- Home

- »

- Advanced Interior Materials

- »

-

Refrigerated Air Dryer Market Size & Share Report, 2030GVR Report cover

![Refrigerated Air Dryer Market Size, Share & Trends Report]()

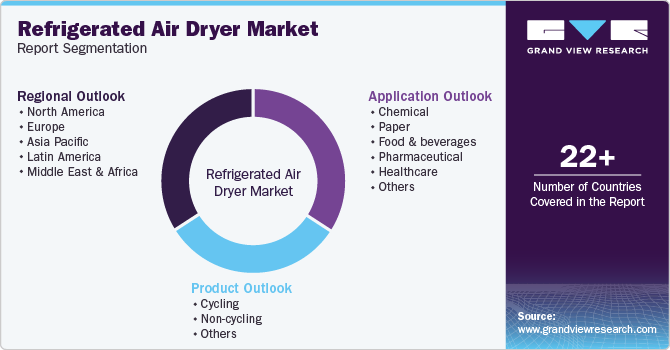

Refrigerated Air Dryer Market Size, Share & Trends Analysis By Product (Cycling, Non-Cycling), By Application (Chemical, Paper, Food & Beverages, Pharmaceutical), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-821-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Refrigerated Air Dryer Market Size & Trends

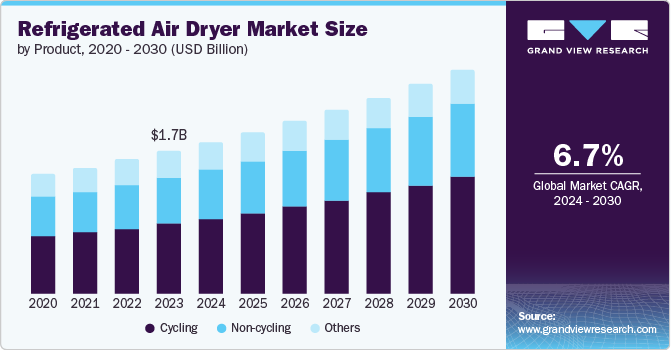

The global refrigerated air dryer market size was valued at USD 1.67 billion in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. This can be attributed to the expansion of industries including food, pharmaceuticals, and electronics which adhere to strict regulations. These industries require refrigerated air dryers to remove moisture that can lead to contamination and compromise product integrity. In addition, refrigerated air dryers are widely used in various tasks such as powering pneumatic tools, operating machinery, and controlling processes to generate clean, high-pressure air.

Furthermore, businesses are increasingly seeking energy-efficient solutions. Advanced technologies including smart controls, sensors, and programmable settings in refrigerated air dryers help maintain optimal moisture levels and contribute to energy savings. For instance, variable-speed compressors adjust their output based on demand, optimizing energy usage. In addition, dry air ensures consistent performance of pneumatic tools, valves, and actuators. It prevents rust and scale buildup in pipelines and minimizes the risk of malfunction.

Moreover, businesses are alarmingly recognizing the need to minimize their environmental impact and conserve resources, they are inclining toward energy-efficient alternatives including refrigerated air dryers. These dryers help industries reduce greenhouse gas emissions and operational costs by optimizing energy usage.

Product Insights

Cycling refrigerated air dryers held a dominant share with 48.6% of the market in 2023 owing to their ability to respond to variable air demands and energy-saving mechanisms. These dryers operate based on the principle of thermal mass and can dynamically adapt their refrigeration system output to match the actual air demand. Industries are increasingly opting for these advanced thermal mass dryers with intelligent controls. These systems monitor airflow, temperature, and humidity, optimizing the drying process while minimizing energy waste. Several cycling dryer models also recover the generated heat during the cooling process which can be repurposed for other applications within a particular industry. Thereby this further enhances energy efficiency. For instance, thermal mass dryers support automotive production lines, where compressed air needs to change based on specific tasks and maintain compliance with air quality standards.

The non-cycling refrigerated air dryers witnessed substantial growth as they offer reliable operation and precise dew point control, ideal for industrial applications. Non-cycling refrigerated air dryers maintain a steady refrigeration cycle, regardless of fluctuations in air demand. Unlike their cycling counterparts, which adjust based on load, non-cycling dryers operate consistently, which ensures predictable performance. Additionally, these dryers maintain a stable dew point, preventing excessive moisture in the compressed air, which is crucial for industries including electronics and manufacturing.

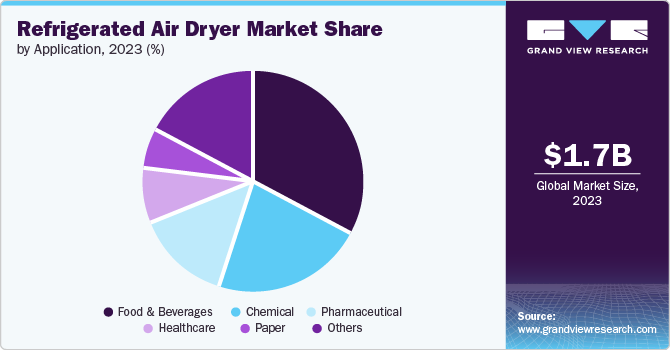

Application Insights

The food and beverages industry secured 33.3% of the global market share in 2023. The food and beverage industry heavily relies on compressed air for various processes, including packaging, bottling, and quality control. These air dryers play a crucial role in maintaining food quality and safety by eliminating moisture that could lead to bacterial growth or product spoilage. As food processors prioritize hygiene and product integrity, the demand for these air dryers continues to be strong, driving market growth. Moreover, environmental and safety regulations mandate the use of dry air in this sector.

The pharmaceutical industry has emerged as the fastest-growing segment at a CAGR of 7.0% in 2023. The industry’s growing emphasis on quality, energy efficiency, and expanding production drives the adoption of refrigerated air dryers. The sector demands high-quality compressed air to prevent contamination, by removing moisture and impurities and ensuring product integrity. Refrigerated air dryers ensure consistent performance, preventing corrosion and equipment damage due to moisture. Additionally, they help maintain sterile conditions by eliminating moisture and contaminants, from compressed air. Moreover, as stringent regulations govern air quality standards in these sectors, the adoption of refrigerated air dryers is projected to increase.

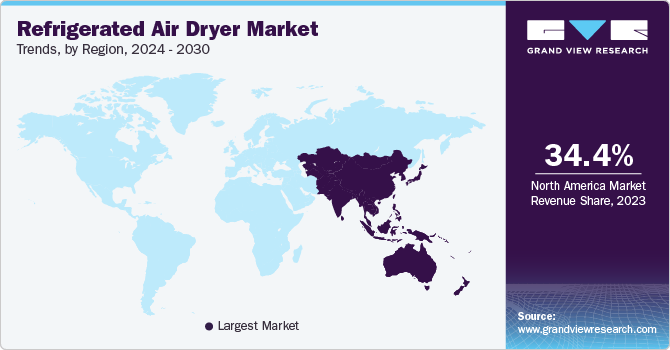

Regional Insights

The Asia Pacific refrigerated air dryer market secured the dominant share in 2023. The region experienced significant growth primarily due to rapid industrialization and urbanization across countries such as China, India, and Southeast Asian nations. The industrial boom increased demand for advanced air dryers with digital controls and energy-saving technologies that help minimize consumption and optimize performance and operational costs. In addition, developing compact, high-performance dryers with enhanced reliability and lower maintenance requirements attracted a broad range of industrial applications. Furthermore, collaborations between air dryer manufacturers and end users facilitated the customization of solutions to meet specific industry needs, thereby market expansion.

China Refrigerated Air Dryer Market Trends

The China refrigerated air dryers market held 17.5% of the share. The market expanded due to the need the high-quality reliable compressed air to meet the production scale. Additionally, the country’s ongoing infrastructure projects, urbanization, and construction activities contributed to increased demand for refrigerated air dryers. These systems are essential for maintaining optimal air quality in industrial facilities, ensuring smooth operations, and preventing equipment damage.

Europe Refrigerated Air Dryer Market Trends

The Europe refrigerated air dryers market experienced robust growth owing to the stringent regulatory environment across the region. European Union regulations on air quality and energy efficiency compelled industries to adopt advanced air-drying solutions to comply with these standards. This regulatory push was particularly significant in sectors such as food and beverage, pharmaceuticals, and electronics, as maintaining high air quality is crucial to prevent contamination. In addition, the growing awareness of the negative effects of moisture on compressed air systems, such as corrosion and reduced equipment lifespan, further fueled the demand for reliable air-drying solutions.

North America Refrigerated Air Dryer Market Trends

The refrigerated air dryers market in North America experienced notable growth owing to the resurgence of the manufacturing sector. This growth was further augmented by significant investments in infrastructure projects, which required reliable and efficient air-drying solutions to ensure the optimal performance of pneumatic tools and machinery. In addition, the need for clean and dry compressed air in medical laboratories, hospitals, and pharmaceutical manufacturing facilities heightened the demand for advanced refrigerated air dryers.

U.S Refrigerated Air Dryer Market Trends

The U.S. refrigerated air dryers market was propelled by increased production activities across various industries, including automotive, aerospace, and electronics. The demand for reliable and efficient compressed air systems has further surges due to substantial investments in infrastructure projects, which require high-quality air-drying solutions. Furthermore, U.S. industries increasingly prioritize energy-efficient technologies to reduce operational costs and meet environmental regulations by minimizing the carbon footprint. Additionally, the integration of IoT-enabled features and digital controls also allowed for real-time monitoring and optimization of air dryer performance, enhancing operational efficiency and reducing downtime.

Key Refrigerated Air Dryer Company Insights

Some of the key companies including Atlas Copco, Ingersoll Rand, and SPX FLOW employed various strategies to strengthen their market operations and enhance their value chain systems. These companies focused on innovation, strategic partnerships, and sustainability initiatives to provide customized solutions for specific industry needs, further driving market growth.

-

ANEST IWATA Corporation is a Japan-based manufacturer known for its cutting-edge technologies in air compressors, coating equipment, vacuum pumps, and liquid application systems.

-

Atlas Copco Group is a leading manufacturer of compressors, vacuum solutions, generators, pumps, power tools, and assembly systems.

Key Refrigerated Air Dryer Companies:

The following are the leading companies in the refrigerated air dryer market. These companies collectively hold the largest market share and dictate industry trends.

- Anest Iwata Corporation

- Atlas Copco Group

- Beko Technologies

- Donaldson Company

- Eaton

- Ingersoll Rand Inc.

- Kaeser Compressors, Inc.

- MTA

- Parker Hannifin Corporation

- SPX Corporation (DEltech)

- Risheng

- CompAir

- Air-Vac Systems LLC.

Recent Developments

-

In June 2024, Atlas Copco Group announced the acquisition of AE Industrial Ltd., a company specializing in sales, installation, and servicing of compressed air systems.

-

In Feb 2024, SPX Technologies revealed its acquisition of Ingenia Technologies which specializes in designing and manufacturing custom air handling units. Their products are primarily applied in various sectors, including healthcare, pharmaceutical, education, food processing, and industrial markets.

Refrigerated Air Dryer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.78 billion

Revenue forecast in 2030

USD 2.63 billion

Growth Rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, UAE

Key companies profiled

Anest Iwata Corporation; Atlas Copco Group; Beko Technologies; Donaldson Company; Eaton; Ingersoll Rand Inc.; Kaeser Compressors, Inc.; MTA; Parker Hannifin Corporation; SPX Corporation (DEltech); Risheng; CompAir; Air-Vac Systems LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Refrigerated Air Dryer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global refrigerated air dryer market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cycling

-

Non-cycling

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Paper

-

Food & beverages

-

Pharmaceutical

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."