Refrigerated Transport Market Size, Share & Trends Analysis Report By Technology, By Mode Of Transport, By Temperature Range, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-241-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Refrigerated Transport Market Size & Trends

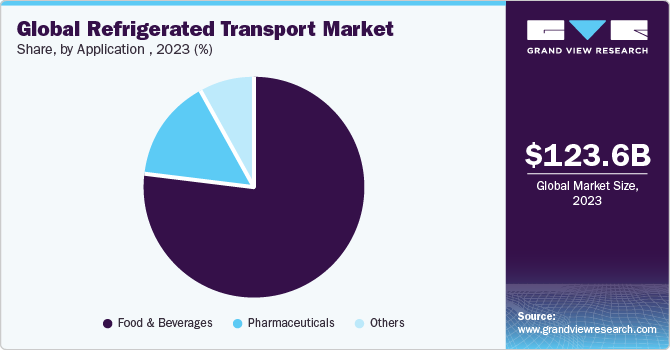

The global refrigerated transport market size was valued at USD 123.59 billion in 2023 and is projected to grow at CAGR of 8.6% from 2024 to 2030. The rising demand for perishable goods and the advancements in refrigeration technology drive the refrigerated transport market. With the increasing population and changing dietary preferences, the demand for perishable goods, such as fresh fruits and vegetables, dairy products, meat, and seafood products, is expected to grow in near future, thereby driving the growth of the refrigerated transport market.

Advancements in refrigeration technology have also contributed to the growth of the refrigerated transport market. With the development of new and improved refrigeration systems, it has become possible to maintain the temperature and humidity levels required for the safe transportation of perishable goods. Moreover, technological advancements have also led to the development of more energy-efficient refrigeration systems, which not only reduce operating costs but also significantly reduce the carbon footprint of the transportation industry. For instance, in February 2023, Lawrence Berkeley National Laboratory researchers developed a novel refrigeration technique, ionocaloric cooling, that presents an alternative to conventional vapor compression-based systems. This innovative approach could mitigate the dependence on gases detrimental to the Earth's atmosphere and contribute to climate change. The technique capitalizes on the storage or release of energy during a phase transition, such as from a solid to a liquid or vice versa, to achieve its cooling effect.

Additionally, increasing awareness of food safety and quality is driving the growth of the refrigerated transport market. There is an increasing demand for temperature-controlled transportation due to consumers' growing concern about food safety and quality. This demand stems from the need to ensure that the food remains fresh and safe for consumption. Additionally, regulations and standards regarding food safety and quality have become more stringent, leading manufacturers and shippers to adopt refrigerated transport solutions to comply with these laws and regulations.

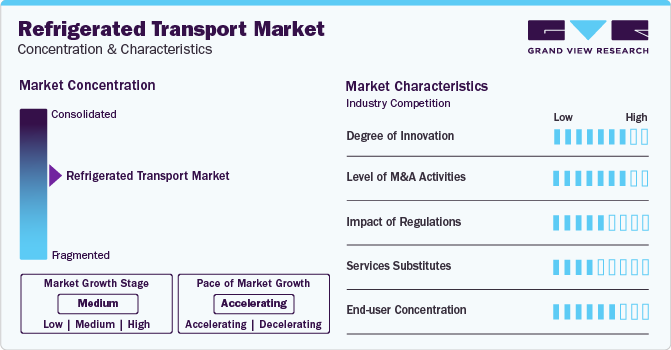

Market Concentration & Characteristics

The global refrigerated transport market is significantly concentrated in nature. The growth stage of the market is medium, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the technological advancements driven by factors such as an improved cooling technologies, alternative refrigerants, multi-temperature control, enhanced monitoring and tracking, and autonomous vehicles. Additional significant advancements include advanced insulation materials, electric and hybrid refrigerated vehicles, and the utilization of artificial intelligence for predictive maintenance and optimized logistics operations.

In November 2023, Whirlpool Corporation developed a novel vacuum insulation technology, SlimTech, an insulation structure containing a thin layer of compressed and proprietary powder sealed inside steel walls, transforming the structure of refrigerators, potentially increasing capacity and reducing energy usage. SlimTech insulation is expected to be 60% thinner than the standard refrigerator container while increasing the interior capacity by 25%. This advancement has the potential to produce significant benefits to the industry and the environment by promoting energy efficiency and reducing the carbon footprint.

The refrigerated transport market has witnessed an increasing trend of mergers and acquisitions worldwide. This trend can be attributed to various factors, including intensified competition, rapidly increasing expenses, and the exigency for companies to expand operations expeditiously and effectively. Consequently, many companies are inclined towards consolidation by means of mergers or acquisitions with other players in the same industry to gain a competitive edge and to enhance their market share.

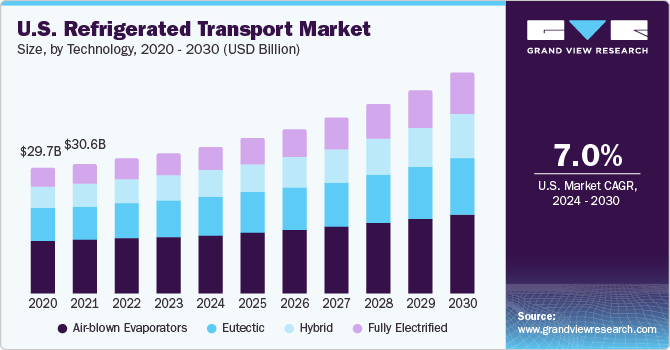

Technology Insights

Based on technology, the market is segmented into air-blown evaporators, eutectic, hybrid and fully electrified. The air-blown segment dominated the market with a share of 40.2% in 2023. The rise in demand for frozen foods, including meat, seafood, and dairy products, is a significant driving factor for the segment. As the demand for these frozen products increases, the need for efficient and reliable refrigeration systems also rises. Air-blown evaporators are a vital component of refrigerated transport systems, playing a pivotal role in maintaining the desired temperature within the cargo space. These evaporators employ forced air circulation over refrigerant-filled coils to absorb heat from the cargo area, facilitating efficient cooling and ensuring uniform temperature throughout the refrigerated space. Their functionality is critical in preserving the quality and freshness of perishable goods during transit.

The fully electrified segment is expected to grow at a significant rate over the forecast period due to the growing concerns for the environment and greenhouse gas emissions. The use of fully electrified refrigeration systems in transport vehicles can help in achieving this objective. The adoption of such systems can also help businesses in complying with environmental regulations and improve their brand reputation. Refrigerated transport systems that are fully electrified rely solely on electric power to facilitate their cooling operations. Typically, these systems incorporate electrically driven compressors and other components that are powered by batteries, grid electricity, or alternative electric sources. The design of fully electrified systems is geared towards moderating environmental impact, enhancing energy efficiency, and aligning with sustainability objectives.

Mode Of Transport Insights

Based on mode of Transport, the market is categorized into road, air, sea and railway. The road transportation segment captured the largest market share in 2023.The increasing preference for online shopping and the demand for quick and reliable delivery of goods, including perishables, has spurred the need for a flexible and responsive transportation network. The road segment, with its door-to-door delivery capabilities, becomes a crucial link in meeting the time-sensitive requirements of e-commerce platforms, ensuring that temperature-sensitive products reach consumers in time while maintaining right quality.

The sea segment is expected to grow at a rapid CAGR during the forecast period. The rise in exports and imports is accelerating the growth of the segment. Increasing demand for global food trade is driving the segment growth. As international commerce continues to expand, the need for efficient and reliable transportation of perishable goods by sea has increased. Fruits, vegetables, meat, and seafood, which are highly perishable goods, require specialized refrigerated transport to maintain their quality throughout the shipping process. This has led to a growing reliance on the sea segment as a vital component of cold chain logistics, ensuring the safe and timely delivery of temperature-sensitive products across borders. According to the International Trade Center (ITC), the world import value increased from USD 623.83 billion in 2018 to USD 890.26 billion in 2022, whereas the world export value increased from USD 588.53 billion to USD 846.54 billion.

Temperature Range Insights

The temperature range segment is categorized into chilled, frozen, and deep frozen. The frozen segment led the market in 2023 and is expected to witness the fastest growth over the forecast period. Reducing food waste has become a critical global issue, and frozen food is emerging as an effective solution to address this challenge. The advantages of frozen food include an extended shelf life, controlled portions, reduced transport emissions, the possibility of seasonal availability, and improved packaging. These benefits collectively contribute to limiting food wastages at both the retail and consumer levels, thereby driving the growth of the frozen food segment.

The chilled segment is expected to grow at a substantial rate during the forecast period, owing to the growth of niche markets. The escalating demand for specialty food items, such as craft beers, artisan cheeses, and premium meats, has necessitated the implementation of temperature-controlled storage and transport systems to ensure the products' quality and freshness. Temperature control has become a primary focus, leading to the development of novel packaging materials and transportation methods that aid in maintaining the quality of these high-end food products throughout the distribution.

Application Insights

The food & beverages segment held the largest market share in 2023. The growth of the e-commerce industry is a significant driver of the segment. With the rise of online grocery shopping, food and beverage manufacturers are increasingly focusing on delivering their goods to consumers' doorsteps. This has led to an increase in demand for refrigerated transport services to ensure the safe and timely delivery of goods, thereby driving the growth of the refrigerated transport market.

The pharmaceuticals segment is expected to grow at a rapid CAGR over the forecast period. The escalating demand for temperature-controlled drugs and vaccines is a significant factor driving the segment. With the surge in chronic ailments and the need for advanced medical treatments, the demand for transporting pharmaceutical products in a refrigerated environment has also escalated. This can be attributed to the heightened sensitivity of these products and their requirement for specific temperature ranges to preserve their efficacy.

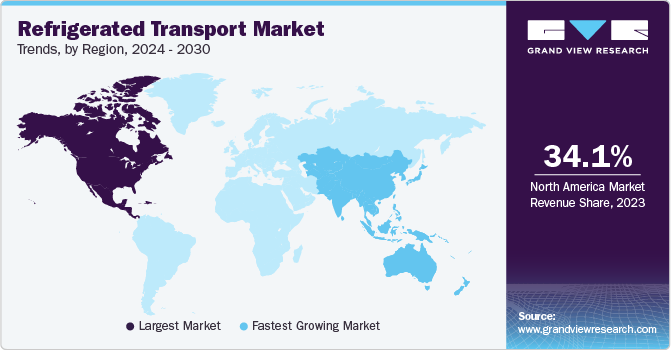

Regional Insights

North America region dominated the market and accounted for a 34.1% share in 2023. The growth of e-commerce and increasing inclination towards online grocery shopping are driving the market growth. With the rise of e-commerce platforms, there is a higher volume of temperature-sensitive goods being shipped directly to consumers' doorsteps every day. Refrigerated transport becomes essential in maintaining the integrity of these products throughout the supply chain, from warehouses to the final delivery destination. The convenience and accessibility of online grocery shopping have led to a surge in demand for refrigerated transport services to ensure the timely and safe delivery of perishable goods.

U.S. Refrigerated Transport Market Trends

The U.S. dominated the refrigerated transport market with a revenue share of 79.0% in 2023. This can be attributed to the country's well-established cold chain infrastructure, which has allowed for the safe and efficient transportation of perishable goods such as fresh produce, dairy products, and frozen food items. Additionally, the U.S. accounted for over 26.9% of the global product information management market in 2023 and is expected to grow significantly over the forecast period.

Europe Refrigerated Transport Systems Market Trends

Europe's refrigerated transport market is identified as a lucrative region in the industry, owing to the emerging need for sustainable food preservation and transportation solutions, owing to the growing awareness among consumers and businesses about the importance of reducing food waste and minimizing the environmental impact of the transportation.

The refrigerated transport market in Germany held a substantial share in the region. To maintain their technological leadership, German companies prioritize innovation and allocate significant resources towards research and development (R&D). This strategy enables them to enhance their infrastructure and facilitate the adoption of refrigerated transport, which in turn drives the market forward.

France's refrigerated transport market is expected to grow at a significant rate, owing to the growing demand for local and organic produce. As consumers become more aware of the benefits of consuming fresh, healthy, and sustainably produced food, they are opting for locally sourced and organic fruits, vegetables, meat, and dairy products.

Asia Pacific Refrigerated Transport Market Trends

The Asia Pacific region is anticipated to witness the fastest growth in the market. The Asia Pacific region is experiencing rapid industrialization, driven by economic growth, urbanization, and the growing population. These factors are driving the market’s growth.

The refrigerated transport market in China is substantial in the region and is expected to grow over the forecast period. China leads the world in e-commerce, and online sale of fresh foods is increasing day by day. This demands rapid, efficient, and temperature-controlled last-mile solutions, favoring innovative players such as autonomous delivery vehicles and micro-fulfillment centers with integrated cold storage.

The India refrigerated transport market is expected to witness significant growth in the region over the forecast period owing to the rising demand for protein and processed foods. Growing income levels and urbanization fuel demand for protein-rich foods like dairy, meat, and seafood. This necessitates an efficient and expansive cold chain network, particularly for long-distance transport from production hubs to urban centers.

MEA Refrigerated Transport Market Trends

The Middle East & Africa (MEA) region is expected to witness substantial growth in the forecast period. The MEA region presents diverse challenges like extreme temperatures, limited access to electricity in remote areas, and complex regulatory environments. Innovative solutions tailored to local conditions and infrastructure limitations are crucial for sustainable growth, leading to the increased demand for refrigerated transportation services.

The refrigerated transport market in UAE held a sizeable share of the manufacturing execution systems market. The UAE's thriving tourism and hospitality industry requires a constant influx of fresh, high-quality food and beverages. This demands efficient and reliable refrigerated transport solutions for both domestic and international movement of perishables.

The Saudi Arabia refrigerated transport market is expected to grow at a significant CAGR during the forecast period. The Vision 2030 plan prioritizes diversifying the economy and reducing reliance on oil. This includes investments in food security, agricultural development, and logistics infrastructure, creating immense opportunities for the refrigerated transport sector.

Key Refrigerated Transport Company Insights

Some of the key players operating in the market include J.B. Hunt Transport Services, Inc., Schneider National, Inc., Swift Transportation Co., C.H. Robinson Worldwide, Inc. and Kuehne + Nagel.

-

J.B. Hunt Transport Services, Inc. is a well-established multimodal supply chain solutions provider. Its Shipper 360 is one of the most popular refrigerated and temperature controlled transportation vehicle.

-

C.H. Robinson Worldwide, Inc. is a logistics platform, offering temperature controlled shipping including refrigerated truckload, climate controlled less than truckload (LTL), consolidation and groupage, and cross-border shipping.

Fenagy, SolarFreeze, SmartCAE are some of the other market participants in the refrigerated transport market.

-

Fenagy is a Denmark-based startup providing sustainable heating and cooling solutions for various applications and industries including refrigerated transport.

-

SolarFreeze is a Kenya-based startup offering solar powered refrigeration and cooling solutions in supply chain and logistics sector.

Key Refrigerated Transport Companies:

The following are the leading companies in the refrigerated transport market. These companies collectively hold the largest market share and dictate industry trends.

- C. R. England Inc.

- J. B. Hunt Transport Services, Inc.

- Schneider National, Inc.

- Swift Transportation Co.

- C.H. Robinson Worldwide, Inc.

- Kuehne + Nagel

- Daikin Industries, Ltd.

- Wabash National Corporation

- Great Dane LLC

- Fenagy

- SolarFreeze

Recent Developments

-

In April 2023, Kodiak Robotics collaborated with truckload carrier C.R. England. Together, they are initiating a pilot program aimed at autonomously transporting Tyson Foods in refrigerated trailer products from Dallas to San Antonio, Texas. To ensure safety during the initial stages of the pilot, human safety drivers will be present in the trucks. Additionally, C.R. England has become a part of Kodiak's Partner Deployment Program, an initiative designed to assist carriers in establishing autonomous freight operations and seamlessly integrating Kodiak Driver, the autonomous system developed by Kodiak, into their existing fleets.

-

In September 2023, Mitsubishi Heavy Industries Thermal Systems, Ltd., a division of the Mitsubishi Heavy Industries (MHI) Group, launched the TEJ35GAM, an electric-driven transport refrigeration unit designed specifically for small and mid-size trucks. The system is capable of automatically switching between plug-in charging and battery operation while in use, depending on the vehicle's operational status. With the launch of the TEJ35GAM, the company aims to address challenges in the distribution industry, focusing on workstyle reform, improved transport efficiency, and enhanced environmental performance to ensure the safe and secure transportation of food.

-

In September 2022, XTL Group, a Canadian cross-border trucking and logistics firm, acquired Quebec-based carrier Transport Savoie. This strategic move aims to enhance XTL's refrigerated transport services by incorporating nearly 40 power units located in proximity to Quebec City, facilitating cross-border operations throughout the eastern U.S. The plan involves integrating Transport Savoie with XTL's existing 400-truck fleet and asset-light logistics operations, effectively scaling up the newly acquired business. This expansion complements XTL's current operations, which already boast a robust presence in the consumer packaged goods sector.

Refrigerated Transport Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 131.61 billion |

|

Revenue forecast in 2030 |

USD 216.07 billion |

|

Growth Rate |

CAGR of 8.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, mode of transport, temperature range, application |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; and South Africa |

|

Key companies profiled |

C. R. England Inc.; J. B. Hunt Transport Services, Inc.; Schneider National, Inc.; Swift Transportation Co.; C.H. Robinson Worldwide, Inc.; Kuehne + Nagel; Daikin Industries, Ltd.; Wabash National Corporation; Great Dane LLC; Fenagy; SolarFreeze |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Refrigerated Transport Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global refrigerated transport market report based on technology, mode of transport, temperature range, application and region.

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Air-blown Evaporators

-

Eutectic

-

Hybrid

-

Fully Electrified

-

-

Mode of Transport Outlook (Revenue, USD Million, 2017 - 2030)

-

Road

-

Air

-

Sea

-

Railway

-

-

Temperature Range Outlook (Revenue, USD Million, 2017 - 2030)

-

Chilled

-

Frozen

-

Deep Frozen

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice Cream

-

Others

-

-

Fish, Meat, and Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global refrigerated transport market size was estimated at USD 123.59 billion in 2023 and is expected to reach USD 131.61 billion in 2024.

b. The global refrigerated transport market is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 216.07 billion by 2030.

b. North America is expected to dominate the market and grow at a CAGR of 7.2%. Increasing penetration of connected devices and a large consumer base are also expected to fuel market growth over the forecast period.

b. Some key players operating in the refrigerated transport market include Nestle SA, Tyson Foods Inc, Smithfield Foods Inc, Kellogg Co., Conagra Brands Inc, Del Monte Pacific Limited, Aryzta AG, The Kraft Heinz Company, and General Mills Inc Among Others.

b. Key factors driving the market growth include the increasing global demand for perishable goods, including fresh produce, dairy products, pharmaceuticals, and frozen foods and the globalization of supply chains has increased the complexity and distance of product distribution.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."