- Home

- »

- Advanced Interior Materials

- »

-

Refrigeration Compressors Market Size, Share Report, 2030GVR Report cover

![Refrigeration Compressors Market Size, Share & Trends Report]()

Refrigeration Compressors Market Size, Share & Trends Analysis Report By Compressor Type (Reciprocating Compressor, Scroll Compressor), By Capacity, By Type, By Motor, By Distribution Channel, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-292-4

- Number of Report Pages: 270

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Refrigeration Compressors Market Trends

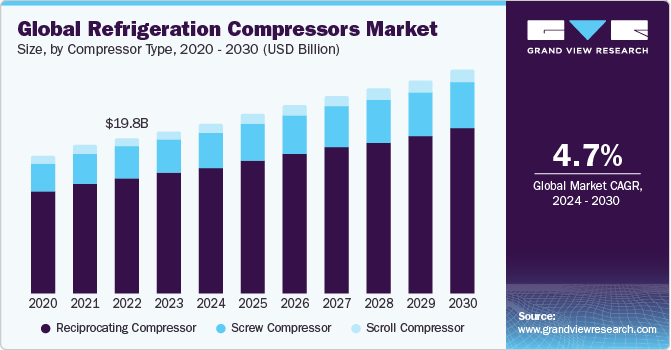

The global refrigeration compressors market size was estimated at USD 20,633.1 million in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. Refrigeration compressors are used for a wide range of applications owing to their versatility and importance. In residential applications, refrigerant compressor plays a key role in food preservation and improving indoor comfort. Commercially, they are employed in supermarket refrigeration systems, keeping perishables fresh.

Moreover, industrially, they are crucial in chemical processing and pharmaceutical production, where precise temperature control is vital. In addition, in the food & beverage industry, they are used in blast chillers and freezers to prevent spoilage and maintain quality. Their broad applicability underscores the refrigeration compressor's role as a cornerstone technology in modern society, impacting daily life, industrial processes, and commercial operations.

Refrigeration compressors play a pivotal role across various sectors due to the region’s diverse climate conditions, advanced industrial circumstances, and stringent environmental regulations. In residential applications, these compressors are integral to household refrigerators and freezers, air conditioning units, and heat pumps, a technology that has seen significant growth owing to its energy efficiency and reduced environmental impact. The commercial application of refrigeration compressors is evident in the food retail industry, where they are used in supermarket display cases and walk-in coolers to preserve the freshness and safety of perishable goods.

The pharmaceutical industry in Europe, which is among the world's leading markets for prescription drugs, relies heavily on precise and reliable cooling systems powered by refrigeration compressors for the storage and transportation of temperature-sensitive medicines and vaccines, a need that has become even more critical with the distribution of COVID-19 vaccines. Furthermore, the industrial sector, refrigeration compressors are employed in chemical manufacturing, plastics production, and other processes where temperature control is crucial for product quality. In addition, the European food processing industry, which is one of the largest and most advanced in the world, utilizes these compressors in freezing and chilling equipment to ensure the safety and longevity of a wide array of food products.

The growing demand for medical devices is significantly driving the market growth for refrigeration compressors, a trend underscored by the region’s advanced healthcare infrastructure, aging population, and increasing health awareness. Medical devices, ranging from diagnostic equipment to medical imaging, often require precise temperature control to ensure their reliability and accuracy. Refrigeration compressors are critical in this aspect, providing the necessary cooling for these devices to function correctly. For instance, according to MedTech Europe, the U.S. has the largest market share of 47% of the global medical device market, and Europe is the second dominant region with a market share of 26% of the global medical device market.

Market Concentration & Characteristics

Market growth stage is medium, and pace is accelerating. The market for refrigeration compressors is characterized by its dynamic nature, largely influenced by technological advancements, environmental regulations, and evolving industry requirements. One of the key characteristics of this market is its innovation-driven approach, where manufacturers continually invest in research and development to enhance energy efficiency, reduce environmental impact, and meet the specific cooling needs of various applications.

The market is also shaped by the diverse application landscape of refrigeration compressors, spanning sectors such as food and beverage, healthcare, industrial processing, and hotels and hospitality. Each industry presents unique requirements for refrigeration, from ultra-low-temperature storage in the pharmaceutical industry to large-scale cooling systems in food processing and distribution. The growth in urbanization and the rising global population have led to increased demand for refrigerated food products and air conditioning, propelling the market growth.

Thermoelectric coolers, leveraging the Peltier effect, present a competitive alternative to traditional refrigeration compressors, offering advantages such as maintenance-free operation, noiseless functionality, and precise temperature control. Although not as efficient for large-scale use, their compactness and precise cooling capabilities make them well-suited for applications like portable coolers, small food & beverage refrigerators, and medical and laboratory equipment. The increasing demand for these specific applications, coupled with advancements in thermoelectric technology, poses a potential challenge to the traditional refrigeration compressor market by offering an effective solution for niche needs.

Regulatory impacts on the global market are significant, particularly with global initiatives aimed at reducing greenhouse gas emissions and improving energy efficiency. Regulations such as the European Union’s F-Gas Regulation and the U.S. Environmental Protection Agency's Significant New Alternatives Policy (SNAP) program have led to a phasedown of high Global Warming Potential (GWP) refrigerants, which are commonly used in refrigeration compressors. Manufacturers are thus incentivized to develop new compressor models and retrofit existing systems to comply with these regulations, impacting market dynamics by pushing towards greener alternatives and away from traditional high-GWP refrigerant-based systems.

Compressor Type Insights

Based on compressor type, the reciprocating compressors segment led the market with the largest revenue share of 74.3% in 2023. Reciprocating refrigerant compressors, characterized by their piston-driven mechanism, play a crucial role in various cooling and refrigeration applications due to their efficiency and versatility. This type of compressor is widely appreciated for its ability to handle a wide range of pressures and capacities, making it suitable for both residential and commercial applications, from household refrigerators and air conditioning systems to larger-scale industrial refrigeration units. The adaptability and reliability of reciprocating compressors, combined with their long history of development and use, ensure their continued presence in applications where precise control over refrigeration is needed, despite the emergence of alternative technologies.

The scroll compressors segment is known for their unique design that involves two spiral-shaped scrolls to compress refrigerant, have become increasingly popular in both residential and commercial air conditioning systems, as well as refrigeration applications. This design offers several advantages, including quieter operation, fewer moving parts, increased reliability, and higher energy efficiency compared to traditional reciprocating compressors. Their ability to provide smooth, continuous compression with minimal vibration makes scroll compressors ideal for use in heat pumps, air conditioners, and commercial refrigeration units where consistent and efficient cooling is required.

Capacity Insights

Based on capacity, the refrigerant compressor with capacity upto 5Hp led the market with the largest revenue share of 24.8% in 2023. Refrigerant compressors with a capacity of up to 5 Hp are highly versatile and serve many applications, particularly in the light commercial and residential sectors. Due to their compact size and efficient operation, these compressors are commonly used in small to medium-sized refrigeration units, such as domestic refrigerators, freezers, and wine coolers.

Refrigerant compressors in the 5 to 10 Hp segment cater to demanding applications. These compressors are integral to medium-sized commercial refrigeration systems, including supermarket display cases, walk-in coolers, and freezers requiring consistent and reliable cooling performance. They also serve in light industrial applications, such as process cooling and environmental chambers where precise temperature control is critical.

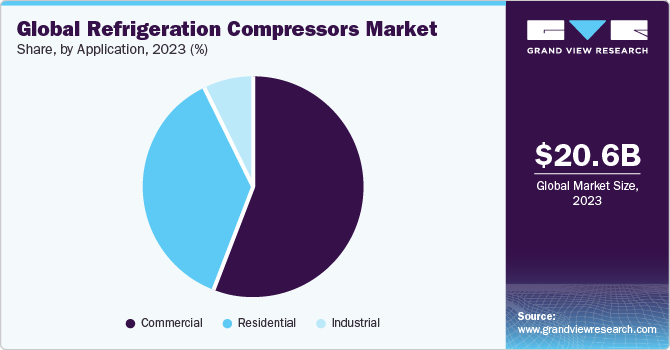

Application Insights

Based on application, the residential segment led the market with the largest revenue share of 36.3% in 2023. The rising application of refrigerant compressors in industries reflects the growing need for efficient cooling and refrigeration solutions across various sectors. In the food & beverage industry, these compressors are crucial for preserving the freshness and extending the shelf life of perishable goods through refrigerated storage and transportation. Moreover, the pharmaceutical industry relies on precise temperature control for the storage of medicines and vaccines, making refrigerant compressors indispensable for maintaining the integrity of these sensitive products. These aforementioned factors are expected to drive the market growth over the forecast period.

The commercial segment is driven by the increasing demand for efficient cooling and refrigeration across various sectors. In the retail industry, they are essential for preserving the quality of perishable goods through sophisticated refrigeration systems in supermarkets and convenience stores. The hospitality sector relies heavily on these compressors for ice machines, under-bar refrigeration, and wine coolers to enhance customer experience.

Type Insights

Based on type, the open segment led the market with the largest revenue share of 12.0% in 2023. The open refrigerant compressors, distinguished by their design where the motor and compressor are separate units, allowing for greater flexibility and maintenance access, are extensively utilized in large-scale industrial and commercial refrigeration applications. Their configuration is particularly advantageous in settings where high-capacity cooling is essential, such as in food processing plants, large cold storage warehouses, and chemical processing facilities. Furthermore, the open design facilitates the use of larger, more powerful motors than those typically found in hermetic or semi-hermetic compressors, enabling them to meet the substantial cooling requirements of industrial chillers, central air conditioning systems, and marine refrigeration. The ability to customize and repair components directly contributes to their popularity in applications where reliability and performance are critical, making open refrigerant compressors a preferred choice for heavy-duty refrigeration needs.

The hermetic and semi-hermetic refrigerant compressors are widely utilized across various applications due to their reliable and efficient design, which seals the compressor and motor within the same casing to prevent refrigerant leakage. Hermetic compressors, completely sealed, are commonly found in residential refrigerators, small air conditioning units, and domestic freezers, where their compact size and lower maintenance requirements offer significant advantages. On the other hand, semi-hermetic compressors, which allow for some level of disassembly, cater to commercial and light industrial applications, such as supermarket refrigeration systems, large-scale air conditioning installations, and refrigerated transport.

Motor Insights

Based on motor, the fixed-speed compressors segment led the market with the largest revenue share of 65.8% in 2023. The fixed-speed compressors are predominantly used in residential applications, standard refrigerators, and small commercial cooling units where the cooling demand is consistent. Their simplicity and cost-effectiveness make them suitable for applications that do not require variable cooling output. In addition, they are known for their durability in environments with stable cooling needs.

The variable speed compressors segment are extensively used in high-end refrigeration units, and industrial applications requiring precise temperature control. Their ability to adjust cooling output enhances energy efficiency, reduces operational costs, and improves indoor comfort levels. This adaptability also allows for a wider application range, from smart home climate systems to critical temperature-sensitive industrial processes.

Distribution Channel Insights

Based on distribution channel, the OEM segment led the market with the largest revenue share of 93.0% in 2023. The OEM’s play a critical role as primary clients, integrating these compressors into a wide range of cooling and refrigeration systems, including refrigerators, and commercial cooling installations. OEMs often partner closely with compressor manufacturers to develop customized solutions that meet specific operational requirements, ensuring optimal performance and efficiency for the end product. The sales channels for refrigerant compressors to reach OEMs typically involve direct sales teams from manufacturers, specialized distributors, and increasingly, digital platforms that offer direct technical support and streamlined procurement processes. In addition, the strategic relationships between compressor manufacturers and OEMs facilitate the entry of advanced refrigeration technologies into various sectors, ranging from residential to industrial applications.

The aftermarket segment plays a crucial role, catering to the needs for replacement parts, upgrades, and maintenance services for existing cooling and refrigeration systems. This segment is essential for ensuring the longevity and efficiency of equipment in various applications, from residential air conditioning units to commercial refrigeration systems. The distribution channels for refrigerant compressors in the aftermarket include specialized distributors, online marketplaces, and direct sales from manufacturers. These channels offer a broad range of products and services, including OEM parts, compatible aftermarket parts, and comprehensive maintenance solutions. The availability of technical support and consultancy services through these channels also helps customers in selecting the right components.

Regional Insights

The refrigeration compressors market in North America is anticipated to grow at a robust CAGR during the forecast period, fueled by several key factors such as expanding cold chain logistics, food processing industries, and the increasing need for energy-efficient HVAC systems.

U.S. Refrigeration Compressors Market Trends

The refrigeration compressors market in the U.S. led the market with the significant CAGR of 1.9% from 2024 to 2030. The demand for refrigeration compressors in the U.S. is experiencing significant growth, largely fueled by food preservation, pharmaceuticals, and air conditioning sectors. For instance, in the food industry, companies like Tyson Foods, Inc., one of the world's largest food companies, rely heavily on advanced refrigeration systems to ensure the freshness and safety of their products during storage and transportation.

The Canada refrigeration compressors market is expected to grow at the substantial CAGR of 2.2% in the North America market. Canada's food processing industry is one of the largest sectors of its economy, requiring extensive refrigeration systems to maintain the safety and quality of food products. As this industry continues to grow, so does the need for advanced refrigeration compressors.

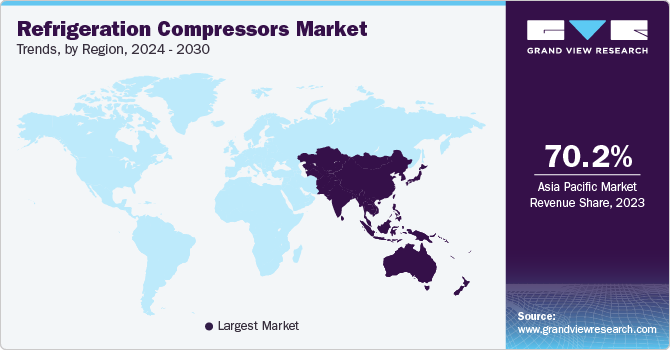

Asia Pacific Refrigeration Compressors Market Trends

Asia Pacific dominated the refrigeration compressors market with the revenue share of 70.2% in 2023. The region has been experiencing significant growth, driven by the increasing demand for refrigeration across various sectors, including food & beverage, pharmaceuticals, and residential appliances. This uptrend is further fueled by the rapid urbanization, rising disposable incomes, and the growing need for energy-efficient refrigeration solutions in the region.

The refrigeration compressors market in China is estimated to grow at a significant CAGR over the forecast period. As China continues to lead in both the production and consumption of refrigerated goods, the need for efficient and reliable refrigeration compressors has surged across various sectors including food preservation, pharmaceuticals, and commercial refrigeration. The push towards energy efficiency and sustainability, coupled with government initiatives aimed at upgrading the country's refrigeration infrastructure, has further fueled the demand.

The India refrigeration compressors market is anticipated to grow at the fastest CAGR of 5.5% in the Asia Pacific market, owing to the increasing demand for refrigeration compressors, primarily driven by the rapid growth in the country's retail and cold chain sectors, alongside a booming consumer electronics market. As India continues to urbanize at an unprecedented rate, the need for efficient and reliable refrigeration in commercial establishments, households, and the agricultural sector for preserving perishable goods has surged.

Europe Refrigeration Compressors Market Trends

The refrigeration compressor market in Europe has been showing a trend towards energy-efficient and environmentally friendly solutions. This shift is largely driven by stringent regulations aimed at reducing carbon emissions and the growing demand for sustainable refrigeration systems across industries such as food and beverage, cold chain logistics, and pharmaceuticals.

The Germany refrigeration compressors market is expected to grow at a significant CAGR of 2.2% during the forecast period. According to Eurostat, the value of sold industrial production in the European Union in 2022 was USD 6744.07 billion, up by 19% from USD 5685.36 billion in 2021. The expansion of industrial production has fueled an increase in the need for refrigeration compressors, adapting to the rising demands for efficient cooling solutions.

The refrigeration compressors market in Italy accounted for the significant share of 6.3% in the Europe market in 2023.The market is witnessing significant technological advancements in compressor design and functionality. These include the development of variable speed compressors, which can adjust their operating speed based on the refrigeration load, leading to improved energy efficiency. In addition, smart compressors equipped with IoT capabilities are becoming more common, enabling remote monitoring and control, predictive maintenance, and enhanced operational efficiency.

Central & South America Refrigeration Compressors Market Trends

The refrigeration compressors market in Central & South America is estimated to grow at a rapid CAGR over the forecast period. As these regions continue to experience economic growth, there's an increasing need for efficient food storage and distribution systems to reduce food wastage and meet the stringent storage requirements of pharmaceutical products. In addition, the hot and humid climate across much of Central and South America drives the demand for air conditioning in residential, commercial, and industrial settings, further propelling the market growth.

The Brazil refrigeration compressors market is expected to grow at a significant CAGR of 3.6% during the forecast period, owing to growing investment in automotive industry. The country's efforts to enhance its cold chain logistics for better food distribution and to meet the pharmaceutical industry's stringent storage requirements also play a crucial role. Moreover, increasing environmental awareness and government regulations are pushing the market towards more energy-efficient and environmentally friendly refrigeration solutions, aligning with global sustainability goals.

Middle East & Africa Refrigeration Compressors Market Trends

The refrigeration compressors market in the Middle East & Africa is experiencing rapid development owing to the rapid expansion of the food retail sector, including supermarkets and hypermarkets, alongside a growing hospitality industry that includes hotels and restaurants requiring advanced refrigeration solutions.

The Saudi Arabia refrigeration compressors market is expected to grow at a significant CAGR of 3.8% during the forecast period. In Saudi Arabia, the market growth is driven by the expansion of cold chain logistics and the food retail sector, alongside a strong emphasis on energy-efficient and sustainable refrigeration solutions to meet the rising environmental standards and operational efficiency demands.

Key Refrigeration Compressors Company Insights

Some of the key players operating in the market include LG, Danfoss,Johnson Controls, among others.

-

LG Electronics is a global manufacturer and provider of home appliances, consumer electronics, mobile communications, vehicle component solutions, and business solutions. The company operates through six business segments, namely home entertainment, home appliances & air solutions, mobile communications, vehicle component solutions, business solutions, and LG Innotek. The home entertainment division is engaged in the manufacturing and sales of TVs, PCs & accessories, monitors, and other digital media products. The home appliances & air solutions division manufactures and sells washing machines, refrigerators, vacuum cleaners, dishwashers, air purifiers, air conditioners, and dehumidifiers. The mobile communications business division focuses on the manufacturing and selling of mobile communications equipment. The vehicle component solutions division is engaged in designing and manufacturing automobile parts such as HVAC and motor & in-vehicle infotainment

-

Johnson Controls designs, manufactures and offers solutions that enhance the operational efficiencies of buildings and various systems related to the automotive industry. The company supplies building control systems, automation, HVAC equipment, seating and interior systems, and integrated facility management services. It operates through four business segments, namely building solutions EMEA/LA, building solutions North America, building solutions Asia Pacific, and global products

Tecumseh Products Company LLC and Siam Compressor Industry Co., Ltd. are some of the emerging market participants in the market.

-

Tecumseh Products Company LLC is a globally recognized leader in the manufacturing of refrigeration and air conditioning compressors, as well as related products. Further, the company provides solutions for cooling and refrigeration across various industries. With a focus on energy efficiency and sustainability, Tecumseh continues to innovate by developing products that meet the evolving needs of both commercial and residential customers worldwide. Moreover, Tecumseh Products Company has expanded its reach through strategic acquisitions and by establishing manufacturing facilities and sales offices around the globe, ensuring they remain at the forefront of the HVACR industry

-

Siam Compressor Industry Co., Ltd. (SCI), a key player in the global compressor market, is a joint venture between Mitsubishi Electric Corporation and the Thai conglomerate, Siam Motor Group. Established in 1990 and headquartered in Chonburi, Thailand, SCI specializes in the development, production, and sales of a wide range of energy-efficient compressors for air conditioning and refrigeration systems. These compressors are renowned for their innovation, reliability, and performance, catering to a diverse array of applications from residential to commercial settings across the globe

Key Refrigeration Compressors Companies:

The following are the leading companies in the refrigeration compressors market. These companies collectively hold the largest market share and dictate industry trends.

- Panasonic Corporation

- Kirloskar

- The BITZER Group

- LG

- Huayi Compressor Barcelona

- Copeland LP

- Danfoss

- Johnson Controls.

- Secop GmbH

- Embraco LLC

- HITACHI AIR CONDITIONING COMPANY

- Italia Wanbao-ACC S.r.l.

- Glen Refrigeration

- Tecumseh Products Company LLC

- Siam Compressor Industry Co., Ltd.

- MITSUBISHI ELECTRIC (GUANGZHOU) COMPRESSOR CO.LTD.

Recent Developments

-

In November 2023, Copeland broadened its production of CO2 compressors, adding manufacturing capabilities to its U.S. facilities in Sidney, Ohio, and Rushville, Indiana. Previously produced exclusively in Mikulov, Czech Republic, and Cookstown, Ireland, Copeland's CO2 semi-hermetic and scroll compressors are now also being crafted in these North American sites

-

In October 2023, Emerson launched a new modular refrigeration system featuring CO2 (R744) scroll compressors, designed specifically for small to medium-sized retail outlets in Europe. These compact, Copeland-branded modules offer flexible installation options, including packed or split configurations, and can be placed either indoors or outdoors. Additionally, the units meet Ecodesign compliance standards

-

In January 2023, LG inaugurated a new refrigerator production facility in Pune, India. At this Pune site, the company has started the local manufacturing of single-door, double-door, and side-by-side refrigerators, with an investment of approximately Rs 200 crore in its refrigerator production unit. The enhanced LG campus in Pune now boasts a production capacity of 200,000 side-by-side refrigerators annually

Refrigeration Compressors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 21,509.9 million

Revenue forecast in 2030

USD 28,389.3 million

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and units and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Compressor type, capacity, application, type, motor, distribution channel

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; Türkiye; Poland; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Panasonic Corporation; Kirloskar; The BITZER Group ; LG; Huayi Compressor Barcelona; Copeland LP; Danfoss; Johnson Controls.; Secop GmbH; Embraco LLC; HITACHI AIR CONDITIONING COMPANY; Italia Wanbao-ACC S.r.l.; Glen Refrigeration; Tecumseh Products Company LLC; Siam Compressor Industry Co., Ltd.; MITSUBISHI ELECTRIC (GUANGZHOU) COMPRESSOR CO.LTD.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Refrigeration Compressors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global refrigeration compressors market report based on compressor type, application, capacity, type, motor, sales channel, and region.

-

Compressor Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Reciprocating Compressor

-

Scroll Compressor

-

Screw Compressor

-

-

Capacity Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Upto 5 Hp

-

5 to 10 Hp

-

10 to 15 Hp

-

Above 15 Hp

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Hotels and Hospitality

-

Healthcare

-

Food & Beverage Retail Outlets

-

Others

-

-

Industrial

-

Refrigerated Warehouse

-

Food & Beverage

-

Chemical, Petrochemical & Pharmaceuticals

-

Refrigerated Transportation

-

Others

-

-

-

Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Open

-

Hermetic

-

Semi-hermetic

-

-

Motor Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Fixed Speed Compressor

-

Variable Speed Compressor (Inverter)

-

-

Distribution Channel Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Mexico

-

Europe

-

Germany

-

Turkey

-

Russia

-

Italy

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global refrigeration compressors market size was estimated at USD 20,633.1 million in 2023 and is expected to be USD 21,509.9 million in 2024.

b. The global refrigeration compressors market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 28,389.3 million by 2030.

b. Asia Pacific region dominated the market and accounted for 70.2% share in 2023. The region has been experiencing significant growth, driven by the increasing demand for refrigeration across various sectors, including food & beverage, pharmaceuticals, and residential appliances. This uptrend is further fueled by the rapid urbanization, rising disposable incomes, and the growing need for energy-efficient refrigeration solutions in the region.

b. Some of the key players operating in the refrigeration compressors market include Panasonic Corporation, Kirloskar, The BITZER Group, LG, Huayi Compressor Barcelona, Copeland LP, Danfoss, Johnson Controls., Secop GmbH, Embraco LLC, HITACHI AIR CONDITIONING COMPANY, Italia Wanbao-ACC S.r.l., Glen Refrigeration, Tecumseh Products Company LLC, Siam Compressor Industry Co., Ltd., MITSUBISHI ELECTRIC(GUANGZHOU) COMPRESSOR CO.LTD., among others.

b. Refrigeration compressors are used for a wide range of applications owing to their versatility and importance. In residential applications, refrigerant compressors play a key role in food preservation and improving indoor comfort.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."