Refrigerant Market Size, Share & Trends Analysis Report By Product (Fluorocarbon, Hydrocarbon, Inorganic), By Application (Stationary Air Conditioning, Chillers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-297-6

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Refrigerant Market Size & Trends

The global refrigerant market size was estimated at USD 14.26 billion in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030.The industry is experiencing growth due to increased demand from various end-use sectors, particularly the commercial & industrial refrigeration industry. Rapid urbanization in emerging economies, the expansion of cold storage facilities, and the rising preference for environmentally friendly refrigerants are all expected to fuel global market growth in the coming years.

Refrigerants such as hydrofluorocarbons (HFCs), 1,1,1,2-Tetrafluoroethane, and Ammonia are widely utilized in the beverage and food processing industry due to their minimal contribution to global warming, thus reducing their impact on the ozone layer. These refrigerants are commonly used for storing, producing, and transporting food and beverages.

Food, perishable goods, and medicines can be refrigerated throughout their life. Refrigerated containers, trucks, and trailers systems keep these supplies fresh during transportation and preserve the goods from production to delivery. The growing demand for medicines, frozen foods, and new treatments requiring cold chains has increased the need for reliable refrigerated transport.

Drivers, Opportunities & Restraints

The increasing demand for air conditioning applications can be primarily attributed to global warming and the rising global temperatures, leading to warmer climates in many regions. Air conditioning is no longer a luxury but a necessity for maintaining comfort in homes and workplaces. This trend is expected to continue, driven by technological advancements making air conditioning units more energy-efficient, affordable, and environmentally friendly, appealing to a broader market seeking comfort and sustainability.

Flammability and toxicity are significant issues because they directly impact the operational and legal aspects of producing and handling materials. From a production standpoint, stricter safety regulations and measures need to be implemented to mitigate these risks, which can increase costs. For example, additional safety equipment, training for handling hazardous materials, and safer manufacturing processes may be required, all contributing to higher operational expenses.

Carbon Dioxide is another rapidly growing refrigerant in the industry. It is widely utilized in commercial refrigeration such as supermarkets, vending machines, ice cream freezers and display cabinets. The demand for carbon dioxide refrigerant has risen over the years owing to its excellent properties, such as energy efficiency, better cooling performance and considerably low emissions in comparison with traditional refrigerants.

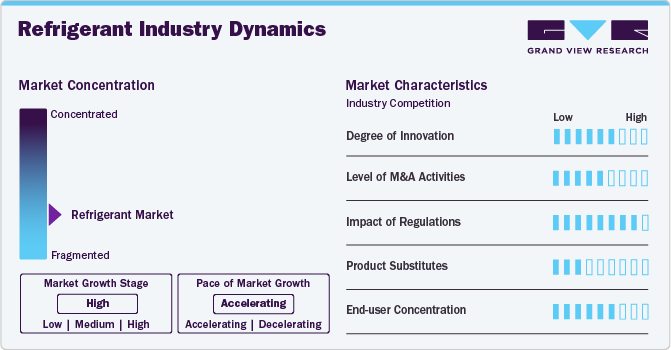

Market Concentration & Characteristics

The market is fragmented and competitive as some key companies account for its significant share. Emerging economies such as India and China are expected to provide growth opportunities to manufacturers of refrigerant over the forecast period.

The raw materials required for producing various types of refrigerants consists of fluorspar, hydrofluoric acid, chlorinated organic & inorganic compounds, propane, butane, ammonia and carbon dioxide. To achieve greater efficiency and control over production costs the industry has witnessed considerable integration.

Refrigerant product suppliers have been involved in backward integration to establish production of refrigerants. The integration assists in considerably lowering their logistics costs and tackling procurement disturbances. The need for innovative products to address the stringent regulations is another key factor driving the suppliers to integrate themselves into production and invest substantially in research and new product development.

Stringent regulations in developed economies on fluorocarbon-based refrigerants are expected to shrink their market size in domestic refrigeration and air conditioning. This factor is expected to boost the demand for hydrocarbon-based refrigerants as the best alternative.

Product Insights & Trends

“Hydrocarbon segment is expected to witness growth at 7.1% CAGR”

The fluorocarbon segment emerged dominant in 2023, accounting for 53.7% market share during the forecast period. the highest market share. Fluorocarbons, specifically in refrigerants, refer to compounds containing carbon, fluorine, and sometimes other elements such as hydrogen and chlorine. These compounds are known for their excellent thermodynamic properties, making them highly effective for cooling systems. There are several types of fluorocarbon refrigerants such as chlorofluorocarbon (CFC), hydrochlorofluorocarbons (HCFC), hydrofluorocarbon (HFC), Hydrofluoroolefins (HFO).

The hydrocarbon segment is expected to witness a CAGR of 7.1% CAGR over the forecast period. Hydrocarbons are becoming increasingly popular as refrigerants in various cooling and refrigeration systems. This shift towards hydrocarbon-based refrigerants is largely attributed to their low environmental impact, particularly in low global warming potential (GWP) and zero ozone depletion potential (ODP). Common hydrocarbons used as refrigerants include propane (R290), isobutane (R600a), and ethylene (R1150).

Application Insights & Trends

“Domestic Refrigeration segment is expected to witness growth at 5.2% CAGR”

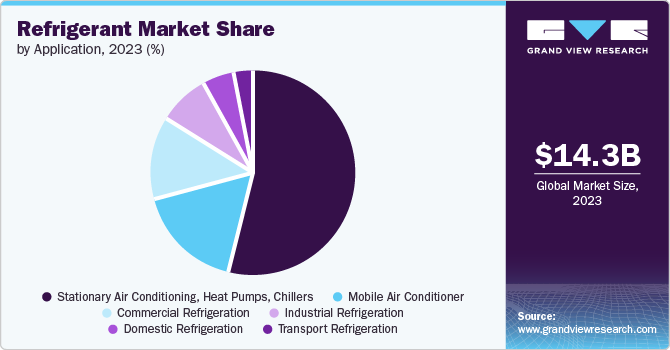

Stationary air conditioning, heat pumps, chillers dominated the application segment with a market share of 53.8%, in 2023. Stationary air conditioning, heat pumps, and chillers, significant components of the HVAC (Heating, Ventilation, and Air Conditioning) system, have significantly influenced the refrigerants market due to their extensive use in commercial, industrial, and residential settings. These systems rely heavily on refrigerants to facilitate the exchange of heat, which is pivotal in cooling or heating. Consequently, their dominance in the market is attributed to the sheer necessity of climate control solutions across various sectors, making them key drivers in the demand for refrigerants.

Mobile air conditioning is a significant application within the refrigerants market, primarily aimed at providing comfort to vehicle passengers. It involves using specific refrigerants that effectively transfer heat outside, cooling the vehicle's interior. As concerns about environmental impact and energy efficiency grow, the selection of refrigerants for mobile air conditioning systems is increasingly focused on substances with lower global warming potential and higher efficiency.

Regional Insights & Trends

“France to witness market growth at 5.1% CAGR”

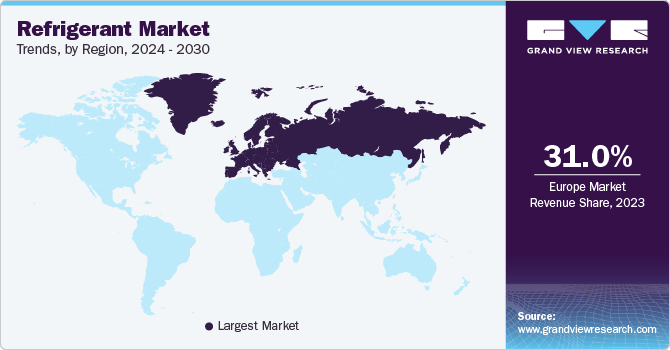

North America refrigerant market is characterized by high demand growth in end-use industries such as domestic refrigeration, commercial refrigeration and mobile air conditioning. Furthermore, growing awareness regarding environment protection and employing energy efficient cooling solutions is also driving natural refrigerant industry growth across the region.

U.S. Refrigerant Market Trends

U.S. refrigerants market is expected to grow during the forecast period. This growth is attributed to rising demand for mobile air conditioning units for automobiles in the region. The refrigerants market is also growing due to the rising demand in the growing commercial and industrial sectors of the region.

Europe Refrigerant Market Trends

Europe is a prominent consumer of refrigerants in the world with revenue share of 31.0% in 2023. The growth of the market in this region can be attributed to the increasing demand for air conditioning units in automotive, industrial, commercial, and domestic.

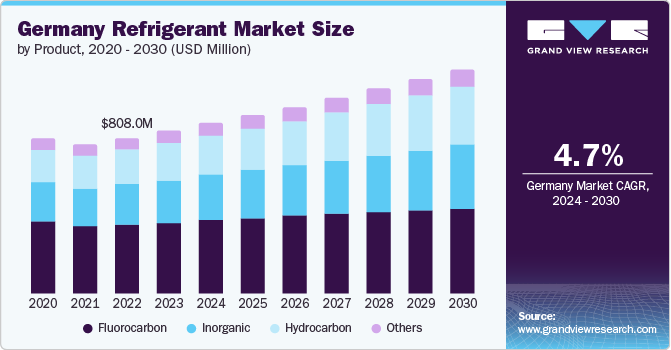

The Germany refrigerants market has been experiencing steady growth in recent years due to the increasing demand for air conditioning units. This rising demand has resulted in a higher need for refrigerants, which are used in air conditioning units in the region. Germany is one of the leading automobile producers in Europe, due to this there is increase in industrial and mobile air conditioning in the region resulting in rising demand for refrigerants.

Asia Pacific Refrigerant Market Trends

The increasing need for refrigeration and cooling equipment and rapid industrialization and urbanization will drive market expansion during the forecast period. The Asia Pacific market is anticipated to grow due to the rapid development of countries like China, India, Japan, and Australia.

The China refrigerants market is expected to grow significantly during the forecast period. China is one of the significant producers and consumer of refrigerant. The rising construction projects, industrial projects require ventilation and air conditioning system resulting in rising demand for the refrigerants.

Central & South America Refrigerant Market Trends

The refrigerants market in Central & South America is expected to grow during the forecast period. This growth is attributed to rising commercial, manufacturing and industrial plants in the region. This rise in commercial, manufacturing and industrial plants requires HVAC, air conditioning units resulting in higher demand for refrigerants in the region.

The Brazil refrigerants market is expected go witness growth during the forecast period. Brazil’s food and beverage industry is one of the growing and strongest sectors of Brazilian economy and significantly uses refrigerants in their process. This are used to store foods and beverages in the region.

Middle East & Africa Refrigerant Market Trends

The Middle East and Africa refrigerants market is expected to grow over the forecast period. The climatic conditions experienced by the region have made it a prominent market for cooling products. This results in rising demand for cooling equipment such as air conditioners and refrigerators resulting in rising demand for refrigerants in the region.

The Saudi Arabia refrigerants market is projected to grow in the coming years. This growth can be attributed to the region's climatic conditions and rapid infrastructure development. The increasing number of manufacturing units and medical facilities is expected to boost the demand for cooling equipment, consequently driving the market growth.

Key Refrigerant Company Insights

Some of the key players operating in the market include Honeywell International Inc., Daikin Industries Ltd., and Arkema S A, among others.

-

Honeywell International Inc. manufactures and supplies aerospace product & services, turbochargers, energy efficient solutions and products for homes, businesses & transport, specialty chemicals, electronic and advanced materials, process technology for refining and petrochemicals and security technologies for home, industries and buildings. The company has its business operating via four segments, aerospace, home and building technologies, performance materials and technologies and safety & productivity solutions. The company has a global presence.

-

Daikin Industries Ltd is a manufacturer and supplier of cooling equipment and chemicals. It operates via three segments, Air Conditioning and Refrigeration Business, Chemicals and others. The Air Conditioning and Refrigeration Business segment is responsible for providing residential and commercial air conditioners, residential and commercial air purifiers, large sized chillers, marine vessel air conditioners and marine refrigeration units. The Chemicals segment manufactures and supplies fluoropolymers, fluorocarbons, fine chemical products and chemical engineering machinery. The company has a global presence.

Mexichem SAB de CV, Linde Group, Air Liquide, and Dongyue Group, among others, are some of the emerging participants in the refrigerants market.

-

Air Liquide manufactures and supplies gases, technologies, and services for healthcare and various industries. It operates through three segments: Gas & Services, which includes refrigerants; Engineering & Construction; and Global Markets & Technologies. The Gases & Services segment comprises four business lines: large industries, Industrial merchants, Healthcare, and Electronics. The company also manufactures and designs plants in the renewable, alternative, and traditional energy sectors and has a presence in 72 countries.

-

Linde Group is a gas and engineering company that operates via three segments Gases, Engineering and Other. The Gases segment provides a wide range of liquified and compressed gases, as well as chemicals to several industries including energy, steel production, chemical processing, environmental protection, welding, food processing, electronics and glass production. The Engineering division assists in planning, development and construction of turnkey industrial plants such as chemical plants, refineries, petrochemical plants, fertilizer plants, and olefin, air separation, hydrogen, natural gas and synthesis gas plants. The other segment consists of logistics services offered by the company’s subsidiary Gist, which provides expert solutions in the distribution of chilled beverages and food.

Key Refrigerant Companies:

The following are the leading companies in the refrigerants market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell Industries Inc.

- Daikin Industries Inc.

- Arkema S A

- Dongyue Group

- The Chemours Company

- Mexichem SAB de CV

- Sinochem Group

- Linde Group

- Air Liquide

- SRF Limited

- Gujarat Fluorochemicals Limited

- Asahi Glass Co, Ltd (AGC)

Recent Developments

-

In June 2024, Hudson Technologies announced the acquisition of USA Refrigerants for USD 27 million. This acquisition helps Hudson Technologies enter the North America and U.S. markets.

-

In November 2022, Danfoss announced the acquisition of BOCK GmbH, a German compressor manufacturer. This move aligns with Danfoss's goal to expand its range of clean, sustainable technologies and accelerate the green transition in commercial refrigeration systems.

Refrigerant Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 14.92 billion |

|

Revenue forecast in 2030 |

USD 19.64 billion |

|

Growth rate |

CAGR of 4.7% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; Saudi Arabia |

|

Key companies profiled |

Honeywell Industries Inc.; Daikin Industries Ltd.; Arkema S A.; Dongyue Group; The Chemours Company; Mexichem SAB de CV; Sinochem Group; Linde Group; Air Liquide; SRF Limited; Gujarat Fluorochemicals Limited; Asahi Glass Co., Ltd. (AGC). |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Refrigerant Market Report Segmentation

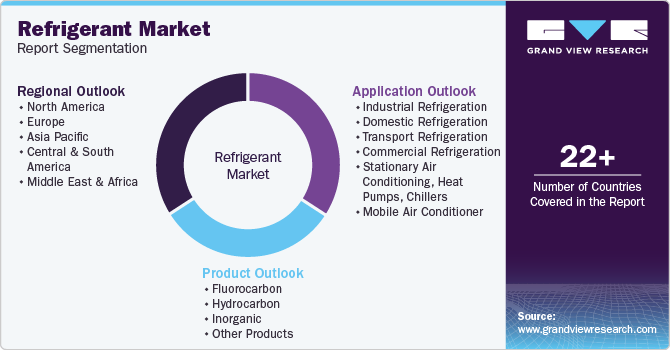

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global refrigerant market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fluorocarbon

-

Hydrocarbon

-

Inorganic

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Industrial Refrigeration

-

Domestic Refrigeration

-

Transport Refrigeration

-

Commercial Refrigeration

-

Stationary Air Conditioning, Heat Pumps, Chillers

-

Mobile Air Conditioner

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global refrigerant market size was estimated at USD 14.26 billion in 2023 and is expected to reach USD 14.92 billion in 2024.

b. The global refrigerants market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 19.64 billion by 2030.

b. Stationary Air Conditioning, Heat Pumps, Chillers dominated the refrigerants market with a share of 53.8% in 2023. Increased spending power of the middle class on consumer appliances, such as refrigeration systems, has resulted in the growth of this segment. Rising demand for cooling equipment owing to rapid industrialization, deteriorating weather conditions, and growth in the manufacture of consumer appliances has also positively influenced its demand.

b. Some key players operating in the refrigerants market include Honeywell International Inc., Daikin International Ltd., Arkema S A., Dongyue Group., The Chemours Company., Linde Group, Air Liquide., Gujarat Fluorochemicals Limited, Asahi Glass Co, Ltd (AGC)

b. Key factors that are driving the market growth include, Increase in demand for energy-efficient cooling solutions and rising awareness regarding global warming and ozone depletion is expected to shape the industry over the forecast period. Fluorocarbon phase-out as per regulations laid down by the Montreal Protocol and updated by the Kyoto Protocol has led to a resurgence in demand for natural refrigerants.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."