- Home

- »

- Plastics, Polymers & Resins

- »

-

Recyclable Packaging Market Size And Share Report, 2030GVR Report cover

![Recyclable Packaging Market Size, Share & Trends Report]()

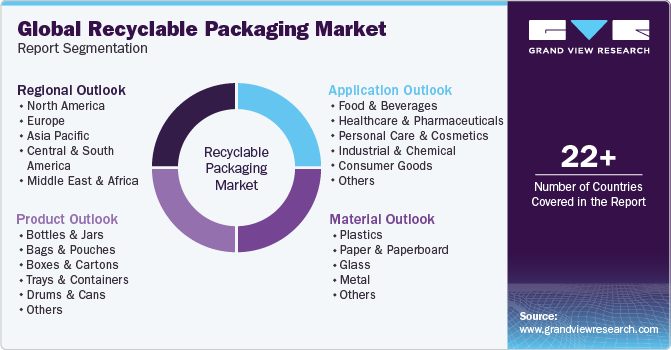

Recyclable Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastics, Paper & Paperboard, Glass, Metal), By Product, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-305-1

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recyclable Packaging Market Summary

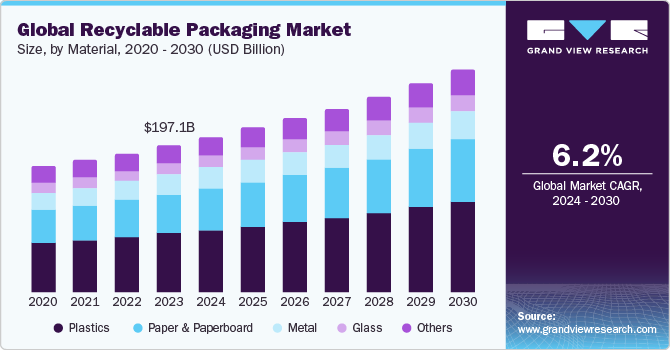

The global recyclable packaging market size was estimated at USD 197.08 billion in 2023 and is projected to reach USD 299.00 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030. Rising awareness among consumers of environmentally friendly packaging has led to a surge in demand for recyclable packaging solutions globally. Furthermore, government regulations & initiatives focused on waste reduction and recycling promotion have significantly contributed to the market growth

Key Market Trends & Insights

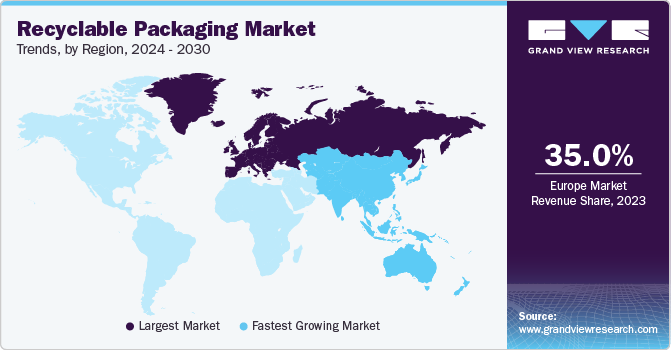

- The recyclable packaging market in Europe held the largest revenue share of over 35% in 2023.

- By product, the bottles & jars segment dominated the market and accounted for the largest revenue share of over 31.0% in 2023.

- By product, the bags & pouches product segment is expected to register the fastest CAGR of 7.1% over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 197.08 Billion

- 2030 Projected Market Size: USD 299.00 Billion

- CAGR (2024-2030): 6.2%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

Rising environmental concerns and the subsequent push toward sustainability are the primary factors driving the growth of the recyclable packaging market. Consumers, businesses, and governments are becoming increasingly aware of the detrimental effects of plastic waste on the environment, leading to a concerted effort to reduce the carbon footprint of packaging materials and solutions. This has prompted a surge in demand for eco-friendly alternatives, such as paper, cardboard, and bioplastics, which are easily recyclable and biodegradable.

Stringent regulations & government initiatives played a pivotal role in fueling the market growth. Many countries have implemented laws and policies that mandate the use of recyclable packaging materials or impose penalties for non-compliance. For instance, the European Union has set ambitious targets for recycling packaging waste, while several states in the U.S. have implemented bottle deposit schemes to incentivize recycling. These regulatory measures have compelled manufacturers to adopt recyclable packaging solutions to remain compliant and avoid hefty fines.

Moreover, shifting consumer preferences and growing demand for sustainable products have significantly influenced the recyclable packaging industry. Consumers, particularly millennials and Generation Z, are increasingly becoming conscious of their environmental impact and are actively seeking out products that align with their eco-friendly values. This has created a ripple effect, with brands and manufacturers recognizing the need to incorporate recyclable packaging into their product offerings to cater to this growing consumer segment and maintain a competitive edge.

Investments made by packaging companies in material processing and recycling in order to secure a steady supply of recycled materials are benefiting the overall recyclable packaging ecosystem. In November 2023, Tetra Pak invested USD 1.09 million in the Netherlands-based material processing and recycling company, Recon Polymers, to scale a pilot plant into a full industrial operation capable of recycling at least 8,000 tons of polyethylene (PE) and aluminum from beverage cartons annually. This investment aims to bolster Recon Polymers' recycling plant, contributing to recycling efforts in Europe where approximately 37% of all beverage cartons are recycled.

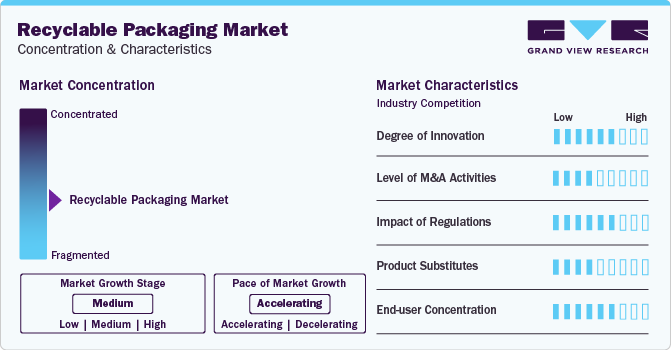

Market Concentration & Characteristics

Companies are increasingly focusing on the introduction of recyclable products in the recyclable packaging market. In December 2023, Smurfit Kappa and Valpak collaborated to introduce a recyclable box for recycling cardboard cups. This initiative led to the creation of a freestanding cardboard cup recycling box designed to collect empty cups. The box is a sustainable solution aimed at promoting recycling efforts, particularly in the UK. The joint effort between Smurfit Kappa and Valpak resulted in tailor-made cardboard bins that are specifically designed for cup recycling in the UK, contributing to environmental sustainability.

In August 2023, DS Smith partnered with sushi specialist, Eat Happy, to develop and launch fully recyclable packaging for sushi. The packaging, made from natural & renewable raw materials using corrugated cardboard, is designed to be water and grease-repellent, protecting and preserving sushi. This innovative solution, created using Circular Design Metrics, is expected to save over 1,250 tons of plastic per year. The packaging features a 100% home compostable plastic-free window for visibility on store shelves and can be recycled using community or private wastepaper bins. Clear recycling guidelines are provided on the packaging to direct consumers toward proper disposal methods. This sustainable packaging aligns with current legislation to reduce single-use plastic and meets the increasing demand for environmentally friendly packaging while helping protect the environment.

Material Insights

The plastics segment dominated the overall market with a share of over 39.0% in 2023. Plastic packaging materials are generally lightweight, reducing transportation costs & carbon emissions associated with shipping. Additionally, plastics are relatively inexpensive to produce compared to other materials such as glass or metal.

The paper & paperboard material segment, on the other hand, is expected to witness robust growth at a CAGR of 6.9% over the forecast period. Paper & paperboard are highly recyclable materials, with well-established recycling infrastructure and processes in place globally. This aligns with the principles of sustainability and circular economy.

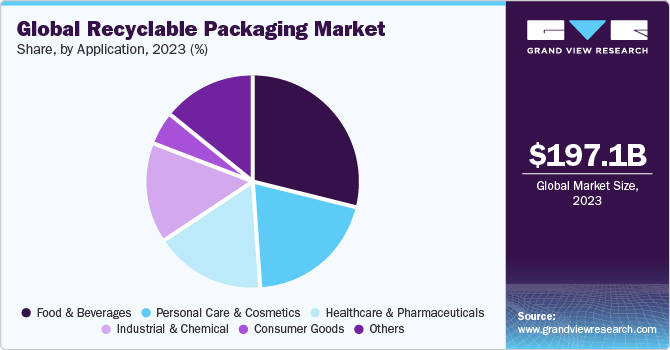

Application Insights

The food & beverages segment accounted for the largest revenue share of over 28.0% in 2023 and is anticipated to grow at the fastest CAGR of 7.2% during the forecast period. Regulatory pressure and consumer demand for sustainable and environmentally friendly packaging solutions are increasing in the food & beverage industry. This has led to a shift toward recyclable packaging materials to reduce plastic waste and environmental impact.

Healthcare & pharmaceutical sectors are heavily regulated and have strict guidelines in place regarding the packaging of drugs, medical devices, and other healthcare products. Many regulatory bodies, such as the FDA and EMA, encourage or mandate the use of environmentally friendly and sustainable packaging solutions, including recyclable materials. Furthermore, the personal care & cosmetics industry extensively uses packaging materials, such as plastic bottles, jars, and tubes, which can be easily made from recycled materials or designed for recyclability.

Product Insights

The bottles & jars segment dominated the market and accounted for the largest revenue share of over 31.0% in 2023. Glass, PolyEthylene Terephthalate (PET), and High Density Polyethylene (HDPE) bottles & jars are 100% recyclable, making them an attractive eco-friendly option compared to non-recyclable plastics.

The bags & pouches product segment is expected to register the fastest CAGR of 7.1% over the forecast period. Bags & pouches offer convenience in terms of portability, ease of handling, and storage. They are lightweight and take up less space compared to rigid containers or bottles, making them a practical & suitable choice for packaging various products.

Regional Insights

The North America recyclable packaging market is influenced by stringent environmental regulations and policies that encourage the use of sustainable and recyclable packaging materials. Companies, such as Coca-Cola, PepsiCo, Unilever, and Procter & Gamble, have implemented significant initiatives to increase the use of recyclable packaging materials in North America, driven by consumer demand, sustainability goals, and regulatory requirements. This outlook is expected to provide growth opportunities for the market within North America.

U.S. Recyclable Packaging Market Trends

The recyclable packaging market in the U.S. is anticipated to experience significant growth, due to the introduction of new recyclable packaging products by companies operating in the country. In February 2024, American Packaging Corporation (APC) announced the commercial launch of a new sustainable offering for frozen food applications, introducing a "Design for Recycle" flexible packaging technology. This initiative is part of its RE sustainable packaging portfolio, which includes various environmentally friendly packaging options, such as Design for Compost, Circular Content, and Renewable Content. The newly launched package is a PE flexible package designed to be recycle-ready and compliant with the Association of Plastic Recycler's guidelines for PE films.

The Canada recyclable packaging market held a significant revenue share in 2023, due to its commitment to the use of recycled content in its packaging. The Canadian Federal Government is engaging the public to develop a Pollution Prevention Plan to reduce plastic pollution, focusing on primary food plastic packaging. This initiative aims to shift toward a circular economy by reducing single-use plastics and increasing recycled content targets. The plan includes efforts to replace single-use packaging with reuse-refill systems and design plastics for safe reuse, recycling, or composting.

Europe Recyclable Packaging Market Trends

The recyclable packaging market in Europe held the largest revenue share of over 35% in 2023, owing to the continuous promotion of recyclability and sustainability across the region. According to the European Parliament, EU member states are mandated to reduce packaging waste by 5% by 2030, 10% by 2035, and 15% by 2040. Besides, all packaging must be recyclable by 2030 and systematically recycled by 2035. Member states need to ensure a separate collection of at least 90% of single-use plastic bottles and metal beverage containers by 2029, as per the European Parliament.

The UK recyclable packaging market is primarily driven by increasing efforts made by packaging companies to launch environmentally friendly packaging to meet the increasing demand for recyclable packaging in various end-use industries, including food & beverages. In September 2023, Mondi and Veetee collaborated to introduce the first paper-based packaging for dry rice in the UK. This innovative packaging, created using Mondi's recyclable Functional Barrier Paper, provides a sustainable alternative to traditional plastic packaging.

The new paper-based packaging offers excellent barrier properties to protect rice while aligning with Veetee's goals to reduce plastic usage. The new packs have been certified for kerbside recycling in the UK. This initiative reflects both companies' commitment to sustainability, with Veetee targeting net zero carbon emissions and increased recycling, while Mondi aims to make all its packaging reusable, recyclable, or compostable by 2030.

Asia Pacific Recyclable Packaging Market Trends

The Asia Pacific recyclable packaging market is anticipated to grow at the fastest CAGR of 6.9% during the forecast period. Asia Pacific is home to some of the world's most populous countries, such as China, India, and Indonesia. The region has experienced rapid urbanization and population growth, leading to increased demand for packaged goods and, consequently, recyclable packaging solutions.

The Japan recyclable packaging market is expected to grow during the forecast period. In February 2024, Oji Holdings and Tetra Pak collaborated to establish Japan’s first recycling system for aseptic carton packages. This initiative involves collecting aseptic carton packages from various sources, including retail and municipal collections, to promote recycling and sustainability. Tetra Pak emphasizes the recyclability of its cartons, which are made of about 70% paperboard, 25% plastic, and 5% aluminum, highlighting the potential for these cartons to be transformed into various products through proper recycling processes. Such strategic efforts related to the recycling of packaging by various players are expected to drive the market growth.

Central & South America Recyclable Packaging Market Trends

The Central & South America recyclable packaging market is projected to expand at a moderate CAGR from 2024 to 2030, due to government regulations & policies regarding sustainability. Many governments in Central & South America implemented regulations and initiatives to promote sustainable practices, including the use of recyclable packaging materials. For example, Brazil has implemented the National Solid Waste Policy, which encourages recycling and use of recyclable materials in packaging.

The Brazil recyclable packaging market is expected to register a healthy growth rate over the forecast period. Companies, such as Heinz Brazil, Tesco, and Clover Sonoma, are making strides in recyclable packaging. Heinz Brazil is moving its sauces to bottles containing 30% recycled PET material, Tesco is introducing chilled meal trays with 30% PCR content, and Clover Sonoma shifted its organic milk jugs to contain 30% rHDPE material. Hence, these strategic efforts by companies in Brazil regarding the recyclability & sustainability of their packaging products are anticipated to aid the market growth.

Middle East & Africa Recyclable Packaging Market Trends

The Middle East & Africa recyclable packaging market dynamics are influenced by government regulations related to plastic packaging. Expanding retail and e-commerce sectors in the region have increased the demand for packaging solutions, including recyclable packaging options. Moreover, many countries in the region are witnessing rapid urbanization and population growth, leading to increased consumption of packaged goods. This has driven the demand for recyclable packaging options to manage the resulting waste.

The UAE recyclable packaging market growth can be attributed to initiatives taken by UAE-based companies to achieve their sustainability goals. For instance, in November 2023, Spinneys, a UAE-based supermarket chain, became the first UAE retailer to transition to recycled plastic packaging in partnership with Al Bayader International. This move represents a significant step toward environmental sustainability, with Spinneys using rPET packaging that significantly reduces CO2 emissions. The transition involves the use of recycled packs containing 30% rPET, initially in Spinneys' bakery products, contributing to a reduction of six metric tons of annual emissions.

Key Recyclable Packaging Company Insights

The market consists of a significant number of companies producing recyclable packaging products. The recyclable packaging market has been witnessing a significant number of new product developments and launches over the past few years. This can be ascribed to government regulations & policies, innovation in materials and technologies, and corporate sustainability initiatives.

-

In December 2023, Smurfit Kappa developed a recyclable film called Lx polyethylene to replace nylon in bag-in-box products, offering similar strength and resilience properties. This sustainable alternative aims to reduce environmental impact without compromising quality, reliability, or safety. The new PE film is part of Smurfit Kappa's efforts to provide sustainable packaging solutions across various sectors, such as wine, juice, liquid eggs, and dairy.

-

In October 2023, Berry Global Inc. launched large containers with 35% recycled content that have received additional UN approval for transporting hazardous goods. These 20 and 25-liter containers are designed to help businesses meet sustainability goals by offering environmentally friendly packaging options. These containers are lightweight, stackable, and available in various colors with standard neck finishes suitable for different closures.

Key Recyclable Packaging Companies:

The following are the leading companies in the recyclable packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Sealed Air

- Tetra Pak

- Huhtamaki Oyj

- Mondi

- DS Smith

- Atlantic Packaging

- ProAmpac

- Constantia Flexibles

- Genpak

- Crown Holdings, Inc.

- Gerresheimer AG

- Stora Enso

- WestRock Company

- NEFAB GROUP

- Scholle IPN

- Greiner Packaging

- Ball Corporation

- Oji Holdings Corporation

- Ardagh Group S.A.

- RAFESA

- Trivium Packaging

- Envases Group

Recyclable Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 208.27 billion

Revenue forecast in 2030

USD 299.00 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Amcor plc; Sealed Air; Smurfit Kappa; Berry Global Inc.; Tetra Pak; Huhtamaki Oyj; Mondi; DS Smith; Atlantic Packaging; ProAmpac; Constantia Flexibles; Genpak; Crown Holdings, Inc.; Gerresheimer AG; Stora Enso; WestRock Company; NEFAB GROUP; Scholle IPN; Greiner Packaging; Ball Corporation; Oji Holdings Corporation; Ardagh Group S.A.; RAFESA; Trivium Packaging; Envases Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recyclable Packaging Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the recyclable packaging market report based on material, product, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Plastics

-

Paper & Paperboard

-

Glass

-

Metal

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Bottles & Jars

-

Bags & Pouches

-

Boxes & Cartons

-

Trays & Containers

-

Drums & Cans

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Food & Beverages

-

Healthcare & Pharmaceuticals

-

Personal Care & Cosmetics

-

Industrial & Chemical

-

Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The recyclable packaging market was estimated at around USD 197.08 billion in the year 2023 and is expected to reach around USD 208.27 billion in 2024.

b. The recyclable packaging market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach around USD 299.00 billion by 2030.

b. Food & beverage emerged as a dominating application with a value share of around 28.0% in the year 2023 owing to the increasing consumer demand for more sustainable and environmentally friendly packaging solutions in the food and beverage industry.

b. The key player in the recyclable packaging market includes Graphic Packaging International LLC, Sonoco Products Company, Sabert Corp., Genpak LLC, Pactiv LLC, Interplast Group, Anchor Packaging Inc., Carlisle FoodService Products, GreenGood USA, Georgia-Pacific LLC, Amhil, Huhtamaki Oyj, Printpack, Dart Container Corporation, Mondi, Airlite Plastics, Reynolds Consumer Products, Material Motion, Inc., CMG Plastics, Berry Global Inc.

b. The rising consciousness among consumers towards environmentally friendly packaging and governmental regulations and initiatives focused on waste reduction and recycling promotion is driving the demand for recyclable packaging solutions worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.