and increased funding for healthcare. This growth is driven by developments in robotic-assisted therapies, smart rehabilitation devices, and telemedicine solutions. For instance, in April 2022, RoboCT, a maker of rehabilitation robots, secured USD 15 million in Series A+ funding. Their exoskeleton robots have enabled over 200 hospitals across China to assist patients in regaining mobility. Essence Securities, Poly Capital, and existing investor Blue Run Ventures China all participated in this investment round, underscoring confidence in RoboCT's innovative healthcare solutions. Government funding and investments are accelerating the adoption of advanced rehabilitation technologies, enhancing patient care and driving market expansion.

The Japan rehabilitation equipment market is fueled by extensive research, innovation, and startup initiatives. Advances in robotic technologies, wearable devices, and personalized rehabilitation solutions are expanding treatment options for patients. For instance, LifeHub, a startup based in Japan, introduced its 'Walking Wheelchair' in July 2023, designed to assist patients in maneuvering through confined spaces and crowded environments. The company secured USD 867,000 in funding from venture capital firms CyberAgent Capital and Incubate Fund to support the development and launch of this innovative mobility solution. Startups are playing a crucial role in driving innovation, supported by government funding and collaborations with research institutions, aiming to enhance rehabilitation outcomes and meet the evolving healthcare needs in Japan.

Latin America Rehabilitation Equipment Market Trends

The Latin America rehabilitation equipment market is experiencing growing demand driven by an increase in the number of hospitals and clinics investing in advanced rehabilitation technologies. This expansion is enhancing accessibility to rehabilitation services and improving patient outcomes across the region.

The Brazil rehabilitation equipment market is expanding due to the rising prevalence of chronic disorders such as cardiovascular diseases, diabetes, and musculoskeletal conditions. This trend is driving demand for advanced rehabilitation technologies aimed at improving mobility, managing pain, and enhancing overall quality of life for patients.

MEA Rehabilitation Equipment Market Trends

The MEA rehabilitation equipment market is witnessing increased demand, fueled by rising numbers of rehabilitation centers & facilities. This growth is driven by a greater awareness of the benefits of rehabilitation therapies and an increasing incidence of chronic diseases & disabilities. Governments and healthcare providers in the region are investing in advanced rehabilitation equipment to improve patient outcomes and cater to the growing rehabilitation needs of the population.

The Saudi Arabia rehabilitation equipment market is expanding rapidly due to heightened awareness of rehabilitation benefits among healthcare providers and patients. This awareness is driving demand for advanced equipment aimed at improving mobility and enhancing rehabilitation outcomes across the country.

Key Rehabilitation Equipment Company Insights

Key participants in the global market focus on devising innovative business growth strategies such as partnerships & collaborations, product portfolio expansions, mergers & acquisitions, and business footprint expansions.

Key Rehabilitation Equipment Companies:

The following are the leading companies in the rehabilitation equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Invacare Corporation

- Medline Industries, Inc.

- Dynatronics Corporation

- Drive Devilbiss Healthcare

- Ekso Bionics

- Caremax Rehabilitation Equipment Ltd

- GF Health Products, Inc

- Hospital Equipment Mfg. Co

- Maddak, Inc.

- India Medico Instruments.

Recent Developments

-

In February 2024, Addverb introduced three robots designed for diverse applications. Venturing into healthcare robotics, the automation solutions provider launched Healan, an advanced medical cobot tailored for rehabilitation and imaging purposes.

-

In August 2023, ReWalk Robotics Ltd., a provider of cutting-edge technologies for mobility in rehabilitation and daily life for individuals with neurological conditions, announced the completion of its acquisition of AlterG, Inc., an innovator and supplier of Anti-Gravity systems used in neurological rehabilitation.

Rehabilitation Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.29 billion

Revenue forecast in 2030

USD 27.29 billion

Growth Rate

CAGR of 8.3% from 2025 to 2030

Actual Data

2018 - 2024

Forecast Data

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD billion/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Application, End use

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden, China, Japan, India, Australia, Thailand, South Korea, Brazil, Argentina,Colombia, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Invacare Corporation; Medline Industries, Inc.; Dynatronics Corporation; Drive Devilbiss Healthcare; Ekso Bionics; Caremax Rehabilitation Equipment Ltd; GF Health Products, Inc; Hospital Equipment Mfg. Co; Maddak, Inc.; India Medico Instruments

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rehabilitation Equipment Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global rehabilitation equipment market report on the basis of type, application, end use and region.

-

Rehabilitation Equipment Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Therapy Equipment

-

Daily Living Aids

-

Medical Beds & Related Products

-

Reading, Writing, and Computing Aids

-

Bathroom and Toilet Assist Devices

-

Other Daily Living Aids

-

-

Mobility Equipment

-

Wheelchairs & Scooters

-

Powered Wheelchairs

-

Mobility Sccoters

-

Manual Wheelchairs

-

-

Walking Assist Devices

-

Canes

-

Crutches

-

Walkers

-

-

-

Body Support Devices

-

Patient Lifts

-

Slings

-

Other Body Support Devices

-

Exercise Equipment

-

Lower-Body Exercise Equipment

-

Upper-Body Exercise Equipment

-

Full-Body Exercise Equipment

-

-

-

Rehabilitation Equipment Application Outlook (Revenue, USD Billion; 2018 - 2030)

-

Physical Rehabilitation & Training

-

Occupational Rehabilitation & Training

-

-

Rehabilitation Equipment End Use Outlook (Revenue, USD Billion; 2018 - 2030)

-

Hospitals & Clinics

-

Rehabilitation Centers

-

Home-care settings

-

Physiotherapy Centers

-

Other End Users

-

-

Rehabilitation Equipment Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global rehabilitation equipment market size was estimated at USD 16.96 billion in 2024 and is expected to reach USD 18.29 billion in 2025.

b. The global rehabilitation equipment market is expected to grow at a compound annual growth rate of 8.3% from 2025 to 2030 to reach USD 27.29 billion by 2030.

b. Therapy Equipment dominated the rehabilitation devices market with a share of 34.3% in 2024. Growing geriatric population, changing lifestyle, and favorable healthcare reforms are factors that are anticipated to propel the market during the forecast period.

b. Some key players operating in the rehabilitation devices market include Invacare Corporation; Medline Industries, Inc.; Dynatronics Corporation; Drive Devilbiss Healthcare; Esko Bionics; Caremax Rehabilitation Equipment Ltd.; GF Health Products, Inc.; Hospital Equipment Mfg. Co.; Maddak, Inc.; and India Medico Instruments

b. Key factors that are driving the rehabilitation equipment market growth include the increasing prevalence of degenerative diseases, such as Parkinson’s, Alzheimer’s, & arthritis, and a growing number of trauma patients who require rehabilitation therapy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.