- Home

- »

- Communication Services

- »

-

Recruitment Process Outsourcing Market Size Report, 2030GVR Report cover

![Recruitment Process Outsourcing Market Size, Share & Trends Report]()

Recruitment Process Outsourcing Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (On-demand, Enterprise), By Service (On-site, Off-site), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-971-5

- Number of Report Pages: 124

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recruitment Process Outsourcing Market Summary

The global recruitment process outsourcing market size was estimated at USD 7.33 billion in 2022 and is anticipated to reach USD 24.32 billion by 2030, growing at a CAGR of 16.1% from 2023 to 2030. The two primary factors driving the market growth are the need for an effective recruiting process and reduced overhead costs.

Key Market Trends & Insights

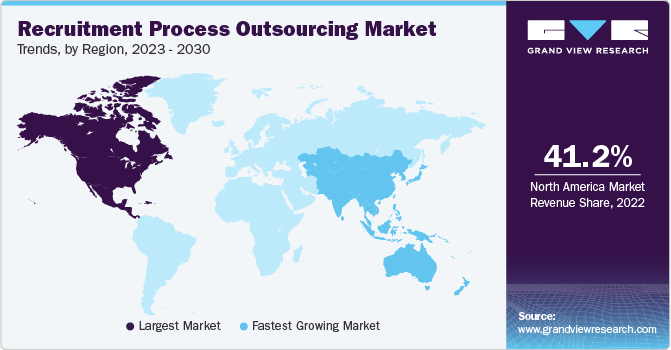

- North America dominated the market and accounted for the largest revenue share of 41.2% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 18.8% during the forecast period.

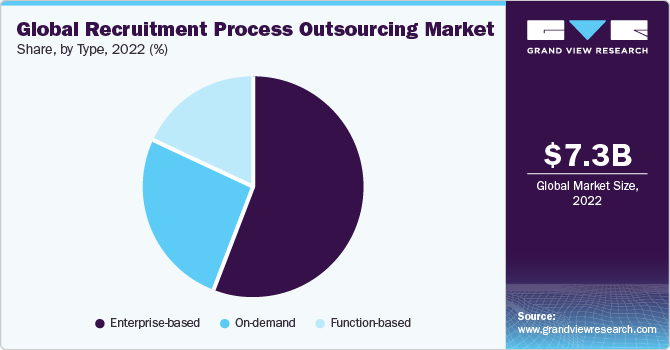

- By type, the enterprise-based segment accounted for the largest revenue share of 55.7% in 2022.

- By service, the off-site segment accounted for the largest revenue share of 66.9% in 2022.

- By enterprise size, the large enterprise segment accounted for the largest revenue share of 68.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 7.33 Billion

- 2030 Projected Market Size: USD 24.32 Billion

- CAGR (2023-2030): 16.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The Recruitment Process Outsourcing (RPO) service providers perform several tasks, from sourcing to selecting candidates and maintaining the quality of recruits. Service providers are implementing innovative technologies such as Artificial Intelligence (AI) and Machine Learning (ML) for self-scheduling interviews and automated screening of CVs to enhance their capabilities. Service providers are further channeling better candidate engagement through chatbots and other assessment tools. AI is expected to be a game-changer in the recruitment industry. It automates candidate sourcing, rediscovery, employee reference, and diversity hiring tasks to improve strategic workforce planning.

The growing attrition rate across several industries is one of the key factors in favor of the RPO market. To remain competitive, several service providers readily offer a replacement for any candidate who quits an organization quickly. Moreover, the education system rapidly evolves, providing hands-on industry experience and advanced skills to fresh graduates and post-graduates. As a result, selecting the right candidate is becoming increasingly challenging for recruiters. The market is also benefitting from the increased focus of employers on core competencies and ways of reducing recruitment costs.

In the automation era, companies are trying to increase or maintain headcount rather than reduce it. Companies invest in digital technologies, requiring a skilled workforce to perform new and complementary tasks to those done by machines. However, the labor shortage and difficulty in finding just-in-time talent are restraining the growth of the companies. As a result, the companies outsource hiring, boosting market growth. To bridge the gap between the new skilled workforce requirement and existing resources, only some companies are upskilling their workforce to build the required expertise. Companies are also deploying diverse approaches to address this challenge, including developing a learning culture within the organization to provide career guidance training sessions.

Amid the COVID-19 pandemic, the industry witnessed a major change in operations. Companies changed their recruitment practices to comply with the social distancing norms enforced across several regions to mitigate the risk of infection. Datum RPO, a U.K.-based workforce solutions provider, advised its clients and resources to take additional care while screening applicants, contemplating their location, and asking for a backdated history of 14 days. Additionally, companies emphasized using advanced recruiting solutions and digital assets to avoid in-person meetings.

Recruitment Process Outsourcing (RPO) vendors focus on technology adoption and social media integration to deliver more creative talent sourcing. The leading RPO firms have already adopted big data, cloud, SaaS, and mobile technologies. The introduction of ATS, automatic CV screening for keywords, and self-scheduling interviews are enablers to improve candidate quality while managing costs. As a result, RPO vendors focus on technology-oriented strategies, most commonly by collaborating with tech providers and developing their proprietary solutions. Moreover, clients are more prone to the technologically updated recruitment process. Artificial Intelligence (AI) and Machine Learning (ML), including chatbots and clever assessment tools such as gamification, is the next stage of innovation in RPO.

Small & medium enterprises opt for RPO services to switch from conventional HR activities to strategic decision-making processes. RPO is becoming more popular as companies emphasize talent acquisition and workforce planning to meet the issues of maintaining human resources. On the other hand, large businesses are looking for a single solution to handle all of their HR needs. Major market players have already introduced such robust RPO services in the market.

RPO vendors focus on creating specialized and diverse service offerings to gain a competitive advantage. The specialization lies in geographical footprints, employer segment focus, industry verticals, job families, strategic value addition, type and source of hires, and global sourcing. Moreover, the RPO service providers offer varied recruitment models based on the client's needs. The typical model includes on-demand, project-based, and end-to-end RPO.

However, RPO service providers must abide by some basic regulations related to employee information security across the organization. For instance, in the U.S., the Health Insurance Portability and Accountability Act (HIPAA) requires companies to safeguard clients' information from being misused. Similarly, the General Data Protection Regulation (GDPR), which applies to organizations operating in the European Union, requires companies to protect the data processed through any system or software.

Type Insights

The enterprise-based segment accounted for the largest revenue share of 55.7% in 2022. Enterprise engagement RPO, or full-scale or end-to-end recruitment process outsourcing, is a complete outsourced recruitment solution generally provided for multi-year contracts. It is a versatile solution that includes services such as candidate sourcing, screening, scheduling interviews, onboarding, monitoring, and conducting interviews. It reduces the burden of talent pooling, allowing organizations to focus on their core business activities. In the developed economies of the U.S. and the U.K., the demand for a full-scale RPO model for hiring against targeted competencies is high in Fortune 500 companies.

The on-demand segment is expected to grow at the fastest CAGR of 17.2% during the forecast period. SMEs recognize the benefits offered by RPO providers and are duly adopting the services for their recruitment needs. Owing to budget constraints, SMEs often prefer cost-effective recruitment models. On-demand RPO serves this purpose by providing flexible, scalable, and low-cost services as needed. Using this model, the organization can scale its recruiting capabilities based on business demand. As a result, the on-demand segment is gaining traction and is likely to exhibit strong growth over the forecast period.

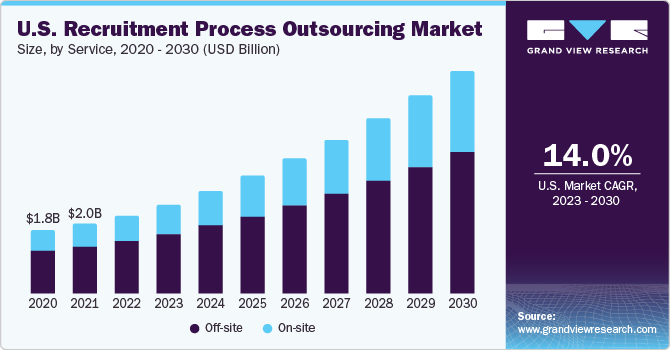

Service Insights

The off-site segment accounted for the largest revenue share of 66.9% in 2022. Off-site recruitment process outsourcing provides a centralized approach to client hiring for various locations. The recruitment firms work with clients to provide the best talent globally. In this process, recruitment firms follow the best practices and personalized approaches to drive optimal results and encourage more diverse hiring. Countries have different employment laws and hiring cultures, which must be considered in recruitment. RPO firms play a crucial role in the international hiring process because of their sound knowledge of the region and its culture and expertise in labor laws and standards. These firms follow proper record-keeping, compliance regulations, and auditable processes and methods. As a result, multinational companies are embracing RPO services for their global recruitment programs.

The on-site segment is estimated to register the fastest CAGR of 17.6% over the forecast period. On-site service is the extension of the company's existing HR department. A recruitment service provider works with the company's HR team to deliver a holistic hiring solution. Several end-use industries widely adopt on-site services as they build effective relationships between the recruiter and RPO firm, simplify the hiring process by providing a single point of contact, and improve the services' efficiency and effectiveness. The on-site service model offers transparency to the client regarding recruitment fees and the number of agencies involved.

Enterprise Size Insights

The large enterprise segment accounted for the largest revenue share of 68.9% in 2022.There is an enormous demand for outsourced recruitment services in large enterprises across the manufacturing, financial services, and pharmaceutical sectors. Most of this demand comes from Greenfield projects, wherein companies must establish full-fledged HR departments and are looking for staffing partners to offer end-to-end recruitment solutions. Moreover, large firms have a higher budget and require sophisticated services, including recruitment and other HR functions, 360-degree interviewing, recruitment audits, and applications.

The small and medium segment is estimated to register the fastest CAGR of 17.1% over the forecast period. SMEs often have a dedicated HR team performing recruitment tasks and other jobs such as payroll, training, and managing employee relations. These firms need more budget and quick turnaround time for recruiting candidates. However, SMEs need help managing continuous fluctuations in the hiring process. SMEs focus on reducing the total recruiting cost and simplifying the recruitment experience for potential candidates, which has resulted in the increased adoption of RPO among SMEs.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 41.2% in 2022. The United States dominated the regional market in the same year and is likely to maintain its dominance throughout the projection period. The US economy is resuming normalcy, with improved employment rates, increased demand for higher education qualifications, and upskilling in new industries. Furthermore, the healthcare and manufacturing industries, with healthcare being one of the fastest-growing sectors, are creating new job opportunities across the country. Several government initiatives and favorable conditions have aided in reviving the industrial sector in the United States, creating new jobs.

Canada, with its four provinces of Ontario, Alberta, British Columbia, and Quebec, considerably contributes to the RPO market in North America. These provinces outsource the majority of their hiring needs, producing more than half of all money in Canada. Because of the growing migration of migrants from other South American countries, Mexico has experienced positive growth in recent years. Employers in Mexico intend to raise their employment levels while maintaining a consistent hiring process, resulting in potential development opportunities for service providers.

Asia Pacific is expected to grow at the fastest CAGR of 18.8% during the forecast period. RPO service providers are increasing their presence in fast-growing regional markets, including Asia Pacific. Increased investments by international corporations across numerous sectors drive the expansion, as these companies always look for methods to stay competitive in the market. Many recruitment outsourcing transactions have been noticed because of the region's increasing labor markets, such as India and China.

The area is expected to increase significantly throughout the projected period because of the expanding number of small, medium, and large-scale companies in Asia Pacific. Furthermore, the regional market is expected to be driven by the expansion of international corporations. Due to strong expansion in industrial sectors such as healthcare, information technology, and manufacturing, India is expected to grow greatly during the next seven years.

Many small & medium logistics firms need more dedicated HR departments. A single employee is responsible for all HR-related tasks, from recruiting to payroll and administrative work. These firms sometimes need to be equipped with digital resources and are doing their jobs traditionally. For instance, in the Asia Pacific region, face-to-face meetings are still considered to hold more value. Moreover, changing the supply chain management system takes financial investment, time, and resources; thus, companies sometimes avoid implementation. Therefore, in the initial years, the logistics sector has yet to take advantage of the advantages offered by RPO services.

End-use Insights

The BFSI segment held the largest revenue share of 28.8% in 2022. The financial sector is evolving rapidly owing to digital disruptions, changing operating models, and new firms entering the market. Owing to the challenges associated with hiring and developing people with the required skills and knowledge base, financial institutes prioritize recruitment process outsourcing for recruiting top talent. The sector comprises insurance companies, commercial banks, co-operatives, asset management firms, venture capitalists, and other small financial bodies. The growth of these entities translates into substantial economic activities, leading to direct or indirect job creation. The stable economic growth and rising per capita income of developing countries also drive the demand for financial services. As a result, credit, insurance, and investment penetration are rising among the lower-income group, signifying the sector's strong growth.

The healthcare segment is expected to grow at the fastest CAGR of 18.4% over the forecast period. The healthcare sector is relatively diverse, from hospitals, enterprises, home healthcare services, community care facilities for elders, and medical and diagnostic labs. All these healthcare verticals require a skilled workforce to operate in a regulated environment. Personal care and home health aides are the fastest-growing occupations in the healthcare sector. The demand for healthcare services from the aging population and people with chronic conditions is expected to drive employment growth in the sector soon. Technological proliferation is further expected to create more employment opportunities in the healthcare sector, thereby driving the need for outsourced recruitment.

Key Companies & Market Share Insights

The recruitment process outsourcing market players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in April 2023, Recruiter.com introduced the Recruiter Marketplace to revolutionize talent acquisition. This platform facilitates connections between employers and verified freelance talent acquisition experts by utilizing automation. It offers unparalleled flexibility, cost-effectiveness, and access to a worldwide talent pool. With the Recruiter Marketplace, recruiters can engage with employers project-by-project, providing a flexible, on-demand solution. It enables businesses, regardless of size, to effectively adjust their hiring efforts according to their needs, giving them a competitive advantage in today's rapidly evolving market.

Key Recruitment Process Outsourcing Companies:

- ADP, Inc.

- Alexander Mann Solutions (AMS)

- Cielo, Inc.

- Hudson Global Inc.

- IBM Corporation

- ManpowerGroup

- Korn Ferry

- PeopleScout - A TrueBlue Company

- Pontoon Solutions

- Randstad N.V.

- Sevenstep

- Fortune Media IP Limited

Recent Developments

-

In January 2023, Wilson HCG, an RPO company, completed the acquisition of Personify, an RPO provider focused on healthcare and life sciences. This collaboration aims to enhance expansion into untapped markets, positioning as the global provider of talent solutions in healthcare, biotechnology, life sciences, and beyond.

-

In May 2021, TrackTik Software, a company specializing in cloud-based security workforce management, announced its integration with ADP Workforce Now, a comprehensive payroll and HR management solution. This integration aims to streamline the payroll process by eliminating the need for manual data entry, resulting in reduced costs, decreased errors, and saved time.

-

In August 2022, Hudson Global, Inc., a management consulting company, acquired Hunt & Badge, a recruitment firm based in Chennai. This acquisition aims to enhance the company's workforce and extend its operations to various industry sectors worldwide.

-

In November 2022, AMS, an RPO provider, completed the acquisition of HirePower, a Canadian RPO Provider. This acquisition aims to enhance AMS's presence in the North American market and strengthen its technology and digital recruitment expertise.

Recruitment Process Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.53 billion

Revenue forecast in 2030

USD 24.32 billion

Growth Rate

CAGR of 16.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

ADP, Inc.; Alexander Mann Solutions (AMS); Cielo, Inc.; Hudson Global Inc.; IBM Corporation; ManpowerGroup; Korn Ferry; PeopleScout — A TrueBlue Company; Pontoon Solutions; Randstad N.V.; Sevenstep; Fortune Media IP Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recruitment Process Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global recruitment process outsourcing market based on type, service, enterprise size, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

On-demand

-

Function-based

-

Enterprise-based

-

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

On-site

-

Off-site

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Healthcare

-

Manufacturing

-

IT & Telecom

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global recruitment process outsourcing market is expected to grow at a compound annual growth rate of 16.1% from 2023 to 2030 to reach USD 24.32 billion by 2030.

b. North America dominated the global recruitment process outsourcing market with a revenue share of 41.17% in 2022. This is attributable to the increasing employment rate and demand for higher education credentials and upskilling across new fields.

b. Some key players operating in the RPO market include Sevenstep; Randstad N.V.; Argus; Pinstripe, Inc.; Accolo, Inc.; Futurestep, Zyoin; Pontoon Solutions; The Rightthing; TalentFusion; Kelly Services Inc.; ManpowerGroup; and Alexander Mann Solutions.

b. The global recruitment process outsourcing market size was estimated at USD 7.33 billion in 2022 and is expected to reach USD 8.53 billion by 2023.

b. Key factors that are driving the global recruitment process outsourcing market growth include the need for an effective recruiting process and reduction in overhead costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.