- Home

- »

- Biotechnology

- »

-

Red Biotechnology Market Size, Share, Industry Report 2030GVR Report cover

![Red Biotechnology Market Size, Share & Trends Report]()

Red Biotechnology Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By End Use (Academic Research Institutes, CMOs & CROs, Pharmaceutical & Biotechnology Companies, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-042-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Red Biotechnology Market Summary

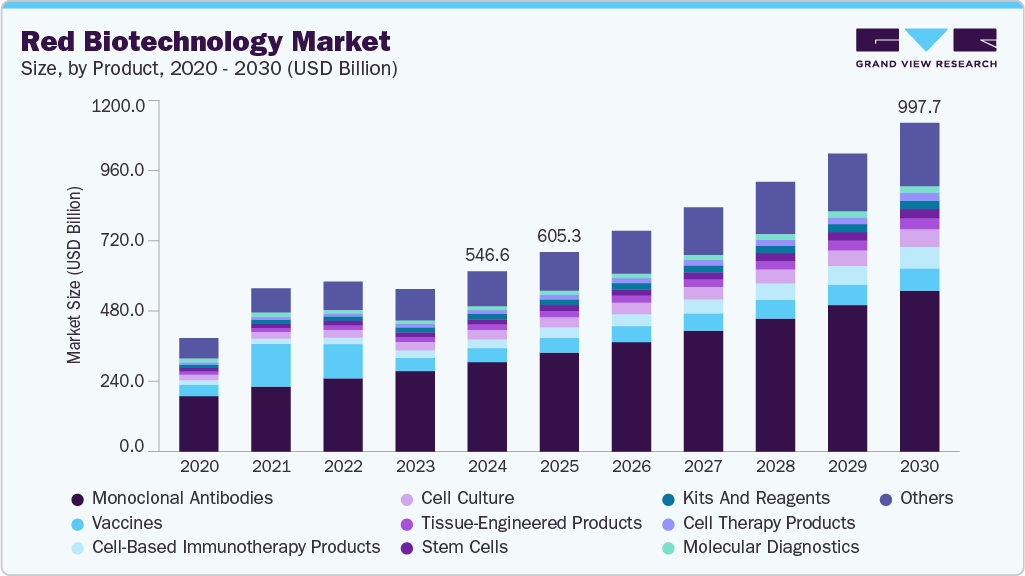

The global red biotechnology market size was estimated at USD 546.59 billion in 2024, and is projected to reach USD 997.74 billion by 2030, growing at a CAGR of 10.5% from 2025 to 2030. The increasing demand for personalized medicine, high investment in the R&D of biotechnology products, and advances in genetic research are shaping the field.

Key Market Trends & Insights

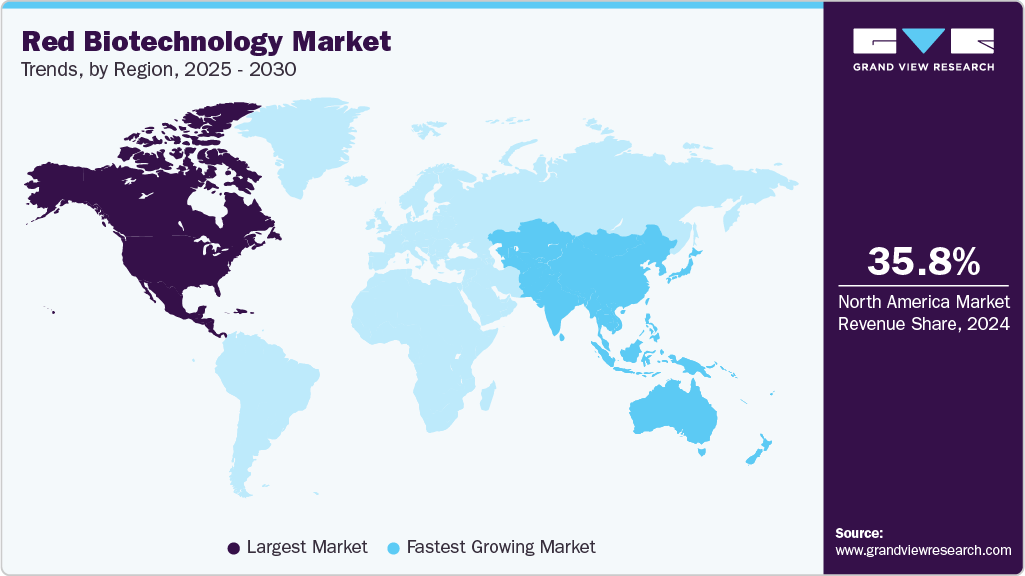

- The North America red biotechnology market held the largest share of 35.8% in 2024.

- The U.S. red biotechnology market dominated the North American market in 2024.

- By product, the monoclonal antibodies segment accounted for the largest share, 49.6 %, in 2024.

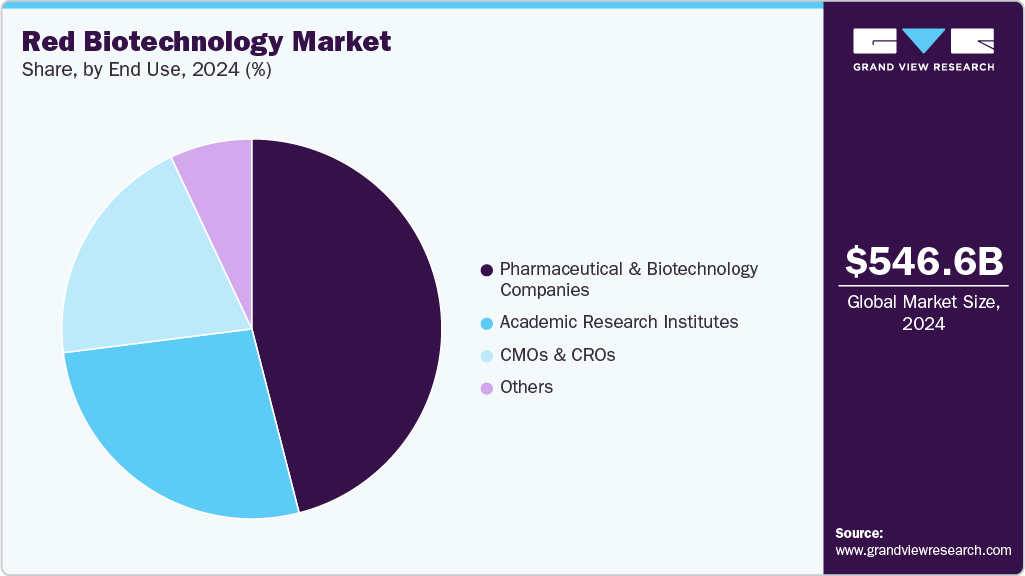

- By end use, the pharmaceutical and biotechnology companies segment dominated the red biotechnology industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 546.59 Billion

- 2030 Projected Market Size: USD 997.74 Billion

- CAGR (2025-2030): 10.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Red biotechnology deals with biotechnological applications such as stem cells, gene therapy, genetic engineering, and the development of new drugs and vaccines. Red biotechnology is a process that uses organisms to improve health care and aid the body in fighting diseases. It is a subset of modern technology used in the field of medicine. It finds application in the pharmaceutical industry and the medical sector, as it helps alleviate human suffering and improves the quality of life. The increasing usage of genetic engineering to produce biological medicine is one of the major trends. This includes using recombinant DNA technology to create genetically modified organisms capable of producing large amounts of a specific protein, such as a therapeutic antibody.The market is expected to witness lucrative growth during the forecast period. It has made significant advancements in disease control, from antibiotics for treating acute microbial infections to chronic conditions such as anti-HIV/AIDS, including azidothymidine, which has helped manage AIDS. Many pharmaceutical companies are developing and manufacturing pipeline products for diabetes and neurological disorders such as Alzheimer's and Parkinson's disease. According to clinicaltrials.gov, 126 agents were in clinical trials for the treatment of Alzheimer's disease as of January 2021, with 28 treatments in phase III trials. Fermentation technology is widely used in the life sciences and healthcare sectors, positively impacting market growth.

The market is still growing, with significant potential for driving medical advancements and transforming the identification of diseases caused by genetic factors. Novel tests can detect changes in the DNA sequence of genes linked to diseases, and early detection is a crucial factor in avoiding disease or slowing its progression through early treatment.

Product Insights

Monoclonal antibodies accounted for the largest share, 49.6 %, in 2024. The rising prevalence of chronic diseases, such as cardiovascular diseases and cancer, is increasing the demand for biologics, which is expected to drive the segment's growth. In 2022, according to a WHO report, 20 million new cases of cancer and 9.7 million deaths were recorded globally.

Gene therapy products are likely to witness the fastest CAGR of 24.3%. The growth can be attributed to factors such as the expansion of gene delivery technologies and advanced therapies and the development of progressive competition among major market players focused on commercializing their therapies. In April 2025, the FDA approved Zevaskyn, the first autologous cell-based gene therapy for Recessive Dystrophic Epidermolysis Bullosa (RDEB), marking a major milestone in the U.S. for innovative treatments addressing genetic skin disorders.

End Use Insights

Pharmaceutical and biotechnology companies dominated the red biotechnology industry in 2024. These companies are involved with a variety of challenging trends and are experiencing a wave of innovation, from new treatment modalities to advanced analytics, smart machines, and digital connectivity.

The CMOs & CROs segment is projected to grow at the fastest rate over the forecast period. The increasing investment in the biotechnology industry by prominent players to enhance their efficiency and productivity has driven biopharmaceutical manufacturers to increase their focus on outsourcing services. Mergers and acquisitions allow CMOs to offer inclusive bioprocessing services, making CMOs/CROs a feasible option for rapid product launches. The market for CMOs and CROs is still in its early stages, but the introduction of novel therapeutics, new bioprocessing tools, and product priority shifts in the bio/pharmaceutical industry has increased the pressure on contract biomanufacturers.

Regional Insights

The North America red biotechnology market held the largest share of 35.8% of the red biotechnology industry in 2024. This is mainly attributed to increased R&D activities and technological advancements in biotechnology. The U.S. is among the key markets in the biotechnology industry. Major factors such as developed infrastructure and the rise in the incidence of various diseases are driving the market growth in the region.

U.S. Red Biotechnology Market Trends

The U.S. red biotechnology market dominated the North American market in 2024 due to advancements in gene delivery, personalized therapies, and precision medicine. Strategic investments from the public and private sectors in biopharmaceutical R&D and a favorable regulatory scenario for advanced therapies further reinforced this dominance.

Europe Red Biotechnology Market Trends

Europe red biotechnology market held a significant share of the global market in 2024, owing to factors such as the increasing prevalence of cancer and new product launches. In February 2024, the EU Commission approved Vertex’s gene-edited therapy to treat sickle cell disease and transfusion-dependent beta-thalassemia, enabling 8,000 eligible patients to access a potentially transformative treatment.

Asia Pacific Red Biotechnology Market Trends

The Asia Pacific red biotechnology market is anticipated to grow at the fastest CAGR of 16.0% during the forecast period. The emerging economies of Asia Pacific, such as India and China, are major contributors to the growth of this region. This growth can be attributed to private-public collaborations, business expansion, and government initiatives. In October 2024, Teijin Ltd. and Hilleman Lab announced the signing of an MOU to establish a strategic partnership to promote the expansion of CDMO business in cell and gene therapy.

Key Red Biotechnology Company Insights

The increasing demand for red biotechnology for various applications has enhanced market opportunities. Companies are involved in strategic initiatives such as new product launches, collaborations, and acquisitions to propel their market share. Some of the key players in the global red biotechnology industry are Merck KGaA, F. Hoffmann-La Roche Ltd, and Pfizer Inc.

-

Pfizer is an American multinational corporation specializing in pharmaceuticals and biotechnology. The company focuses on developing vaccines and medicines across various therapeutic areas, addressing critical health challenges through innovation.

Key Red Biotechnology Companies:

The following are the leading companies in the red biotechnology market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- F. Hoffmann-La Roche Ltd

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- AstraZeneca

- Takeda Pharmaceutical Company Limited

- Gilead Sciences, Inc.

- Biogen

- Amgen Inc.

- Celgene Corporation (acquired by Bristol-Myers Squibb Company)

Recent Developments

-

In May 2025, the Angelman Syndrome Foundation announced the U.S. FDA clearance for an Investigational New Drug (IND) application for MVX-220, an AAV gene therapy for the treatment of Angelman Syndrome (AS).

Red Biotechnology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 605.26 billion

Revenue forecast in 2030

USD 997.74 billion

Growth rate

CAGR of 10.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Merck KGaA; F. Hoffmann-La Roche Ltd; Pfizer Inc.; Regeneron Pharmaceuticals, Inc.; AstraZeneca; Takeda Pharmaceutical Company Limited; Gilead Sciences, Inc.; Biogen; Amgen Inc.; Celgene Corporation (acquired by Bristol-Myers Squibb Company)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

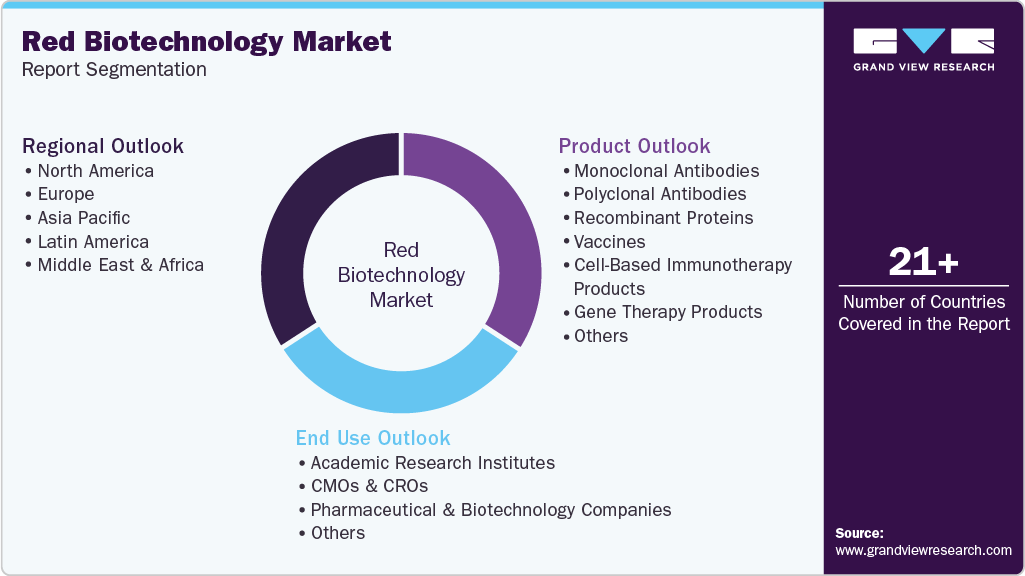

Global Red Biotechnology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global red biotechnology market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Monoclonal Antibodies

-

Polyclonal Antibodies

-

Recombinant Proteins

-

Vaccines

-

Cell-Based Immunotherapy Products

-

Gene Therapy Products

-

Cell Therapy Products

-

Tissue-Engineered Products

-

Stem Cells

-

Cell Culture

-

Viral Vector

-

Enzymes

-

Kits and Reagents

-

Animal models

-

Molecular diagnostics

-

Others

-

-

End-User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Academic Research Institutes

-

CMOs & CROs

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.