Red Meat Market Size, Share & Trends Analysis Report By Type (Beef, Pig, Sheep & Goat, Others), By Distribution Channel (B2B, Supermarket/Hypermarket, Convenience Stores, Online), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-262-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Red Meat Market Size & Trends

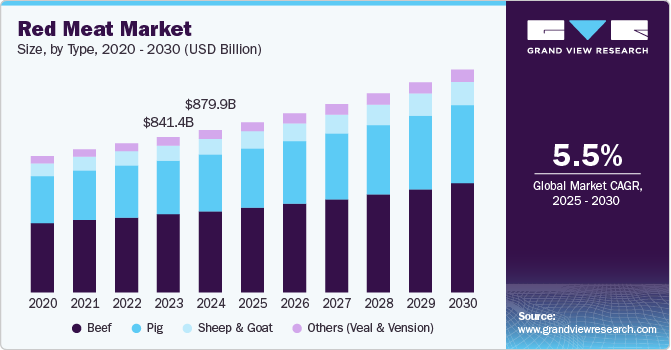

The global red meat market size was valued at USD 879.97 billion in 2024 and is expected to grow at a CAGR of 5.5% from 2025 to 2030. The rising demand and consumption of red meat are primarily fueled by economic growth, lifestyle changes, and shifting dietary preferences worldwide. As disposable incomes increase, particularly in emerging economies across Asia Pacific, Latin America, and parts of Africa, consumers can afford to include higher-priced protein sources like red meat in their diets. Urbanization has also shifted dietary patterns, with city dwellers often adopting Western eating habits, where red meat consumption is more prevalent. This trend is most notable among middle-class populations, who have greater access to diverse food options and are willing to spend on quality protein sources, boosting red meat consumption.

Health and fitness trends are another major driver, as consumers are more aware of the importance of protein in their diets. Red meat is widely valued as a nutrient-dense source of high-quality protein, iron, and essential vitamins, such as B12, making it attractive to fitness enthusiasts and those looking to enhance their protein intake. These health-conscious consumers see red meat as a beneficial addition to a balanced diet despite some concerns about saturated fat. The nutrient profile of red meat appeals especially to active individuals seeking to support muscle growth, recovery, and overall energy.

Cultural and culinary traditions also play a strong role in sustaining the demand for red meat. Many regions and cultures feature red meat prominently in traditional meals, celebrations, and family gatherings. Even as global diets diversify, red meat remains central to various cuisines, such as steaks in North America, lamb dishes in the Middle East, and beef barbecues in Latin America. Additionally, younger generations are exploring diverse culinary experiences, often choosing red meat for its rich flavors and versatility in international dishes. This cultural significance reinforces red meat as a staple food choice, bolstering consumption through various occasions and social gatherings.

The booming food service industry, particularly restaurants and food delivery, significantly contributes to rising red meat demand. Fast-food chains, steakhouses, and casual dining establishments frequently offer red meat options, making it a convenient and popular choice for dining out. This growth in the food service sector makes red meat more accessible, with consumers able to enjoy it both in premium settings and quick-service restaurants.

Moreover, innovations in the red meat market, including premium and specialty options like grass-fed, organic, and hormone-free products, attract consumers who prioritize quality and ethical sourcing. This premiumization trend is not only for health-focused individuals but also for ethically-conscious buyers who are willing to pay a higher price for what they perceive as superior, sustainable meat. Improved supply chains and distribution networks have also enhanced red meat availability in various regions, supporting a consistent supply. These factors together contribute to the steady rise in demand for red meat globally, with continued growth expected as dietary trends, economic factors, and culinary traditions sustain its popularity.

Type Insights

Beef accounted for a revenue share of 50.0% in 2024. The market is experiencing a steady rise in demand for beef products like steaks, ground cuts, and similar items, particularly among younger consumers who prefer burgers and rolls made from these offerings. For instance, in March 2023, JBS U.S.A. introduced Pound of Ground Crumbles frozen uncooked ground beef, a pioneering dinner solution that can be cooked directly from frozen without the need for thawing or advance planning.

The sheep & goat segment is expected to grow at a CAGR of 6.7% from 2025 to 2030. One of the primary drivers of the sheep and goat meat market is changing consumer preferences. There is a growing demand for alternative protein sources that are perceived as healthier compared to traditional red meats such as beef and pork. Goat meat, in particular, is gaining popularity due to its lean profile and lower fat content, appealing to health-conscious consumers seeking nutritious options. In addition, the environmental benefits associated with goat production-such as lower methane emissions compared to cattle-are increasingly influencing consumer choices toward more sustainable meat options.

Distribution Channel Insights

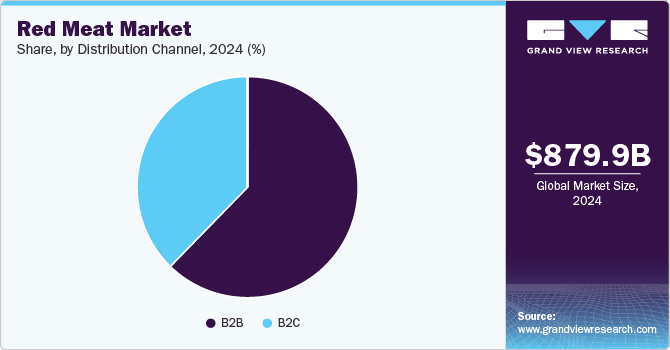

Sales through B2B accounted for a revenue share of 62.3% in 2024 in the red meat market. The growth of the meat market through B2B distribution channels is driven by several key factors. One of the primary drivers is the rising demand from the foodservice industry, which includes restaurants, hotels, catering services, and institutional buyers like hospitals and schools. As consumer preferences shift toward high-quality meat products, these businesses are increasingly relying on B2B suppliers to meet demand with a steady supply of fresh, processed, or specialty meat.

Sales of red meat through B2C channels are expected to grow with a CAGR of 6.0% from 2025 to 2030. The B2C distribution channel allows consumers to purchase red meat products directly from retailers, online platforms, or specialty stores, catering to their preferences and needs. Moreover, the growth of e-commerce platforms has revolutionized the way consumers shop for red meat products. Online retail channels offer a wide range of options, convenience, and often competitive pricing, driving more consumers toward purchasing red meat products online.

Regional Insights

North America red meat market is expected to grow at a CAGR of 6.1% from 2025 to 2030. There is a high demand for red meat in North America, particularly beef. Beef plays a significant role in the traditional American diet, with popular dishes such as meatloaf, steaks, and hamburgers often highlighting beef as the primary ingredient. Consumer preferences for specific types of red meat, cuts, and quality attributes impact production, pricing, and market trends. In November 2023, Del Taco introduced three fresh Shredded Beef Birria options across the U.S. These new offerings were Two Shredded Beef Birria Tacos, Shredded Beef Birria Quesadilla, and Shredded Beef Birria Ramen.

U.S. Red Meat Market Trends

The red meat market in the U.S. is expected to grow at a CAGR of 6.0% from 2025 to 2030. The U.S. red meat market is expected to grow at a significant rate from 2024 to 2030. This can be attributed to the increasing consumption of and demand for meat in the country. According to an article by TheWorldCounts, meat consumption in the U.S. accounted for 124 kilos per person per year. Moreover, increasing trade is driving the market. According to the U.S. Meat Export Federation, in January 2024, U.S. pork exports to South Korea surged by 53% compared to the previous year, reaching 20,727 metric tons. The export value also witnessed a significant increase of 51%, amounting to USD 67.6 million.

Europe Red Meat Market Trends

The red meat market in Europe is expected to grow at a CAGR of 5.2% from 2025 to 2030. Red meat, such as beef, pork, and lamb, are of great significance in European culinary traditions and diets. Many European countries have a long history of consuming red meat as a staple food item, leading to a consistent demand for these products. According to the European Union agricultural outlook for 2021-31 report, EU sheep meat production is anticipated to experience a slight annual growth of 0.3% from 2021 to 2031, reaching 660,000 tons by 2031. This growth will be supported by factors such as coupled income support, limited global supply, and improving prices for producers.

Asia Pacific Red Meat Market Trends

The red meat market in Asia Pacific accounted for a revenue share of 40.1% in 2024. The increasing number of cold chain facilities in developing countries across the Asia Pacific region is playing a crucial role in the meat consumption, especially frozen meat. Cold chain facilities are crucial for preserving meat and ensuring their quality and safety. With the growing demand for meat, there has been a significant increase in the number of cold chain facilities in countries like India, China, and Indonesia. This has not only improved the availability of frozen foods in these countries but has also increased the shelf life of these products, making them more attractive to consumers.

Key Red Meat Company Insights

The market is characterized by numerous well-established and emerging players. Manufacturers in the red meat market are engaging in a variety of strategic initiatives to keep pace with evolving consumer demands and market trends. For instance, in July 2024, JBS Foods Canada expanded its beef processing facility in Brooks, Alberta, with aid from the province's Agri-Processing Investment Tax Credit program. This expansion involved a USD 90 million investment in a new patty processing line and fulfillment center, enabling JBS Canada to produce nearly seven million additional kilograms of beef patties annually for Western Canadian restaurants. The project is expected to create up to 24 permanent jobs and 170 temporary positions, with completion anticipated by fall 2025.

Key Red Meat Companies:

The following are the leading companies in the red meat market. These companies collectively hold the largest market share and dictate industry trends.

- Hormel Foods Corporation

- JBS Foods

- W.H. Group

- Tyson Foods, Inc.

- Kraft Heinz Company

- Cargill, Incorporated

- ConAgra Foods Inc.

- BRF SA

- OSI Group, LLC.

- Tönnies Group

View a comprehensive list of companies in the Red Meat Market

Recent Developments

-

In March 2024, Hormel Foods Corporation's brand Black Label announced the launch of ranch bacon. These products are available at grocery retailers all across the U.S. This initiative was taken by the company to meet the growing demand for innovative and exciting new flavors, particularly among younger generations.

-

In January 2024, Tyson Foods, Inc. inaugurated a food production facility in Bowling Green, Kentucky, with an investment totaling USD 355 million. Designed to accommodate a substantial increase in bacon production, the plant positions Tyson Foods, Inc. to further leverage its market leadership and meet the growing demand for its products. Spanning an impressive 400,000 square feet, this facility is projected to yield a weekly output of two million pounds of premium-quality bacon products under the Jimmy Dean and Wright Brand labels for both retail and foodservice applications.

Red Meat Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 922.47 billion |

|

Revenue forecast in 2030 |

USD 1,208.46 billion |

|

Growth Rate (Revenue) |

CAGR of 5.5% from 2025 to 2030 |

|

Actuals |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S, Canada, Mexico, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, Argentina, & South Africa |

|

Key companies profiled |

Hormel Foods Corporation; JBS Foods; W.H. Group; Tyson Foods, Inc.; Kraft Heinz Company; Cargill, Incorporated; ConAgra Foods Inc.; BRF SA; OSI Group, LLC.; Tönnies Group |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Red Meat Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global red meat market report on the basis of type, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Beef

-

Pig

-

Sheep & Goat

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Supermarket/Hypermarket

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global red meat market size was estimated at USD 879.97 billion in 2024 and is expected to reach USD 922.47 billion in 2025.

b. The global red meat market is expected to grow at a compounded growth rate of 5.5% from 2025 to 2030 to reach USD 1,208.46 billion by 2030.

b. Sales through B2C channels are expected to grow at a CAGR of 6.0% from 2025 to 2030. The shifts in consumer preferences and awareness within the Europe region are poised to drive demand, particularly fueled by the introduction of new products and a growing recognition of organic options in meat categories. Notably, countries like Luxembourg, the Netherlands, and Belgium are expected to play a significant role in this trend due to evolving dietary preferences among their populations.

b. Some key players operating in red meat market include Hormel Foods Corporation; JBS Foods; W.H. Group; Tyson Foods, Inc.; Kraft Heinz Company, and others.

b. Key factors that are driving the market growth include rising demand for protein rich food and rising technological advancements in production and processing

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."