RV Rental Market Size, Share & Trends Analysis Report By Product (Motorhomes, Conventional Travel Trailer, Campervans, Fifth-wheel Trailer), By End-user, By Booking Mode, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-006-9

- Number of Report Pages: 83

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

The global RV rental market size was valued at USD 820.3 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.4% from 2022 to 2030. The rise in demand for recreational vehicles (RV) for tailgating, traveling with pets, and business activities among travelers is the major factor driving the industry’s growth. In addition, improved features to protect vehicles and owners such as insurance, user verification, secure payments, low fuel cost, and 24/7 road assistance will contribute to market expansion over the foreseeable future.

The COVID-19 pandemic has impacted the growth of the market. In the wake of the COVID-19 pandemic, customers have been willing to spend more time in nature through activities such as sports, camping, and, traveling, which is boosting the market demand for recreational vehicles. For instance, according to an RVshare report, to avoid crowds during the COVID-19 pandemic, RVshare saw an increase in RV bookings. Air travel and public transportation have become extremely unpopular due to the COVID-19 outbreak, while the recreational vehicle is seen as being a more secure choice.

Moreover, the work-from-home scenario due to the pandemic is driving the demand for RV rental among consumers. For instance, according to a survey conducted by Go RVing, around 65 million U.S. leisure travelers are planning on taking RV vacations in 2022. The surge is attributed to changes in the workplace as a large number of consumers are working remotely, allowing them to travel along with working.

Additionally, before buying an RV, younger campers are considering renting, and RV owners are increasingly making their vehicles accessible for peer-to-peer rentals as a way to profit financially from their RV purchase. This trend is anticipated to make availability of a significant number of recreational vehicles for renting, thereby boosting the market. For instance, according to RV Industry Association 2021 report, overall 14% of RV owners purchased a recreational vehicle to rent. Also, 20% of RV owners began renting their vehicles due to the pandemic.

The rapid growth of economies including Asia Pacific, a burgeoning middle class with discretionary income, rising consumer interest in RVs and RV camping, campground development, and the rising number of people choosing to travel the country in recreational vehicles are key factors driving the demand for recreational vehicles and consequently, propelling the RV rental market.

Furthermore, companies operating in the market cater to consumers worldwide, particularly in North America and Europe. Increasing innovation by these companies is rapidly transforming the recreational vehicle market. For instance, in March 2019, China Beijing International Recreational Vehicle and Camping Exhibition IVECO launched an intelligent daily recreational vehicle, and along with that, it displayed more than 20 imported IVECO daily RVs. The RVs are equipped with features such as a ventilation control, remote temperature lighting, and one-button parking.

Product Insights

In terms of revenue, motorhomes dominated the market with a share of 31.3% in 2021. The availability of various types of motorhomes such as Type A, Type B, and Type C motor homes in the market is likely to propel the demand among consumers. According to a blog published by RVshare, in June 2020, Type C motorhomes have high demand owing to their low price and features. Moreover, Type C motorhomes are increasingly preferred among consumers and this trend is likely to continue over the forecast period.

Fifth-wheel trailer is projected to register a CAGR of 9.0% from 2022 to 2030. The growing customer base of outdoor travelers is boosting the adoption of RV rental. Additionally, the ability of the fifth-wheel trailer to offer more storage space and height, along with large holding tanks, is likely to surge the demand for the segment over the foreseeable future.

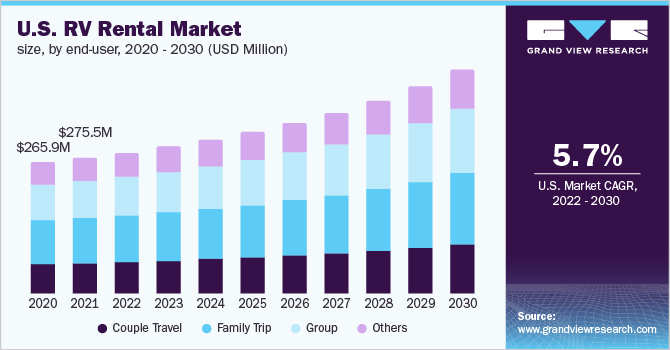

End-user Insights

In terms of revenue, family trips dominated the market with a share of 33.3% in 2021. Growing urbanization, rising disposable income, and several dual-income families are some of the key factors expected to drive the growth of the RV rental market. According to the 2021 U.S. Family Travel Survey, conducted by Family Travel Association (FTA), 88% of parents are planning to travel with their children in the year 2022.

The group trips segment is projected to register a CAGR of 8.3% from 2022 to 2030. According to a blog published by Trip Advisor, over 39% of millennials prefer to travel in groups. Moreover, the increasing trend of solo traveling is likely to propel the demand for recreational vehicles among consumers. For instance, according to a blog published by Northstar Travel Media LLC, solo travel comprised 18% of global bookings in 2019, witnessing an increase of 7% as compared to the previous year. Furthermore, according to Cox & Kings, solo travel is the second-most popular category for post-lockdown trips.

Booking Mode Insights

In terms of revenue, online booking mode dominated the market with a share of 63.4% in 2021. The high penetration of internet users is primarily attributed to the increase in online booking modes. For instance, according to GSM Association, in January 2021, there were around 650 million mobile internet users in Europe. As a result, RV rental players are shifting from offline structures to online business models to improve customer experience.

Online booking mode is estimated to grow with the fastest CAGR of 7.8% over the forecast period. The online booking segment of the market is estimated to experience considerable growth during the forecast period due to the increasing inclination for RV rentals throughout the globe and the expansion of peer-to-peer rental service providers. Moreover, the number of online portals connecting different rental organizations for recreational vehicles, like independent dealers and private owners, with clients has increased globally, impacting positively the growth of the market.

Regional Insights

North America dominated the market with a share of 40.8% in 2021. This is attributable to the rapidly increasing presence of recreational parks and campgrounds in the region. The high inclination of people in America towards outdoor recreational activities, short trips, and picnics is fueling the demand for RV rentals in the region. Moreover, consumers in the U.S. and Canada prefer to travel short distances with hassle-free planning and RV rentals are a convenient option for them.

Asia Pacific is expected to witness a CAGR of 9.1% from 2022 to 2030. The growth can be attributed to the expansion of economies and the rising middle-class population, boosting the demand for leisure activities including recreational vehicles and camping. Moreover, consumers from developing countries such as India are shifting travel preferences to explore the countryside with recreational vehicles, likely favoring the growth.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the growing trend of recreational vehicle rentals. Players in the market are diversifying their service offerings to maintain market share. For instance:

-

In September 2021, Outdoorsy, an online marketplace for RV rentals and outdoor travel, announced its partnership with Lead Bank to expand the availability of financial services for lending RVs, motorhomes, trailers, and overland vehicles in the United States. With the introduction of an RV loan financing product, Outdoorsy and Lead Bank's relationship enables qualified owners to benefit from low-interest rates

-

In April 2022, Cruise America partnered with The Dyrt, a camping app, to improve camping trips for renters. Through the partnership, Cruise America will provide its customers with the membership of THE Dyrt PRO to enhance the consumer experience

Some prominent players in the global RV rental market include:

-

Cruise America

-

Apollo RV Holidays

-

El Monte RV

-

McRent

-

Outdoorsy

-

Fuji Cars Japan

-

USA RV Rental

-

RV Share

-

Motorvana

-

CamperTravel

RV Rental Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 865.05 million |

|

Revenue forecast in 2030 |

USD 1.55 billion |

|

Growth rate |

CAGR of 7.4% from 2022 to 2030 |

|

Base year for estimation |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-user, booking mode, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; South Africa |

|

Key companies profiled |

Cruise America; Apollo RV Holidays; El Monte RV; McRent; Outdoorsy; Fuji Cars Japan; USA RV Rental; RV Share; Motorvana; CamperTravel |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global RV Rental Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global RV rental market report based on product, end-user, booking mode, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Motorhomes

-

Conventional Travel Trailer

-

Campervans

-

Fifth-Wheel Trailer

-

Others (Pop-up Camper, Folding Camping Trailer, Park Model, etc.)

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Couple Travel

-

Family Trip

-

Group

-

Others (Office Trips, Solo)

-

-

Booking Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 -2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global RV rental market was estimated at USD 820.3 million in 2021 and is expected to reach USD 865.05 million in 2022.

b. The global RV rental market is expected to grow at a compound annual growth rate of 7.4% from 2022 to 2030 to reach USD 1.55 billion by 2030.

b. North America region dominated the recreational vehicle rental market with a share of 40.9% in 2021. This is owing rise in outdoor recreational activities among consumers.

b. Some key players operating in the RV rental market include Cruise America, Apollo RV Holidays, El Monte RV, McRent, Outdoorsy, Fuji Cars Japan, USA RV Rental, RV Share, Motorvana, and CamperTravel.

b. Key factors that are driving the recreational vehicle rental market growth includes the rising spending on leisure activities coupled with improved features offered by recreational vehicle rental providers.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."