Reduced Sugar Food & Beverages Market Size, Share & Trends Analysis Report By Product (Bakery, Beverages, Confectionery, Dairy, Snacks), By Distribution Channel (Supermarkets & Hypermarkets), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-963-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

The global reduced sugar food & beverages market size was valued at USD 46.18 billion in 2021 and is expected to register a compound annual growth rate (CAGR) of 8.9% from 2022 to 2030. The major driving factor for the growth of the market is the increasing demand for healthy and low-sugar foods and drinks due to the rising health concerns, such as obesity and diabetes, created by regular consumption of high-fructose food & drinks. The growing popularity of healthy diets in developed countries such as the U.S., the U.K., Germany, and others also contributes to the market growth over the forecast period. Moreover, new product launches of low sugar food products by manufacturers are further providing a significant expansion to the market growth.

During the pandemic, there was a high demand for healthy diet items, particularly low-sugar food products, which boosted the industry. During the COVID-19 pandemic, healthcare experts recommended regular consumption of healthy food to preserve the body's immunity. Furthermore, the considerable increase in online sales of food and beverage products during the shutdown aided industry growth. During the COVID-19 pandemic, the consumers spent more time at home, which raised consumer interest in personal health and weight management which further increased the sales of less sweetened products. In order to maintain a robust immune system and reduce the risk of developing COVID-19, the World Health Organization (W.H.O.) also recommended a well-balanced diet that includes less sweetened products.

Moreover, the increasing trend toward reducing the intake of sugar among consumers across the globe further contributes to the growth of the market. Due to the growing demand for food products with fewer sweeteners in the major economies such as the U.S., UK, Germany, Canada, and China are considerably contributing to the market's growth. Consumers are becoming more aware of the amount of sweetener in food products, and they frequently check the nutritional information on food packaging while making food purchases. Additionally, as per the International Food Information Council (IFIC) around 72% of consumers across the globe were trying to limit their sugar intake in 2021.

The rising obesity across the globe further increases the demand for less sweetened food products as obesity mainly occurs due to the high intake of artificial sweeteners, calories, and fats. Along with that the significant growth in the diabetic population across the globe further increases the demand for reduced sugar-based products. As per the International Diabetes Federation (IDF), in 2021 around 537 million adults (20-79) were living with diabetes across the globe and that number is further projected to reach over 643 million in 2045. As per the IDF, in 2021 there were around 6.7 million mortalities due to diabetes across the globe.

Product Insights

The beverage segment contributed to a larger market share of over 40% in 2021. The market is mainly driven due to the significant demand for less sweetener-based carbonated drinks and energy drinks among the working and college-going population in developed economies such as the U.S., the U.K., and others. Various health organizations advised reducing the sugar intake in the beverages further enhances the adoption of less artificial sweetener-based soft drinks across the globe. For instance, the American Heart Association (AHA) recommends people limit their daily intake of added sugar to roughly 6tsp, or 24g of sugar for women, and 9tsp, or 36g of sugar for men in order to lower the risk of heart diseases and obesity.

The snacks segment is forecast to grow with the fastest CAGR of 10.2% over the forecast period. Shifting consumer food preferences and evolving trends towards healthy snacks in the food industry are pacing the demand for reduced sugar snacks across the globe. Less sweetener-based snacks are widely adopted by consumers in their healthy diet since they comprise essential vitamins and minerals to boost immunity. Furthermore, the busy lives and increased health and wellness concerns will fuel these less sugary snacking dietary habits and accelerate industry growth over the next decade. Along with this the significant growth in the food processing industry further creates ample opportunity for segmental growth.

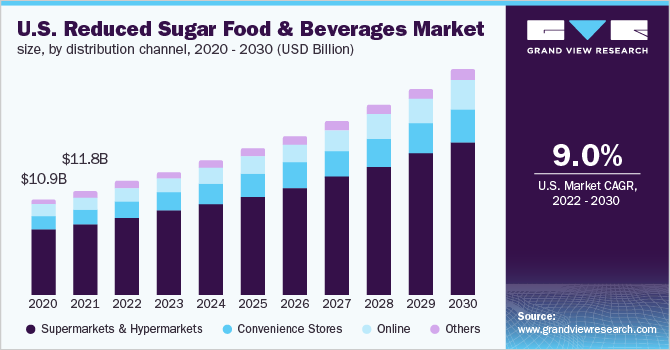

Distribution Channel Insights

The supermarkets and hypermarkets segment held the largest share of over 65% in 2021. The growing number of supermarkets and hypermarkets has increased overall sales of reduced sugar and beverages. Customers prefer to purchase at brick-and-mortar supermarkets due to their ease of access and availability. Furthermore, supermarkets offer a diverse choice of options as well as the possibility to scan product details before making a purchase, therefore contributing to the segmental share. Moreover, the strong offline retail chain in various economies such as the U.S., China, India, and other major countries further contributed to the increased sales of low sugary products through hypermarkets and supermarkets.

Moreover, the online distribution channel is expected to expand at the fastest CAGR of 10.1% from 2022 to 2030 due to the rising use of the internet as a result of the widespread use of smartphones and other similar gadgets. Furthermore, several e-commerce giants, including Amazon and JD.com, are collaborating with food and beverage manufacturers and retail outlets to provide grocery items through their online channels. Moreover, the growing consumer preference for an online platform for grocery shopping across the globe further contributes to the market growth over the forecast period. Appropriate purchasing and quick delivery choices have increased online businesses' popularity among buyers.

Regional Insights

North America accounted for the largest revenue share of over 30% in 2021. The market is mainly driven due to the increased diabetic population in the region which raises the demand for low sugar-based food products in the region. As per The National Diabetes Statistics Report around 37.3 million people are living with diabetes in the U.S. Moreover, the growing demand for a healthy diet containing less sweetened food and drinks in the U.S. and Canada further contributed to the market share. The high preference of millennials for less sweetened convenience foods with a strong nutritional profile further supported the market expansion in the region.

Moreover, Asia Pacific is expected to emerge as the fastest-growing regional market and register a CAGR of 9.9% over the forecast period. The market is mainly driven by the rising awareness regarding less sugary food and beverages' health benefits in major countries such as India, China, and others. Moreover, the growing concern related to obesity and diabetes further increases the demand for less sugary food in these countries. Moreover, the significant growth in the food & beverages industry in India and China further creates significant growth opportunities for the reduced sugar food & beverages market in the region.

Key Companies & Market Share Insights

The rising demand for low sugary food and drinks has widened the opportunity for growth for manufacturers across the globe. Thus, the product launch has been a major competitive strategy in the global market. In order to fulfill the consumer demand, the manufacturers are launching various low sugar-based food and beverages products.

-

In August 2020 The J. M. Smucker Co. announced the launch of a new Jif no added sugar creamy peanut butter spread, that will be available in the large retail stores and online via Amazon and Walmart

-

In July 2020, Cargill Inc. announced the latest sweetener CTruSweet 01795 to facilitate a 30% sugar and calorie reduction in beverages and other food applications via lower usage levels

-

In March 2021, Mondelēz International acquired Grenade which is one of the major providers of high protein, low sugary products including bars, drinks, and shakes

Some of the prominent players in the reduced sugar food & beverages market include:

-

The J. M. Smucker Company

-

Bayn Europe AB

-

Nestlé S.A.

-

Hain Celestial Group

-

Unilever plc

-

Fifty50 Foods, LP

-

Alchemy Foodtech Pte. Ltd.

-

NOW Foods

-

Givaudan SA

-

Cargill Inc.

-

The Coca-Cola Company

-

PepsiCo

-

Danone S.A.

-

Mondelēz International

Reduced Sugar Food & Beverages Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 50.16 billion |

|

Revenue forecast in 2030 |

USD 99.79 billion |

|

Growth rate |

CAGR of 8.9% from 2022 to 2030 |

|

Base year for estimation |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Million/Billion and CAGR from 2022 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Sweden; Spain; China; India; Japan; South Korea; Australia; South Africa; Brazil |

|

Key companies profiled |

The J. M. Smucker Company; Bayn Europe AB; Nestlé S.A.; Hain Celestial Group; Unilever plc; Fifty50 Foods, LP.; Alchemy Foodtech Pte. Ltd.; NOW Foods; Givaudan SA; Cargill Inc.; The Coca-Cola Company; PepsiCo; Danone S.A.; Mondelēz International. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Reduced Sugar Food & Beverages Market Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global reduced sugar food & beverages market based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Bakery

-

Beverages

-

Confectionery

-

Dairy

-

Snacks

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Sweden

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global reduced sugar food & beverages market size was estimated at USD 46.18 billion in 2021 and is expected to reach USD 50.16 billion in 2022.

b. The global reduced sugar food & beverages market is expected to grow at a compound annual growth rate of 8.9% from 2022 to 2030 to reach USD 99.79 billion by 2030.

b. North America dominated the reduced sugar food & beverages market with a share of 32.8% in 2021. The high share of the region is attributed to the rising demand for food products with low sugar content owing to the presence of a high diabetic population in the region.

b. Some of the key players operating in the reduced sugar food & beverages market include The J. M. Smucker Company, Bayn Europe AB, Nestlé, Hain Celestial Group, Unilever, Fifty50 Foods, LP., Alchemy Foodtech Pte. Ltd., NOW Foods, Givaudan SA, Cargill Inc.

b. The reduced sugar food & beverages market is driven by the increasing popularity of healthy diets among the consumers in developing countries coupled with surging demand for low-sugar-based food and beverages owing to growing health issues such as diabetes and obesity.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."