- Home

- »

- Biotechnology

- »

-

Regenerative Medicine Market Size, Industry Report 2030GVR Report cover

![Regenerative Medicine Market Size, Share & Trends Report]()

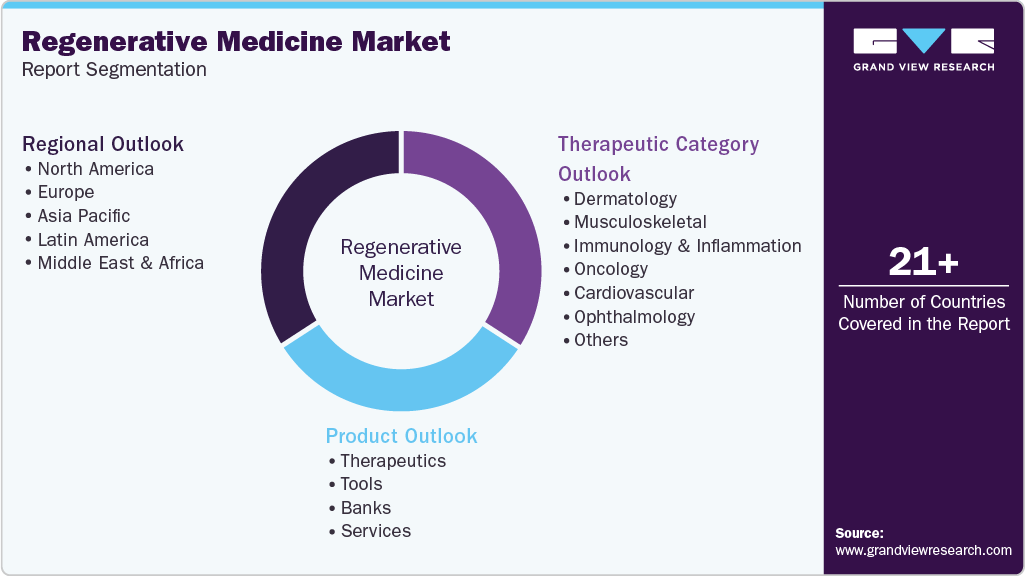

Regenerative Medicine Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Therapeutics, Tools, Banks), By Therapeutic Category (Dermatology, Musculoskeletal, Immunology & Inflammation), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-952-4

- Number of Report Pages: 245

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Regenerative Medicine Market Summary

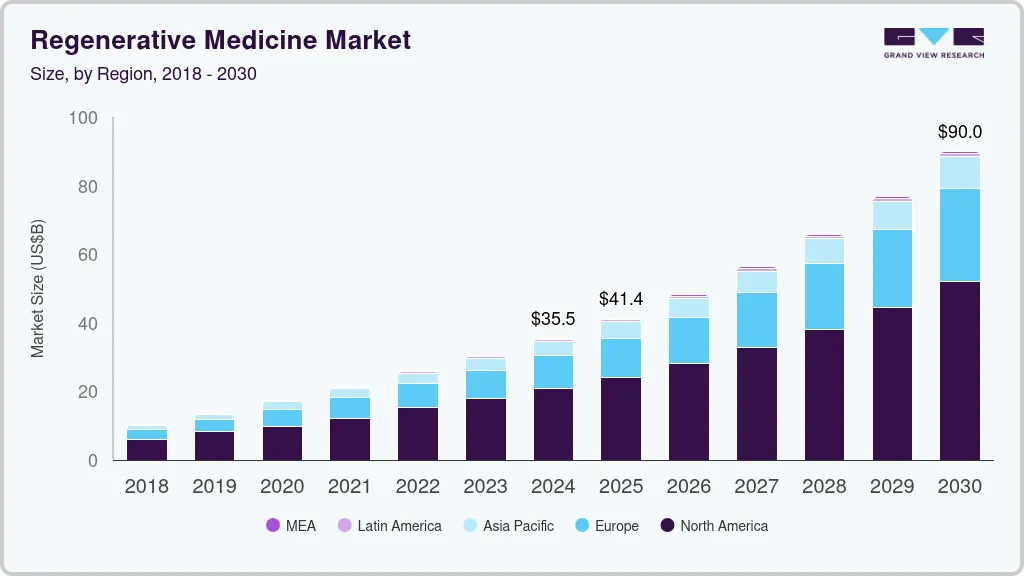

The global regenerative medicine market size was estimated at USD 35.47 billion in 2024 and is projected to reach USD 90.01 billion by 2030, growing at a CAGR of 16.83% from 2025 to 2030. Recent advancements in biological therapies have resulted in a gradual shift in preference toward personalized medicinal strategies over the conventional treatment approach.

Key Market Trends & Insights

- North America regenerative medicine market held the largest share of 58.62% in 2024.

- The regenerative medicine market in the U.S. is propelled by regulatory support, a concentration of biotech hubs, and private-sector investment.

- By product, the therapeutics segment held the largest revenue share of 76.39% in 2024.

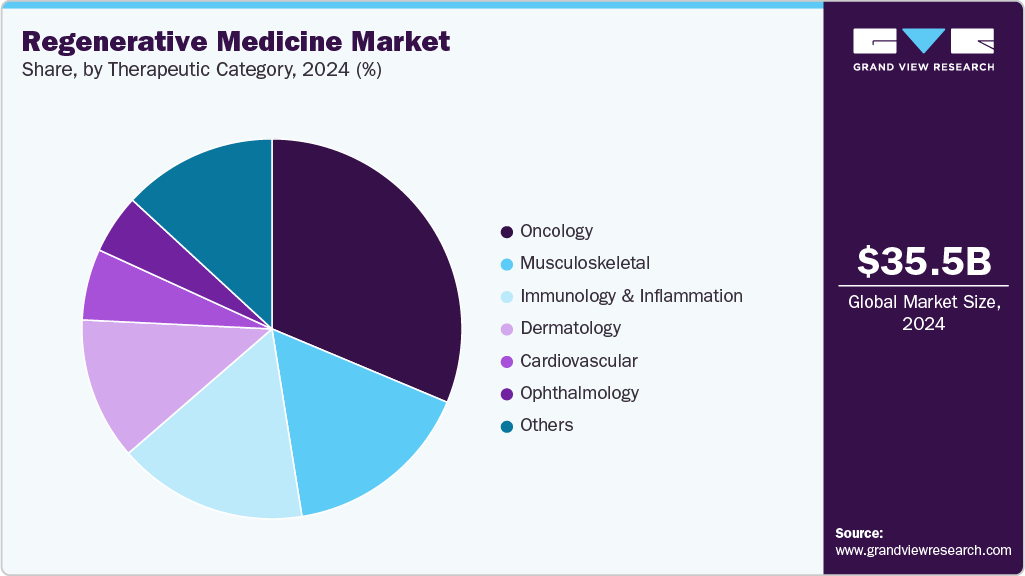

- By therapeutic category, the oncology segment held the largest share of 31.87% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 35.47 Billion

- 2030 Projected Market Size: USD 90.01 Billion

- CAGR (2025-2030): 16.83%

- North America: Largest market in 2024

This has created opportunities for companies that are involved in the development of biological therapeutics. Furthermore, the rise in incidence of degenerative disorders has led to an increase in focus on research to discover novel regenerative therapies. The COVID-19 outbreak has considerably impacted various markets, including the regenerative medicine and T-cell therapy manufacturing market. The SARS-CoV-2 coronavirus crisis has significantly affected the delivery of CAR T-cell therapies. This impact is not just limited to patient care. It has extended beyond patient care to administration, logistics, and limited healthcare resources. Several universities have slowed down clinical trial enrollment and other research activities. However, the market continues to expand as market players such as Novartis provide access to the therapies, such as Athersys, Inc.’s MultiStem, which is a highly relevant COVID-19 therapy.

Furthermore, the regenerative medicines have been identified to have the unique ability to alter the fundamental mechanisms of diseases. Regenerative therapies in trials provide promising solutions for specific chronic indications with unmet medical needs. In December 2021, Novartis announced T-ChargeTM, a next-generation CAR-T platform that would be a beneficial tool for novel investigational CAR-T cell therapies.

Significant advancements in molecular medicines have resulted in the development of gene-based therapy, which uses targeted delivery of DNA as a medicine to fight against various disorders. Gene therapy has high potential in the treatment of cancer and diabetes type 1 & 2 through restoring gene function. Currently, gene-based therapies are used in the treatment of patients suffering from cancer, oncology, infectious diseases, cardiovascular disorders, monogenic diseases, genetic disorders, ophthalmological indications, and diseases of the central nervous system. These factors have contributed to the global regenerative medicine Industry.

In addition, a strong product pipeline in clinical trials and the presence of government & private funding to support research are expected to drive market growth over the forecast period. The presence of highly efficient products such as grafts, tissue patches, ointments, and scaffolds have resulted in the development of regenerative medicines for use in dermatology as well as musculoskeletal treatments. Advancements in nanotechnology that have further improved the efficiency of these products are expected to significantly contribute to revenue generation.

Regenerative medicine FDA-approved products:

Category

Name

Biological agent

Approved use

Biologics

laViv

Autologous fibroblasts

Improving nasolabial fold appearance

Carticel

Autologous chondrocytes

Cartilage defects from acute or repetitive trauma

Apligraf, GINTUIT

Allogeneic cultured keratinocytes and fibroblasts in bovine collagen

Topical mucogingival conditions, leg and diabetic foot ulcers

Cord blood

Hematopoietic stem and progenitor cells

Hematopoietic and immunological reconstitution after myeloablative treatment

Biopharmaceuticals

GEM 125

PDGF-BB, tricalcium phosphate

Periodontal defects

Regranex

PDGF-BB

Lower extremity diabetic ulcers

Infuse, Infuse bone graft, Inductos

BMP-2

Tibia fracture and nonunion, and lower spine fusion

Osteogenic protein-1

BMP-7

Tibia nonunion

Source: National Academy of Sciences

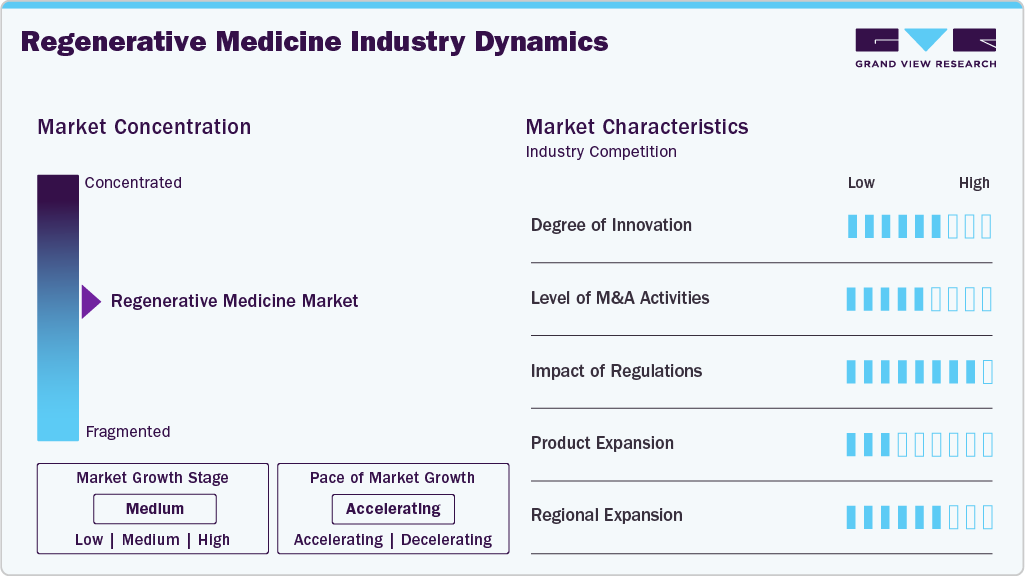

Market Concentration & Characteristics

The regenerative medicine industry is marked by a high degree of innovation, driven by breakthroughs in stem cell therapy, gene editing (e.g., CRISPR), tissue engineering, and biomaterials. Continuous R&D efforts by biotechnology firms, academic institutions, and research consortia fuel novel therapeutic approaches aimed at repairing or replacing damaged tissues and organs. Companies increasingly focus on platform technologies that can be applied across multiple indications, enhancing the competitive landscape and intellectual property intensity.

Collaboration is extensive and essential in regenerative medicine due to the complex, interdisciplinary nature of the field. Partnerships between biotech firms, academic research centers, pharma companies, and contract development and manufacturing organizations (CDMOs) are common. These alliances foster access to cutting-edge science, funding, infrastructure, and clinical development capabilities, expediting innovation and commercialization. Strategic joint ventures and licensing agreements also help mitigate the risks associated with lengthy regulatory approval and market adoption timelines.

Regulations have a significant but dual-faceted impact on the regenerative medicine industry. On one hand, stringent approval requirements-especially in the U.S. (FDA), EU (EMA), and Japan (PMDA)-can delay product development and increase compliance costs. On the other hand, frameworks like the FDA’s RMAT (Regenerative Medicine Advanced Therapy) designation and Japan’s fast-track conditional approval system encourage innovation by accelerating approval for promising therapies. Thus, while regulatory complexity remains a barrier, tailored policies are also acting as enablers for rapid clinical translation.

The sector shows moderate to high product expansion, with companies gradually broadening their portfolios from autologous therapies and first-generation stem cell treatments to more complex gene-modified and allogeneic solutions. There's growing interest in off-the-shelf therapies, which promise scalable manufacturing and broader patient access. While the number of commercially approved regenerative therapies remains limited, the pipeline is robust, with hundreds of candidates in clinical trials. Expansion is especially notable in areas like orthopedic, cardiovascular, and oncology applications.

The industry is undergoing active regional expansion, with North America, Europe, and Japan leading, while China, South Korea, and the Middle East are rapidly growing hubs due to supportive policies and investment. Companies are entering new markets through partnerships, local manufacturing sites, and region-specific clinical trials. Government initiatives, such as China’s national biotech development strategy and Saudi Arabia’s Vision 2030, are fostering regional growth. However, disparities in infrastructure, reimbursement policies, and regulatory maturity across regions can impact adoption rates and strategic entry decisions.

Product Insights

The therapeutics segment held the largest revenue share of 76.39% in 2024, owing to the growing geriatric population coupled with higher incidence rates of age-related as well as degenerative disorders. Increased prevalence of diseases with unmet medical solutions, such as cancer, diabetes, and neurodegenerative diseases, including AMD, has encouraged researchers to develop alternative options. For instance, in April 2022, Kite, a Gilead Company, announced receiving U.S. FDA authorization for its CAR T-cell therapy product, Yescarta, which could be used for the treatment of refractory or relapsed large B-cell lymphoma. Hence, propelling the regenerative medicine Industry growth.

The banks segment is expected to witness the fastest CAGR of 17.38% from 2025 to 2030. Banks are usually research-focused and are established with an intention to accelerate research by reducing the efforts, time, and cost for researchers in the collection, storage, and curation of human tissues or cells. However, with the rising adoption of cell-based and tissue engineering approaches in medical applications, a number of banks providing services for non-research applications have witnessed a rise. Thus, a rise in the number of clinical trials for stem cell and tissue-based regenerative therapies, along with an increase in demand for regenerative therapies, is expected to influence regenerative medicine Industry growth.

Therapeutic Category Insights

The oncology segment held the largest share of 31.87% in 2024 and is expected to witness the fastest CAGR of 17.66% from 2025 to 2030. The growing prevalence of cancer is expected to positively influence the global market throughout the forecast period. According to the American Cancer Society estimate, the overall number of new cancer cases in 2023 is approximately 1,958,310, and 609,820 cancer deaths in the U.S., boosting the market growth. The global cancer impact has resulted in worldwide efforts to decrease mortality and increase efficient treatment options pertaining to cancer. Therefore, Various government organizations, along with private companies, have made high investments in cancer research and development of regenerative & advanced cell therapies. In January 2023, Calidi Biotherapeutics (CBT) and First Light Acquisition Group (FLAG) entered into a partnership agreement that aims to revolutionize oncolytic virotherapies with the help of stem cell-based platforms and further boost the regenerative medicine Industry growth.

The cardiovascular segment is anticipated to witness significant growth during the forecast period. Advancements in cell-based therapies and regenerative medicines have accelerated the growth of the segment. Many key players are involved in the development of regenerative therapies to repair, restore, and revascularize damaged heart tissues. There is growing adoption of single and mixed cells from autologous as well as allogeneic sources to study the effect on CVDs. In addition, advanced biologics, small molecules, and gene therapy are being investigated to stimulate the regeneration of damaged heart cells. These factors would further fuel the industry.

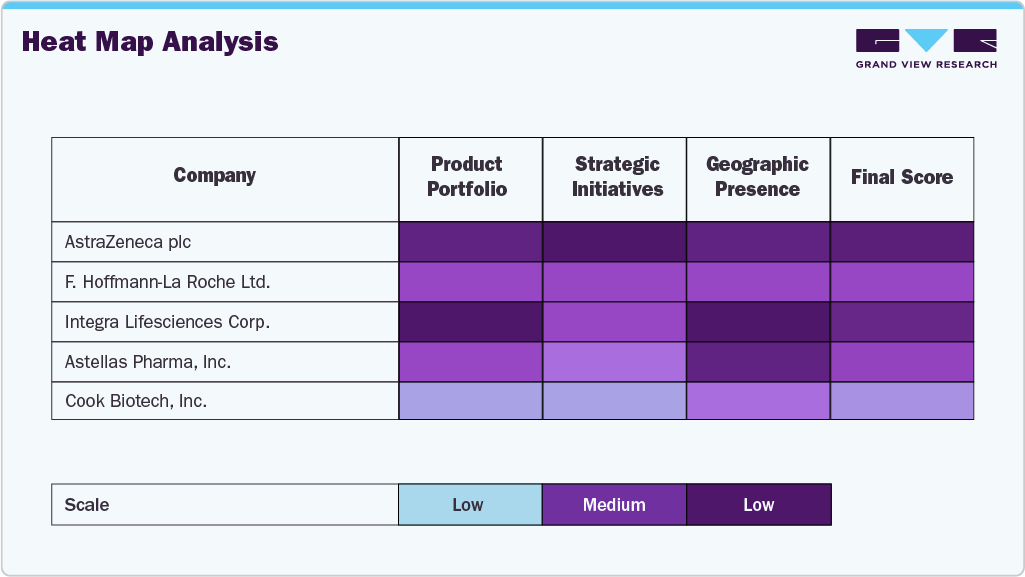

A heat map analysis of the regenerative medicine positioning for AstraZeneca plc, F. Hoffmann-La Roche Ltd., Integra LifeSciences Corp., Astellas Pharma, Inc., and Cook Biotech, Inc. reveals varying strengths across innovation, collaboration, regulatory engagement, and geographic/product expansion. F. Hoffmann-La Roche Ltd. leads in innovation and collaboration, particularly through Genentech’s gene therapy pipeline and multiple strategic partnerships.

AstraZeneca scores high in innovation and regional expansion, leveraging its global footprint and strong R&D in cell therapy, especially in oncology. Astellas Pharma demonstrates a robust collaboration and product expansion focus, notably through acquisitions like Audentes Therapeutics, enhancing its gene therapy capabilities. Integra LifeSciences excels in product and regional expansion, with a broad regenerative portfolio in wound care and orthopedics, though it shows lower innovation intensity in gene/cell therapy. Cook Biotech ranks moderate, with strong product specialization in biologic tissue repair and a lower presence in advanced gene therapies or international collaborations. Overall, Roche and AstraZeneca emerge as frontrunners, while Cook and Integra are more niche-focused with targeted strengths.

Regional Insights

North America regenerative medicine market held the largest share of 58.62% in 2024. The high market growth is attributed to the availability of government and private funding for development, the presence of advanced tech frameworks to support the rapid detection of chronic diseases, and high healthcare spending in the region. Moreover, several ongoing clinical trials for regenerative medicine by significant market players have contributed to the region’s growth. In December 2021, Bristol Myers Squibb received U.S. FDA approval for Orencia for the prevention of acute graft versus host disease in adults and pediatric patients 2 years of age and elderly patients undergoing hematopoietic stem cell transplantation (HSCT).

U.S. Regenerative Medicine Market Trends

The regenerative medicine market in the U.S. is propelled by regulatory support (RMAT, Fast Track, Orphan Drug designations), a concentration of biotech hubs (Boston, San Diego), and private-sector investment. Institutions like the NIH and BARDA continue to support cell and gene therapy pipelines. Patient demand for personalized medicine and curative treatments is high, especially in oncology, neurology, and rare diseases. Additionally, increasing hospital adoption of stem cell therapies and advancements in manufacturing platforms are key enablers.

Europe Regenerative Medicine Market Trends

The regenerative medicine market in Europe is driven by strong academic research, cross-border consortia (e.g., Horizon Europe), and a growing number of EU-approved ATMPs (Advanced Therapy Medicinal Products). The region benefits from centralized regulatory oversight through the EMA and an increasingly harmonized approval process. Public-private partnerships and national innovation funds help startups scale. However, fragmented reimbursement systems and regulatory variations between EU states can slow uptake post-approval.

The UK stands out due to government-led initiatives such as the Cell and Gene Therapy Catapult and strong regulatory clarity post-Brexit. London and Cambridge are hubs for regenerative medicine R&D, and the NHS offers early access programs for breakthrough therapies. The UK’s Biobank and genomics leadership further support the development of targeted therapies. Regulatory agility and public investment post-COVID-19 have created a favorable landscape for regenerative product development.

The regenerative medicine market in Germany is bolstered by strong industrial-academic collaboration, manufacturing capabilities, and healthcare spending. The country is home to major cell and tissue engineering companies, as well as GMP-compliant production centers. Supportive reimbursement structures for hospital-based therapies and early-stage innovation grants from agencies like BMBF enhance pipeline growth. Regulatory and ethical scrutiny is relatively strict, but consistent, providing stability for innovators.

Asia Pacific Regenerative Medicine Market Trends

The regenerative medicine market in APAC is fueled by rising healthcare investments, supportive government policies, and increasing local biotech innovation, particularly in China, Japan, South Korea, and Australia. The region is seeing an expansion of GMP-certified facilities and clinical trial activity. Cross-border licensing deals and Western collaborations are common as companies seek to fast-track development. Aging populations and high unmet needs in chronic and degenerative diseases are key demand drivers.

China regenerative medicine market is expanding rapidly, driven by government investment under its 14th Five-Year Plan, streamlined clinical trial regulations, and strong domestic demand. Numerous startups and academic spin-offs are exploring stem cell, gene editing (CRISPR), and biomaterials-based solutions. The NMPA has recently restructured its regulatory framework to facilitate innovation while improving oversight. State-sponsored industrial parks and funding schemes are enabling rapid scale-up of cell therapy manufacturing.

The regenerative medicine market in Japan is a leader due to pro-innovation regulation (e.g., conditional approval system), a rapidly aging population, and strong pharma-biotech collaboration. The PMDA allows faster approval of regenerative therapies based on early efficacy signals, making Japan a global testbed for novel treatments. Companies like Takeda and Astellas are active in gene and cell therapies, and academic centers such as CiRA (Kyoto University) lead in iPSC research. Public health initiatives and reimbursement support also drive adoption.

MEA Regenerative Medicine Market Trends

The regenerative medicine market in the Middle East is emerging through strategic investments in healthcare transformation, medical tourism, and localized biotech ecosystems. Countries like the UAE and Qatar are developing advanced medical cities and research hubs, creating demand for cutting-edge therapies. However, the market is still nascent, with limited regulatory and clinical infrastructure for advanced therapeutics. International partnerships and knowledge transfer will be crucial for sustained growth.

Saudi Arabia regenerative medicine market is gaining momentum under Vision 2030, which promotes biotechnology and healthcare innovation. Investment in R&D infrastructure, collaborations with global biotech firms, and state-led initiatives (e.g., King Abdulaziz City for Science and Technology) are building capacity. There’s a rising demand for cell therapy solutions for diabetes and orthopedic conditions. However, regulatory pathways for advanced therapies are still maturing, posing both challenges and opportunities.

The regenerative medicine market in Kuwait is in the early stages, driven by the increasing prevalence of chronic diseases, the modernization of healthcare facilities, and the growing interest in stem cell research. The government is focusing on improving specialty care and attracting medical expertise through public-private partnerships. While infrastructure and regulatory readiness for regenerative therapies are developing, regional collaborations and imports currently dominate therapeutic availability.

Key Regenerative Medicine Companies Insights

Key players operating in the regenerative medicine market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Regenerative Medicine Companies:

The following are the leading companies in the regenerative medicine market. These companies collectively hold the largest market share and dictate industry trends.

- AstraZeneca plc

- F. Hoffmann-La Roche Ltd.

- Integra Lifesciences Corp.

- Astellas Pharma, Inc.

- Cook Biotech, Inc.

- Bayer AG

- Pfizer, Inc.

- Merck KGaA

- Abbott

- Vericel Corp.

- Novartis AG

- GlaxoSmithKline (GSK)

Recent Developments

-

In December 2024, Sysmex and J-TEC Enter Basic Agreement to Enhance Regenerative Medicine and Cell Therapy Manufacturing Capabilities.

-

In October 2023, Editas Drug, Inc. stated that the FDA has given EDIT-301, a research-stage gene editing drug, Regenerative Medicine Advanced Therapy (RMAT) classification for the treatment of severe sickle cell disease (SCD).

-

In October 2022, Astellas Pharma Inc. and Pantherna Therapeutics GmbH announced a technology evaluation agreement to develop mRNA-based regenerative medicine programs through direct reprogramming. Their collaborative effort aims to expand treatment options for diseases with high unmet medical needs by targeting new organs.

-

In July 2022, Mogrify Limited and Astellas Pharma Inc. announced a collaborative research agreement to develop regenerative medicine approaches for sensorineural hearing loss. Astellas Gene Therapies will fund the research and provide expertise in AAV-based genetic medicine, while Mogrify will leverage its bioinformatic platform for screening and validation to identify potential therapeutic factors. Their shared goal is to transform the lives of patients with hearing loss through innovative regenerative therapies.

-

In January 2022, Novartis unveiled a strategic collaboration with Alnylam to harness Alnylam's established siRNA technology in inhibiting a target identified at Novartis Institutes for BioMedical Research. By merging regenerative medicine principles with cutting-edge siRNA technology, both companies aim to create a potential treatment fostering the regrowth of functional liver cells, offering an alternative to transplantation for patients suffering from liver failure.

Regenerative Medicine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 41.36 billion

Revenue forecast in 2030

USD 90.01 billion

Growth rate

CAGR of 16.83% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, therapeutic category, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

AstraZeneca plc; F. Hoffmann-La Roche Ltd.; Integra Lifesciences Corp.; Astellas Pharma, Inc.; Cook Biotech, Inc.; Bayer AG; Pfizer, Inc.; Merck KGaA; Abbott; Vericel Corp.; Novartis AG; GlaxoSmithKline (GSK)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Regenerative Medicine Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global regenerative medicine market report based on product, therapeutic category, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutics

-

Primary cell-based therapeutics

-

Dermatology

-

Musculoskeletal

-

Surgical

-

Dental

-

Others

-

-

Stem Cell & Progenitor Cell-based therapeutics

-

Autologous

-

Allogenic

-

Others

-

-

Cell-based Immunotherapies

-

Gene Therapies

-

-

Tools

-

Banks

-

Services

-

-

Therapeutic Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermatology

-

Musculoskeletal

-

Immunology & Inflammation

-

Oncology

-

Cardiovascular

-

Ophthalmology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global regenerative medicine market size was estimated at USD 35.47 billion in 2024 and is expected to reach USD 41.36 billion in 2025

b. The global regenerative medicine market is expected to grow at a compound annual growth rate of 16.83% from 2025 to 2030 to reach USD 90.01 billion by 2030.

b. North America dominated the regenerative medicine market with a share of 58.62% in 2024. This is attributable to the availability of advanced technologies and the presence of research institutes involved in the development of novel therapeutics in the region.

b. Some key players operating in the regenerative medicine market include Integra LifeSciences Corporation; MiMedx Group, Inc.; AstraZeneca; F. Hoffmann-La Roche Ltd; Merck & Co., Inc.; Pfizer Inc.; and Baxter.

b. Key factors that are driving the market growth include the presence of a strong pipeline portfolio and a high number of clinical trials, high economic impact of regenerative medicine and technological advances in regenerative medicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.