Refurbished Medical Imaging Devices Market Size, Share & Trends Analysis Report By Modality (CT, Nuclear Imaging), By End-use (Diagnostic Imaging Centers, Hospitals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-175-1

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global refurbished medical imaging devices market size was estimated at USD 4.39 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.38% from 2024 to 2030. The market is being driven by several factors, such as increasing demand for cost-effective medical imaging devices by smaller hospitals and clinics, availability of large inventories of used or old medical imaging devices, rising adoption of eco-friendly products, growing number of hospitals & diagnostic imaging centers, and emerging opportunities in developing countries. The market is experiencing growth due to the presence of multiple suppliers. This has increased competition and provided buyers with a wider range of options.

Reputable suppliers offer warranties, repair services, and ongoing support, giving healthcare facilities confidence in their purchase and ensuring the equipment remains in good working condition. The availability of technologically advanced equipment at lower prices drives market growth. Refurbishing medical imaging devices can be an effective way to conserve materials and resources. However, it is crucial to have regulations in place to ensure that refurbished imaging devices meet safety and quality standards. The regulatory framework comprising appropriate standards and guidelines is necessary to import, sell, label, and use refurbished medical imaging devices.

Standards including IEC 63077:2019, which outlines the procedure of refurbishing used diagnostic imaging equipment, and ISO 13485:2016, which prescribes requirements for a quality management system for medical devices and related services, could provide a solid foundation for the buildout of these standards and guidelines. In addition, the World Health Organization (WHO) is working on finalizing guidelines for refurbishing processes, labeling requirements, and regulations in the revised version of the WHO Global Model Regulatory Framework for Medical Devices, including in vitro diagnostic medical devices.

If these guidelines are implemented, they could reduce the risk of damage to patients/users due to malfunctioning refurbished medical imaging devices. The global market is growing in low and middle income countries, presenting a lucrative opportunity for key players to increase their share. With no major domestic players in this sector, an established medical equipment company can diversify and profit from this market. While affordability remains a challenge, collaborations with state and central governments can help tap into small-town and rural markets. Companies can also establish national centers to offer after-sales services and build trust among customers.

Key market players, such as Siemens Healthineers, Koninklijke Philips N.V., and GE HealthCare, are ramping up their equipment refurbishing services to keep up with the demand. However, strict guidelines on the import and usage of refurbished medical imaging devices, absence of standard policies for the sales and usage of such devices, rising availability of cost-effective new medical devices, and negative prejudices about the quality of the refurbished medical devices are the factors hampering the market growth.

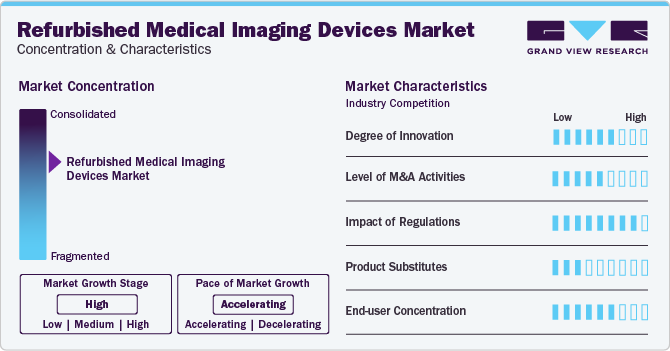

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The global market has witnessed a significant degree of innovation, marked by advancements to enhance both performance and cost effectiveness. Medical imaging device manufacturers are adopting new technologies to ensure that their systems meet the latest diagnostic standards. One common approach is the integration of advanced imaging software and artificial intelligence (AI) algorithms. This technology combination has become increasingly popular, as it enhances the accuracy and efficiency of medical imaging devices.

Companies have been strategically pursuing mergers and acquisitions to enhance their market presence by expanding their range of products. For instance, in May 2023, Block Imaging decided to spin off and rename its mobile business after the acquisition by Siemens and CommonSpirit Health. The mobile business will now operate as a standalone family-owned business under the name Cube Mobile Imaging. While it will not be involved in the acquisition, the company will continue to provide its services, such as CT and MRI equipment rentals, as well as assisting with site planning, delivery, setup, and preparation for patient scanning.

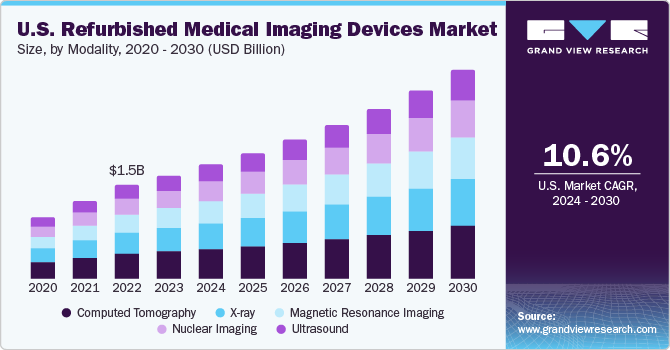

Modality Insights

The computed tomography (CT) segment dominated the global market and accounted for the largest revenue share of 25.81 % in 2023. Refurbished computed tomography systems are preferred over new ones due to several factors such as availability at a lower cost, which makes them a more viable option for small and medium-sized healthcare facilities. Additionally, they undergo rigorous testing and quality checks before being put up for sale, ensuring that they are in good working condition. Lastly, they are environmentally friendly as they help to reduce electronic waste and promote sustainability.

The nuclear imaging is anticipated to grow at a fastest rate over the forecast period. Nuclear imaging products such as PET and SPECT are growing at a fast rate due to their ability to diagnose and treat various diseases accurately. The cost difference between new and refurbished PET and SPECT products can be significant, with refurbished options often being more affordable for medical facilities and clinics. These devices are widely used for cancer detection, cardiovascular disease diagnosis, neurological disorders, and others. Companies such as GE Healthcare, Philips Healthcare, Siemens Healthineers, and Toshiba offer refurbished PET and SPECT devices.

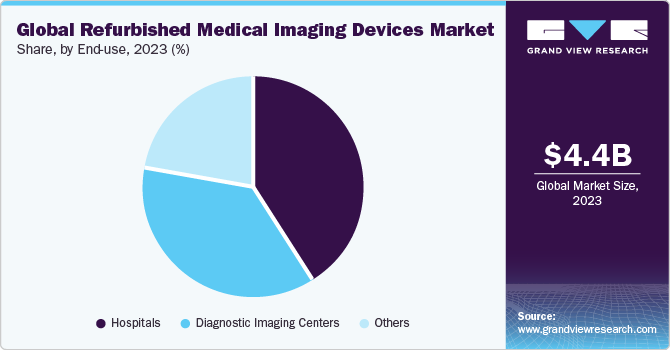

End-use Insights

The hospitals segment captured the largest revenue share of 41.35% in 2023. Refurbished medical imaging devices are becoming increasingly preferable in hospital settings due to their cost-effectiveness and reliability. New medical imaging devices can be incredibly expensive, making it difficult for many hospitals to afford the latest technology. Refurbished devices, on the other hand, can be purchased at a fraction of the cost of new devices, freeing up budget for other important hospital expenditures. In addition, these devices are highly reliable and are tested & certified to meet the same standards as new equipment, ensuring they are safe & effective for use in a hospital setting.

Refurbished devices also come with warranties and service contracts, providing hospitals with assurance and confidence in using such devices. The aforementioned factors suggest the key reasons behind the segment’s dominance. The diagnostic imaging centers segment is expected to register the fastest CAGR from 2024 to 2030. This growth can be attributed to factors, such as increasing demand for technologically advanced products and high demand for diagnostic imaging centers.

As technology advances rapidly, many centers may not continually have the resources to upgrade to the latest equipment. Refurbished medical imaging devices can provide a more affordable way to access the latest technology. As the demand for diagnostic imaging services continues to grow, there is a need to expand existing facilities or open new ones. Refurbished imaging devices can offer a more affordable way to equip these new facilities, allowing for faster growth.

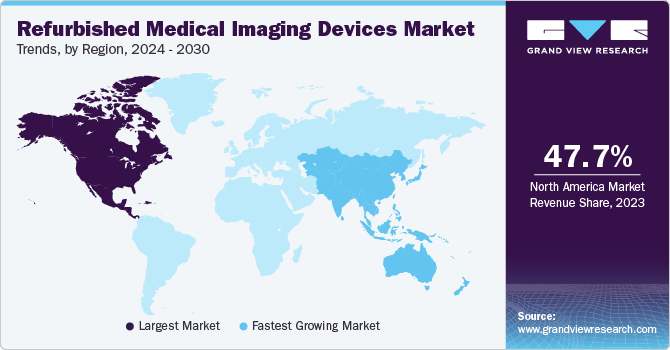

Regional Insights

North America dominated the market in 2023 with the largest revenue share of 47.72%. Rising prevalence of chronic disorders, rising disposable income, growing preference for early disease diagnosis have driven the market demand in the region. According to an article published by NCBI, North America's market is the largest among all regions, followed by Europe and Asia Pacific. As per estimates, a significant 70% of all refurbished imaging medical devices are sold in the United States of America (46%) and the European Union (EU; 24%). Asia Pacific is expected to witness a rise in growth due to the high demand for refurbished medical equipment by hospitals and clinics with constrained resources, increasing privatization of the healthcare sector, and the region's large population. Introducing new regulations in the region is expected to standardize procedures and drive regional market growth.

For instance, in February 2022, the Malaysian Medical Device Authority (MDA) established regulations that outline the criteria for registering refurbished medical equipment. There are two registration procedures for reprocessed medical equipment: ROUTE (A) for original suppliers and ROUTE (B) for third-party refurbishes. Also, it is allowed for Japanese authorities to import and sell refurbished medical imaging devices, which may also include spare parts. Refurbished medical imaging devices are considered a category of previously used medical devices. The import and reuse of used critical care medical equipment in India are regulated under the Hazardous and other Wastes (Management, Handling and Transboundary Movement) Rules, 2016. In addition, lucrative growth opportunities in developing countries are expected to contribute to region’s growth.

Key Companies & Market Share Insights

Some of the key players operating in the market include Siemens Healthineers, CANON MEDICAL SYSTEMS CORPORATION, Koninklijke Philips N.V., GE HealthCare, and Hitachi Medical Systems.

-

Siemens Healthineers is a well-known producer and supplier of medical diagnostics equipment. The company's major divisions are energy, health services (Siemens Healthineers), and infrastructure & cities. The company specializes in designing, developing, producing, and distributing a wide range of diagnostic imaging systems, clinical and workflow systems, and minimally invasive procedure systems

-

Canon Medical Systems Corporation designs and produces diagnostic imaging systems that prioritize patient comfort and accessible healthcare services. The company offers a range of computed tomography, magnetic resonance imaging, ultrasound, advanced visualization, X-ray systems, and clinical laboratory systems that allow clients to receive prompt diagnoses and early treatment

Agito Medical, Block Imaging Inc., EverX Pty Ltd., Radiology Oncology Systems are some of the emerging market participants in the refurbished medical imaging devices market.

-

AGITO Medical, which was acquired by Philips in 2018, offers hospitals, clinics, and distributors worldwide with cost-effective imaging equipment and spare parts. The company has facilities in Spain, Germany, France, the Netherlands, and the United Kingdom, and boasts more than 3,600 square meters of storage space, test bays for MRI, CT, and X-ray, and cold storage for more than 8 MRIs. AGITO Medical's warehouse is constantly stocked with high-quality, used imaging equipment, providing reliable healthcare solutions to its customers

-

Block Imaging is a global provider of diagnostic imaging solutions, offering healthcare providers new and refurbished medical imaging equipment and parts. The company specializes in various imaging modalities and serves customers across the globe

Key Refurbished Medical Imaging Devices Companies:

- GE HealthCare

- Siemens Healthineers

- Koninklijke Philips N.V.

- Hitachi Healthcare Systems

- Canon Medical Systems Corporation

- Agito Medical A/S

- Block Imaging, Inc.

- EverX Pty Ltd.

- Radiology Oncology Systems, Inc.

- Future Health Concepts

Recent Developments

-

In October 2023, Brown's Medical Imaging was acquired by Atlantic Street Capital, a private equity firm. Brown's Medical Imaging is the Midwest's largest provider of radiology services and solutions, specializes in offering equipment, maintenance, support, and servicing to radiology practices and hospitals. It also provides specialized services in areas, such as orthopedics, pulmonology, urology, and urgent care

-

In July 2023, Tristate Biomedical Solutions, LLC was acquired by Radon Medical Imaging. Tristate specializes in providing sales and services for new, used, and refurbished medical imaging and biomedical equipment. The terms of the acquisition have not been disclosed

-

In May 2023, Siemens Healthineers and CommonSpirit Health collaborated to acquire Block Imaging. Block Imaging specializes in selling refurbished medical equipment, as well as offering related services and parts. The acquisition aims to promote the repairing and reusing of medical equipment, aiming to deliver more value to consumers and their patients while also reducing waste

-

In January 2023, Premier Imaging Medical Systems was acquired by Radon Medical Imaging. Premier is known for providing maintenance services, as well as sales of imaging and biomedical equipment that are either new, used, or refurbished

Refurbished Medical Imaging Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.83 billion |

|

Revenue forecast in 2030 |

USD 8.73 billion |

|

Growth rate |

CAGR of 10.38 % from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Modality, end-use, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

GE HealthCare; Siemens Healthineers; Koninklijke Philips N.V.; Hitachi Healthcare Systems; Canon Medical Systems Corp.; Agito Medical A/S; Block Imaging, Inc.; EverX Pty. Ltd.; Radiology Oncology Systems, Inc.; Future Health Concepts |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Refurbished Medical Imaging Devices Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global refurbished medical imaging devices market report based on modality, end-use, and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

X-ray

-

Magnetic Resonance Imaging

-

Ultrasound

-

Computed Tomography

-

Nuclear Imaging

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global refurbished medical imaging devices market size was estimated at USD 4.39 billion in 2023 and is expected to reach USD 4.83 billion in 2024.

b. The global refurbished medical imaging devices market is expected to grow at a compound annual growth rate of 10.38% from 2024 to 2030 to reach USD 8.73 billion by 2030.

b. North America dominated the refurbished medical imaging devices market with a share of 47.72% in 2023. The rising prevalence of chronic disorders, rising disposable income, and growing preference for early disease diagnosis have driven the demand for the refurbished medical imaging devices market in the region.

b. Some key players operating in the refurbished medical imaging devices market include GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., Hitachi Healthcare Systems, Canon Medical Systems Corporation, Agito Medical A/S, Block Imaging, Inc., EverX Pty Ltd., Radiology Oncology Systems, Inc., and Future Health Concepts

b. Key factors that are driving the market growth include increasing demand for cost-effective medical imaging devices by smaller hospitals and clinics, the availability of large inventories of used or old medical imaging devices, the rising adoption of eco-friendly products, the growing number of hospitals and diagnostic imaging centers, and the emerging opportunities in developing countries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."