Recreational Vehicle Market Size, Share & Trends Analysis Report By Vehicle Type (Motorhomes, Towable RVs), By Application (Personal, Commercial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-154-800

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Recreational Vehicle Market Size & Trends

The global recreational vehicle market size was estimated to be USD 60.70 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 11.5% from 2023 to 2030. The growth of the market is attributed to the shift towards eco-tourism and sustainable travel across the globe. This shift reflects a growing awareness and preference among travelers for environmentally responsible and sustainable travel options. Moreover, the appeal of eco-friendly recreational vehicles extends beyond their reduced environmental impact. With an increased focus on preserving natural habitats and minimizing the negative impacts of travel, the global market has witnessed a surge in demand for environmentally friendly alternatives. This shift in consumer preferences has led to an expansion in the global market as manufacturers strive to meet the growing demand for eco-conscious travel options.

Leisure and recreational activities in parks and camping sites are gaining traction owing to increasing focus on healthier lifestyles. In countries such as the U.S., Germany, the UK, and Australia, demand for recreational vehicles is witnessing a surge due to the growing motorhome culture and the integration of campgrounds around and within national parks, hiking trails, and picturesque areas in a bid to boost footfall at local tourism spots. Moreover, increasing government support for the tourism sector is another major factor propelling market growth. For instance, in November 2022, the Australian government approved a budget of USD 10 million to upgrade and open new facilities at caravan parks.

The demand for luxury and customized recreational vehicles is another major factor driving the market growth. Luxury recreational vehicle purchasers prefer vehicles that suit their distinct interests. Manufacturers of recreational vehicles are offering a range of customization services, enabling potential customers to design their recreational vehicles based on their needs. Luxury recreational vehicles can be modified to provide an enhanced and comfortable traveling experience, owing to the incorporation of high-quality fitting and materials to connected technology and smart home amenities. The desire for convenience and comfort also fuels the market growth.

Fluctuating raw material prices, such as aluminum, steel, and copper, are major restraints hindering market development. Price fluctuations might induce fluctuations in the supply of RV components, resulting in a supply-demand imbalance in the market's demand for recreational vehicles. Furthermore, increases in the price of components due to variable raw material costs compel recreational vehicle manufacturers to raise the starting cost of recreational vehicles, which may have a negative impact on market growth.

The repercussions of rising carbon emissions, deforestation, and global warming have affected national parks and nature trails worldwide. As the automotive industry is in the midst of transitioning towards electric vehicles, stakeholders in the recreational vehicles industry actively taking up initiatives such as investing in research and development and developing prototypes of electric recreational vehicles is anticipated to present new growth opportunities for the market growth. For instance, in January 2023, Winnebago, a brand under Winnebago Industries, Inc., unveiled a prototype of a zero-emission, electric recreational vehicle at the Florida RV SuperShow held in Tampa, Florida.

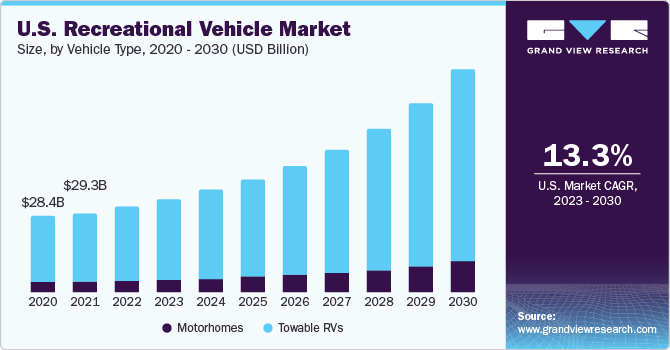

Vehicle Type Insights

Amongst vehicle type, towable RVs held the largest market share of nearly 73% in 2022. The towable RVs have witnessed significant growth globally, owing to the increasing trend towards experiential travel and the desire for freedom and flexibility that have spurred the demand for towable RVs. Consumers are seeking to explore diverse destinations without compromising on the comforts of home, making RVs an appealing choice. In addition, the flexibility of detachability allows for more versatility in transportation, enabling users to use their towing vehicle separately. This adaptability appeals to those seeking a multipurpose vehicle for both leisure and daily use. As a result, these factors are expected to propel the growth of the market over the forecast period.

The motorhomes segment is anticipated to register the fastest CAGR of 12.7% over the forecast period. The rapidly expanding demand for enhanced and comfortable experiences is driving the adoption of motorhomes within the market. Consumer preference for road trips over traditional vacation packages drives market demand for motorized recreational vehicles. Furthermore, stricter car pollution restrictions encourage buyers to transition to electric and hybrid recreational vehicles, which is another factor driving the segmental growth. In regions such as North America, motorized recreation vehicles are a preferred form of transportation for outdoor sports and other leisure activities. The increasing popularity of leisure travel in motorhomes is reflected in the country's expanding number of campgrounds and is further anticipated to drive segmental growth.

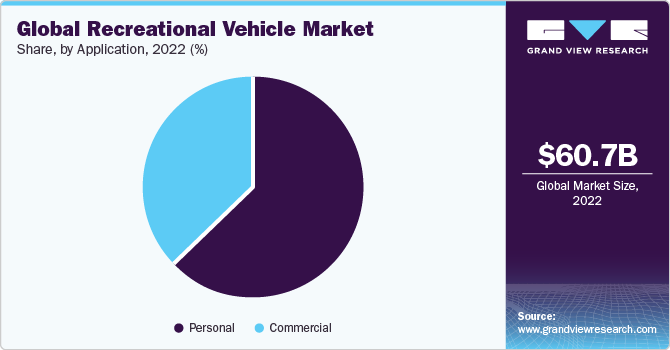

Application Insights

Based on application, the personal segment held the largest market share, exceeding 63% in 2022, and is anticipated to register the fastest CAGR over the forecast period. The recreational vehicle enables individuals to undertake activities such as camping, hiking, fishing, and other outdoor activities while also serving as a convenient and comfortable base camp. Furthermore, manufacturers have consistently innovated to improve the comfort and convenience of recreational vehicles. Modern recreational vehicles include modern amenities such as increased fuel efficiency, opulent interiors, cutting-edge entertainment systems, smart home connectivity, and environmentally friendly solutions. Buyers seeking a more sophisticated and comfortable travel experience are drawn to these technology developments to enhance the traveling experience, further driving the personal market growth.

The commercial segment is anticipated to register a significant CAGR over the forecast period. The rising trend for renting recreational vehicles is a major factor propelling the commercial market. For less frequent travels, renting a recreational vehicle based on travel duration, distance traveled, and type of recreational vehicle with required amenities is a convenient option. Moreover, the growing trend of remote work and the increasing focus on work-life balance have prompted businesses to adopt hybrid work models, driving the demand for RVs equipped with modern amenities that can function as mobile workspaces. Lastly, the commercial sector's increasing emphasis on sustainability and eco-friendly practices has led to a surge in the demand for eco-conscious RVs that promote green living and minimize the environmental footprint during travel and stay.

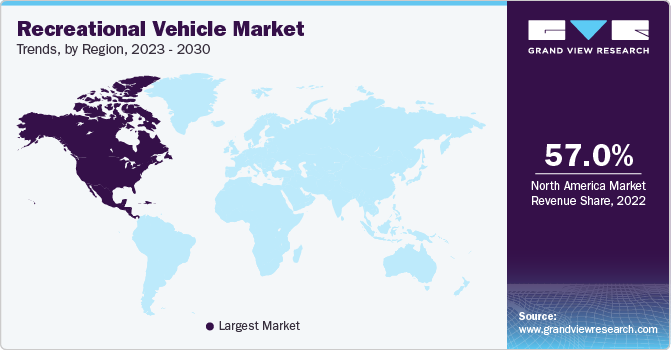

Regional Insights

North America dominated the recreational vehicle industry with a market share of over 57% in 2022 and is expected to register the fastest CAGR over the forecast period. The regional growth is attributed to factors such as the rising popularity of outdoor activities and tourism, the rise in recreational vehicle rental trends, the inclusion of connected vehicles in RVs, and the rise in camping activities among Gen Z and millennials. Development in RVs as chassis and other components provide enhanced performance, innovation in RV interior designs, and increasing traction toward electric recreational vehicles are other factors driving the growth of the North America market.

Europe is anticipated to register the second-fastest CAGR over the forecast period. The region is witnessing increased traction towards the campaign and off-road activities, as many RV buyers frequently visit national parks and hiking locations or travel from city to city for their jobs, which are the major factors driving the regional growth.

Product enhancement to make RVs more comfortable, such as additional storage space and features such as voice command and telematics, is augmenting the demand for RVs in the Canadian market.

Key Companies & Market Share Insights

The recreational vehicles industry is consolidated in nature, with major manufacturers holding the majority market share. The manufacturers operating in the market are focusing on developing recreational vehicles that prioritize occupant's comfort within the vehicle by incorporating features such as wireless connectivity, smart home features, and entertainment systems. The manufacturers are maintaining their market share by positioning themselves through the spectrum of product offerings, innovations in vehicle design and amenities included, or manufacturing recreational vehicles for certain target customers ranging from high-end luxurious recreational vehicles to affordable recreational vehicles.

The manufacturers implement organic and inorganic growth strategies such as product launches, partnerships, expansions & mergers, and acquisitions. For instance, in January 2023, Dethleffs GmbH & Co. KG launched a compact motorhome named Dethleffs Globebus Go, at CMT 2023, held in Stuttgart, Germany. The motorhome has been developed on a Ford Transit chassis and is equipped with an EcoBlue diesel engine.

Key Recreational Vehicle Companies:

- ALINER (Columbia Northwest, Inc.)

- Dethleffs GmbH & Co. KG

- Forest River Inc.

- Gulf Stream Coach, Inc.

- Hymer GmbH & Co. KG

- Northwood Manufacturing

- REV Recreation Group

- Swift Group Limited

- Thor Industries Inc.

- Trigona SA

- Winnebago Industries Inc.

Recreational Vehicle Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 65.56 billion |

|

Revenue forecast in 2030 |

USD 144.55 billion |

|

Growth rate |

CAGR of 11.5% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in units, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Vehicle type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Denmark; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

ALINER (Columbia Northwest, Inc.); Dethleffs GmbH & Co. KG; Forest River Inc.; Gulf Stream Coach, Inc.; Hymer GmbH & Co. KG; Northwood Manufacturing; REV Recreation Group; Swift Group Limited; Thor Industries Inc.; Trigona SA; Winnebago Industries Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

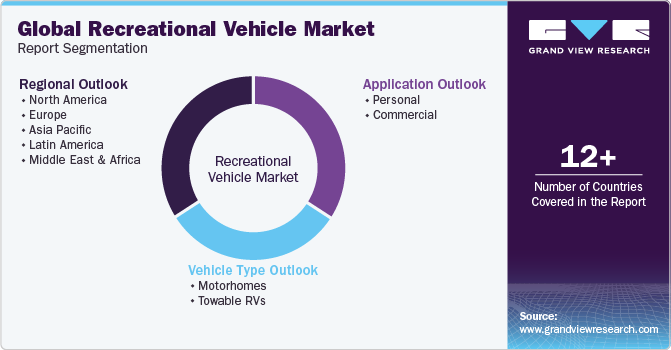

Global Recreational Vehicle Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global recreational vehicle market report based on vehicle type, application, and region:

-

Vehicle Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Motorhomes

-

Class A

-

Class B

-

Class C

-

-

Towable RVs

-

Fifth Wheel

-

Travel Trailer

-

Camping Trailer

-

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Personal

-

Commercial

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Denmark

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global recreational vehicle market size was estimated at USD 60.70 billion in 2022 and is expected to reach USD 65.56 billion in 2023.

b. The global recreational vehicle market is expected to grow at a compound annual growth rate of 11.5% from 2023 to 2030 to reach USD 144.55 billion by 2030.

b. North America dominated the recreational vehicle market owing to factors such as the rising popularity of outdoor activities & tourism and the rise in camping activities among Genz and millennials.

b. Some key players operating in the recreational vehicles market include ALINER (Columbia Northwest, Inc.); Dethleffs GmbH & Co. KG; Forest River Inc.; Gulf Stream Coach, Inc.; Hymer GmbH & Co. KG; Northwood Manufacturing; REV Recreation Group; Swift Group Limited; Thor Industries Inc.; Trigona SA; and Winnebago Industries Inc.

b. Key factors that are driving the recreational vehicle market growth are attributed to the shift towards eco-tourism and sustainable travel, increasing leisure and recreational activities in tourist sports in camping sites, and increasing demand for luxury & customized RVs across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."