- Home

- »

- Petrochemicals

- »

-

Refrigeration Oil Market Size & Share, Industry Report, 2033GVR Report cover

![Refrigeration Oil Market Size, Share & Trends Report]()

Refrigeration Oil Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Mineral, Synthetic, Semi Synthetic), By Application (Refrigerators, Air Conditioners, Automotive, Coolers & Conditioners), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-159-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Refrigeration Oil Market Summary

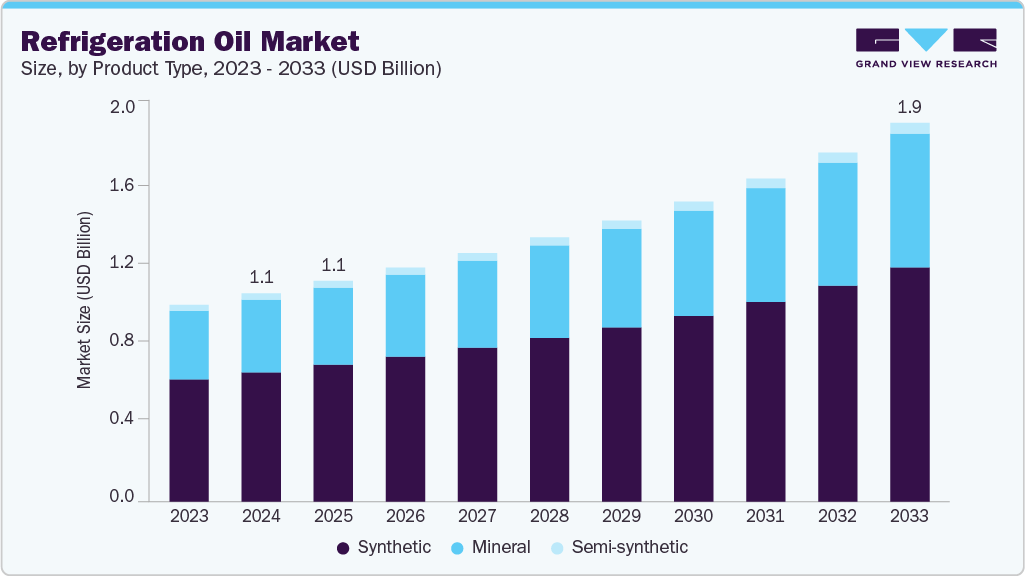

The global refrigeration oil market size was estimated at USD 1,077.2 million in 2024 and is projected to reach USD 1,958.8 million by 2033, growing at a CAGR of 7.0% from 2025 to 2033. This growth is attributed to the rising demand for new and innovative electronics, such as refrigerators, air conditioners, and automotive AC systems.

Key Market Trends & Insights

- Asia Pacific dominated the refrigeration oil market with the largest revenue share of 34.6% in 2024.

- The refrigeration oil market in China accounted for the largest market revenue share in Asia Pacific in 2024.

- By product type, the synthetic segment led the market with the largest revenue share of 62.1% in 2024.

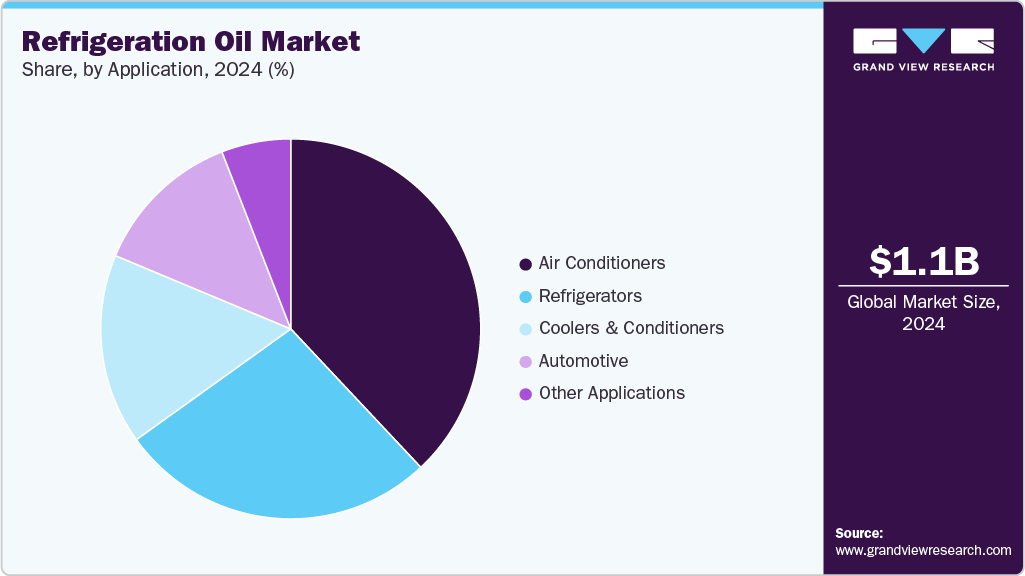

- By application, air conditioners segment led the market with the largest revenue share of 38.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,072.2 Million

- 2033 Projected Market Size: USD 1,958.8 Million

- CAGR (2025-2033): 7.0%

- Asia Pacific: Largest market in 2024

This growth in the electronics industry leads to technological advancements and product innovation, which in turn increases the demand for refrigeration oil. Moreover, the rising demand for frozen food, especially in countries like China and the U.S., is driving the need for efficient refrigeration systems and refrigeration oils. This presents an opportunity for manufacturers and suppliers in the product market.The global lubricants market acts as the overarching parent segment for refrigeration oils, comprising a broad range of products engineered to minimize friction, manage heat, and improve the performance and durability of mechanical systems. It is divided into key categories such as automotive, industrial, marine, and specialty lubricants, each developed to meet distinct application needs and technical specifications.

The synthetic segment dominated the market. This growth is driven by rising air conditioner and refrigerator production, increased adoption of electric vehicles, and demand for energy-efficient cooling systems. Regulatory shifts toward low-GWP refrigerants are also accelerating the use of compatible synthetic oils, especially in automotive and commercial HVAC applications.

Moreover, the growing demand for frozen food, both domestically and for export, has contributed to the rise in product demand. The U.S. is a major player in the frozen food industry. With the increasing consumption of frozen food products, the requirement for reliable and efficient refrigeration systems has surged, subsequently boosting the demand for refrigeration oil.

Market Concentration & Characteristics

The refrigeration oil industry is moderately concentrated, with dominance by a few large, vertically integrated players. These companies utilize economies of scale, backward integration into base oil and additive production, and extensive global distribution networks to sustain strong market positions. Their integration across the value chain, from crude oil refining and base oil manufacturing to finished refrigeration oil blending, enables them to achieve cost efficiencies, ensure consistent product quality, and offer a reliable supply. This strategic positioning supports their presence across various end-use sectors such as automotive, food processing, pharmaceuticals, and industrial refrigeration systems.

At the same time, emerging manufacturers in Asia-Pacific and the Middle East are expanding their presence by capitalizing on low-cost raw materials, favorable energy pricing, and growing domestic demand. Backed by investments in base oil refining and lubricant blending facilities within industrial clusters or economic zones, these regional players focus on price-sensitive markets and high-volume applications, including commercial refrigeration and industrial cooling systems. This dual dynamic of global consolidation and regional expansion shapes the competitive landscape of the refrigeration oil industry.

However, threats to the refrigeration oil industry include increasing environmental regulations, the transition toward low-global warming potential (GWP) refrigerants, and the development of alternative lubrication technologies that may reduce or replace conventional refrigeration oils. In response, companies are investing in the development of synthetic and environmentally friendly refrigeration oils, while also adopting digital solutions to optimize system performance, improve lifecycle management, and ensure regulatory compliance.

Product Type Insights

The synthetic segment led the market with the largest revenue share of 62.1% in 2024. This is attributed to their excellent thermal stability, low volatility, and enhanced lubrication properties, which make them more efficient compared to traditional mineral-based oils. These properties contribute to improved system reliability, reduced maintenance requirements, and extended equipment lifespan, driving the demand for synthetic refrigeration oil. Furthermore, the advancements in refrigerant technology, particularly in the automotive and industrial sectors, have led to the development of new refrigeration systems that require specialized lubricants. Synthetic refrigeration oil is often the preferred choice for these advanced systems due to its ability to meet specific performance requirements and compatibility with modern refrigerants.

The mineral segment is expected to grow at the fastest CAGR of 7.1% from 2025 to 2033, driven by its cost-effectiveness and compatibility with older refrigeration systems that still operate using legacy refrigerants like R-12 and R-22. These oils remain in use across developing regions such as Southeast Asia and Latin America, where affordability and infrastructure constraints support the continued operation of older equipment. Industrial cold storage facilities using ammonia-based systems also contribute to demand due to mineral oils’ non-polar characteristics. However, regulatory shifts, including the global phase-out of R-22 and limited compatibility with modern HFC and HFO refrigerants, are constraining growth and gradually reducing their market share in favor of more chemically stable synthetic alternatives.

Application Insights

The air conditioners segment led the market with the largest revenue share of 38.0% in 2024. This is attributed to the fact that refrigeration oil is used extensively in residential, commercial, and industrial air conditioning systems, which form the largest segment of demand globally. As the world faces rising temperatures and increasing urbanization, demand for air conditioning, particularly in Asia-Pacific and the Middle East, has surged, leading to a parallel rise in demand for compatible refrigeration oils. The transition from traditional R-22 refrigerant to low-GWP refrigerants like R-410A, R-32, and R-1234yf has made polyol ester (POE) oils the dominant lubricant in this segment due to their superior miscibility, oxidative stability, and low volatility.

The coolers & conditioners segment is expected to grow at the fastest CAGR of 8.0% from 2025 to 2033, driven by high-demand applications such as water coolers, chillers, and portable air conditioning units in sectors like data centers, hospitality, and manufacturing. These systems operate continuously, requiring oils with high oxidative stability, long service life, and minimal sludge formation. Depending on the refrigerant, ammonia, CO₂, R-410A, or HFOs, suitable oils range from mineral to synthetic types like POEs. Data centers, especially from major players like AWS and Google Cloud, are increasingly adopting synthetic oils to ensure consistent cooling amid growing infrastructure demands.

Regional Insights

The refrigeration oil market in North America is anticipated to grow at the fastest CAGR during the forecast period, driven by stringent environmental regulations, rising adoption of energy-efficient systems, and a well-established HVAC, automotive, and cold chain infrastructure. Regulatory programs like the U.S. EPA SNAP and Canadian Environmental Protection Act are accelerating the shift to low-GWP refrigerants, boosting demand for compatible synthetic oils such as POEs and PAGs. Growth in electric vehicles, pharmaceutical cold chains, and advanced retail refrigeration is further propelling market expansion. Key players like ExxonMobil, Lubrizol, and Idemitsu Kosan are actively innovating to support evolving compressor and refrigerant technologies.

U.S. Refrigeration Oil Market Trends

The refrigeration oil market in the U.S. is experiencing strong demand due to the expansion of the cold chain logistics industry, which includes refrigerated transport and temperature-controlled storage for food, beverages, and pharmaceuticals. With rising consumer demand for frozen and packaged foods and the need for safe vaccine and biologic storage, refrigeration systems are increasingly being installed and upgraded across the country. Environmental regulations such as the EPA’s SNAP (Significant New Alternatives Policy) program have led to a shift toward low-global-warming-potential (GWP) refrigerants. These new refrigerants require compatible high-performance refrigeration oils like POE or PAG oils, fueling further demand. The increase in construction of commercial buildings, supermarkets, and data centers, each requiring efficient cooling systems, also supports market growth. Furthermore, rising energy efficiency standards are pushing manufacturers to develop advanced refrigeration oils that ensure optimal compressor performance and longer equipment life.

Asia Pacific Refrigeration Oil Market Trends

Asia Pacific dominated the refrigeration oil market with the largest revenue share of 34.6% in 2024, driven by expanding HVAC manufacturing, rising urbanization, and increasing consumer demand in countries like China, India, and Southeast Asia. According to JRAIA (2024), the region accounted for over 60% of global air conditioner shipments in 2023. This surge fuels demand for refrigeration oils critical to compressor performance. Synthetic oils like POE and PAG are increasingly preferred due to their compatibility with low-GWP refrigerants such as R-32 and R-1234yf, aligning with regional climate goals under the Kigali Amendment.

The refrigeration oil market in China accounted for the largest market revenue share in Asia Pacific in 2024, owing to a massive HVAC manufacturing ecosystem and rising domestic consumption. The country is home to major OEMs like Gree, Haier, and Midea. It plays a pivotal role in the global market, contributing over 30% of global air conditioner exports in 2023. The shift toward R-32 systems is driving the adoption of synthetic oils, especially POE types, due to their superior thermal and chemical stability. Government initiatives like the "Green Cooling Action Plan" and Kigali Amendment compliance are accelerating the transition to low-GWP refrigerants. In addition, growth in cold chain logistics and vaccine storage is boosting demand for high-performance refrigeration oils.

Europe Refrigeration Oil Market Trends

The refrigeration oil market in Europe accounted for the second largest market revenue share of 31.6% in 2024, driven by stringent environmental regulations, the phase-out of high-GWP refrigerants, and growing adoption of energy-efficient cooling systems. The EU F-Gas Regulation is accelerating the transition to low-GWP refrigerants like R-1234yf, R-290, and CO₂, which require high-performance synthetic oils such as POE and PAG. Demand is rising across applications including air conditioning, automotive HVAC, supermarket refrigeration, and medical cold storage, especially in Western Europe with its mature infrastructure and strong sustainability focus.

Middle East & Africa Refrigeration Oil Market Trends

The refrigeration oil market in the Middle East & Africa is experiencing strong growth, fueled by rising demand for HVAC systems due to extreme climatic conditions, rapid urbanization, and infrastructure development. Key markets such as the GCC countries, South Africa, and Egypt are seeing increased adoption of refrigeration systems across residential, commercial, and industrial segments. According to the International Energy Agency (IEA), cooling accounts for over 70% of peak electricity demand during summer months in the Gulf countries, intensifying the need for efficient refrigeration systems and high-quality lubrication oils.

Latin America Refrigeration Oil Market Trends

The refrigeration oil market in Latin America is witnessing steady growth, due to the increasing demand for refrigeration systems across residential, commercial, and industrial sectors. Rising urbanization and expansion of cold chain infrastructure, especially in food & beverage and pharmaceuticals, are the primary growth drivers in the region. Countries such as Brazil and Argentina are key contributors to market demand due to their large population base, developing retail sector, and growing automotive production.

Key Refrigeration Oil Company Insights

Some of the key players operating in the refrigeration oil industry include Exxon Mobil Corporation and Shell Global.

-

Exxon Mobil Corporation, a global energy and petrochemical producer headquartered in the U.S., is a dominant force in the refrigeration oil industry, leveraging its extensive base oil refining capabilities and advanced lubricant technologies. Through its Mobil brand, ExxonMobil offers a comprehensive portfolio of high-performance refrigeration oils, including synthetic polyolester (POE), naphthenic, and mineral-based formulations, used in residential, commercial, and industrial refrigeration systems. As part of its vertically integrated operations, ExxonMobil ensures consistent quality and supply of refrigeration lubricants for applications such as HVAC systems, cold chain logistics, and automotive air conditioning.

INEOS and Johnson Controls are emerging market participants in the refrigeration oil industry.

-

INEOS is an influential and emerging leader in the refrigeration oil industry, with a growing global footprint driven by strategic acquisitions and vertically integrated operations. Headquartered in the UK, INEOS operates across key energy and petrochemical sectors, leveraging its recent upstream investments in oil and gas assets, particularly in the U.S. Gulf and South Texas, to secure feedstock supply for base oils and specialty lubricant production. Its presence in chlor-alkali and hydrocarbon processing enables the production of high-quality refrigeration oils for industrial applications, including commercial cooling, HVAC systems, and large-scale refrigeration infrastructure. The company is actively investing in low-carbon technologies, including carbon capture and storage (CCS) and hydrogen, which align with rising global demand for environmentally responsible refrigeration solutions

Key Refrigeration Oil Companies:

The following are the leading companies in the refrigeration oil market. These companies collectively hold the largest market share and dictate industry trends.

- INEOS

- Idemitsu Kosan Co., Ltd.

- Exxon Mobil Corporation

- Shell Global

- TotalEnergies

- China Petroleum & Chemical Corporation

- FUCHS

- PETRONAS Lubricants International

- Johnson Controls

Recent Developments

-

In April 2025, INEOS Energy completed its acquisition of deepwater oil and gas assets in the U.S. Gulf from CNOOC, marking its third major U.S. investment in three years. This move expands INEOS Energy’s global production capacity to over 90,000 barrels of oil equivalent per day and raises its total capital spend in the U.S. energy sector to over $3 billion. For the refrigeration oil industry, this acquisition reinforces the upstream security of base oil supply, especially for synthetic and mineral oil formulations used in refrigeration lubricants. With deeper integration into oil and gas production-particularly in the U.S.-INEOS strengthens its position in the value chain, enabling stable sourcing of high-quality feedstocks critical for refrigeration oil manufacturing.

-

In June 2023, Johnson Controls announced the acquisition of M&M Carnot, a reputable company known for its natural refrigeration solutions. These solutions offer ultra-low global warming potential (GWP), making them highly beneficial for customers who are striving to achieve their sustainability objectives and comply with environmental regulations. This acquisition not only strengthens Johnson Controls' position in the market but also enables it to provide enhanced solutions that align with the growing demand for environmentally friendly refrigeration options.

Refrigeration Oil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,141.1 million

Revenue forecast in 2033

USD 1,958.8 million

Growth rate

CAGR of 7.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico, UK; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

INEOS; Idemitsu Kosan Co., Ltd.; Exxon Mobil Corporation; Shell Global; TotalEnergies; China Petroleum & Chemical Corporation; FUCHS; PETRONAS Lubricants International; Jhonson Controls

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Refrigeration Oil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global refrigeration oil market report based on product type, application, and region:

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

Mineral

-

Synthetic

-

Semi-Synthetic

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

Air Conditioner

-

Refrigerators

-

Automotive

-

Coolers & Conditioners

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.