Recycled Polypropylene In Packaging Market Size, Share & Trends Analysis Report By Packaging Type (Flexible Packaging, Rigid Packaging), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-554-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

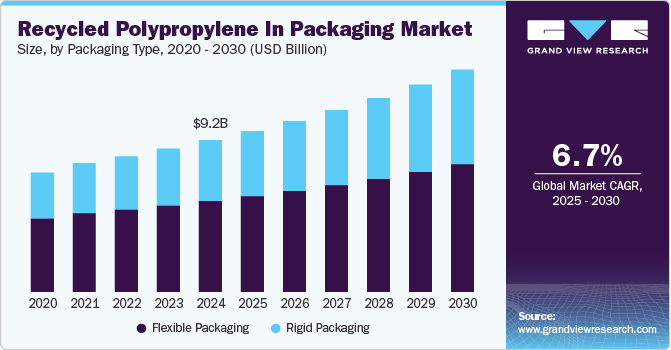

The global recycled polypropylene in packaging market was estimated at USD 9.20 billion in 2024 and is expected to expand at a CAGR of 6.7% from 2025 to 2030. Market growth of recycled polypropylene (rPP) in packaging is driven by rising environmental regulations promoting sustainable materials and increasing consumer demand for eco-friendly packaging. In addition, its durability, lightweight nature, and compatibility with various packaging formats boost its adoption.

As governments, consumers, and brands push for eco-friendly solutions, recycled materials such as rPP are gaining traction. PP is a versatile, lightweight plastic widely used in rigid and flexible packaging applications. However, virgin PP’s environmental impact has prompted a shift towards post-consumer recycled alternatives. For instance, companies such as Unilever and Nestlé increasingly incorporate recycled plastics into their packaging portfolios to meet corporate sustainability targets and reduce their reliance on fossil-based plastics. This push for greener solutions creates a strong demand for rPP, particularly in secondary and tertiary packaging formats such as containers, caps, and trays.

Regulatory support and government mandates also accelerate the adoption of recycled polypropylene in the packaging sector. Various regions, including the European Union, Canada, and parts of the U.S., have enacted legislation mandating minimum recycled content in plastic packaging or penalizing the use of virgin plastic. For example, the European Plastics Strategy targets 10 million tonnes of recycled plastics to be used in new products by 2025, creating a clear incentive for manufacturers to shift toward recycled polymers. These regulations encourage packaging companies to incorporate rPP and stimulate investments in recycling infrastructure and technologies, thus improving the overall availability and quality of recycled polypropylene.

The rising consumer awareness and preference for eco-friendly packaging is another key growth driving factor. Brands have responded by redesigning their packaging to include recycled materials and communicating these choices through labeling. For instance, major retailers such as Walmart and Target have rolled out private-label products that feature packaging made with recycled PP, enhancing brand loyalty while meeting environmental commitments. This shift in consumer expectations is especially noticeable in food, beverage, personal care, and household product segments, where packaging plays a critical role in purchasing decisions.

Moreover, technological advancements in polymer recycling and sorting processes enable higher-quality recycled polypropylene that is suitable for more demanding packaging applications. Innovations in chemical recycling and advanced mechanical sorting have helped overcome previous limitations, such as odor, contamination, and inconsistent material properties in rPP. These advancements have opened the door for recycled PP to be used in more sensitive applications, including food-contact packaging in some cases when properly treated and certified.

Packaging Type Insights

The flexible packaging segment recorded the largest market revenue share of over 59.0% in 2024. Flexible packaging using rPP involves materials that can be easily shaped or bent, such as films, pouches, and wraps. It is widely used for products such as snacks, frozen foods, personal care items, and dry goods. rPP films offer excellent moisture resistance, durability, and barrier properties, making them a sustainable alternative to virgin plastics. This type of packaging is especially favored in the food industry due to its lightweight nature and lower carbon footprint during transportation.

The rigid packaging segment is projected to grow at the fastest CAGR of 7.8% during the forecast period. Rigid packaging includes containers, bottles, caps, tubs, and trays that maintain a fixed shape. rPP is commonly used in rigid packaging for household products, beverages, personal care items, and food containers. Rigid packaging's growth is driven by increasing demand for strong, durable packaging solutions offering high product protection and extended shelf life.

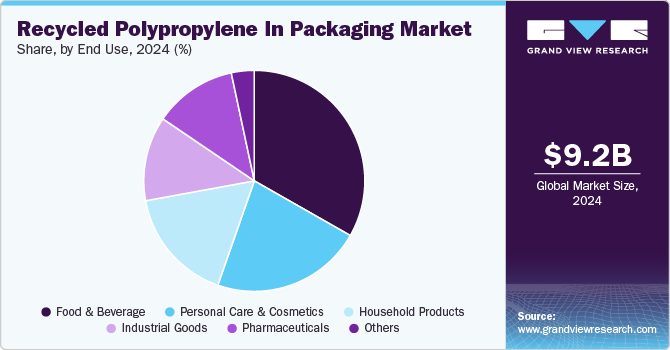

End Use Insights

The food & beverage segment recorded the largest market share of over 33.0% in 2024. rPP is increasingly used in the food and beverage packaging sector for applications such as containers, trays, caps, and flexible pouches. Although direct food-contact rPP use is subject to stringent regulatory compliance, its use in secondary packaging, such as outer cartons and carry-home packs, is expanding rapidly.

The personal care & cosmetics segment is projected to grow at the fastest CAGR of 8.1% during the forecast period. In personal care and cosmetic products, rPP packages items such as shampoo bottles, cream jars, and cosmetic caps. These products often prioritize aesthetics and shelf appeal, and rPP can meet these requirements with appropriate processing and color-matching technologies. The drive for sustainability in the beauty and personal care industry is strong, with major brands committing to using a significant percentage of recycled content in their packaging.

In the pharmaceutical sector, rPP is used mainly in non-contact secondary packaging, such as blister pack trays, medicine transport containers, and outer cartons. Strict regulations generally limit rPP use in primary packaging unless it meets rigorous safety standards. Increased consumer preference for green homecare products is influencing brand packaging decisions. Retailers and manufacturers are under increasing scrutiny to reduce plastic footprints, encouraging the shift toward rPP-based packaging. Moreover, household product packaging generally requires less regulatory approval, offering more flexibility for recycled content integration.

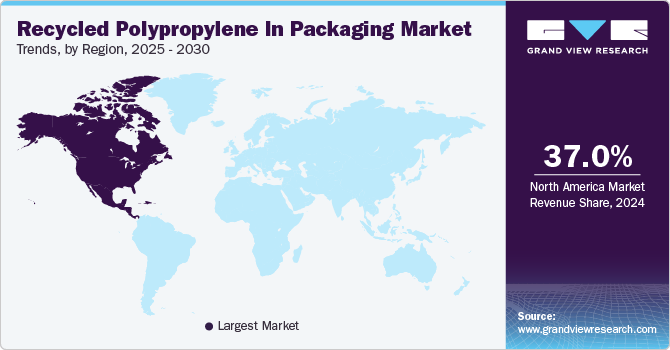

Region Insights

North America dominated the market and accounted for the largest revenue share of over 37.0% in 2024. This positive outlook is due to strong regulatory frameworks, growing corporate sustainability mandates, and increasing consumer awareness around eco-friendly packaging. Government agencies such as the U.S. Environmental Protection Agency (EPA) and Canada’s Environment and Climate Change Department are pushing for circular economy principles, which encourage using recycled materials like polypropylene in packaging. This regulatory push is complemented by Extended Producer Responsibility (EPR) laws and plastic waste reduction initiatives at both state and federal levels, creating a favorable environment for the growth of rPP use in packaging in the region.

U.S. Recycled Polypropylene In Packaging Market Trends

The recycled polypropylene in packaging market in the U.S. can be attributed to a combination of regulatory pressure, corporate sustainability goals, and strong infrastructure for recycling and innovation. Besides, large consumer goods and packaging companies such as Procter & Gamble, Unilever, and Berry Global Inc. also accelerated demand for rPP in the packaging sector. These companies have strongly committed to integrating post-consumer recycled (PCR) content into their packaging.

Asia Pacific Recycled Polypropylene In Packaging Market Trends

The recycled polypropylene in packaging market in Asia Pacific is anticipated to grow at the fastest CAGR of 6.2% over the forecast period. This outlook is expected due to its rapidly expanding packaging industry, coupled with growing environmental concerns and supportive government initiatives toward circular economy goals. Countries such as China, India, Japan, and South Korea are witnessing rising demand for sustainable packaging solutions across food & beverage, personal care, and e-commerce sectors.

China recycled polypropylene In packaging market growth can be attributed to its massive manufacturing base, growing commitment to sustainability, and a robust domestic demand for cost-effective, eco-friendly packaging materials. Moreover, China’s well-established recycling infrastructure and large-scale availability of polypropylene waste make it a favorable environment for rPP production.

Europe Recycled Polypropylene In Packaging Market Trends

The recycled polypropylene in packaging market in Europe is primarily due to stringent regulatory frameworks and ambitious sustainability targets set by the European Union (EU). The EU has established comprehensive circular economy policies, such as the European Green Deal and the Circular Economy Action Plan, which emphasize using recycled materials, including recycled plastics, in packaging. These policies have compelled manufacturers and packaging companies to increase the use of rPP to meet recyclability and recycled content requirements. For example, the EU’s Single-Use Plastics Directive has shifted from virgin plastics to recycled alternatives in applications such as food containers, trays, and wrapping films.

Germany recycled polypropylene In the packaging market is primarily driven by its advanced waste management infrastructure, strong regulatory framework, and high consumer awareness around sustainability. In addition, Germany’s packaging industry is under pressure to comply with stringent EU directives, particularly the European Commission’s Packaging and Packaging Waste Directive (PPWD) and the German Packaging Act (VerpackG). These regulations mandate minimum recycled content targets in plastic packaging and incentivize eco-design, driving demand for rPP in the country.

Key Recycled Polypropylene In Packaging Company Insights

The competitive environment of recycled polypropylene (rPP) in the packaging market is characterized by a growing demand for sustainable and eco-friendly packaging solutions, driving innovation and competition among key players. Major companies are focusing on improving the quality and cost-efficiency of rPP materials while meeting regulatory requirements for recycled content in packaging. Competitors include large plastic manufacturers and specialized companies providing advanced recycling technologies. Companies that successfully integrate circular economy principles, invest in advanced sorting technologies, and maintain strong supply chains for sourcing post-consumer polypropylene are gaining a competitive edge. However, challenges such as fluctuating raw material prices and limited rPP availability can influence competitiveness, with new entrants leveraging partnerships and collaborations to scale production.

Key Recycled Polypropylene In Packaging Companies:

The following are the leading companies in the recycled polypropylene in packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Braskem

- Borealis AG

- Mitsubishi Chemical

- Exxon Mobil Corporation

- Nexam Chemical

- Pashupati Group of Industries

- Sumitomo Chemical Co., Ltd.

- Nexeo Plastics, LLC

- Shell Chemicals

- ECOPLAS (HK) LIMITED

- Berry Global Inc.

- Banyan Nation

- TotalEnergies

- Formosa Plastics

Recent Development

-

In June 2024, Braskem, under its circular eco-system brand Wenew, collaborated with Georg Utz AG, a major Swiss manufacturer of reusable transport packaging, to introduce chemically recycled polypropylene (PP) for food transport packaging. This partnership marks the first sale of such chemically recycled PP, which is ISCC+ mass balance certified and made from post-consumer plastic waste.

-

In January 2024, Braskem Netherlands B.V. and Shell Chemicals Europe B.V. partnered to produce circular polypropylene from mixed plastic waste, leveraging chemical recycling to convert plastic waste into virgin-quality raw materials. Under the agreement, Shell agreed to upgrade pyrolysis oils into circular feedstocks at its Chemicals Park in Moerdijk, Netherlands, which Braskem agreed to process into polypropylene at its Wesseling, Germany facility. The circular polypropylene will be marketed under Braskem's Wenew brand, contributing to its sustainability goals of achieving 1 million tons of recycled products and recovering 1.5 million tons of plastic by 2030.

Recycled Polypropylene In Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 9.74 billion |

|

Revenue forecast in 2030 |

USD 13.46 billion |

|

Growth rate |

CAGR of 6.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Packaging type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Braskem; Borealis AG; Mitsubishi Chemical; Exxon Mobil Corporation; Nexam Chemical; Pashupati Group of Industries; Sumitomo Chemical Co., Ltd.; Nexeo Plastics, LLC; Shell Chemicals; ECOPLAS (HK) LIMITED; Berry Global Inc.; Banyan Nation; TotalEnergies; Formosa Plastics |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

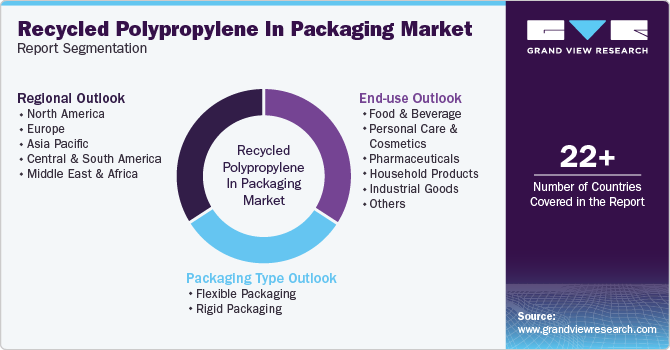

Global Recycled Polypropylene In Packaging Market Report Segmentation

This report forecasts volume & revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global recycled polypropylene in packaging market report based on packaging type, end use, and region:

-

Packaging Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flexible Packaging

-

Rigid Packaging

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Household Products

-

Industrial Goods

-

Others

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global recycled polypropylene in packaging market was estimated at around USD 9.20 billion in the year 2024 and is expected to reach around USD 9.74 billion in 2025.

b. The global recycled polypropylene in packaging market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach around USD 13.46 billion by 2030

b. Food & beverage emerged as a dominating application with a value share of around 33.0% in the year 2024 owing to rising demand for sustainable, lightweight packaging and increasing regulatory pressure for eco-friendly materials. Its versatility and compliance with food safety standards further supported widespread adoption.

b. The key players in the recycled polypropylene in packaging market include Braskem; Borealis AG; Mitsubishi Chemical; Exxon Mobil Corporation; Nexam Chemical; Pashupati Group of Industries; Sumitomo Chemical Co., Ltd.; Nexeo Plastics, LLC; Shell Chemicals; ECOPLAS (HK) LIMITED; Berry Global Inc.; Banyan Nation; TotalEnergies; Formosa Plastics.

b. The recycled polypropylene in packaging market is driven by growing environmental regulations promoting sustainable materials and increasing consumer demand for eco-friendly packaging. Additionally, cost-effectiveness and the rising adoption of circular economy practices further boost market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."